Issuer Free Writing Prospectus

Filed Pursuant to Rule 433(d)

Registration No. 333-202260

July 28, 2015

SAVE 2015-1 EETC Investor Presentation

July 28, 2015

Forward Looking Statements

Statements in this

Investor Presentation contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which represent expectations

or beliefs concerning future events of Spirit Airlines, Inc. (the “Company”, “we”, “us” or “your”). The words “expects,” “estimates,” “plans,” “anticipates,”

“indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to

identify forward-looking statements. Similarly, statements that describe the Company’s objectives, plans or goals, or actions the Company may take in the future, are forward-looking statements. Forward-looking statements include, without

limitation, statements regarding the Company’s intentions and expectations regarding revenues, cost of operations, the delivery schedule of aircraft on order, and announced new service routes. All forward-looking statements are based upon

information available to the Company at the time the statement is made. The Company has no intent, nor undertakes any obligation, to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or

otherwise, except as required by law. Forward-looking statements are subject to a number of factors that could cause the Company’s actual results to differ materially from the Company’s expectations, including the competitive environment

in the airline industry; the Company’s ability to keep costs low; changes in fuel costs; the impact of worldwide economic conditions on customer travel behavior; the Company’s ability to generate non-ticket revenues; and government

regulation. Additional information concerning these and other factors is contained in the

Company’s

Securities and Exchange Commission (“SEC”) filings, including but not limited to the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

This Investor Presentation highlights basic information about the Company and this offering. Because it is a summary, it

does not contain all of the information that you should consider before investing.

Use of Non-GAAP Financial

Information

This presentation includes presentations of Adjusted EBITDAR, Adjusted Net Income and Adjusted

CASM, which are “non-GAAP financial measures” as defined under the rules of the SEC. These non-GAAP financial measures are commonly used by management and investors as performance measures and liquidity indicators. These non-GAAP financial

measures are not considered measures of financial performance under generally accepted accounting principles (“GAAP”) and the items excluded therefrom are significant components in understanding and assessing our financial performance.

These non-GAAP financial measures should not be considered in isolation or as an alternative to GAAP measures such as net income, cash flows provided by or used in operating, investing or financing activities, net capital expenditures or other

financial statement data presented in the Company’s consolidated financial statements as an indicator of financial performance or liquidity. Since these non-GAAP financial measures are not measures determined in accordance with GAAP and are

susceptible to varying calculations, these measures, as presented, may not be comparable to other similarly titled measures of other companies.

Basis of Presentation

Information presented as

“LTM” or “last twelve months” is the arithmetical sum of the Company’s financial results for the last twelve months. This information is not necessarily indicative of the results to be expected for the full year or any

future period.

We have filed a registration statement (including a prospectus) and a related prospectus

supplement with the SEC for the offering to which this Investor Presentation relates. Before you invest, you should read such prospectus and prospectus supplement (including the risk factors described in the prospectus supplement) and other

documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer

participating in this offering will arrange to send you the prospectus and prospectus supplement if you request it by calling Citigroup Global Markets, Inc. at 1-212-723-6171 or Morgan Stanley & Co. LLC at 1-800-718-1649 or Credit Suisse

toll-free at 1-800-221-1037

Transaction Overview

Spirit Airlines, Inc.

(“SAVE” or “Spirit Airlines”) intends to offer its inaugural EETC (“SAVE 2015-1”) to raise approximately $576 million of proceeds

Spirit Airlines intends to issue $576,581,000 of Pass Through Certificates, Series 2015-1, in two classes, as follows:

Class A: $455,622,000

Class B: $120,959,000

The Equipment Notes

underlying the SAVE 2015-1 certificates will have the benefit of a security interest in the following fifteen (15) Airbus aircraft to be delivered to Spirit Airlines:

Twelve (12) new Airbus A321-200 aircraft scheduled to be delivered to Spirit Airlines between October 2015 and December 2016

Three (3) new Airbus A320-200 aircraft scheduled to be delivered to Spirit Airlines between June 2016 and December

2016

The EETC Structure will include the following:

Senior Class A debt amortizing over 12.6 years

Subordinate Class B debt amortizing over 8.6 years

Liquidity Facilities will be provided for three semiannual interest payments on Class A and Class B exclusively

Lead Bookrunners and Structuring Agents: Citi and Morgan Stanley Bookrunner: Credit Suisse Liquidity Provider

and Depositary: Natixis, acting via its New York branch

Summary of the Certificates Offering

Class A

Class B

Aggregate Face Amount $455,622,000 $120,959,000

Expected Ratings (S&P / Fitch)( A / A )( BBB- / BBB+)

