UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10

AMENDMENT NO. 2

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

BARISTAS COFFEE COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

26-4204714

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

411 Washington Ave. N. Kent, WA

|

|

98032

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (800) 988-7735

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

Common stock, par value $0.001 per share

(Title of Class)

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

TABLE OF CONTENTS

|

|

|

Page

|

|

Item 1

|

|

4

|

|

Item 1A

|

|

7

|

|

Item 2

|

|

15

|

|

Item 3

|

|

23

|

|

Item 4

|

|

23

|

|

Item 5

|

|

24

|

|

Item 6

|

|

25

|

|

Item 7

|

|

26

|

|

Item 8

|

|

26

|

|

Item 9

|

|

27

|

|

Item 10

|

|

28

|

|

Item 11

|

|

36

|

|

Item 12

|

|

37

|

|

Item 13

|

|

37

|

|

Item 14

|

|

37

|

|

Item 15

|

|

38

|

FORWARD-LOOKING STATEMENTS

This registration statement contains forward-looking statements as defined under the federal securities laws. All statements other than statements of historical facts included in this registration statement regarding our financial performance, business strategy and plans and objectives of management for future operations and any other future events are forward-looking statements and based on our beliefs and assumptions. Words such as "may," "will," "expect," "might," "believe," "anticipate," "intend," "could," "estimate," "project," "plan," and other similar words are one way to identify such forward-looking statements. Actual results could vary materially from these forward-looking statements. Such statements reflect our current view with respect to future events and are subject to certain risks, uncertainties, and assumption, and assumptions including, without limitation, those risks and uncertainties contained in the Risk Factors section of this registration statement. Although we believe that our expectations are reasonable, we can give no assurance that such expectations will prove to be correct. Based upon changing conditions, any one or more of these events described herein as anticipated, believed, estimated, expected or intended may not occur. Al prior and subsequent written and oral forward-looking statements attributable to our Company or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. We do not intend to update any of the forward-looking statements after the date of this registration statements to conform these statements to actual results or to changes in our expectations, except as required by laws.

USE OF CERTAIN DEFINED TERMS

Unless the context requires otherwise, references to "the Company," "we," "us," "our," "Baristas" and "Baristas Coffee." refer specifically to Baristas Coffee Company, Inc.

In addition, unless the context otherwise requires and for the purposes of this report only:

|

●

|

"Exchange Act" refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

"SEC" refers to the United States Securities and Exchange Commission; and

|

|

●

|

"Securities Act" refers to the Securities Act of 1933, as amended.

|

ITEM 1. DESCRIPTION OF BUSINESS.

HISTORY

Baristas Coffee Company, Inc. ("BCCI") is a Nevada Corporation that was originally formed on October 18, 1996. Its fiscal year end date is December 31st. Neither the issuer nor any of its predecessors has ever been in bankruptcy, receivership or any other similar proceeding. We are in the development stage with limited operations. Our independent public accounting firm has issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next 12 months.

The Company was originally formed as InfoSpi.com in 1996, and developed software programs, hired programmers and procured funding from a venture capital group prior to merging with Innovative Communications Technologies in 2001. In 2009, InfoSpi was looking for new opportunities, as its discount long distance business was decreasing and winding down. Pangea was accumulating coffee shops, formulating a business model and procedures for the Baristas brand. On December 22, 2009, InfoSpi acquired greater than a 60% interest in Pangea Networks, Inc. ("Pangea"), DBA Baristas and Inc., for cash, stock, and other consideration. The assets of Pangea, including numerous coffee stands in the greater Seattle area were transferred to the Company, and, thereafter, Pangea was administratively dissolved. In May of 2010, the Company changed its name to Baristas Coffee Company, Inc. The transaction was structured as a partial stock purchase. After the acquisition, the assets and operations were transferred to InfoSpi, and the Company was renamed to Baristas Coffee Company.

The Company is not in default on the terms of any indebtedness or financing arrangement requiring it to make payments, nor has it had a change of control.

In conjunction with the above discussed acquisition of Pangea, the acquisition of certain coffee shops and the conversion of debt to equity, the Company issued common stock shares that increased the number of shares outstanding by more than 10%. Subsequent to year-end, the Company effected a 20:1 reverse split resulting in the number of shares outstanding at June 30, 2010 being more than 10% less than the number of shares outstanding at December 31, 2009.

BCCI had negotiated an Operating Agreement with BMOC USA Partners, LLP, providing Master Franchise Rights to BMOC in the states of NJ, PA, OH, IN, IL, MI, WI, and MN. As part of that Operating Agreement, BCCI had agreed to purchase a restaurant in Knoxville, TN, formerly known as Pavillion 117, to be re-branded to Baristas Bar and Grill. Terms were as follows:

|

1. |

Total purchase Price of $1,220,000 |

|

2. |

$140,000 +/- delinquent taxes to be paid by Baristas (additional taxes to be paid by Seller) |

|

3. |

$136,000 paid at closing |

|

4. |

$25,000 credit for Baristas Coffee Franchising Fee |

|

5. |

$7500/ month to be paid to a related party for 24 months ($180,000 total) |

|

6. |

$739,000 of BCCI Common Stock |

The parties mutually agreed to not pursue this agreement with BMOC, and neither party has any further obligations as of the date of this filing.

Baristas Coffee Company has premiered its reality show "Baristas Grounded in Seattle" The show features the daily lives and challenges of working as a costumed Barista, and it aired in different time slots over a few weeks on WE TV . The show can also be seen as it aired at http://youtu.be/NnTP58vbc1k.

