France, Insurers Working to Shore Up Terror Compensation Fund

August 03 2016 - 6:43PM

Dow Jones News

By Nick Kostov and Alexa Liautaud

The surge in terror attacks across France is draining a fund for

compensating victims faster than the insurance industry can

replenish it.

President François Hollande's government has been in talks with

France's largest insurer AXA SA and other industry players since

February about how insurance companies can shore up funding of a

government-run program that pays families of terror victims and

people injured in attacks, AXA France Chief Executive Jacques de

Peretti told analysts on Friday. Government officials said they aim

to announce an agreement in September.

"This contribution is quite insufficient to face up to the

recurring terrorist acts," said Mr. de Peretti.

The potential shortfall is a measure of how the insurance

industry must adapt to what some are calling a "new normal" across

the continent, in which people inspired by Islamic State and other

radical groups carry out attacks on cafes, concert venues and other

so-called soft targets with greater frequency.

The Guarantee Fund for Victims of Terrorist and Other Criminal

Acts, or FGTI, was established by the French government in 1986 in

an effort to prevent insurance companies from creating an unseemly

cottage industry that might profit from the violence. The fund also

provides insurers with a financial buffer from terror attacks.

The government requires insurers to fund FGTI through an "attack

tax" on the 80 million policies currently in force across France,

from auto to life insurance policies. Paris raised the attack tax

to EUR4.30 ($4.79) from EUR3.30 per policy as recently as January.

But industry players are now saying that increase won't be

enough.

"We are working with the public authorities to see how we can

face up to this new need for funding probably via the increase in

the tax and probably via other contributions that the government

may make available, " Mr. de Peretti said.

Even before the drumbeat of terror attacks began in the January

2015 with the assault at the office of Charlie Hebdo magazine that

killed 12 people, the FGTI was paying out more than it was taking

in, according to the fund's publicly disclosed accounts.

Compensation has increased significantly this year, erasing some of

the EUR1.3 billion in reserves the fund had at the end of 2015.

Government officials said the fund easily has the means to

compensate all victims but said that a concern would be claims for

future attacks.

The Nov. 13 Paris attacks that killed 130 people are estimated

to cost EUR350 million in claims in the coming years, according to

government officials. The fund has compensated some 2,300 victims

of those attacks so far, said Françoise Rudetzki, a member of the

FGTI's board of directors.

The attack in Nice -- in which a man drove a truck through a

crowd of an estimated 30,000 people for more than a mile, killing

84 people and injuring hundreds more -- will also be costly and

complex to calculate. Under the rules of the fund, anyone within

the official perimeter of the attack is eligible to claim

compensation, even if they didn't suffer a physical injury.

"A lot of people are becoming a lot more aware of the ability to

claim for these losses -- maybe this is kind of a claim culture, or

a compensation culture that's crept in maybe from the (United)

States," said Srdjan Todorovic, head of terrorism at Allianz SE,

Europe's biggest insurance company by revenue.

Ms. Rudetzki of FGTI said family members of victims who died in

the attack in Nice are likely to receive up to EUR40,000. Those who

were injured will be compensated depending on the severity of their

injuries. There is no explicit limit on payouts for people who are

deemed unable to return to work, she said.

On July 28, the government announced it had made the first

payments to terror victims in Nice totaling EUR300,000.

People who draw on the state-run fund can still claim payouts

from private insurance policies that cover damages resulting from

terror attacks, according to the trade body representing France's

insurers.

Some insurers have responded by tailoring coverage to the

shifting security environment, selling policies that cover

international events ranging from terror attacks to violence during

protests and other civil unrest.

Four months after the Charlie Hebdo attacks, Allianz began

offering stand-alone terrorism insurance. "There's a growing sort

of demand for this sort of business," said Mr. Todorovic.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

August 03, 2016 18:28 ET (22:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

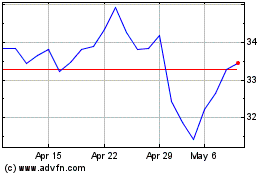

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024