Initial / Highest LTV (1) 54.0% / 54.0% 66.7% / 66.7%

Interest Rate Fixed rate, semiannual payments, 30/360 day count

Initial Average Life 8.6 years 5.5 years

April 1 & April 1 &

Regular

Distribution Dates October 1 October 1

Expected Principal Distribution Window(2) 1.1—12.6

years 1.1—8.6 years

Final Expected Distribution Date April 1, 2028 April 1, 2024

Final Legal Distribution Date October 1, 2029 October 1, 2025

Minimum Denomination(3) $2,000 $2,000

| 3 |

|

semiannual interest 3 semiannual interest |

Liquidity Facility Coverage payments payments

Proceeds of the offering will be held in escrow with

Depositary the Depositary and withdrawn from time to time to

purchase Equipment Notes as the aircraft are

financed

1. Initial Loan to Value Ratio calculated as of April 1, 2017, the first Regular Distribution Date after all aircraft are assumed to be financed and after giving effect to

distributions expected to be made on or prior to such date and assumed depreciation of aircraft. The assumed aggregate appraised value of the aircraft on such date is $784,535,850. Appraised value is calculated using the lesser of the mean and

median (“LMM”) values of each aircraft as appraised by AISI, BK and MBA. An appraisal is only an estimate of value and should not be relied upon as a measure of realizable value. Please refer to the Preliminary Prospectus Supplement for

further details

2. Each series of Equipment Notes will mature on the Final Expected Distribution Date for the

related class of certificates

3. The certificates will be issued in minimum denominations of $2,000 (or such

other denomination that is the lowest integral multiple of $1,000 that is, at the time of issuance equal to at least 1,000 euros) and integral multiples of $1,000 in excess thereof

SAVE 2015-1 Indicative Transaction Structure

Consistent with recent US airline EETC Issues

| (1) |

|

The Equipment Notes with respect to each Aircraft will be issued under a separate Indenture

|

(2) The Liquidity Facility for each of the Class A Certificates and the Class B

Certificates is expected to be sufficient to cover up to three consecutive semiannual interest payments with respect to such Class, except that the Liquidity Facilities will not cover interest on the Deposits

(3) The proceeds of the offering of each Class of Certificates will initially be held in escrow and deposited with the

Depositary, pending financing of each Aircraft. The Depositary will hold such funds as interest bearing Deposits. Each Trust will withdraw funds from the Deposits relating to such Trust to purchase Equipment Notes from time to time as each Aircraft

is financed. The scheduled payments of interest on the Equipment Notes and on the Deposits relating to a Trust, taken together, will be sufficient to pay accrued interest on the outstanding Certificates of such Trust. If any funds remain as Deposits

with respect to a Trust at the Delivery Period Termination Date, such funds will be withdrawn by the Escrow Agent and distributed to the holders of the Certificates issued by such Trust, together with accrued and unpaid interest thereon. No interest

will accrue with respect to the Deposits after they have been fully withdrawn.

Mortgage Payments

Indenture / Loan Trustees (1)

Series A Series B Equipment Equipment Notes Notes

Equipment Note Advances and Payments on all Reimbursements Aircraft (if any)

Subordination Liquidity Agent Provider (2)

Principal, Make-Whole Amount (if any) and Interest Distributions

Class A Class B

Trustee Trustee Depositary

(3)

Class A Class B Escrow Certificate Certificate Agent holders holders

Key Structural Considerations

Documentation

consistent with recent precedent U.S. airline EETC structures(1)

· Two Tranches of amortizing debt are

being offered, with the Class A and Class B each benefitting from a

Classes Offered separate liquidity

facility covering three semiannual interest payments

Cross-· The Equipment Notes will be

cross-collateralized by all Aircraft

Collateralization and Cross-Default · All Indentures will include

cross-default provisions

· Same waterfall both before and after an Indenture Event of Default

Waterfall

· Interest on Eligible Pool Balance on Class B Certificates is paid ahead of principal on Class A Certificates

· Class B Certificateholders have the right to purchase all (but not less than all) of then outstanding

Class A Certificates

Buyout Rights at par plus accrued and unpaid interest upon certain events during

Spirit Airlines’ bankruptcy

· Strategically core aircraft types to Spirit Airlines’ fleet

operation all of which are expected to be delivered new in 2015

Collateral and 2016

1. See Preliminary Prospectus Supplement for further details

Collateral Summary

SAVE 2015-1 will have the

following Airbus aircraft as collateral

The initial aggregate aircraft Appraised Value is $784,535,850(1)

Appraisals indicate an initial collateral cushion of approximately 46.0%(2) and 33.3%(2) on the Class A

and B Certificates respectively, which increases over time as the Class A and Class B debt amortizes based on assumed depreciation of collateral value(3)

Collateral Pool Composition

By Base Value(1)

A320-200 18%

A321-200 82%

Appraised Base Value ($MM)

Expected Delivery Registration Engine AISI BK MBA LMM(4)

