Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 28 2015 - 6:04AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-202409

Final Term Sheet dated May 27, 2015 supplementing

the Preliminary Prospectus Supplement dated May 27, 2015

Final Term Sheet

ArcelorMittal

$500,000,000 aggregate principal amount of its 5.125% Notes due 2020

This final term sheet dated May 27, 2015 relates only to the securities described below and should be read together with the preliminary prospectus

supplement dated May 27, 2015 and the accompanying prospectus (including the documents incorporated by reference in the Preliminary Prospectus and the accompanying prospectus) (together. the “Preliminary Prospectus”) before making a

decision in connection with an investment in the securities. Terms used but not defined herein have the meaning ascribed to them in the Preliminary Prospectus.

|

|

|

| Issuer: |

|

ArcelorMittal |

| Security description: |

|

5.125% notes due 2020 |

| Size: |

|

$500,000,000 |

| Price: |

|

100.000% of face amount |

| Maturity: |

|

June 1, 2020, unless earlier redeemed |

| Coupon: |

|

5.125% per annum |

| Yield to Maturity: |

|

5.125% |

| Benchmark Treasury: |

|

UST 1.375% due April 30, 2020 |

| Spread to Benchmark Treasury: |

|

T+359 bps |

| Interest Payment Dates: |

|

June 1 and December 1, commencing December 1, 2015 |

| Total Net Proceeds Before Expenses: |

|

The net proceeds of the Notes Offering, after deduction of underwriting discounts and commissions (excluding any potential discretionary fees) of approximately $2.0 million, amount to approximately $498 million. |

| Use of Proceeds: |

|

The net proceeds of the offering will be used to repay existing indebtedness, in particular the early redemption (through the exercise of the make-whole option) of bonds maturing in August 2015 that bear interest at 4.5% per annum

and possibly in the interim short-term indebtedness |

| Change of Control: |

|

101% |

| Make-whole Spread: |

|

T+50 bps |

| Trade date: |

|

May 27, 2015 |

| Settlement: |

|

T+3; June 1, 2015 |

| CUSIP: |

|

03938LAY0 |

| ISIN: |

|

US03938LAY02 |

| Denominations/Multiple: |

|

$2,000 x $1,000 |

|

|

|

| Expected Ratings:* |

|

Ba1 (negative) (Moody’s) / BB (stable) (S&P) / BB+ (stable) (Fitch) |

| Underwriters: |

|

Joint Book-Running Managers J.P. Morgan

Securities LLC Citigroup Global Markets Inc. Deutsche Bank

Securities Inc. Merrill Lynch, Pierce, Fenner & Smith

Incorporated |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting J.P. Morgan

Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717 or by calling toll-free at 1-866-803-9204, Citigroup Global Markets Inc. by calling toll-free at 1-800-831-9146, Deutsche Bank Securities Inc. by

calling toll-free at 1-800- 503-4611 and Merrill Lynch, Pierce, Fenner & Smith Incorporated by calling toll-free at 1-800-294-1322.

ANY

DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR

ANOTHER EMAIL SYSTEM.

| * |

Note on Rating Information: Ratings are not a recommendation to purchase, hold or sell notes, inasmuch as the ratings do not comment as to market price or suitability for a particular investor. The ratings are based

upon current information furnished to the rating agencies by the issuer and information obtained by the rating agencies from other sources. The ratings are only accurate as of the date thereof and may be changed, superseded or withdrawn as a result

of changes in, or unavailability of, such information. Each rating should be evaluated independently of any other rating. |

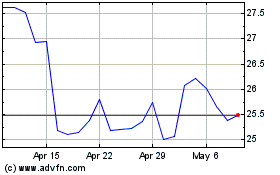

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

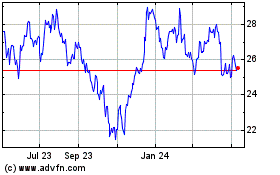

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024