Franc Strengthens As SNB Holds Rate Near Zero, EUR/CHF Floor At 1.20

June 14 2012 - 4:22AM

RTTF2

The Swiss franc edged higher on Thursday after the Swiss

National Bank decided to retain the exchange rate cap for the euro

and the near-zero interest rate.

The bank noted that it "will not tolerate" further gains in the

currency and is prepared to take necessary measures at any

time.

The SNB fixed the minimum rate at CHF 1.20 per euro on September

6, 2011 and decided to enforce this minimum rate with the utmost

determination.

The central bank reaffirmed it today that it would continue to

enforce the minimum exchange rate of CHF 1.20 per euro "with the

utmost determination." The bank said it is prepared to buy foreign

currency in unlimited quantities for this purpose.

The target range for the benchmark three-month Libor was kept

unchanged at 0.00-0.25 percent.

"Even at the current rate, the Swiss franc is still high," SNB

said. "Another appreciation would have a serious impact on both

prices and the economy in Switzerland. The SNB will not tolerate

this. If necessary, it stands ready to take further measures at any

time."

Further, the SNB maintained the inflation forecast for 2013 at

0.3 percent and raised 2012 inflation from -0.6 percent to -0.5

percent.

The official data released last month showed that the Swiss

economy expanded 0.7 percent quarter-on-quarter in the first

quarter of 2012. Annually, the gross domestic product rose 2

percent.

The central bank added that they are more uncertain about euro

developments. In yet another blow to Europe's efforts to contain

the deepening debt crisis, Moody's Investors Service yesterday

downgraded two euro area members, Spain and Cyprus, and placed

their bond ratings on review for further possible downgrade.

Spanish government bond rating was lowered by three notches to

'Baa3' from 'A3,' reflecting increasing concerns that the

government's decision to seek EUR100 billion financial support from

EU will further increase the nation's debt burden. Cyprus's

government bond ratings were cut by two notches to 'Ba3' from

'Ba1.'

Traders are also cautious as the second round of Greek elections

will take place this weekend. Also, Italy will hold another key

bond auction today, with the government aiming to raise between EUR

4 billion and EUR 6 billion by selling medium and longer-term

bonds.

The franc gained almost 11-pips against the euro following the

SNB, snapping back to 1.2012 from a fresh 2-week low of 1.2023. The

euro-franc pair, which hardly breached the 1.20 floor since it

pegged last year, has been trading in a range of 1.2023 and 1.2007

so far this month.

Wholesale price inflation in Germany eased to 1.7 percent in May

from 2.4 percent in April, the Federal Statistical Office said

today.

Wholesale prices of metals and metal ores as well as

semi-finished products declined 4.3 percent year-on-year.

Month-on-month, the price index fell 0.7 percent following 0.5

percent gain in the preceding month.

The franc advanced above the 1.48 level against the pound after

a gap of 3-days, rising as much as 1.4793 immediately following the

rate decision. The next upside target for the alpine currency is

seen around the 1.4775/80 area.

The Swiss franc also gained almost 15-pips each against the

dollar and the yen after the Swiss rate decision, rising as much as

0.9542 and 83.27, respectively before holding steady around 4:00 am

ET. The franc is presently trading at 83.10 against the yen and

0.9553 against the greenback.

Japan's industrial production declined 0.2 percent

month-on-month in April instead of a 0.2 percent rise as initially

estimated, data from the Ministry of Economy, Trade and Industry

showed today. Annually, production grew 12.9 percent.

Looking ahead, eurostat is slated to release Eurozone final

inflation data at 5.00 am ET. According to flash estimate, annual

inflation fell to 2.4 percent in May from 2.6 percent in April.

The U.S. inflation data for May and the weekly jobless claims

report for the weekended June 2 are expected to garner market

attention in the North American session.

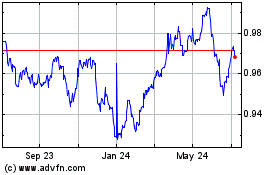

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

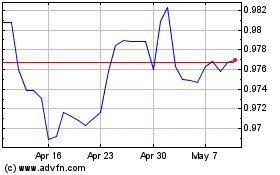

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024