Franc Falls As SNB Introduces Negative Deposit Rate

December 18 2014 - 2:35AM

RTTF2

The Swiss franc drifted lower against its major counterparts

ahead of European deals on Thursday, after the Swiss National bank

imposed negative rates and affirmed the currency ceiling, as

currency exchange rate has been pressure amid global market

turmoil.

In a surprise move, the Swiss National Bank introduced an

interest rate of -0.25% on sight deposit account balances at the

bank, with the aim of taking the three-month Libor into negative

territory.

The target range for the three-month Libor was expanded to

-0.75% to 0.25%.

"The introduction of negative interest rates makes it less

attractive to hold Swiss franc investments, and thereby supports

the minimum exchange rate," the bank noted.

Negative interest will be charged as of January 22, 2015, it

said.

The central bank also reaffirmed its commitment to the minimum

exchange rate of CHF 1.20 per euro, and said it would continue to

enforce it with the utmost determination.

The franc dropped to 1.2084 against the euro, its lowest since

October 14.

Extending early low, the franc slipped to 0.9822 against the

greenback, a 1-1/2-year low.

The franc slipped to a 10-day low of 1.5304 against the pound,

compared to yesterday's closing value of 1.5150.

Reversing from an early high of 122.17 against the yen, the

franc slipped to a 2-day low of 120.86.

The next possible support for the franc is seen around 120.00

against the yen, 1.215 against the euro, 1.55 against the pound and

1.05 against the greenback.

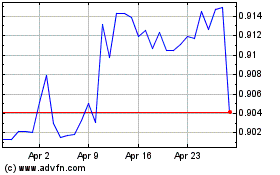

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024