There has been no delisting of the issuer's securities by any securities exchange or deletion from the OTC Markets , nor are there any current, past, pending or threatened legal proceedings or administrative actions either by or against the issuer that could have a material effect on the issuer's business, financial condition, or operations. There have been no current, past or pending trading suspensions by a securities regulator. The Company's common stock currently trades on the OTC Markets under the symbol BCCI.

Emerging Growth Company Status

We are an "emerging growth company", as defined in the Jumpstart Our Business Startups Act enacted on April 5, 2012 (the "JOBS Act"). For as long as we are an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory "say-on-pay" and "say-when-on-pay" votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an emerging growth company until the earliest of:

|

|

●

|

the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more;

|

|

|

●

|

the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock;

|

|

|

●

|

the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; or

|

|

|

●

|

the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934 (the "Exchange Act") (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter).

|

The JOBS Act also provides that an emerging growth company may utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. However, we are choosing to "opt out" of such extended transition period, and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for companies that are not emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Current Business Operations

Baristas provides its customers the ability to drive up and order their choice of a custom-blended espresso drink, freshly brewed coffee or other beverages. Baristas believes it offers a high quality option to fast-food, gas station, or institutional coffee.

Baristas strives to offer its patrons the finest hot and cold beverages, specializing in specialty coffees, blended teas and other custom drinks. In addition, Baristas offers smoothies, fresh-baked pastries and other confections. Seasonally, Baristas will add beverages such as hot apple cider, hot chocolate, frozen coffees and more. Through the three-month period ended March 31, 2015, the Company generated $331,984 from the sale of their products. Net losses for the period were $2,048,913. For the year ended December 31, 2014, the Company generated $1,297,957 from the sale of their products and franchise fees. Net losses for the year were $3,858,403.

Baristas also holds, as of March 31, 2015 , 21,460,000 shares of common stock (approximately 7.5 %) of Reeltime Rentals, Inc. ("Reeltime"). Reeltime is a publicly traded media distribution company (ticker symbol RLTR) that leverages a technology developed at Baristas and has holdings in Business Continuity Systems, Inc. ("BUCS") a publicly traded company which currently is called Green Leaf 101.

The Company is working to develop other revenue streams by promoting and selling Baristas merchandise, calendars, mugs, t-shirts and hats. The products are sold primarily through its retail drive-thru locations throughout the greater Seattle area. It also sells merchandise and other novelties via its website at www.baristas.tv and plans to sell said merchandise displaying its logo via other retail outlets.

From July 1, 2015 through December 31, 2015 , Baristas forecasts opening ten new franchise locations in addition to maintaining existing locations. The Company will receive a franchise fee of $25,000 for each new location ($250,000 in revenue) and anticipate expenses in supporting each new franchise location to be $17,500 ($175,000 in expenses) for an additional net profit of $75,000 before royalties and other revenues. The Company anticipates hiring an operations manager as franchise sales are closed.

On May 20, 2014, the Company signed an exclusive Binding Letter of Agreement with BMOC USA Partners LLC ("BMOC") for the development, construction, and management of franchises in eight states including New Jersey, Pennsylvania, Ohio, Indiana, Illinois, Michigan, Wisconsin, and Minnesota. The deal exempts the previously purchased franchise rights owned by Cuppa Joe's in Manalapan County, New Jersey.

The issuer obtains its raw material from a variety of suppliers that are very competitive and reasonably generic in offering. The Company does not anticipate any disruption obtaining raw goods. The Company is not dependent on one or a few major customers.

The Company does not have the need for any government approval of principle product or services, except for the normal licenses to operate a business.

Future governmental regulations, such as tax on coffee, restrictions on attire, varying health requirements, among others, may affect profitability of the operations of the Company in the future.

Competition

Competition in the market for coffee and coffee related products is intense and we expect it to increase. Our most significant competitors include premium coffee companies such as Starbucks, Peet's Coffee, Keurig Green Mountain (formerly Green Mountain Coffee Roasters), Dunkin' Donuts, McDonalds, Farmer's Brothers, Dutch Brothers, and other national, local and regional companies in the grocery retail and office coffee service and hospitality industry market, many of which have substantially greater financial, sales, marketing and human resources than we do. In addition, there are numerous smaller companies and that offer similar products and which compete in the coffee business. Baristas separates itself from the competition by offering a premium product and by featuring attractive female servers in fun costumes that provide for a unique coffee experience in the industry. The only risk with the business model is that zoning laws might change, and our female servers might be precvented from wearing fun costumes.

We believe that our customers choose among coffee brands based on the total value proposition that includes quality, variety, convenience, personal taste preference, price, service and social/sustainable consciousness. We believe that our market share in the category is driven by the quality of our product and the overall experience created by the Company and its servers, while being competitively priced in the premium category.

The environment in the greater Seattle area is very competitive and saturated. Markets outside of the Pacific Northwest are less saturated and do not have the same level of competition.

Product Research and Development

The Company has not spent significant money in the last two fiscal years on research and development activities.

Patents, Trademarks and Licenses

On January 11, 2012, Baristas filed for a trademark of the Baristas Brand SER. No. 85-513,645. On Sept 25, 2012 it was granted protection of the Baristas service mark for coffee shops: Restaurant and Cafe services, in class 43 (U.S. CLS. 100 and 101). The United States Patent and Trademark Office Service Mark Reg. No. is 4,213,149. The Baristas Brand has been in use in commerce since July 1, 2009.

