FuelCell Energy, Inc. (Nasdaq:FCEL), a global leader in the design,

manufacture, operation and service of ultra-clean, efficient and

reliable fuel cell power plants, today reported financial results

for its fourth quarter ended October 31, 2015 and key business

highlights.

Financial ResultsFuelCell Energy (the Company)

reported total revenues for the fourth quarter of 2015 of $51.5

million compared to $54.4 million for the comparable prior year

period. Revenue components include:

- Product sales of $43.9 million for the current period compared

to $42.4 million for the comparable prior year period

- Service agreements and license revenues of $5.5 million for the

current period compared to $6.7 million for the comparable prior

year period

- Advanced Technologies contract revenues of $2.1 million for the

current period compared to $5.3 million for the comparable prior

year period

The gross profit generated in the fourth quarter of 2015 totaled

$3.1 million and the gross margin for the period was 6.1 percent,

compared to gross profit of $6.0 million and gross margin of 10.9

percent for the fourth quarter of 2014. The gross margin

decreased in the current period compared to last year reflecting a

product sales mix weighted towards Asian sales in the current

quarter compared to North American power plant installation sales

in the fourth quarter of 2014. In addition, a number of

Advanced Technologies contracts concluded towards the end of fiscal

year 2015 while new contracts announced and included in backlog at

October 31, 2015 were just beginning to commence, resulting in

lower overhead absorption of fixed costs for the fourth quarter of

2015. Operating expenses for the current period totaled $11.0

million compared to $10.9 million for the prior year period.

Net loss attributable to common shareholders for the fourth

quarter of 2015 totaled $9.7 million, or $0.38 per basic and

diluted share, compared to $5.5 million or $0.24 per basic and

diluted share for the fourth quarter of 2014.

Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA) in the fourth quarter of 2015 totaled ($6.7)

million. Refer to the discussion of Non-GAAP financial measures

below regarding the Company’s calculation of EBITDA. Capital

spending was $3.1 million, an increase from recent prior quarters

reflecting expenditures for manufacturing process

improvements. Depreciation expense was $1.1

million.

Revenue BacklogTotal backlog was $381.4 million

as of October 31, 2015 compared to $333.9 million as of October 31,

2014 and $338.3 million at July 31, 2015.

- Product sales backlog totaled $90.8 million as of October 31,

2015 compared to $113.1 million as of October 31, 2014.

- Service backlog totaled $254.1 million as of October 31, 2015

compared to $196.8 million as of October 31, 2014.

- Advanced Technologies contracts backlog totaled $36.5 million

as of October 31, 2015 compared to $24.0 million as of October 31,

2014.

Cash and LiquidityCash, restricted cash and

borrowing availability totaled $123.0 million at October 31, 2015,

including:

- $58.9 million of cash and cash equivalents, and $26.9 million

of restricted cash. Cash balance includes $9.6 million of cash

advanced by POSCO Energy for raw material purchases made on its

behalf by FuelCell Energy under an inventory procurement agreement

that ensures coordinated purchasing from the shared global supply

chain.

- $36.2 million of borrowing availability under the NRG Energy

revolving project financing facility.

- Subsequent to October 31, 2015, the State of Connecticut

Department of Economic and Community Development disbursed $10.0

million to the Company under an Assistance Agreement for funding of

the first phase of manufacturing capacity expansion. The

interest rate for this loan is fixed at 2.0 percent per annum and

principal payments are deferred for four years.

Business Highlights

- United Illuminating purchased its fourth megawatt class fuel

cell power plant for a town-wide micro-grid project. FuelCell

Energy possesses the expertise and capabilities to model, build and

operate this micro-grid, a differentiator in the distributed power

generation industry.

- Alameda County, California entered into a power purchase

agreement (PPA) for a new 1.4 megawatt fuel cell plant at a

correctional facility. This PPA structure is well suited for

municipalities to avoid the capital investment in clean on-site

power generation.

- Commercial operations began in November 2015 for the

grid-support application in Bridgeport, Connecticut purchased by

United Illuminating and service revenue from the multi-year service

agreement will begin to be recognized.