# Aircraft Type Date Number Type

| 1 |

|

A320-200 Jun-16 N644NK V2527-A5S1 50.76 49.20 44.69 48.22 |

| 2 |

|

A320-200 Sep-16 N645NK V2527-A5S1 51.01 49.40 44.80 48.40 |

| 3 |

|

A320-200 Dec-16 N646NK V2527-A5S1 51.26 49.60 44.91 48.59 |

| 4 |

|

A321-200 Oct-15 N660NK V2533-A5S1 57.06 54.75 54.48 54.75 |

| 5 |

|

A321-200 Nov-15 N661NK V2533-A5S1 57.15 54.75 54.52 54.75 |

| 6 |

|

A321-200 Dec-15 N662NK V2533-A5S1 57.25 54.75 54.57 54.75 |

| 7 |

|

A321-200 Feb-16 N663NK V2533-A5S1 57.44 54.95 54.66 54.95 |

| 8 |

|

A321-200 Mar-16 N664NK V2533-A5S1 57.53 54.95 54.70 54.95 |

9 A321-200 Mar-16 N665NK V2533-A5S1 57.53 54.95 54.70 54.95

| 10 |

|

A321-200 Apr-16 N667NK V2533-A5S1 57.62 55.15 54.75 55.15 |

| 11 |

|

A321-200 May-16 N668NK V2533-A5S1 57.72 55.15 54.79 55.15 |

| 12 |

|

A321-200 Aug-16 N669NK V2533-A5S1 58.00 55.35 54.93 55.35 |

| 13 |

|

A321-200 Sep-16 N670NK V2533-A5S1 58.10 55.35 54.97 55.35 |

| 14 |

|

A321-200 Nov-16 N671NK V2533-A5S1 58.29 55.55 55.06 55.55 |

| 15 |

|

A321-200 Dec-16 N672NK V2533-A5S1 58.39 55.55 55.11 55.55 |

Total 845.11 809.40 791.64 806.41

1. As of April 1, 2017, the first Regular Distribution Date after all aircraft are assumed to be financed and after giving effect to all distributions expected to be made on or prior

to such date and assumed depreciation of the aircraft. Appraised value is calculated using the lesser of the mean and median (“LMM”) values of each aircraft as appraised by AISI, BK and MBA. An appraisal is only an estimate of value and

should not be relied upon as a measure of realizable value

2. Initial collateral cushion is calculated as of

the first Regular Distribution Date after all aircraft are assumed to be financed (April 1, 2017)

3. Assumes

that the base value of the aircraft depreciates by 3% per year during the first 15 years after initial delivery, 4% for years 15 through 20, and 5% for years 20 and beyond

4. Lesser of the median and mean of the base values of the aircraft as appraised by AISI, BK and MBA

Collateral Fleet Importance

The transaction

collateral is an essential component of Spirit Airlines’ fleet and is core to its future fleet strategy

#

of Aircraft Owned Fleet(1) # of Aircraft Total Fleet(1) 100 35

16%

30 80 25

50%

60 20

3%

15 20% of

40 10% A320 80% of owned fleet

10 A321

40% owned fleet 20 5

13%

0 (1) 0

Owned Fleet A320-200 ceo & neo A321-200 Total Fleet (1) A319-100 A320-200 ceo A321-200 A320-200neo Owned Fleet SAVE 2015-1 Collateral Total Fleet SAVE 2015-1 Collateral

SAVE 2015-1 collateral pool represents ~16% of Spirit Airlines’ total operating fleet (which includes

both owned and leased aircraft)(2)

However, SAVE 2015-1 collateral pool represents ~50% of Spirit

Airlines’ total owned fleet

A320 represents ~10% of total owned fleet and ~20% of A320 fleet

A321 represents ~40% of total owned fleet and ~80% of A321 fleet

SAVE 2015-1 collateral pool is thus anticipated to be vital to Spirit Airlines and its operational efficiency

Source: Spirit Airlines

1. Owned / Total fleet includes all deliveries until Dec 2016 (inclusive of collateral in the SAVE 2015-1 transaction)

2. Based on current fleet plan as of June 30, 2015 and measured as of December 31, 2016. For Spirit

Airlines’ fleet plan beyond 2016, see section entitled “Prospectus Supplement Summary – Overview of Spirit – Our Fleet” in the Preliminary Prospectus Supplement

A320-200 Highlights

A320-200 has a global

customer base and operates in all sectors

This aircraft is expected to be one of the most marketable aircraft,

drawing on the large customer base and commonality within the A320 family

Wider fuselage than main competitors

allows increased passenger comfort and better cargo capacity

Aircraft has received positive feedback and is a

lessor and financier favorite

Remains popular with operating lessors with more than half the fleet managed

through this sector

Key Statistics(1)

# Customers 168

# Operators 218

# In Operation 3,735

# Ordered 4,747 In Production Yes

A320-200ceo (In

Service/On Order)

Breakdown by Geography

Other Africa Middle East 4% 2% 7%

Latin America Asia Pacific

9% 38%

North America 12%

Europe 28%

Top 5 Airline Operators(2) Top 5

Operating Lessors(2)