Employees

The Issuer currently has approximately 41 employees (including employees of joint ventures) of which approximately 30 are full-time employees.

Available Information

We are subject to the information and reporting requirements of the Exchange Act, under which we file periodic reports, proxy and information statements and other information with the United States Securities and Exchange Commission, or SEC. Copies of the reports, proxy statements and other information may be examined without charge at the Public Reference Room of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, or on the Internet at http://www.sec.gov. Copies of all or a portion of such materials can be obtained from the Public Reference Room of the SEC upon payment of prescribed fees. Please call the SEC at 1-800-SEC-0330 for further information about the Public Reference Room.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this registration statement before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through the issuance of additional shares of our common stock.

Wherever possible, our Board of Directors will attempt to utilize revenues and profits in order to satisfy debts and other obligations. Any non-cash based compensations will be reserved for executive performance incentives, debt reconciliations, acquisitions, or other such activities that the board determines in the best interest of the Company. Our Board of Directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock. In addition, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management's ability to maintain control of the Company because the shares may be issued to parties or entities committed to supporting existing management.

We rely upon key personnel and if they leave us, our business plan and results of operations could be adversely affected.

Although Baristas relies on key personnel, the Company has reached a point of duty diversification such that given the loss of one or a few key personnel, although potentially detrimental, would not likely materially affect the ongoing operations for an extended period of time.

Competition for coffee products and coffee brands is intense and could affect our future sales and profitability.

The coffee industry is highly fragmented. Competition in coffee products and brands are increasingly intense as relatively low barriers to entry encourage new competitors to enter the marketplace. In addition, we believe that maintaining and developing our brands is important to our success, and the importance of brand recognition may increase to the extent that competitors offer products similar to ours. Many of our current and potential competitors have substantially greater financial, marketing and operating resources and access to capital than we do. Our primary competitors include Starbucks, Tully's, Seattle's Best, Peet's Coffee, Keurig Green Mountain (formerly Green Mountain Coffee Roasters), Farmer's Brothers and other companies in the office coffee service and hospitality industry market. If we do not succeed in effectively differentiating ourselves from our competitors in the coffee industry, including by developing and maintaining our brands, or our competitors adopt our strategies, then our competitive position may be weakened and our sales of coffee, and accordingly our future revenues may be materially adversely affected.

Our business is dependent on sales of coffee, and if demand for coffee decreases, our business would suffer.

All of our revenues are planned to be generated through the sale of coffee. Demand for coffee is affected by many factors, including:

|

|

•

|

Changes in consumer tastes and preferences;

|

|

|

•

|

Changes in consumer lifestyles;

|

|

|

•

|

National, regional and local economic and political conditions;

|

|

|

•

|

Perceptions or concerns about the environmental impact of our products;

|

|

|

•

|

Demographic trends; and

|

|

|

•

|

Perceived or actual health benefits or risks.

|

Because we are highly dependent on consumer demand for coffee, a shift in consumer preferences away from coffee would harm our business more than if we had more diversified product offerings. If customer demand for our coffee decreases, our sales, if any, would decrease and we would be materially adversely affected.

If we fail to continue to develop and maintain our brand, our business could suffer.

We believe that maintaining and developing our brand is critical to our success and that the importance of brand recognition may increase as a result of competitors offering products similar to ours. Our brand building initiative involves increasing the availability of our products on the Internet, in grocery stores, licensed locations and food service locations to increase awareness of our brand and create and maintain brand loyalty. If our brand building initiative is unsuccessful, we may never recover the expenses incurred in connection with these efforts and we may be unable to increase our future revenue or continue to implement our business strategy. As part of our brand building initiative, we may revise our packaging or make other changes from time to time. If these changes are not accepted by customers, our business could suffer.

Our success in promoting and enhancing our brand will also depend on our ability to provide customers with high quality products and customer service. Although we take measures to ensure that we sell only high-quality coffee, we have no control over our coffee products once purchased by customers. Accordingly, customers may prepare coffee from our products in a manner inconsistent with our standards, store our coffee for long periods of time or resell our coffee without our consent, which in each case potentially affects the quality of the coffee prepared from our products. If customers do not perceive our products to be of high quality, then our reputation and the value of our brand may be diminished and, consequently, our ability to implement our business strategy may be adversely affected.

Coffee costs have been very volatile over the last several years and increases in the cost of high-quality coffee beans could impact the profitability of our business.

In the past several years, we have experienced a dramatic increase in the price volatility of Arabica coffee traded on the New York Board of Trade. While we do not purchase coffee on the commodity markets, price movements in the commodity trading of Arabica coffee beans impacts the prices we pay. We expect the coffee commodity market to continue to be challenging as it continues to be influenced by worldwide supply and demand, the relative strength of the United States Dollar and speculative trading. Coffee prices can also be affected by multiple factors in the producing countries, including weather, natural disasters, political and economic conditions, export quotas or similar factors.

Decreases in the availability of high-quality coffee beans could impact the profitability and growth of our business.

One of our main concerns for fiscal 2015 is a shortage in Jamaican Blue Mountain (JBM) beans and products. Hurricane Sandy and coffee leaf rust has impacted the production output of JBM by about 40 percent for 2014. Jamaica and the industry expect a slow recovery in 2015 and to be back in full production by 2016. We are diligently working to secure more JBM as the market we created for it continues to expand. Limited JBM supply hampered our growth in fiscal 2014. If we are not able to purchase sufficient quantities of high-quality coffee beans, we may not be able to fulfill the demand for our coffee, our revenue may decrease and our ability to expand our business may be negatively impacted.