- Recent progress in the development of multi-megawatt fuel cell

parks, includes another development step for the 63 megawatt

project in Connecticut with the November site visit and public

hearing by the Connecticut Siting Council and the permitting body

for siting power generation facilities in the State of

Connecticut. The draft decision from the Council is expected

in January 2016.

- Advanced Technology backlog at fiscal year-end 2015 included

four contracts executed with the U.S. Department of Energy and

totaling $39.0 million, including cost-share: (1) $23.7 million

project to site a DFC3000® power plant adjacent to an existing

coal-fired power plant for both carbon capture and ultra-clean

power generation, (2) $10.9 million project to install and operate

a 400 kilowatt solid oxide fuel cell power plant, (3) $3.1 million

project for automated manufacturing of SOFC, and (4) $1.3 million

project adapting existing SOFC stack technology for hydrogen

production utilizing a solid oxide electrolyzer cell (SOEC) at very

high efficiency.

“Closing projects for new markets and existing customers coupled

with project financing speaks to the value proposition we provide

to our customers and investors,” said Chip Bottone, President and

Chief Executive Officer, FuelCell Energy, Inc. “Backlog

increased for the second quarter in a row as we continue to close

projects in North America and Europe.”

Cautionary Language This news release

contains forward-looking statements within the meaning of the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995, including, without limitation, statements with respect to

the Company’s anticipated financial results and statements

regarding the Company’s plans and expectations regarding the

continuing development, commercialization and financing of its fuel

cell technology and business plans. All forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those projected. Factors that

could cause such a difference include, without limitation, changes

to projected deliveries and order flow, changes to production rate

and product costs, general risks associated with product

development, manufacturing, changes in the regulatory environment,

customer strategies, unanticipated manufacturing issues that impact

power plant performance, changes in critical accounting policies,

potential volatility of energy prices, rapid technological change,

competition, and the Company’s ability to achieve its sales plans

and cost reduction targets, as well as other risks set forth in the

Company’s filings with the Securities and Exchange Commission. The

forward-looking statements contained herein speak only as of the

date of this press release. The Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or

circumstances on which any such statement is based.

Reverse stock splitThe Company effected a

1-for-12 reverse stock split on December 3, 2015. The

information provided for 2014, including the loss per share, has

been adjusted on a pro-forma basis to reflect the reverse stock

split for comparison.

Non-GAAP Financial MeasuresFinancial Results

are presented in accordance with accounting principles generally

accepted in the United States (“GAAP”). Management also uses

non-GAAP measures to analyze the business.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) is an alternate measure of cash utilization. The

table below calculates Adjusted EBITDA and reconciles these figures

to the GAAP financial statement measure Net loss attributable to

FuelCell Energy, Inc.

| |

|

| |

Three Months Ended October 31, |

| (Amounts in

thousands) |

2015 |

|

|

|

2014 |

|

| Net loss attributable to FuelCell

Energy, Inc. |

$ |

(8,860 |

) |

|

$ |

(4,700 |

) |

| Depreciation |

1,101 |

|

|

|

1,086 |

|

| Provision for income

taxes |

95 |

|

|

|

219 |

|

| Other (income)/expense, net

(1) |

179 |

|

|

|

(957 |

) |

| Interest expense |

765 |

|

|

|

660 |

|

| EBITDA |

$ |

(6,720 |

) |

|

$ |

(3,692 |

) |

| |

|

|

|

|

(1) Other income (expense), net includes gains and losses from

transactions denominated in foreign currencies, changes in fair

value of embedded derivatives, and other items incurred

periodically which are not the result of the Company’s normal

business operations.

EBITDA is a non-GAAP measure of financial performance and should

not be considered as an alternative to net income or any other

performance measure derived in accordance with GAAP, or as an

alternative to cash flows from operating activities. This

information is included to assist in the understanding of the

results of operations on a comparative basis.

