Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 23 2016 - 4:24PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Dated May 23, 2016

Registration Statement No. 333-196003

3M Company

Medium-Term Notes, Series F

€500,000,000 0.375% Notes due 2022

€500,000,000 1.500% Notes due 2031

Summary of Terms

|

0.375% Notes due 2022

|

|

|

|

|

|

|

|

Issuer:

|

|

3M Company

|

|

|

|

|

|

Expected Ratings*:

|

|

A1 (Stable) / AA- (Stable) (Moody’s / S&P)

|

|

|

|

|

|

Security Description:

|

|

SEC-Registered Fixed Rate Notes

|

|

|

|

|

|

Principal Amount:

|

|

€500,000,000

|

|

|

|

|

|

Trade Date:

|

|

May 23, 2016

|

|

|

|

|

|

Settlement Date:

|

|

May 31, 2016 (T+5)

|

|

|

|

|

|

Maturity Date:

|

|

February 15, 2022

|

|

Coupon:

|

|

0.375% per annum

|

|

|

|

|

|

Interest Payment Dates:

|

|

Payable annually on the 15

th

day of February, beginning February 15, 2017 (short first coupon)

|

|

|

|

|

|

Regular Record Date:

|

|

The 15th calendar day immediately preceding the applicable Interest Payment Date

|

|

|

|

|

|

Day Count Convention:

|

|

Actual/Actual (ICMA)

|

|

|

|

|

|

Benchmark Government Security:

|

|

DBR 2.000% due January 4, 2022

|

|

|

|

|

|

Benchmark Government Security Yield:

|

|

-0.296%

|

|

|

|

|

|

Re-offer Spread to Benchmark:

|

|

+ 74.8 bps

|

|

|

|

|

|

Re-offer Yield:

|

|

0.452%

|

|

|

|

|

|

Mid-Swap Yield:

|

|

0.102%

|

|

|

|

|

|

Spread to Mid-Swap Yield:

|

|

+ 35 bps

|

|

|

|

|

|

Price to Public:

|

|

99.567%

|

|

|

|

|

|

Gross Proceeds:

|

|

€497,835,000

|

|

|

|

|

|

Currency of Payment:

|

|

Euro

|

|

|

|

|

|

Payment of Additional Interest:

|

|

Yes, as provided in the preliminary pricing supplement dated May 23, 2016 (the “Preliminary Pricing Supplement”).

|

|

|

|

|

|

Optional Redemption Provision:

|

|

Yes, make-whole call prior to November 15, 2021 (T+12.5 bps) (three months prior to the Maturity Date) and par call on or thereafter, in each case as provided in the Preliminary Pricing Supplement.

|

|

|

|

|

|

Redemption for Tax Reasons:

|

|

Yes, as provided in the Preliminary Pricing Supplement.

|

|

|

|

|

|

Listing:

|

|

The Issuer intends to apply to list the notes on the NYSE.

|

|

|

|

|

|

Minimum Denominations:

|

|

€100,000 and integral multiples of €1,000 in excess thereof

|

|

|

|

|

|

CUSIP / ISIN / Common Code:

|

|

88579Y AS0 / XS1421914745 / 142191474

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Barclays Bank PLC

Credit Suisse Securities (Europe) Limited

Deutsche Bank AG, London Branch

|

|

|

|

|

* A security rating is not a recommendation to buy, sell or hold securities and should be evaluated independently of any other rating. The rating is subject to revision or withdrawal at any time.

|

1.500% Notes due 2031

|

|

|

|

|

|

|

|

Issuer:

|

|

3M Company

|

|

|

|

|

|

Expected Ratings*:

|

|

A1 (Stable) / AA- (Stable) (Moody’s / S&P)

|

|

|

|

|

|

Security Description:

|

|

SEC-Registered Fixed Rate Notes

|

|

|

|

|

|

Principal Amount:

|

|

€500,000,000

|

|

|

|

|

|

Trade Date:

|

|

May 23, 2016

|

|

|

|

|

|

Settlement Date:

|

|

May 31, 2016 (T+5)

|

|

|

|

|

|

Maturity Date:

|

|

June 2, 2031

|

|

Coupon:

|

|

1.500% per annum

|

|

|

|

|

|

Interest Payment Dates:

|

|

Payable annually on the 2

nd

day of June, beginning June 2, 2017 (long first coupon)

|

|

|

|

|

|

Regular Record Date:

|

|

The 15th calendar day immediately preceding the applicable Interest Payment Date

|

|

|

|

|

|

Day Count Convention:

|

|

Actual/Actual (ICMA)

|

|

|

|

|

|

Benchmark Government Security:

|

|

DBR 5.500% due January 4, 2031

|

|

|

|

|

|

Benchmark Government Security Yield:

|

|

0.445%

|

|

|

|

|

|

Re-offer Spread to Benchmark:

|

|

+ 109.6 bps

|

|

|

|

|

|

Re-offer Yield:

|

|

1.541%

|

|

|

|

|

|

Mid-Swap Yield:

|

|

0.941%

|

|

|

|

|

|

Spread to Mid-Swap Yield:

|

|

+ 60 bps

|

|

|

|

|

|

Price to Public:

|

|

99.454%

|

|

|

|

|

|

Gross Proceeds:

|

|

€497,270,000

|

|

|

|

|

|

Currency of Payment:

|

|

Euro

|

|

|

|

|

|

Payment of Additional Interest:

|

|

Yes, as provided in the preliminary pricing supplement dated May 23, 2016 (the “Preliminary Pricing Supplement”).

|

|

|

|

|

|

Optional Redemption Provision:

|

|

Yes, make-whole call prior to March 2, 2031 (T+20 bps) (three months prior to the Maturity Date) and par call on or thereafter, in each case as provided in the Preliminary Pricing Supplement.

|

|

|

|

|

|

Redemption for Tax Reasons:

|

|

Yes, as provided in the Preliminary Pricing Supplement.

|

|

|

|

|

|

Listing:

|

|

The Issuer intends to apply to list the notes on the NYSE.

|

|

|

|

|

|

Minimum Denominations:

|

|

€100,000 and integral multiples of €1,000 in excess thereof

|

|

|

|

|

|

CUSIP / ISIN / Common Code:

|

|

88579Y AT8 / XS1421915049 / 142191504

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Barclays Bank PLC

Credit Suisse Securities (Europe) Limited

Deutsche Bank AG, London Branch

|

|

|

|

|

* A security rating is not a recommendation to buy, sell or hold securities and should be evaluated independently of any other rating. The rating is subject to revision or withdrawal at any time.

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays Bank PLC toll-free at +1-888-603-5847, Credit Suisse Securities (Europe) Limited toll-free at +1-800-221-1037 and Deutsche Bank AG, London Branch toll-free at

+1-800-503-4611.

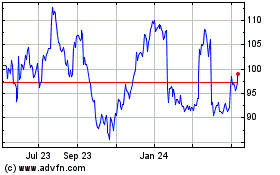

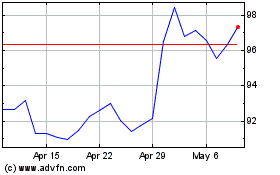

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024