Filed Pursuant to Rule 433

Supplementing the Preliminary Pricing Supplement No. 25 dated November 8, 2017

(To Prospectus dated February 19, 2015 and

Prospectus Supplement dated May 6, 2015)

Registration Statement No. 333-202185

AVALONBAY COMMUNITIES, INC.

TERMS OF THE NOTES

|

Terms Applicable to the $300,000,000

Floating Rate Notes due 2021

(the “Floating Rate Notes”)

|

|

Principal Amount: $300,000,000

|

Issue Price (Public Offering Price):

|

100%

|

|

Net Proceeds (before expenses) to Issuer: $298,800,000

|

Agents’ Discount Commission:

|

0.40%

|

|

Stated Maturity Date: January 15, 2021

|

Initial Interest Rate:

|

%

|

|

Original Issue Date: November 15, 2017

|

CUSIP:

|

05348E

BD0

|

|

Interest Payment Dates: January 15, April 15, July 15 and October 15

|

First Interest Payment Date:

|

January 15, 2018

|

|

|

|

|

|

Redemption:

|

|

|

o

The Floating Rate Notes cannot be redeemed prior to their Stated Maturity Date at the option of the issuer.

x

The Floating Rate Notes may be redeemed in whole but not in part prior to their Stated Maturity Date at the option of the issuer.

Initial Redemption Date: At any time after the first anniversary of their Original Issue Date and prior to their Stated Maturity Date. See Additional/Other Terms of the Notes.

Initial Redemption Percentage/Redemption Price: See Additional/Other Terms of the Notes.

Annual Redemption Percentage Reduction: N/A

Optional Repayment:

x

The Floating Rate Notes cannot be required to be repaid prior to the applicable Stated Maturity Date at the option of the Holder of the Notes.

o

The Floating Rate Notes can be repaid prior to the applicable Stated Maturity Date at the option of the Holder of the Notes.

Optional Repayment Dates:

Repayment Price: %

Currency:

Specified Currency: U.S. Dollars (If other than U.S. Dollars, see attached)

Minimum Denominations:

(Applicable only if Specified Currency is other than U.S. Dollars)

Original Issue Discount (“OID”):

o

Yes

x

No

Total Amount of OID:

Yield to Maturity:

Initial Accrual Period:

Form:

x

Book-Entry

o

Certificated

1

Additional/Other Terms of the Floating Rate Notes

Other Terms:

Reopening of Issue.

We may, from time to time and without the consent of the noteholders, reopen an issue of Floating Rate Notes and issue additional Floating Rate Notes having the same terms and conditions (including maturity, interest payment terms and CUSIP number) as Floating Rate Notes of that series issued on an earlier date, except for the issue date, issue price and, if applicable, the first payment of interest. After such additional Floating Rate Notes are issued, they will be fungible with the Floating Rate Notes of that series issued on such earlier date.

Optional Redemption.

The Floating Rate Notes may be redeemed at the option of AvalonBay, in whole but not in part, upon notice of not more than 45 and not less than

15 days prior to the date fixed for redemption of the Floating Rate Notes, on November 16, 2018 (the date that is the first business day after the date that is one year following the Original Issue Date of the Floating Rate Notes) or at any time thereafter, at a redemption price equal to 100% of the principal amount of the Floating Rate Notes to be redeemed plus accrued and unpaid interest thereon to, but excluding, the redemption date.

Acceleration of Maturity.

If an Event of Default with respect to the Floating Rate Notes that are then outstanding occurs and is continuing, and pursuant to Section 2.7 of the Amended and Restated Third Supplemental Indenture dated as of July 10, 2000 (the “Third Supplemental Indenture”), the Trustee or the Holders of not less than 25% in principal amount of the then outstanding Floating Rate Notes of the applicable series shall have declared the principal amount (or, if the Floating Rate Notes of the applicable series are Original Issue Discount Securities or Indexed Securities, such portion of the principal as may be specified in the terms hereof) of all the Floating Rate Notes of the applicable series to be due and payable immediately, by a notice in writing to AvalonBay (and to the Trustee if given by the Holders), then upon any such declaration such principal, or specified portion thereof, plus accrued interest to the date the Floating Rate Notes of the applicable series are paid shall become immediately due and payable.

If an Event of Default set forth in Section 501(6) of the Indenture, dated as of January 16, 1998, between AvalonBay and the Trustee (the “Indenture”) occurs and is continuing, such that pursuant to Section 2.7 of the Third Supplemental Indenture all the Floating Rate Notes of the applicable series are immediately due and payable, without notice to AvalonBay, at the principal amount thereof, plus accrued interest to the date the applicable series of Floating Rate Notes are paid.