Besides coffee, we face exposure to other commodity cost fluctuations, which could impair our profitability.

In addition to the increase in coffee costs discussed above, we are exposed to cost fluctuation in other commodities, including milk, sugar, syrups, energy and fuel. For example, an increase in the cost of fuel could indirectly lead to higher electricity costs, transportation costs and other commodity costs. An increase in the cost of milk or other products, including sugar and other sweeteners, which coffee drinkers use to flavor and season their coffee, could also lead to a decrease in the demand for our products. Much like coffee costs, the costs of these commodities depend on various factors beyond our control, including economic and political conditions, foreign currency fluctuations and global weather patterns. To the extent that we are unable to pass along such costs to our customers through price increases, our margins and profitability will decrease.

Our financial performance is highly dependent upon the sales of coffee; changes in the coffee environment and retail landscape could impact our financial results.

The coffee environment is rapidly evolving as a result, among other things, of changes in consumer preferences; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. In addition, the beverage retail landscape is very dynamic and constantly evolving, not only in emerging and developing marketplaces, where modern trade is growing at a faster pace than traditional trade outlets, but also in developed marketplaces, where discounters and value stores, as well as the volume of transactions through e-commerce, are growing at a rapid pace. If we are unable to successfully adapt to the rapidly changing environment and retail landscape, our share of sales, volume growth and overall financial results could be negatively affected.

We have a history of operating losses, and we may not become profitable.

We have an accumulated deficit of approximately $9,985,749 at March 31, 2015. To date, we have derived revenue from the sale of our products through our retail locations. Our ability to attain profitability will depend on the rate of growth of our retail locations and the rate of our retail sales.

While we anticipate expanding our business, our level of growth and profitability will be directly impacted by how successfully we develop our business plan, launch new products, competitor offerings and overall market conditions.

We currently do not have a sufficient number of authorized shares to issue to meet all of our current obligations.

As of March 31, 2015, our CEO owned 12,762,358 shares and our President owned 12,866,000 shares of preferred stock. Each share of preferred stock may be converted into one (1) share of common stock. In addition, as of March 31, 2015, our CEO has convertible notes totaling $57,500 and our President has $67,897.50, which convert to approximately 2,875,000 and 3,394,875, shares of common stock, respectively.

As of March 31, 2015, pursuant to the agreements signed between the Company and its two officers, the Company owed 62,500,000 common shares (31,250,000 common shares each) for their service during March 1, 2009 to March 31, 2015.

As of March 31, 2015, there were $489,717 convertible loans due to other shareholder and $330,432 convertible notes due to other un-related investors, which convert to approximately 24,035,850 and 16,521,600, shares of common stock, respectively.

We do not currently have sufficient shares of common stock to issue on the event of conversion of the preferred stock or notes. If our officers elected to convert and we did not have sufficient shares of common stock to meet those obligations, we would be in default under the note and in violation of the terms of the preferred shares. In such event, our officers may be able to seize our assets and our business would suffer, or fail.

The Company's board of directors has approved a resolution authorizing an amendment to the Company's Articles of Incorporation that will have the effect of increasing shares of common stock available for issuance, and has mailed out a proxy statement presenting such corporate action to shareholders for approval.

Climate change may have a long-term adverse impact on our business and results of operations.

Decreased agricultural productivity in certain regions of the world as a result of changing weather patterns may limit availability or increase the cost of key agricultural commodities, such as coffee and tea, which are important sources of ingredients for our products, and could impact the food security of communities around the world. Increased frequency or duration of extreme weather conditions could also impair production capabilities, disrupt our supply chain or impact demand for our products. As a result, the effects of climate change could have a long-term adverse impact on our business and results of operations.

We cannot predict the impact that the following may have on our business: (i) new or improved technologies, (ii) alternative methods of delivery, or (iii) changes in consumer behavior facilitated by these technologies and alternative methods of delivery.

Advances in technologies or alternative methods of delivery, including advances in vending machine technology and home coffee makers, or certain changes in consumer behavior driven by these or other technologies and methods of delivery could have a negative effect on our business. Moreover, technology and consumer offerings continue to develop, and we expect that new or enhanced technologies and consumer offerings will be available in the future. We may pursue certain of those technologies and consumer offerings if we believe they offer a sustainable customer proposition and can be successfully integrated into our business model. However, we cannot predict consumer acceptance of these delivery channels or their impact on our business. In addition, our competitors, many of whom have greater resources than us, may be able to benefit from changes in technologies or consumer acceptance of alternative methods of delivery, which could harm our competitive position. There can be no assurance that we will be able to successfully respond to changing consumer preferences, including new technologies and alternative methods of delivery, or to effectively adjust our product mix, service offerings, and marketing and merchandising initiatives for products and services that address, and anticipate advances in technology and market trends. If we are not able to successfully respond to these challenges, our business, financial condition, and operating results could be harmed.

Adverse public or medical opinion about caffeine may harm our business.

Our coffee contains significant amounts of caffeine and other active compounds, the health effects of some of which are not fully understood. A number of research studies conclude or suggest that excessive consumption of caffeine may lead to increased heart rate, nausea and vomiting, restlessness and anxiety, depression, headaches, tremors, sleeplessness and other adverse health effects. An unfavorable report on the health effects of caffeine or other compounds present in coffee could significantly reduce the demand for coffee, which could harm our business and reduce our sales and profits. Also, we could become subject to litigation relating to the existence of such compounds in our coffee; any such litigation could be costly and could divert management attention.

Adverse publicity regarding product quality or food and beverage safety, whether or not accurate, may harm our business.