About FuelCell EnergyDirect FuelCell® power

plants are generating ultra-clean, efficient and reliable power at

more than 50 locations worldwide. With more than 300

megawatts of power generation capacity installed or in backlog,

FuelCell Energy is a global leader in providing ultra-clean

baseload distributed generation to utilities, industrial

operations, universities, municipal water treatment facilities,

government installations and other customers around the

world. The Company’s power plants have generated more than

four billion kilowatt hours of ultra-clean power using a variety of

fuels including renewable biogas from wastewater treatment and food

processing, as well as clean natural gas. For

additional information, please visit www.fuelcellenergy.com, follow

us on Twitter and view our videos on YouTube.

Direct FuelCell, DFC, DFC/T, DFC-H2 and FuelCell Energy, Inc.

are all registered trademarks of FuelCell Energy, Inc.

DFC-ERG is a registered trademark jointly owned by Enbridge,

Inc. and FuelCell Energy, Inc.

Conference Call InformationFuelCell Energy

management will host a conference call with investors beginning at

10:00 a.m. Eastern Time on December 15, 2015 to discuss the fourth

quarter 2015 results. An accompanying slide presentation for

the earnings call will be available at

http://fcel.client.shareholder.com/events.cfm immediately

prior to the

call.

Participants can access the live call via webcast on the Company

website or by telephone as follows:

- The live webcast of this call will be available on the Company

website at www.fuelcellenergy.com. To listen to the call,

select ‘Investors’ on the home page, then click on ‘Events &

presentations’ and then click on ‘Listen to the webcast’

- Alternatively, participants can dial 678-809-1045

The replay of the conference call will be available via webcast

on the Company’s Investors’ page at www.fuelcellenergy.com

approximately two hours after the conclusion of the call.

