France's Oddo Trumps Fosun Offer For Fund Manager

November 27 2015 - 7:50AM

Dow Jones News

FRANKFURT—Oddo & Cie, a French boutique investment-banking

and asset-management firm, has made a €760 million ($805 million)

offer for Belgium-headquartered rival BHF Kleinwort Benson Group,

trumping an earlier approach by China's Fosun International

Ltd.

The move by the Paris-based firm follows BHF's rejection of a

takeover offer from the fast-expanding Chinese group in July.

Oddo has offered €5.75 a share for BHF Kleinwort Benson, a 13%

premium to the €5.10 a share offer made by Fosun.

Oddo's Managing Partner Philippe Oddo said the deal "would be a

milestone to grow" his company and help expand Oddo's footprint in

Germany.

The French firm plans to sell some BHF Kleinwort Benson U.K.

assets, with an equity value of £ 190 million ($285 million), to

French bank Socié té Gé né rale should the deal go through, Mr.

Oddo said. Oddo expects regulatory approval of the transaction by

mid-December, he said.

SocGen said combining the BHF Kleinworth Benson assets with its

SG Hambros unit would create "one of the best private banks in the

U.K. and Channel Islands."

Fosun is currently waiting for regulatory approval for its own

BHF offer.

The Chinese investment firm earlier this year bought a

controlling stake in Hauck & Aufhaeuser KGaA, a private German

bank for wealthy clients. Fosun seeks to combine Hauck &

Aufhaeuser with BHF Kleinwort Benson, people familiar with the

matter said.

Oddo, which made net profit of €54 million on net banking income

of €315 million in 2014, acquired Close Brothers Seydler AG last

year.

Write to Eyk Henning at eyk.henning@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 27, 2015 07:35 ET (12:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

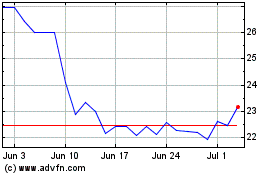

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

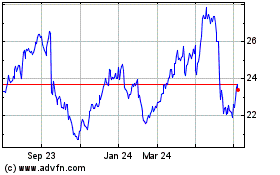

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024