Freeport-McMoRan Swings to Profit After String of Losses

October 25 2016 - 11:19AM

Dow Jones News

By Imani Moise

Freeport-McMoRan Inc. swung to a profit for the first time in

nearly two years, as the company moves to focus more on its copper

business.

The biggest U.S. mining company by market value has been

increasing copper production despite weak prices, and it also has

been shedding assets to help reduce its debt.

The Phoenix-based company agreed to sell its onshore California

oil and gas properties for $592 million in cash earlier this month.

Additionally, it agreed to sell its Mexican oil and gas assets for

$2 billion in September. Chief Executive Richard Adkerson said

Tuesday that the company has announced asset sale transactions

totaling $6.6 billion so far this year.

The company said it sold 1.2 billion pounds of copper and

317,000 ounces of gold in the quarter, up from 1 billion pounds and

294,000 ounces, respectively.

In all for the third quarter, Freeport-McMoRan reported a profit

of $217 million, or 16 cents a share, compared with a loss of $3.83

billion, or $3.53 a share, a year earlier. The year-earlier period

was hurt by $3.65 billion of impairments related to the company's

oil and gas properties.

On an adjusted basis for the latest quarter, the company

reported earnings of 13 cents, below analysts' views of 18

cents.

Revenue jumped 15% to $3.88 billion.

The profit breaks a streak of seven straight quarterly losses

for Freeport-McMoRan, whose shares rose 5.4% to $10.72 in Tuesday

morning trading. They are still down 13% in the past three

months.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

October 25, 2016 11:04 ET (15:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

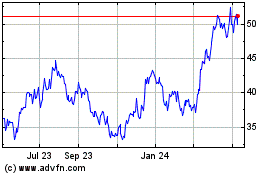

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

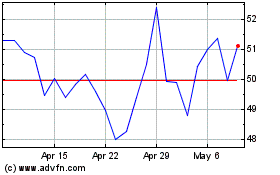

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024