Freeport-McMoRan Loss Widens, Unveils Job Cuts -- Update

April 26 2016 - 2:39PM

Dow Jones News

By John W. Miller and Tess Stynes

Freeport-McMoRan Inc. on Tuesday posted a $4.2 billion quarterly

loss, mostly due to the declining book value of its oil and gas

assets, but said it would continue to ramp up copper production

despite stagnating prices.

Phoenix-based Freeport, the U.S.'s biggest mining company by

market value, said revenue fell 15% to $3.5 billion from $4.1

billion in the same quarter a year ago. It took $3.8 billion in

charges "to reduce the carrying value of oil and gas

properties."

The company lost $2.5 billion in the same quarter a year ago,

part of a streak of six straight losing quarters.

Freeport, a major global copper mining company, said it would

remain focused on reducing its debt, which stood at $20.8 billion

at the end of the quarter.

"You should not be this leveraged," Chief Executive Richard

Adkerson told analysts on a conference call Tuesday. When prices

decline as part of a commodity downturn, "having this kind of debt

is a killer," he said.

Mr. Adkerson declined to discuss continuing asset sale

negotiations, but said he felt "real good" about the talks.

Freeport has agreed to sell $1.4 billion worth of assets this year,

including selling a 13% stake in its Morenci copper mine in Arizona

for $1 billion.

Freeport said Tuesday it would cut 25% of the oil and gas

workforce -- or 325 jobs -- as part of an overall restructuring in

that business, and expected to post a related charge of around $40

million in the second quarter. The company said Tuesday it is

evaluating options for the oil-and-gas business, including possible

asset sales or joint-venture arrangements.

Freeport made a big bet on oil and gas in 2013 when it bought

McMoRan Exploration Co. and Plains Exploration & Production

Co., which drill off the coast of California and in the Gulf of

Mexico, for a total of $9 billion. The purchase, which loaded the

company with debt, was followed by a steep decline in energy

prices.

The pressure on Freeport grew when activist investor Carl Icahn

disclosed the purchase of a stake last August. Since Mr. Icahn

disclosed his initial investment last August, Freeport has

suspended its dividend, cut capital spending, and announced the

resignation of longtime chairman James R. Moffett, an oil

wildcatter who also developed the Grasberg mine in Indonesia, one

of its so-called super mines.

Freeport is still staking its future on its big copper mines,

which remain profitable.

The company said Tuesday it expects to increase copper sales to

five billion pounds in 2016, up around 25% from 2015, even though

prices continue to putter between $2 and $2.5 per pound, half their

level of five years ago. The company sold 1.1 billion pounds of

copper in the first quarter, up 15% from 960 million pounds over

the same period in 2015.

Freeport attributed the increase to its Cerro Verde complex in

southern Peru, another super mine, reaching full capacity in the

first quarter. One of the top mines in the world, Cerro Verde is

expected to produce over a billion pounds of copper in 2016, over

2% of global production.

That expansion is also a big part of why Freeport said it had

reduced unit cash costs per pound to $1.38 from $1.64 a year ago,

"primarily reflecting higher copper sales volumes in South America

and the impact of ongoing cost reduction initiatives."

Keeping costs down is key. "Mining projects have long tails, and

once you get past any significant investment, you have to finish,"

says Charles Bradford of Bradford Research, Inc. "But after you get

these things finished, you can sometimes find efficiencies you

hadn't built into your original cost model."

Write to John W. Miller at john.miller@wsj.com and Tess Stynes

at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 26, 2016 14:24 ET (18:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

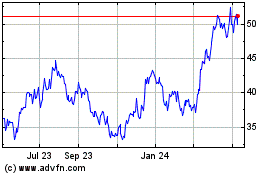

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

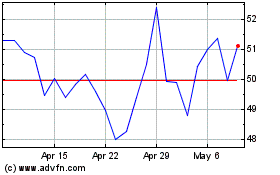

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024