2

Definitions.

Terms used but not defined herein shall have the meanings set forth in the Indenture and the Third Supplemental Indenture.

Interest Rate on the Floating Rate Notes.

The Floating Rate Notes will bear interest at the rate equal to the three month U.S. dollar LIBOR as determined at the beginning of each quarterly period, plus 43 basis points, as described in greater detail below.

The Floating Rate Notes will bear interest at a floating rate of interest, reset quarterly, from the Original Issuance Date of the Floating Rate Notes or from the most recent Floating Rate Note Interest Payment Date (as defined below) to which interest has been paid or provided for.

The per annum interest rate on the Floating Rate Notes for the period from the issue date to, but not including, the first Floating Rate Note Interest Payment Date (as defined below) will be equal to LIBOR on November 13, 2017, plus 43 basis points (such rate, the “Initial Floating Rate Note Interest Rate”). Following the initial Floating Rate Note Interest Period, the per annum interest rate on the Floating Rate Notes for each subsequent Floating Rate Note Interest Period will be equal to LIBOR as determined on the related LIBOR Determination Date, plus 43 basis points. The interest rate applicable to any day in a given Floating Rate Note Interest Period will be either the Initial Floating Rate Note Interest Rate or the interest rate as reset on the immediately preceding Floating Rate Note Interest Payment Date.

Interest is payable on the Floating Rate Notes quarterly in arrears on January 15, April 15, July 15 and October 15 of each year (each, a “Floating Rate Note Interest Payment Date”). The

initial Floating Rate Note Interest Payment Date will be January 15, 2018. The amount of interest for each day that the Floating Rate Notes are outstanding (the “Daily Interest Amount”) will be calculated by dividing the interest rate in effect for such day by 360 and multiplying the result by the principal amount of the Floating Rate Notes outstanding on such day. The amount of interest to be paid on the Floating Rate Notes for each Floating Rate Note Interest Period will be calculated by adding such Daily Interest Amounts for each day in such Floating Rate Note Interest Period.

3

If any Floating Rate Note Interest Payment Date, other than the Maturity Date of the Floating Rate Notes, falls on a day that is not a Business Day, the Floating Rate Note Interest Payment Date will be postponed to the next day that is a Business Day. If the Maturity Date of the Floating Rate Notes falls on a day that is not a Business Day, the payment of interest and principal will be made on the next succeeding Business Day, and no interest on such payment will accrue for the period from and after the Maturity Date. If any such Floating Rate Note Interest Payment Date (other than the Maturity Date) is postponed as described above, the amount of interest for the relevant Floating Rate Note Interest Period will be adjusted accordingly.

The interest payable on the Floating Rate Notes on any Floating Rate Note Interest Payment Date will be paid to the person in whose name the Floating Rate Notes are registered at the close of business on January 1, April 1 and July 1 and October 1 (whether or not a Business Day), as the case may be, immediately preceding the Floating Rate Note Interest Payment Date; however, interest payable at maturity will be paid to the person to whom principal is payable.

All percentages resulting from any of the above calculations will be rounded, if necessary, to the nearest one hundred thousandth of a percentage point, with four one-millionths of a percentage point being rounded downwards (e.g., 9.876544% (or .09876544) being rounded to 9.87654% (or .0987654)) and all dollar amounts used in or resulting from such calculations will be rounded to the nearest cent (with less than one-half cent being rounded downwards).

Notwithstanding the foregoing, the interest rate on the Floating Rate Notes will in no event be higher than the maximum rate permitted by New York law as the same may be modified by United States law of general application. In addition, the interest rate on the Floating Rate Notes will in no event be lower than zero.

The Trustee initially will act as the calculation agent in respect of the Floating Rate Notes.

AvalonBay may change the calculation agent without prior notice to or consent of the holders of the Floating Rate Notes. Any agreement between AvalonBay and any calculation agent may provide that no amendment to the provisions of the Floating Rate Notes relating to the duties or obligations of such calculation agent may become effective as against such calculation agent without the prior written consent of such calculation agent. The calculation agent will, upon the written request of any holder of Floating Rate Notes, provide to such holder of Floating Rate Notes the interest rate then in effect with respect to the Floating Rate Notes. All calculations made by the calculation agent in the absence of manifest error will be conclusive for all purposes and binding on AvalonBay and the holders of the Floating Rate Notes.

Set forth below is a summary of certain of the defined terms used for purposes of determining the interest rate payable on the Floating Rate Notes.

“Designated LIBOR Page” shall be Bloomberg L.P. page “BBAM” or such other page as may replace Bloomberg L.P. page “BBAM” on that service or any successor service for the purpose of displaying London interbank offered rates for U.S. dollar deposits of major banks.