On Order On Order

Airlines # of Aircraft Lessors # of Aircraft

171 226

143 213

132 154 114 89 113 80

Source: Airbus as of May 31, 2015. Ascend Q2 2015 Market Commentary

1. Airbus as of May 31, 2015

2. Includes

only A320-200ceo aircraft

A320-200 Aircraft Characteristics

Founding member

of Airbus single-aisle family

Fuselage A320-200 aircraft

Fuel Efficiency

Sharklets improve fuel economy by Fuselage structure built around a reducing drag from the air flow series of frames pitched at 21 inches around the wing tip

Cockpit

Fly-by-wire cockpit with advanced electronic flight deck

Engine

Equipped with V2527-A5 SelectOne Engine

Type

Airbus first delivered A320-200 on March 1982 to Air France Strong orderbook indicates operator

enthusiasm

Currently there are 4,747 firm orders with 168 customers worldwide

Spirit Airlines’ current forward delivery configuration accommodates 182 passengers (compared to 150 on United and

JetBlue)

A320’s advanced technology includes a centralized fault display for easier troubleshooting and

lower maintenance costs

A320 is equipped with the advanced electronic flight deck

Six fully integrated EFIS(1) color displays

Innovative side stick controllers rather than conventional control columns

Source: Airbus as of June, 2015. Ascend Q2 2015 Market Commentary

| 1. |

|

Electronic flight instrument system |

9

A321-200 Highlights

A321-200 continues to be an

increasingly popular type

A321ceo is outperforming the Boeing competitor (737-900ER) in terms of fleet size,

order growth and total backlog

Over 1,500 orders for A321-200ceo filling almost all delivery slots

More than 40% of the fleet is lessor owned which increases liquidity

A321-200ceo Overview

A321-200ceo (In Service/On Order)

Breakdown by

Geography

Middle East Other 3% 5% Latin America

Europe 5% 34%

North America 25%

Asia Pacific 28%

Source: Airbus as of May 31, 2015. Ascend Q2 2015 Market Commentary

1. Airbus as of May 31, 2015

2. Includes only A321-200ceo aircraft

3. Includes

121 orders for US Airways

Key Statistics(1)

# Customers 94

# Operators 86

# In Operation 1,075

# Ordered 1,606 In Production Yes

Top 5 Airline Operators(2) Top 5 Operating Lessors(2)

On Order On Order

Airlines # of Aircraft Lessors

# of Aircraft

(3) 91

192

65 39

64 38

57 34

46 25

10

A321-200 Aircraft Characteristics

Benchmark A320

family’s largest member

Fuselage A321-200 aircraft

A321 has 13 frames more than A320

Fuel Efficiency

Sharklets improve fuel economy by

reducing drag Cockpit from the air flow around the wing tip Fly-by-wire cockpit with advanced electronic flight deck

Cabin

High density layout allows seating to

currently accommodate 218 passengers with push to 230

Engine

Equipped with V2533-A5 SelectOne Engine Type

1,606 cumulative orders from 94 customers worldwide

A321-200ceo offers lower seat-mile costs than 150-seaters

Provides more capacity at slot- constrained airports

Compared to A320, A321’s major change is the elongated length

Overall length of 44.51m

A321 is the largest member of Airbus’ A320 series

Spirit Airlines’ configuration currently accommodates up to 218 (compared to 181 on American Airlines and 190 on JetBlue), although additional seating capacity up to 228 passengers is

anticipated for the A321-200s in SAVE

2015-1 collateral pool

Sharklets improve fuel burn and emissions and raise payload range

A321-200 first flew from Daimler Benz

Aerospace’s Hamburg facility in December

1996

Source: Airbus as of June, 2015

11

APPENDIX A: CREDIT PRESENTATION

1. Spirit Airlines – Taking a Different Approach

2. Business Highlights – ULCC for the Americas

3. Financial Performance – A Profitable, Defensible Model

13

SPIRIT AIRLINES –

TAKING A DIFFERENT

APPROACH

Spirit is an Industry Innovator

Differentiated

business model in the U.S.

Low total fares (Bare Fares™ + Frill Control™/options) drives demand

One of the lowest cost producers in our markets

One of the highest margin performers among competitors

Disciplined growth strategy has resulted in positive net income for eight consecutive years, even during volatile economic

environments

Strong credit position and cash balance

15

74 Aircraft Serving Over 180 Non-Stop Markets

Route selection based on optimizing operating margin and utilization

360+ daily flights to 57 destinations (1)

Diversified network

Low frequency, primarily

point-to-point

84% of the Top 25 U.S. Metros

Demographic affinity between Ft. Lauderdale & Caribbean

1. As of July 2015, includes routes announced but not yet started and seasonal routes.

16

BUSINESS HIGHLIGHTS – ULCC FOR THE AMERICAS

Resilient ULCC Business Model

Ultra Low Cost By

Design

+ Multifaceted Revenue Model

+ Growing Addressable Market with Low Fares

+

Large Market Opportunity

= Industry Leading Profitability

18

Ultra Low Cost by Design

Keep it simple –

one class cabin, treat all customers the same, no waivers & favors

High asset utilization

Maximize real estate on aircraft (seat density)