We may be the subject of complaints or litigation from customers alleging beverage and food-related illnesses or other quality, health or operational concerns. Adverse publicity resulting from such allegations may materially adversely affect us, regardless of whether such allegations are true or whether we are ultimately held liable. In addition, any litigation relating to such allegations could be costly and could divert management attention.

We face a risk of a change in control due to the fact that our current officers and directors do not own a majority of our outstanding voting stock.

Our current officers and our directors do not hold voting control over the Company. As a result, our shareholders who are not officers and directors may be able to obtain a sufficient number of votes to choose who serves on our Board of Directors, and/or to remove our current directors from the Board of Directors. Because of this possibility, the current composition of our Board of Directors may change in the future, which could in turn have an effect on those individuals who currently serve in management positions with us. If that were to happen, our new management could affect a change in our business focus and/or curtail or abandon our business operations, which, in turn could cause the value of our securities, if any, to decline or become worthless.

Failure to comply with applicable laws and regulations could harm our business and financial results.

Our policies and procedures are designed to comply with all applicable laws, accounting and reporting requirements, tax rules and other regulations and requirements, including those imposed by the SEC, as well as applicable trade, labor, healthcare, privacy, food, anti-bribery and corruption and merchandise laws. In addition to potential damage to our reputation and brand, failure to comply with the various laws and regulations, as well as changes in laws and regulations or the manner in which they are interpreted or applied, may result in civil and criminal liability, damages, fines and penalties, increased cost of regulatory compliance and restatements of our financial statements. Future laws or regulations (or the cost of complying with such laws, regulations or requirements) could also adversely affect our business and results of operations.

A Change in Labor Laws may Adversely Affect our Business

There has been a movement to increase the minimum wage, both locally and nationally. Any substantial increase in wages will adversely affect our costs and may lead to an inability to continue our operations.

Adverse changes in global and domestic economic conditions or a worsening of the United States economy could materially adversely affect us.

Our sales and performance depend significantly on consumer confidence and discretionary spending, which are still under pressure from United States and global economic conditions. A worsening of the economic downturn and decrease in consumer spending may adversely impact our sales, ability to market our products, build customer loyalty, or otherwise implement our business strategy and further diversify the geographical concentration of our operations. For example, we are highly dependent on consumer demand for specialty coffee, and a shift in consumer demand away from specialty coffee due to economic or other consumer preferences would harm our business.

We believe that our future success will depend in part on our ability to obtain and maintain protection of our intellectual property and brand names.

Our brand is among our most valuable assets. Maintaining the brand "Baristas" as it becomes a more generalized term may lead to a dilution of our brand as a generic term as opposed to solidifying "Baristas" as our brand. If we are unsuccessful in deterring others from utilizing our name, and our likeness to promote their products, then we could suffer an adverse effect which could cause material harm to our Company and its value to shareholders.

We may incur additional indebtedness which could reduce our financial flexibility, increase interest expense and adversely impact our operations.

In the future, we may incur significant amounts of additional indebtedness in order to make acquisitions or continue our business plan. Our level of indebtedness could affect our operations in several ways, including the following:

|

●

|

a significant portion of our cash flows could be used to service our indebtedness;

|

|

●

|

a high level of debt would increase our vulnerability to general adverse economic and industry conditions;

|

|

●

|

any covenants contained in the agreements governing our outstanding indebtedness could limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments;

|

|

●

|

a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore, may be able to take advantage of opportunities that our indebtedness may prevent us from pursuing; and

|

|

●

|

debt covenants to which we may agree may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry.

|

A high level of indebtedness increases the risk that we may default on our debt obligations. We may not be able to generate sufficient cash flows to pay the principal or interest on our debt, and future working capital, borrowings or equity financing may not be available to pay or refinance such debt. If we do not have sufficient funds and are otherwise unable to arrange financing, we may have to sell significant assets or have a portion of our assets foreclosed upon which could have a material adverse effect on our business, financial condition and results of operations.

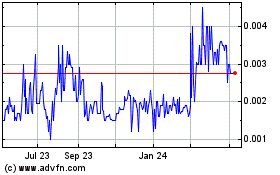

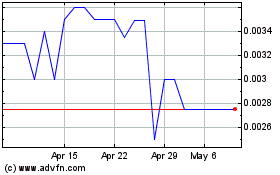

There is currently a volatile, sporadic and illiquid market for our common stock.

Our securities are currently quoted on the OTCQB under the symbol "BCCI." We, at times, have a volatile, sporadic and illiquid market for our common stock, which is subject to wide fluctuations in response to several factors, including, but not limited to:

|

|

●

|

actual or anticipated variations in our results of operations;

|

|

|

●

|

our ability or inability to generate new revenues;

|

|

|

●

|

increased competition; and

|

|

|

●

|

conditions and trends in the market for coffee and coffee related products.

|

Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price and liquidity of our common stock.

Investors may face significant restrictions on the resale of our common stock due to federal regulations of "penny stocks."

We are subject to the requirements of Rule 15(g)9, promulgated under the Exchange Act, as long as the price of our common stock is below $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock. Generally, the SEC defines a penny stock as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. The required penny stock disclosures include the delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and NYSE MKT Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than legally required, we have not yet adopted these measures.