“Floating Rate Note Interest Period” means the period from, and including, a Floating Rate Note Interest Payment Date to, but excluding, the next succeeding Floating Rate Note Interest Payment Date, except for the initial Floating Rate Note Interest Period, which will be the period from, and including, the original issue date of the Floating Rate Notes to, but excluding, the Floating Rate Note Interest Payment Date occurring on January 15, 2018.

4

“LIBOR” means, with respect to a Floating Rate Note Interest Period, the rate (expressed as a percentage per annum) for deposits in U.S. dollars for a three-month period beginning on the second London Banking Day after the applicable LIBOR Determination Date that appears on the Designated LIBOR Page as of 11:00 a.m., London time, on such LIBOR Determination Date.

If the Designated LIBOR Page does not include such a rate or is unavailable on a LIBOR Determination Date, the calculation agent will request the principal London office of each of four major banks in the London interbank market, as selected by AvalonBay, to provide such bank’s offered quotation (expressed as a percentage per annum), as of approximately 11:00 a.m., London time, on such LIBOR Determination Date, to prime banks in the London interbank market for deposits in a Representative Amount of U.S. dollars for a three-month period beginning on the second London Banking Day after such LIBOR Determination Date.

If at least two such offered quotations are so provided, the LIBOR rate for the Floating Rate Note Interest Period will be the arithmetic mean of such quotations. If fewer than two such quotations are so provided, the calculation agent will request each of three major banks in New York City, as selected by AvalonBay, to provide such bank’s rate (expressed as a percentage per annum), as of approximately 11:00 a.m., New York City time, on such LIBOR Determination Date, for loans in a Representative Amount in U.S. dollars to leading European banks for a three-month period beginning on the second London Banking Day after such LIBOR Determination Date. If at least two such rates are so provided, the LIBOR rate for the Floating Rate Note Interest Period will be the arithmetic mean of such rates. If fewer than two such rates are so provided, then the LIBOR rate for the Floating Rate Note Interest Period will be the rate in effect with respect to the immediately preceding Floating Rate Note Interest Period.

“LIBOR Determination Date” means, with respect to a Floating Rate Note Interest Period, the London Banking Day that is two London Banking Days prior to the first day of such Floating Rate Note Interest Period.

“London Banking Day” is any day on which dealings in U.S. dollars are transacted or, with respect to any future date, are expected to be transacted in the London interbank market.

“Representative Amount” means a principal amount of not less than $1,000,000 for a single transaction in the relevant market at the relevant time.

5

|

Terms Applicable to the $450,000,000 3.2% Notes due 2028 (the “2028

Notes”)

|

|

Principal Amount: $450,000,000

|

|

Issue Price (Public Offering Price):

|

99.599%

|

|

Net Proceeds (before expenses) to Issuer: $445,270,500

|

Agents’ Discount Commission:

|

0.65%

|

|

Stated Maturity Date: January 15, 2028

|

|

Interest Rate:

|

3.20%

|

|

Original Issue Date: November 15, 2017

|

|

CUSIP:

|

05348E

BC2

|

|

Interest Payment Dates: January 15 and July 15

|

|

First Interest Payment Date:

|

January 15, 2018

|

|

Redemption:

|

|

|

|

|

|

|

|

|

|

|

|

o

The 2028 Notes cannot be redeemed prior to the their Stated Maturity Date at the option of the issuer.

x

The 2028 Notes may be redeemed in whole or in part prior to the their Stated Maturity Date at the option of the issuer.

Initial Redemption Date: At any time prior to the their Stated Maturity Date. See Additional/Other Terms of the Notes.

Initial Redemption Percentage/Redemption Price: See Additional/Other Terms of the Notes. Annual Redemption Percentage Reduction: N/A

Optional Repayment:

x

The 2028 Notes cannot be required to be repaid prior to the applicable Stated Maturity Date at the option of the Holder of the Notes.

o

The 2028 Notes can be repaid prior to the applicable Stated Maturity Date at the option of the Holder of the Notes.

Optional Repayment Dates:

Repayment Price: %

Currency:

Specified Currency: U.S. Dollars (If other than U.S. Dollars, see attached)

Minimum Denominations:

(Applicable only if Specified Currency is other than U.S. Dollars)

Original Issue Discount (“OID”):

o

Yes

x

No

Total Amount of OID:

Yield to Maturity:

Initial Accrual Period:

Form:

x

Book-Entry

o

Certificated

6

Additional/Other Terms of the 2028 Notes

Other Terms:

Reopening of Issue.