High aircraft utilization (hrs/day)

Cost

effective use of facilities

Optimize the variable component of our cost structure

Flexible outsourcing at stations, especially when first entering a market

Lease gates on an as needed basis —avoid initial long-term commitments

Keep a low cost mindset

Continual pressure to eliminate and reduce costs

Unit cost targets communicated company-wide

Bonus program is directly linked to achieving unit cost targets

Average Daily Aircraft Utilization (1)

(Hours)

13.0 12.7

11.8

10.9 11.0

9.0

1. Based on public company reports for the twelve months ended December 31, 2014.

19

Cost Structure Allows Low Total Fares

Spirit’s total revenue per passenger is below the competition’s breakeven cost

Full-Year 2014 Stage Length Adj. Revenue Per Passenger (1)

($) Breakeven Cost per Passenger Pre-tax Profit per Passenger % Pre-tax Margin

375 25.0% 350 325 5.1% 300 20.0%

275 11.2%

250 9.8%

225 15.0% 200 17.2%

175 6.6%

150 10.0%

12.0% 125 19.2%

100

75 5.0% 50 25

0.0% Alaska

1. Derived from public company reports for the twelve months ended December 31, 2014. American assumes pro forma results including US Airways for entire period. Reflects consolidated

operations. Excludes special items and unrealized mark-to-market gains and losses for all carriers shown.

20

Price 50 Non-stop vs. connecting flight 13 Schedule 11 Reputation of airline service 6 Airports served (which area airport is selected) 5 Luggage charges and other fees 3 Wi-fi 3 Extra

legroom 3 Business class availability 2 Frequent flier benefits 2 Complimentary in-flight snack and beverage 1

0 20 40 60 (%)

1. Source: Toluna MultiMind Omnibus Surveys; sample size: 1,474 air travelers; field date: June 26-27, 2014.

21

Base Fare + Optional Services = Lowest Total Price

Average Domestic Fare + Bag & Seat Options (1)

($)—LTM 12/31/14

175

166 168 170

153 149 150

125

104

100

75

Mainline domestic data only for all carriers

shown derived from US DOT Form 41 for the twelve months ended December 31, 2014. “Average Domestic Fare + Bag & Seat Options” equals domestic passenger, seat and excess bag revenue divided by the total number of domestic

revenue passenger enplanements. Average for peer carriers is subsequently normalized to Spirit’s domestic length of haul (“LOH”) of 1,008 miles for the corresponding period. Normalization for other airlines equals their unadjusted

“Average Domestic Fare + Bag & Seat Options” multiplied by the ratio of (a respective airlines LOH / 1,008)-0.55. Coefficient of 0.55 is consistent with industry accepted figures derived from regression of ticket prices to LOH.

#1 in Non-ticket

Spirit remains #1 in non-ticket

revenue per passenger segment (1)

… and we aren’t done yet

($)

60.00

55.03 53.84 51.39 50.00 44.79

40.00 30.00 20.00 10.00

0.00

2011 2012 2013 2014

Non-Ticket/Ancillary Characteristics

Encourages demand stimulation

Customers choose

what they value

Less seasonal

Less subject to price wars

Provides economic

incentives to drive low cost behavior

Example:

Charge for bags

Customers bring fewer bags

Less infrastructure

needed

Burn less fuel

Saves Spirit & Customers Money!

High

Margin, Stable Source of Revenue

1. Source: Company filings

23

Grows the Market with Low Fares

On average,

Spirit’s low fares grow the traffic base by about 37% (1)

Average Passengers per Day Each Way

(2)

Pre Spirit Post Spirit

2,000

1,777

1,500

1,347

1,048 1,000 951 737 650

535 500 407 346 191

0

Chicago Ft. Lauderdale Los Angeles Las Vegas

Dallas/Fort Worth

& & & & & Orlando San Jose, CR Chicago Oakland

Detroit

1. Measurement period runs from January 2007 through June 2014. System average measures only those

markets Spirit has served for at least twelve months.

2. Sample markets do not necessarily reflect system

average. Pre Spirit is the average for the four calendar quarters prior to Spirit’s entry; Post Spirit is the average for the four calendar quarters following Spirit’s entry.

24

Spirit Has Substantial Growth Opportunities

Many

untapped markets with high average fares

Potential Routes for Growth (1)

(¢)

40.00

35.00

Mile) 30.00 Over 500 Markets Seat Meet our Threshold for Growth

Available 25.00

per 20.00

(Revenue 15.00 RASM

10.00

5.00

100 600 1,100 1,600 2,100 2,600

Miles

1. Based on USDOT DB1B twelve months ended 12/31/14.

25

Long Track Record of Profitability

Credit Rating

(2) 2007 2008 2009 2010 2011 2012 2013 2014

BB- / — / BB+ ? ? ? ? ? ? ? ?