| |

| FUELCELL ENERGY, INC. |

| Consolidated Balance Sheets |

| (Amounts in thousands, except share and per

share amounts) |

|

|

|

|

|

|

October

31, 2015 Unaudited |

|

|

October 31, 2014 |

|

ASSETS |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and cash

equivalents |

$ |

58,852 |

|

|

$ |

83,710 |

|

| Restricted cash and cash

equivalents – short-term |

|

6,288 |

|

|

|

5,523 |

|

| Accounts receivable,

net |

|

60,790 |

|

|

|

64,375 |

|

| Inventories |

|

65,754 |

|

|

|

55,895 |

|

| Project assets |

|

5,260 |

|

|

|

784 |

|

| Other current assets |

|

6,954 |

|

|

|

7,528 |

|

| Total

current assets |

|

203,898 |

|

|

|

217,815 |

|

| |

|

|

|

|

|

|

|

| Restricted cash and

cash equivalents – long-term |

|

20,600 |

|

|

|

19,600 |

|

| Long-term project

assets |

|

6,922 |

|

|

|

- |

|

| Property, plant and

equipment, net |

|

29,002 |

|

|

|

25,825 |

|

| Goodwill |

|

4,075 |

|

|

|

4,075 |

|

| Intangible assets |

|

9,592 |

|

|

|

9,592 |

|

| Other assets, net |

|

3,142 |

|

|

|

3,729 |

|

| Total

assets |

$ |

277,231 |

|

|

$ |

280,636 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

| Current portion of long-term

debt |

$ |

7,358 |

|

|

$ |

1,439 |

|

| Accounts payable |

|

15,745 |

|

|

|

22,969 |

|

| Accrued liabilities |

|

19,175 |

|

|

|

12,066 |

|

| Deferred revenue |

|

31,787 |

|

|

|

37,626 |

|

| Preferred stock obligation

of subsidiary |

|

823 |

|

|

|

961 |

|

| Total

current liabilities |

|

74,888 |

|

|

|

75,061 |

|

| |

|

|

|

|

|

|

|

| Long-term deferred

revenue |

|

22,646 |

|

|

|

20,705 |

|

| Long-term preferred

stock obligation of subsidiary |

|

12,088 |

|

|

|

13,197 |

|

| Long-term debt and

other liabilities |

|

12,998 |

|

|

|

13,367 |

|

| Total

liabilities |

|

122,620 |

|

|

|

122,330 |

|

| Redeemable preferred

stock (liquidation preference of $64,020 at October 31, 2015 and

2014) |

|

59,857 |

|

|

|

59,857 |

|

| Total Equity: |

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

| Common

stock ($.0001 par value; 39,583,333 and 33,333,333 shares

authorized at October 31, 2015 and 2014, respectively; 25,964,710

and 23,930,000 shares issued and outstanding at October 31,

2015 and 2014, respectively) |

|

3 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

934,488 |

|

|

|

909,458 |

|

|

Accumulated deficit |

|

(838,673 |

) |

|

|

(809,314 |

) |

|

Accumulated other comprehensive loss |

|

(509 |

) |

|

|

(159 |

) |

| Treasury

stock, Common, at cost (5,845 and 3,796 shares at October 31, 2015

and October 31, 2014, respectively) |

|

(78 |

) |

|

|

(95 |

) |

| Deferred

compensation |

|

78 |

|

|

|

95 |

|

|

Total shareholders’ equity |

|

95,309 |

|

|

|

99,987 |

|

| Noncontrolling interest in

subsidiaries |

|

(555 |

) |

|

|

(1,538 |

) |

|

Total equity |

|

94,754 |

|

|

|

98,449 |

|

|

Total liabilities and equity |

$ |

277,231 |

|

|

$ |

280,636 |

|

|

|

|

|

|

|

|

|

|

| |

|

| FUELCELL ENERGY, INC. |

| Consolidated Statements of

Operations |

| Unaudited |

| (Amounts in thousands, except share and per

share amounts) |

| |

|

| |

Three Months EndedOctober

31, |

| |

2015 |

|

2014 |

| Revenues: |

|

|

|

|

Product sales |

$ |

43,826 |

|

|

$ |

42,360 |

|

|

Service agreements and license revenues |

|

5,506 |

|

|

|

6,741 |

|

|

Advanced technologies contract revenues |

|

2,119 |

|

|

|

5,308 |

|

| Total

revenues |

|

51,451 |

|

|

|

54,409 |

|

| |

|

|

|

| Costs of revenues: |

|

|

|

| Cost

of product sales |

|

41,222 |

|

|

|

37,922 |

|

| Cost

of service agreements and license revenues |

|

4,581 |

|

|

|

5,491 |

|

| Cost

of advanced technologies contract revenues |

|

2,504 |

|

|

|

5,041 |

|

| Total

cost of revenues |

|

48,307 |

|

|

|

48,454 |

|

| |

|

|

|

| Gross profit |

|

3,144 |

|

|

|

5,955 |

|

| |

|

|

|

| Operating

expenses: |

|

|

|

|