Because our Directors are not independent directors, we do not currently have independent audit or compensation committees. As a result, our Directors have the ability to, among other things, determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and any potential investors may be reluctant to provide us with funds necessary to expand our operations.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of the Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of Directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

Because we are a small company, the requirements of being a public company, including compliance with the reporting requirements of the Exchange Act and the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

As a public company with listed equity securities, we must comply with the federal securities laws, rules and regulations, including certain corporate governance provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act and the Dodd-Frank Act, related rules and regulations of the SEC, with which a private company is not required to comply. Complying with these laws, rules and regulations will occupy a significant amount of time of our sole director and management and will significantly increase our costs and expenses, which we cannot estimate accurately at this time. Among other things, we must:

|

|

●

|

establish and maintain a system of internal control over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board;

|

|

|

●

|

prepare and distribute periodic public reports in compliance with our obligations under the federal securities laws;

|

|

|

●

|

maintain various internal compliance and disclosures policies, such as those relating to disclosure controls and procedures and insider trading in our common stock;

|

|

|

●

|

involve and retain to a greater degree outside counsel and accountants in the above activities;

|

|

|

●

|

maintain a comprehensive internal audit function; and

|

|

|

●

|

maintain an investor relations function.

|

In addition, being a public company subject to these rules and regulations may require us to accept less director and officer liability insurance coverage than we desire or to incur substantial costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our Board of Directors.

We estimate that we will incur approximately $60,000 per year in legal and accounting expenses as a direct result of becoming a publicly reporting company. If we are unable to produce revenues from our business plan in sufficient amounts to pay these fees, in addition to our regular operating costs and execution of our business plan, we could cease to become a reporting company. Additionally, these expenses could limit our ability to invest sufficient funds in the execution of our business plan and our business could fail.

ITEM 2. FINANCIAL INFORMATION.

Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion in conjunction with the audited financial statements and the corresponding notes, the unaudited financial statements and the corresponding notes included elsewhere in this information statement. This Management's Discussion and Analysis of Financial Condition and the Results of Operations contains forward-looking statements. The matters discussed in these forward-looking statements are subject to risk, uncertainties, and other factors that could cause actual results to differ materially from those made, projected or implied in the forward-looking statements. Please refer to "Risk Factors" for a discussion of the uncertainties, risks and assumptions associated with these statements.

Overview

Baristas Coffee Company, Inc., is a Nevada corporation, originally formed on October 18, 1996, doing business as Baristas. The Company was formerly known as Innovative Communications, Inc. Baristas provides its customers the ability to drive up and order their choice of a custom-blended espresso drinks, freshly brewed coffee, or other beverages. Our fiscal year end is December 31.

Results of Operations

Three Months Ended March 31, 2015 Compared to Three Months Ended March 31, 2014

Revenue was $331,984 for the three months ended March 31, 2015 compared to $318,738 for the three months ended March 31, 2014, an increase of $13,246 or 4.16%. The increase was primarily due to increase advertising and promotion done by the Company.

The changes in our operating expenses from March 31, 2015 to March 31, 2014 are as follows:

| |

|

Three Months Ended

|

|

|

|

|

|

|

|

| |

|

March 31,

|

|

|

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

$ Change

|

|

|

% Change

|

|

|

Direct costs

|

|

$

|

119,269

|

|

|

$

|

99,617

|

|

|

$

|

19,652

|

|

|

|

19.73

|

|

|

Compensation

|

|

|

147,591

|

|

|

|

129,259

|

|

|

|

18,332

|

|

|

|

14.18

|

|

|

Depreciation and amortization

|

|

|

44,110

|

|

|

|

40,471

|

|

|

|

3,639

|

|

|

|

8.99

|

|

|

General and administrative

|

|

|

114,116

|

|

|

|

42,797

|

|

|

|

71,319

|

|

|

|

166.64

|

|

|

Professional expenses

|

|

|

45,018

|

|

|

|

11,809

|

|

|

|

33,209

|

|

|

|

281.22

|

|

|

Stock-based compensation

|

|

|

119,350

|

|

|

|

10,000

|

|

|

|

109,350

|

|

|

|

1,093.50

|

|

|

Total Operating Expenses

|

|

$

|

589,454

|

|

|

$

|

333,953

|

|

|

$

|

255,501

|

|

|

|

76.51

|

|

Direct costs for generating sales was $119,269 for the three months ended March 31, 2015 compared to $99,617 in the three months ended March 31, 2014, an increase of 19,652 or 19.73%. The increase in direct costs for the three months ended March 31, 2015 was primarily the result of increase of sales.

Compensation was $147,591 for the three months ended March 31, 2015 compared to $129,259 in the three months ended March 31, 2014, an increase of $18,332 or 14.18%. The increase compensation in three months ended March 31, 2015 was primarily the result of increase of staff.

Depreciation and amortization expenses for the three months ended March 31, 2015 was $44,110, an increase of $3,639 or 8.99%, compared to $40,471 in the three months ended March 31, 2014.

General and administrative expenses consisted of expenses covering office, supplies, shipping, telephone, internet insurance, and other general operating costs related to our business. General and administrative expenses was $114,116 for the three months ended March 31, 2015 compared to $42,797 for the three months ended March 31, 2014, an increase of $71,319 or 166.64%. The increase was the result of increase business activities.

Professional expenses was $45,018 for the three months ended March 31, 2015, compared to $11,809 in the three months ended March 31, 2014, an increase of $33,209 or 281.22%. The increase of professional expenses was primarily used to meet regulatory filing requirements.

Stock-based compensation consisted of $119,350 in stock issued for compensation in the three months ended March 31, 2015, compared to $10,000 in the three months ended March 31, 2014, an increase of $109,350 or 1,093.50%. The increase on stock-based compensation was primarily due to 2,500,000 shares granted to two officers of the Company (1,250,000 shares each) for their services with a value of $108,500.