BBB / Baa1 / BBB ? ? ? ? ? ? ? ? BB / Ba3 / — ? ? ? ? ? ? ? ? BBB- / — / BBB- ? ? ? ? ? ? ? ? B+ / Ba3 / B+ B+ / B3 / B ?

BB / Ba2 / BB

BB- / Ba3 / B+

— / — / — —

BB- / Ba3 / B+

et income (GAAP) for fiscal years

= profitable; negative reported net income (GAAP) for fiscal year = not profitable. ? Profitable (1) ? Not profitable (1) ch long-term corporate ratings as of July 17, 2015. bility not pro forma and for original comp mesake only

(United Airlines, American Airlines, Southwest and Delta)

26

FINANCIAL PERFORMANCE – A PROFITABLE, DEFENSIBLE MODEL

Financial Policy and Results

Unwavering

commitment to profitability

Industry-leading margins and liquidity

Low leverage

No current plans for dividend

Opportunistic share

repurchase

Highly disciplined growth strategy

Operating and Financial Results

$MM unless 1Q2015 FY2014 FY2013

otherwise stated

LTM

Total Aircraft (#) 70 65 54

Available Seat Miles (MM) 17,285 16,340 13,861

Revenue 1,987 1,932 1,654

Adj. EBITDAR (1) 676 614 485

Adj. Net Income

(1) 270 237 178

Adj. Net Income YoY Growth 48% 33% 50%

Capitalization

$MM As of March 31, 2015

Market

Capitalization (2) 4,331

Gross Debt (3) 325

Adj. Total Debt (3) 1,741

Cash and Cash Equivalents 742

Adj. Net Debt

(3) 999

Adj. Aggregate Value (2)(3) 5,330

1. Excludes special items and unrealized mark-to-market gains and losses. See Appendix for reconciliation to most

comparable GAAP measure.

2. Market capitalization as of July 17, 2015 market close.

3. Gross Debt equals the sum of all Long-Term Debt as reported on the balance sheet. Adjusted Total Debt equals Gross Debt

plus LTM Aircraft Rent capitalized at 7x. Adjusted Net Debt equals Adjusted Total Debt minus Cash and Cash Equivalents as reported on the balance sheet. Adjusted Aggregate Value equals Market Capitalization plus Adjusted Net Debt.

28

Strong Financial Performance

RASM Adjusted

EBITDAR (1)

(Cents) ($MM) 12.00 11.94 11.82 800 11.62 11.45 $614 11.00 600 $485 10.00 9.62 400 $349 $275 $198

9.00 200

8.00 0

2010 2011 2012 2013 2014 2010 2011 2012

2013 2014

Adjusted CASM ex-Fuel (1) Adjusted EBITDAR Margin (1)

(Cents) (%)

6.50 40.0

31.8

5.98 29.3

6.00 5.91 5.88 30.0

25.7 26.0

5.66 5.72 24.5

5.50 20.0

5.00 10.0

4.50 0.0

2010 2011 2012 2013 2014 2010 2011 2012 2013 2014

1. Excludes special items and unrealized mark-to-market gains and losses. 2010 adjusted for estimated impact of pilot

strike. 2012 adjusted for estimated impact of Hurricane Sandy. See Appendix for reconciliation to most comparable GAAP measure.

29

Consistent Industry Leading Performance

Great

Recession

Adjusted EBITDAR Margin (1) – 2009 (%)

40

29.4

30 27.6

25.2

20.2 19.3 17.5 20

13.0 12.4

11.3

10 7.5 7.1

5.6 4.8 0

Today

Adjusted EBITDAR Margin (1) – 2014 (%)

40

31.8

30 27.8 27.2

24.2

22.0 22.0

20.1 18.8 18.8

18.4 20

10

0

1. For Spirit, excludes special items and unrealized mark-to-market gains and losses. See Appendix for reconciliation to

most comparable GAAP measure. EBITDAR for peer carriers per Capital IQ.

30

Solid Credit Metrics

Adjusted Net Debt / Adjusted

EBITDAR (1)

As of Fiscal Year End 2014 (x)

2.8x 2.9x 3

2.4x

2.2x

1.4x

1.1x 1.1x 1

0.4x

0.3x 0

Total Cash / LTM Revenue (3)

As of Fiscal Year End 2014 (%)

40

32.8 32.7

30 26.5

22.9 22.7

18.9

20 16.1

12.2 11.4

10 8.2 0

1. For Spirit, EBITDAR excludes special items and unrealized mark-to-market gains and losses. See Appendix for

reconciliation to most comparable GAAP measure. Adjusted net debt includes LTM aircraft rent capitalized at 7x. EBITDAR, Net Debt and Aircraft Rent for peer carriers per Capital IQ.

2. Cash includes unrestricted/restricted cash, equivalents and short-term investments. Cash and Revenue figures for peer

carriers per Capital IQ.

