Fox Revenue Falls 8.4%

February 08 2016 - 5:00PM

Dow Jones News

21st Century Fox Inc. said its revenue fell 8.4% in its latest

quarter, as stronger cable and television advertising revenue was

offset by lower revenue at its film business and the effect of

asset sales a year earlier.

For the period ended Dec. 31, revenue decreased to $7.38 billion

from $8.06 billion a year earlier. The year-earlier period included

$631 million of revenue from Sky Italia and Sky Deutschland, which

were sold in November 2014. Excluding revenue from those direct

broadcast satellite businesses, revenue fell 1%. Analysts polled by

Thomson Reuters had expected revenue of $7.51 billion.

Executive Chairmen Rupert and Lachlan Murdoch said the company's

cable business continued to drive growth in the latest quarter,

delivering sustained increases in domestic affiliate fees and

growth in advertising revenue.

Cable network division revenue increased 9.4% to $3.7 billion.

Domestic affiliate revenue improved by 10% and domestic advertising

revenue grew 3%.

Television segment revenue increased 5.7% to $1.72 billion amid

strong retransmission consent revenue growth and a 4% increase in

advertising revenue.

But film studio revenue fell 14% to $2.36 billion, mostly on

lower world-wide home entertainment revenues reflecting difficult

comparisons to last year's strong performance of "X-Men: Days of

Futures Past" and "Dawn of the Planet of the Apes" with this year's

home entertainment performance of "Spy" along with the absence of

Shine Group.

Over all, 21st Century Fox reported a profit of $672 million, or

34 cents a share, down from $6.21 billion, or $2.88 a share, a year

earlier. The year-earlier profit was boosted by certain one-time

items, and excluding those, per-share earnings from continuing

operations fell to 44 cents from 53 cents. Analysts expected

per-share profit of 44 cents.

The Wall Street Journal reported last week that the media

company was seeking to trim annual expenses by $250 million— mostly

through voluntary buyouts, for the current fiscal year that ends in

June. If the television group and movie studio doesn't meet its

targets through voluntary buyouts, job cuts would be possible, the

Journal reported. The company's earnings report didn't include any

further details about its cost-cutting efforts.

The cost-cutting plan comes amid sweeping changes in the media

landscape in which viewers have far more options beyond the small

screen and the movie theater, changing the way audiences pay for

and consume entertainment and news.

Last summer, Fox completed a transition that put media mogul Mr.

Murdoch's sons at the helm of the media conglomerate, which

includes the Fox broadcast network, cable channels in the U.S. and

around the world, and one of the largest film and television

studios. In September, Fox struck a deal to add National Geographic

magazine and other assets to its media properties.

In July, Mr. Murdoch officially stepped down as chief executive

of 21st Century Fox Inc., handing the title to his son James. The

elder Mr. Murdoch stayed on as executive chairman at Fox. His older

son, Lachlan Murdoch, was named executive co-chairman.

Mr. Murdoch split up his media empire in mid-2013, with the

entertainment assets going to 21st Century Fox and the publishing

assets, including The Wall Street Journal, going to News Corp.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 08, 2016 16:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

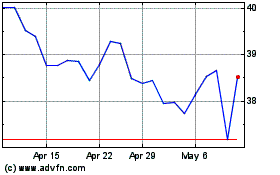

News (ASX:NWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

News (ASX:NWS)

Historical Stock Chart

From Apr 2023 to Apr 2024