The changes in our other loss from March 31, 2015 to March 31, 2014 are as follows:

| |

|

Three Months Ended

|

|

|

|

|

|

|

|

| |

|

March 31,

|

|

|

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

$ Change

|

|

|

% Change

|

|

|

Beneficial conversion fee

|

|

$

|

121,500

|

|

|

$

|

-

|

|

|

$

|

121,500

|

|

|

|

100.00

|

|

|

Impairment loss on marketable securities

|

|

|

1,620,230

|

|

|

|

-

|

|

|

|

1,620,230

|

|

|

|

100.00

|

|

|

Interest expense

|

|

|

23,543

|

|

|

|

85,703

|

|

|

|

(62,160

|

)

|

|

|

(72.53

|

)

|

|

Gain on disposal

|

|

|

-

|

|

|

|

(32

|

)

|

|

|

32

|

|

|

|

(100.00

|

)

|

|

Loss on loan settlement

|

|

|

26,170

|

|

|

|

-

|

|

|

|

26,170

|

|

|

|

100.00

|

|

|

Total Other Expenses

|

|

$

|

1,791,443

|

|

|

$

|

85,671

|

|

|

$

|

1,705,772

|

|

|

|

1,991.07

|

|

The Company has issued a number of notes with various maturities dates to related parties for advances. These notes are convertible either at a fixed dollar amount or 50% of market price and accrue interest at an average rate of 8% per annum. Due to the short-term nature of these loans they are recorded as current liabilities. The outstanding balances at March 31, 2015 and December 31, 2014 were $615,115 and $564,115, respectively. The Company plans to pay the loans back as cash flows become available. During the periods ended March 31, 2015, and 2014, the Company recognized $51,000 and $0 beneficial conversion fee on convertible shareholder loans respectively.

The Company has issued a number of notes with various maturities dates to unrelated parties. These notes are convertible at a fixed dollar amount and accrue interest at 8% per annum. Due to the short-term nature of these loans they are recorded as current liabilities. The outstanding balances at March 31, 2015 and December 31, 2014 and were $330,432 and $286,432, respectively. During the periods ended March 31, 2015 and 2014, the Company recognized a $70,500 and $0 beneficial conversion fee on convertible loans from unrelated parties respectively.

During the period ended March 31, 2015, the Company recognized an impairment loss of $1,620,230 on marketable securities based on the highest price of $0.018 per share during April 1, 2013 to March 31, 2015.

During the period ended March 31, 2015, 1,592,055 shares valued at $57,090, in exchange for debt of $15,000 and accrued interest of $921, result a $26,170 loss on settlement. During the period ended March 31, 2014, no loans were settled by shares.

Restatement of Prior Year Financial Results

The Company has restated its previously reported consolidated financial statements as at and for the year end December 31, 2013 to reflect beneficial conversion feature on convertible loans issued prior to January 1, 2014.

The total cumulative impact of the restatement is to decrease retained earnings by $568,569 and increase additional paid-in capital by $568,569.

Year Ended December 31, 2014 Compared to Year Ended December 31, 2013

Revenue was $1,222,957 for the year ended December 31, 2014, compared to $1,415,125 for the year ended December 31, 2013, a decrease of $192,168 or 13.58%. The decrease was primarily due to the closing of three coffee stands during the fourth quarter of 2013. We had 13 coffee stands for the year ended December 31, 2013, whereas, we had 10 coffee stands for the period ended December 31, 2014.

On November 10, 2014, the Company entered into a franchise agreement with BMOC USA Partners LLP to open three new coffee stores. Franchise fess revenue was $75,000 for the year ended December 31, 2014 compared to $0 for the year ended December 31, 2013.

The changes in our operating expenses from December 31, 2014 to December 31, 2013 are as follows:

| |

|

Years Ended December 31,

|

|

|

|

|

|

|

|

| |

|

2014

|

|

|

2013

|

|

|

$ Change

|

|

|

% Change

|

|

|

Compensation

|

|

$

|

616,614

|

|

|

$

|

627,656

|

|

|

$

|

(11,042

|

)

|

|

|

(1.76

|

)

|

|

Depreciation and amortization

|

|

|

175,401

|

|

|

|

132,990

|

|

|

|

42,411

|

|

|

|

31.89

|

|

|

Direct costs

|

|

|

433,604

|

|

|

|

369,939

|

|

|

|

63,665

|

|

|

|

17.21

|

|

|

General and administrative

|

|

|

710,680

|

|

|

|

880,728

|

|

|

|

(170,048

|

)

|

|

|

(19.31

|

)

|

|

Professional expenses

|

|

|

114,253

|

|

|

|

35,849

|

|

|

|

78,404

|

|

|

|

218.71

|

|

|

Stock-based compensation

|

|

|

2,485,275

|

|

|

|

633,687

|

|

|

|

1,851,588

|

|

|

|

292.19

|

|

|

Total Operating Expenses

|

|

$

|

4,535,827

|

|

|

$

|

2,680,849

|

|

|

$

|

1,854,978

|

|

|

|

69.19

|

|

Compensation expenses were $616,614 in the year ended December 31, 2014 compared to $627,656 for the year ended December 31, 2013, a decrease of $11,042 or 1.76%. The decrease of payroll compensation was due to the closures of coffee stands during the fourth quarter of 2013.

Depreciation and amortization expenses for the year ended December 31, 2014 of $175,401 increased $42,411 from $132,990 or 31.89% from the year ended December 31, 2013.