31

APPENDIX B: RECONCILIATION

Steady Fleet Plan Provides for Measured Growth

Aircraft Delivery Schedule (net of Scheduled Retirements) as of April 29, 2015

A319 A320 CEO A320 NEO A321 CEO A321 NEO Total Total Aircraft Year-end 2014 29 34—2—65

1Q15—5 ——5 2Q15—3 ——3 3Q15 ——3—3 4Q15 — 1 3—4 Total Aircraft

Year-end 2015 29 42 1 8—80

1Q16 (1)—1 3—3 2Q16 (2) 1 1 2—2 3Q16—1 2 2—5

4Q16—1—2—3 Total Aircraft Year-end 2016 26 45 5 17—93

2017 (4) 7—8—11 2018

(5) 2 6 5—8 2019 (1)—3—10 12 2020 (7)—13 — 6 2021 (4)—18 — 14 Total Aircraft Year-end 2021 5 54 45 30 10 144

Notes:

Includes aircraft on firm order as well as

5 leased A320neo aircraft.

2017 reflects scheduled deliveries of 8 A320ceo and 10 A321ceo aircraft, net of 1

A320ceo and 2 A321ceo lease expirations.

33

Reconciliation for Adjusted EBITDAR

Year Ended

December 31,

2009 2010 (e) 2011 2012(f) 2013 2014 LTM 1Q15

(in thousands)

EBITDA Reconciliation:

Net income, as reported $

83,693 $ 72,481 $ 76,448 $ 108,460 $ 176,918 $ 225,464 $ 256,760

Add: Provision for income taxes 1,533(52,296)

46,383 66,124 105,492 127,530 145,284

Income before income taxes, as reported 85,226 20,185 122,831 174,584

282,410 352,994 402,044

Add:

Interest expense 46,892 50,313 24,781 1,350 214 2,747 5,452

Capitalized interest(951)(1,491)(2,890)(1,350)(214)(2,747)(5,173)

Interest income(345)(328)(575)(925)(401)(336)(402)

Gain on extinguishment of debt (a)(19,711) — — —

Depreciation and amortization 4,924 5,620 7,760 15,256 31,947 46,971 50,713

EBITDA 116,035 74,299 151,907 188,915 313,956 399,629 452,634

Add:

Other expense 298 194 235 331 283 2,605 2,640

Unrealized mark-to-market (gains) losses (b)(1,449)(2,065) 3,204 46 265 3,881 5,576

Loss on disposal of assets 1,010 77 255 956 525 3,008 3,453

Special charges (credits) (c)(392) 621 3,184(8,450) 174 45 461

Operating special items (d) — ——9,278 9,278

Adjusted EBITDA 115,502 73,126 158,785 181,798 315,203 418,446 474,042

Add: Aircraft rent 89,974 101,345 116,485 143,572 169,737 195,827 202,228

Adjusted EBITDAR $ 205,476 $ 174,471 $ 275,270 $ 325,370 $ 484,940 $ 614,273 $ 676,270

Adjusted EBITDAR margin 29.4% 22.3% 25.7% 24.7% 29.3% 31.8% 34.0%

Total Operating Revenue $ 700,037 $ 781,265 $ 1,071,186 $ 1,318,388 $ 1,654,385 $ 1,931,580 $ 1,986,948

Estimated impact from 2010 strike $ 24,000

Strike-Adjusted EBITDAR (e) $ 198,471

Estimated impact from 2010 strike 28,000

Strike-Adjusted Total Operating Revenue (e) $ 809,265

Strik e-Adjusted EBITDAR Margin (e) 24.5%

Estimated impact from Hurricane Sandy $ 24,000

Hurricane Sandy-Adjusted EBITDAR (f) $ 349,370

Estimated impact from Hurricane Sandy $ 25,000

Hurricane Sandy-Adjusted Total Operating Revenue (f) $ 1,343,388

Hurricane Sandy-Adjusted EBITDAR Margin (f) 26.0%

34

See “Reconciliation Footnotes” at

the end of the Appendix for more details.

Reconciliation for Adjusted Net Income

Year Ended

December 31,

2012(f) 2013 2014 LTM 1Q14 LTM 1Q15

(in thousands)

Net income, as reported $ 108,460 $ 176,918 $ 225,464 $ 184,070 $ 256,760

Add: Provision for income taxes 66,124 105,492 127,530 108,640 145,284

Income before income taxes, as reported 174,584 282,410 352,994 292,710 402,044

Add: Unrealized mark-to-market (gains) losses (b) 46 265 3,881(3,116) 5,576

Add special items: —

Loss on disposal of

assets 956 525 3,008 505 3,453

Special charges (credits) (c)(8,450) 174 45 160 461

Operating special items (d) — 9,278—9,278

Non-operating special items (g) — 1,388—1,388

Income before income taxes, non-GAAP 167,136 283,374 370,594 290,259 422,200

Add: Adjustment for interest expense (pre-IPO) — — -

Income before income taxes, non-GAAP 167,136 283,374 370,594 290,259 422,200

Provision for income taxes (h) 63,303 105,852 133,889 107,730 152,568

Adjusted net income, non-GAAP 103,833 177,522 236,705 182,529 269,632

Estimated impact from Hurricane Sandy 24,000

Adjusted income before income taxes, non-GAAP $ 191,136

Estimated impact from Hurricane Sandy, net of taxes 14,676

Adjusted net income, non-GAAP $ 118,509

35

See “Reconciliation Footnotes” at the end of the Appendix for more details.

