FedEx Corp. is raising its fuel surcharge for the second time

this year, jolting e-commerce companies, retailers and other

shippers with price increases just as they gear up for the

make-or-break holiday sales season.

The increase, which takes effect Nov. 2, would add about $170 to

the bill for shipping 100 shoeboxes overnight from New York to

Atlanta, up from the $67 added by the current surcharge. The

figures, from an analysis by supply-chain consulting firm Spend

Management Experts, are based on FedEx's published rates and the

August average fuel price.

The package-delivery company previously boosted its

fuel-surcharge index in February, following a similar increase by

rival United Parcel Service Inc. Their indexes determine how much

the price of shipping a package will rise as fuel prices

fluctuate.

UPS's surcharge would add about $200 to the cost of shipping the

same 100 shoeboxes, the analysis found.

FedEx's latest increase caught customers off guard because the

company's fuel costs have been falling. The price of diesel fuel,

which FedEx uses in its trucks, has plunged by about a third over

the past year.

Spot prices for jet kerosene, which power FedEx's airplanes,

have fallen by nearly half to about $1.37 a gallon, according to

the U.S. Energy Information Administration.

The company says its latest increase is in response to heavier

packages and a rise in residential deliveries, which use up more

fuel.

Both FedEx and UPS reported that fuel costs were down about 35%

from the year earlier in their most recent quarter. While some

companies use the futures market to hedge their fuel costs, the two

delivery companies buy most of their fuel at near market

prices.

FedEx disclosed its latest surcharge-index increase without

fanfare on its website late last month, and it hasn't been

popular.

"There's no justification for it, because there's just no

explaining it, other than they're paying a whole heck of a lot less

for fuel, and they don't want to pass any fuel savings along to

their customers," said John Haber, chief executive of Spend

Management Experts.

"It's frustrating," said Sara Henderson, founder of e-commerce

startup BOGO Bowl, which ships as many as 30 packages of 20- to

60-pound bags of pet food each week, primarily via UPS.

"They give you discounts for being a regular shipper, but they

seem to make it up in others ways by putting all these little fees

here and there," she said.

For BOGO Bowl, like other companies that offer free shipping,

every penny counts. It builds shipping costs into the prices it

charges customers, so unanticipated increases eat into its

margins.

FedEx and UPS have been scrambling to boost their profits as

their customers shift to email for sending urgent documents,

instead of paying a premium to overnight them. Though e-commerce

has taken off, margins on that business are narrower because of the

higher costs of making deliveries to scattered homes.

The two companies have been raising prices to cover these costs,

charging by package size, instead of weight alone, and raising fees

for giant packages.

A FedEx spokesman attributed the surcharge boost to increasing

demand for residential deliveries and heavier packages, both of

which boost fuel consumption. "These trends have been accelerating

during the past year," the spokesman said.

A UPS spokeswoman said in an email that the company "maintains a

[fuel surcharge] level necessary to reduce price volatility and

ensure that revenue is properly aligned with our cost of service."

She said fuel surcharges themselves have been on a downtrend, even

with the change in UPS's fuel-surcharge index.

Shipping is one of the biggest costs for eCreamery Ice Cream

& Gelato, which ships customized frozen treats. While the

company has been able to negotiate some shipping discounts, the

fuel surcharge has never been open for discussion. "Shipping is one

of our biggest line items, and is hard to pass on to the customer,"

said Abby Jordan, eCreamery's co-founder.

As fuel prices rose between 2007 and 2013, both UPS and FedEx

cut their fuel surcharges, instead incorporating the costs into

their base rates. Both companies typically raise rates an average

of about 5% annually.

This year, the companies separated their fuel-surcharge-index

changes from their base rate increases, so most shippers who have

negotiated discounts won't be immune to the increases.

Consultants who work with shipping customers say most of them

have yet to notice the quiet change in FedEx's fuel-surcharge

index, and they worry about the precedent it sets.

"It's a bad sign for shippers across the board. If the market is

going to bear a fuel surcharge increase when fuel's at its lowest

levels in years, what's next?" said Brian Litchfield, executive

director of Transpend Solutions, which helps shippers manage

transportation expenses.

Write to Laura Stevens at laura.stevens@wsj.com

Access Investor Kit for "CitiGroup Inc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US1729674242

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 05, 2015 20:55 ET (00:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

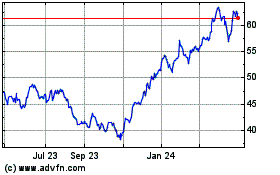

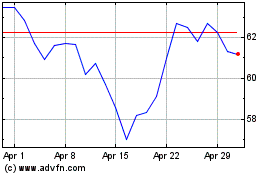

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024