We may, from time to time and without the consent of the noteholders, reopen an issue of 2028 Notes and issue additional 2028 Notes having the same terms and conditions (including maturity, interest payment terms and CUSIP number) as 2028 Notes of that series issued on an earlier date, except for the issue date, issue price and, if applicable, the first payment of interest. After such additional 2028 Notes are issued, they will be fungible with the 2028 Notes of that series issued on such earlier date.

Optional Redemption—2028 Notes.

The 2028 Notes may be redeemed at any time at the option of AvalonBay, in whole or in part, upon notice of not more than 45 and not less than 15 days prior to the date fixed for redemption of such 2028 Notes, at a redemption price equal to the sum of (i) the principal amount of the 2028 Notes being redeemed, plus accrued interest thereon to such redemption date and (ii) the Make-Whole Amount, if any, with respect to the 2028 Notes. If such 2028 Notes are redeemed on or after 90 days prior to the Stated Maturity Date of the 2028 Notes (the “Par Call Date”), the redemption price of such 2028 Notes will equal 100% of the principal amount of the 2028 Notes to be redeemed plus accrued interest thereon to the redemption date.

Acceleration of Maturity; Make-Whole Amount.

If an Event of Default with respect to the 2028 Notes that are then outstanding occurs and is continuing, and pursuant to Section 2.7 of the Amended and Restated Third Supplemental Indenture dated as of July 10, 2000 (the “Third Supplemental Indenture”), the Trustee or the Holders of not less than 25% in principal amount of the then outstanding 2028 Notes of the applicable series shall have declared the principal amount (or, if the 2028 Notes of the applicable series are Original Issue Discount Securities or Indexed Securities, such portion of the principal as may be specified in the terms hereof) of all the 2028 Notes of the applicable series to be due and payable immediately, by a notice in writing to AvalonBay (and to the Trustee if given by the Holders), then upon any such declaration such principal, or specified portion thereof, plus accrued interest to the date the 2028 Notes of the applicable series are paid, plus the Make-Whole Amount on the 2028 Notes, shall become immediately due and payable.

If an Event of Default set forth in Section 501(6) of the Indenture, dated as of January 16, 1998, between AvalonBay and the Trustee (the “Indenture”) occurs and is continuing, such that pursuant to Section 2.7 of the Third Supplemental Indenture all the 2028 Notes of the applicable series are immediately due and payable, without notice to AvalonBay, at the principal amount thereof, plus accrued interest to the date the applicable series of 2028 Notes are paid, then the Make-Whole Amount on the applicable series of 2028 Notes, if any, shall also be immediately due and payable.

7

Definitions.

Terms used but not defined herein shall have the meanings set forth in the Indenture and the Third Supplemental Indenture. The following terms shall have the following meanings:

“Make-Whole Amount” means, in connection with any optional redemption or accelerated payment of any 2028 Note, the excess, if any, of (i) the aggregate present value as of the date of such redemption or accelerated payment of each dollar of principal being redeemed or paid and the amount of interest (exclusive of interest accrued to the date of redemption or accelerated payment) that would have been payable in respect of such dollar to the Par Call Date, determined by discounting, on a semi-annual basis, such principal and interest at the applicable Reinvestment Rate (determined on the third Business Day preceding the date such notice of Redemption is given or declaration of acceleration is made) from the respective dates on which such principal and interest would have been payable if such redemption or accelerated payment had been made on the Par Call Date, over (ii) the aggregate principal amount of the 2028 Notes being redeemed or paid.

“Reinvestment Rate” means fifteen (15) basis points plus the arithmetic mean of the yields under the respective headings “This Week” and “Last Week” published in the Statistical Release under the caption “Treasury Constant Maturities” for the maturity (rounded to the nearest month) corresponding to the remaining life to the Par Call Date, as of the payment date of the principal being redeemed or paid. If no maturity exactly corresponds to such maturity, yields for the two published maturities most closely corresponding to such maturity shall be calculated pursuant to the immediately preceding sentence and the Reinvestment Rate shall be interpolated or extrapolated from such yields on a straight-line basis, rounding in each of such relevant periods to the nearest month. For such purposes of calculating the Reinvestment Rate, the most recent Statistical Release published prior to the date of determination of the Make-Whole Amount shall be used.

“Statistical Release” means the statistical release designated “H.15(519)” or any successor publication which is published weekly by the Federal Reserve System and which establishes yields on actively traded United States government securities adjusted to constant maturities or, if such statistical release is not published at the time of any determination of the Make-Whole Amount, then such other reasonably comparable index which shall be designated by AvalonBay.

8

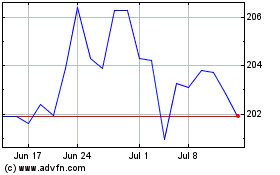

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Apr 2023 to Apr 2024