Reconciliation for Adjusted CASM

Year Ended

December 31,

2010(e) 2011 2012(f) 2013 2014

(in thousands except CASM data in cents)

Total operating expenses, as reported $ 712,392 $ 926,804 $ 1,144,398 $ 1,372,093 $ 1,576,317

Less: Unrealized mark-to-market (gains) losses (b)(2,065) 3,204 46 265 3,881

Less special items:

Loss on disposal of assets 77

255 956 525 3,008

Special charges (credits) (c) 621 3,184(8,450) 174 45

Operating special items (d) — — 9,278

Adjusted operating expenses, non-GAAP $ 713,759 $ 920,161 $ 1,151,846 $ 1,371,129 $ 1,560,105

Less economic fuel expense, non-GAAP 250,271 384,842 471,717 551,481 599,750

Adjusted operatings expenses excluding fuel $ 463,488 $ 535,319 $ 680,129 $ 819,648 $ 960,355

Available seat miles (ASMs) 8,119,923 9,352,553 11,344,731 13,861,393 16,340,142

Cost per ASM (CASM)—GAAP 8.77 9.91 10.09 9.90 9.65

Adjusted CASM (cents) (i) 8.79 9.84 10.15 9.89 9.55

Adjusted CASM ex-fuel (cents) (i) 5.71 5.72 6.00 5.91 5.88

Estimated impact from 2010 strike 4,000

Strike-Adjusted operating expense ex-fuel (e) $ 467,488

Estimated impact from 2010 strike 145,800

Stike-Adjusted ASMs (e) 8,265,723

Strike-Adjusted CASM ex-fuel (cents) (e) 5.66

Estimated impact from Hurricane Sandy 19,900

Hurricane Sandy-Adjusted ASMs (f) 11,364,631

Hurricane Sandy-Adjusted CASM ex-fuel (cents) (f) 5.98

36

See “Reconciliation Footnotes” at the end of the Appendix for more details.

Reconciliation Footnotes

(a) Gain on

extinguishment of debt represents the recognition of contingencies provided for in our 2006 recapitalization agreements, which provided for the cancellation of shares of Class A Preferred Stock and reduction of the liquidation preference of the

remaining Class A Preferred Stock and associated accrued but unpaid dividends based on the outcome of the contingencies.

| (b) |

|

Unrealized mark-to-market gains and losses is comprised of non-cash adjustments to fuel expenses.

|

(c) Special charges (credits) include: (i) for 2009, amounts relating to the early

termination in mid-2008 of leases for seven Airbus A319 aircraft, a related reduction in workforce and the exit facility costs associated with returning planes to lessors in 2008 and the sale of previously expensed MD-80 parts, (ii) for 2010,

amounts relating to exit facility costs associated with moving our Detroit, Michigan maintenance operations to Fort Lauderdale, Florida, (iii) for 2011, amounts relating to exit facility costs associated with moving our Detroit, Michigan

maintenance operations to Fort Lauderdale, Florida and termination costs in connection with the IPO during the three months ended June 30, 2011 comprised of amounts paid to Indigo Partners, LLC to terminate its professional service agreement

with Spirit and fees paid to three individual, unaffiliated holders of the Company’s subordinated notes, and, (iv) for 2012, recognition of a gain on the sale of four carrier slots at Ronald Reagan National Airport and secondary offering

costs related to the sale of 9.4 million shares by Oaktree Capital Management.

(d) Operating special

items include for 2014 additional federal excise tax on a minority of fuel volume for the period beginning July 1, 2009 through December 31, 2013.

| (e) |

|

Reflects the estimated impact of the pilot strike in 2010. |

| (f) |

|

Adjusted for the estimated impact of Hurricane Sandy in 2012. |

(g) Non-operating special items for 2014 relate to the settlement paid to the Pre-IPO Stockholders in excess of the

liability the Company had previously estimated related to the Company’s Tax Receivable Agreement.

| (h) |

|

Assume same marginal tax rate as is applicable to GAAP net income for the period. |

(i) Adjusted CASM equal to adjusted operating expenses, non-GAAP / available seat miles. Adjusted CASM ex-fuel equal to

adjusted operating expenses excluding fuel, non-GAAP / available seat miles.

37

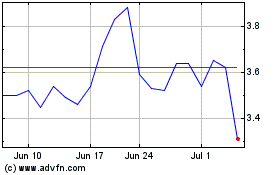

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

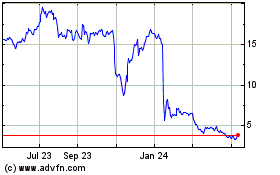

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024