Administrative and selling expenses |

|

6,224 |

|

|

|

6,628 |

|

|

Research and development expenses |

|

4,786 |

|

|

|

4,295 |

|

| Total

operating expenses |

|

11,010 |

|

|

|

10,923 |

|

| |

|

|

|

| Loss from

operations |

|

(7,866 |

) |

|

|

(4,968 |

) |

| |

|

|

|

|

Interest expense |

|

(765 |

) |

|

|

(660 |

) |

| Other

income (expense), net |

|

(179 |

) |

|

|

957 |

|

| |

|

|

|

| Loss before provision

for income taxes |

|

(8,810 |

) |

|

|

(4,671 |

) |

| |

|

|

|

|

Provision for income taxes |

|

(95 |

) |

|

|

(219 |

) |

| |

|

|

|

| Net loss |

|

(8,905 |

) |

|

|

(4,890 |

) |

| |

|

|

|

| Net

loss attributable to noncontrolling interest |

|

45 |

|

|

|

190 |

|

| |

|

|

|

| Net loss attributable

to FuelCell Energy, Inc. |

|

(8,860 |

) |

|

|

(4,700 |

) |

| |

|

|

|

|

Preferred stock dividends |

|

(800 |

) |

|

|

(800 |

) |

| |

|

|

|

| Net loss to common

shareholders |

$ |

(9,660 |

) |

|

$ |

(5,500 |

) |

| |

|

|

|

| Loss per share basic

and diluted |

|

|

|

|

Basic |

$ |

(0.38 |

) |

|

$ |

(0.24 |

) |

|

Diluted |

$ |

(0.38 |

) |

|

$ |

(0.24 |

) |

| |

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

Basic |

|

25,111,368 |

|

|

|

23,380,314 |

|

|

Diluted |

|

25,111,368 |

|

|

|

23,380,314 |

|

|

|

|

|

|

|

|

|

|

| |

|

| FUELCELL ENERGY, INC. |

| Consolidated Statements of

Operations |

| (Amounts in thousands, except share and per

share amounts) |

| |

|

| |

Year EndedOctober

31, |

| |

2015Unaudited |

|

2014 |

| Revenues: |

|

|

|

| Product

sales |

$ |

128,595 |

|

|

$ |

136,842 |

|

| Service

agreements and license revenues |

|

21,012 |

|

|

|

25,956 |

|

| Advanced

technologies contract revenues |

|

13,470 |

|

|

|

17,495 |

|

| Total

revenues |

|

163,077 |

|

|

|

180,293 |

|

| |

|

|

|

| Costs of revenues: |

|

|

|

| Cost of

product sales |

|

118,530 |

|

|

|

126,866 |

|

| Cost of

service agreements and license revenues |

|

18,301 |

|

|

|

23,037 |

|

| Cost of

advanced technologies contract revenues |

|

13,470 |

|

|

|

16,664 |

|

| Total

cost of revenues |

|

150,301 |

|

|

|

166,567 |

|

| |

|

|

|

| Gross profit |

|

12,776 |

|

|

|

13,726 |

|

| |

|

|

|

| Operating

expenses: |

|

|

|

|

Administrative and selling expenses |

|

24,226 |

|

|

|

22,797 |

|

| Research

and development expenses |

|

17,442 |

|

|

|

18,240 |

|

| Total

operating expenses |

|

41,668 |

|

|

|

41,037 |

|

| |

|

|

|

| Loss from

operations |

|

(28,892 |

) |

|

|

(27,311 |

) |

| |

|

|

|

| Interest

expense |

|

(2,960 |

) |

|

|

(3,561 |

) |

| Other

income (expense), net |

|

2,442 |

|

|

|

(7,523 |

) |

| |

|

|

|

| Loss before provision

for income taxes |

|

(29,410 |

) |

|

|

(38,395 |

) |

| |

|

|

|

| Provision

for income taxes |

|

(274 |

) |

|

|

(488 |

) |

| |

|

|

|

| Net loss |

|

(29,684 |

) |

|

|

(38,883 |

) |

| |

|

|

|

| Net loss

attributable to noncontrolling interest |

|

325 |

|

|

|

758 |

|

| |

|

|

|

| Net loss attributable

to FuelCell Energy, Inc. |

|

(29,359 |

) |

|

|

(38,125 |

) |

| |

|

|

|

| Preferred

stock dividends |

|

(3,200 |

) |

|

|

(3,200 |

) |

| |

|

|

|

| Net loss to common

shareholders |

$ |

(32,559 |

) |

|

$ |

(41,325 |

) |

| |

|

|

|

| Loss per share basic

and diluted |

|

|

|

|

Basic |

$ |

(1.33 |

) |

|

$ |

(2.02 |

) |

|

Diluted |

$ |

(1.33 |

) |

|

$ |

(2.02 |

) |

| |

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

Basic |

|

24,513,731 |

|

|

|

20,473,915 |

|

|

Diluted |

|

24,513,731 |

|

|

|

20,473,915 |

|

|

|

|

|

|

|

|

|

|

Contact:

FuelCell Energy, Inc.

Kurt Goddard, Vice President Investor Relations

203-830-7494

ir@fce.com

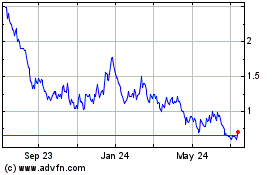

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

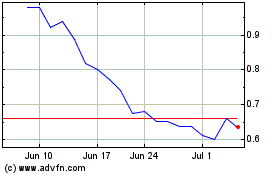

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024