Direct cost was $433,604 for the year ended December 31, 2014 compared to $369,939 for the year ended December 31, 2013, an increase of $63,665 or 17.21% due to increase of commodity price of coffee supplies.

General and administrative expenses consisted of expenses covering office, supplies, shipping, telephone, internet insurance, and other general operating costs related to our business. General and administrative expenses of $710,680 for the year ended December 31, 2014 compared to $880,728 for the year ended December 31, 2013, a decrease of $170,048 or 19.31%. The decrease of general and administrative expenses was the result of coffee stand closures during the fourth quarter of 2013.

Professional expenses were $114,253 in the year ended December 31, 2014 compared to $35,849 for the year ended December 31, 2013, an increase of $78,404 or 218.71%. The increase of professional expenses was primarily used to meet regulatory filing requirements.

Stock-based compensation and compensation expenses consisted of: $2,485,275 in stock issued for compensation in the year ended December 31, 2014 compared to $633,687 in the year ended December 31, 2013, an increase of $1,851,588 or 292.19%; The increase was primarily due to 60,000,000 shares granted in 2014 by the Company to two of its directors for their service.

The changes in our other loss from December 31, 2014 to December 31, 2013 are as follows:

| |

|

Years Ended

|

|

|

|

|

|

|

|

| |

|

December 31,

|

|

|

|

|

|

|

|

| |

|

2014

|

|

|

2013

|

|

|

$ Change

|

|

|

% Change

|

|

|

Beneficial conversion fee

|

|

$

|

411,030

|

|

|

$

|

568,569

|

|

|

$

|

(157,539

|

)

|

|

|

(27.71

|

)

|

|

Interest expense

|

|

|

33,015

|

|

|

|

115,740

|

|

|

|

(82,725

|

)

|

|

|

(71.47

|

)

|

|

Fair value adjustment on loan receivable

|

|

|

(137,500

|

)

|

|

|

-

|

|

|

|

(137,500

|

)

|

|

|

100.00

|

|

|

Loss on disposal

|

|

|

-

|

|

|

|

89,969

|

|

|

|

(89,969

|

)

|

|

|

(100.00

|

)

|

|

Loss on loan settlement

|

|

|

313,988

|

|

|

|

-

|

|

|

|

313,988

|

|

|

|

100.00

|

|

|

Total Other (Income) Expenses

|

|

$

|

620,533

|

|

|

$

|

774,278

|

|

|

$

|

(153,745

|

)

|

|

|

(19.86

|

)

|

The Company has issued a number of notes with various maturities dates to related parties for advances. These notes are convertible either at a fixed dollar amount or 50% of market price and accrue interest at an average rate of 8% per annum. Due to the short-term nature of these loans they are recorded as current liabilities. The outstanding balances at December 31, 2014 and December 31, 2013 were $564,115 and $477,847, respectively. The Company plans to pay the loans back as cash flows become available. During the year ended December 31, 2014 and 2013, the Company recognized $201,758 and $430,652 beneficial conversion fee on convertible shareholder loans respectively.

The Company has issued a number of notes with various maturities dates to unrelated parties. These notes are convertible at a fixed dollar amount and accrue interest at 8% per annum. Due to the short-term nature of these loans they are recorded as current liabilities. The outstanding balances at December 31, 2014 and 2013 were $286,432 and $44,635, respectively. During the years ended December 31, 2014 and 2013, the Company recognized $209,272 and $137,917 beneficial conversion fee on convertible loans from un-related parties, respectively

The Company has a receivable from a related party for services in prior years. On June 18, 2014, the Company reached a settlement agreement with the related party to pay $300,000, including reimbursement of prior years' expenses of $162,500. During the year ended December 31, 2014, the Company recorded a gain on fair value adjustment of $137,500.

During the year ended December 31, 2014, 9,307,953 shares in exchange for debt and accrued interest valued at $200,856, result a $313,988 loss on settlement. During the year ended December 31, 2013, 2,900,000 shares in exchange for debt valued at $161,000, result a $0 loss on settlement.

Liquidity and Capital Resources

The Company's liquidity may be affected by general decrease in revenues during the holiday months and by the need to allocate startup costs for potential expansion.

Baristas forecasts opening ten new franchise locations in addition to maintaining our existing locations, during the next 12 month period. We will receive a franchise fee of $25,000 for each new location ($250,000 in revenue) and anticipate expenses in supporting each new franchise location to be $17,500 ($175,000 in expenses) for a additional net profit of $75,000 before royalties and other revenues. We anticipate hiring an operations manager as franchise sales are closed.

We believe that we do not have enough cash on hand and from operations to operate for the next 12 months. We will require additional financing if we are to complete our expansion plan for the next 12 months. While we are optimistic that we can generate the revenue from new franchise fees and refinancing of our existing properties, we do not have any current financing available to us. If we are unable to generate additional fees through franchising, in order to execute our plan of expansion, we would be required to raise funds through a sale of equities, the issuance of debt or a combination thereof. We have no assurances that we would be successful in raising the requite financing.

Going Concern

We have a history of operating losses, as we have focused our efforts on raising capital and building our brand and expanding our business locations. The report of our independent auditors issued on our consolidated financial statements as of and for the year ended December 31, 2014, expresses substantial doubt about our ability to continue as a going concern. For the period ended March 31, 2015, we were successful in raising net proceeds of $111,500 through debt financing in order to fund the development and growth of our operations. For the period ended March 31, the Company received $115,000 cash from minority interest. Our ability to continue as a going concern is dependent on our obtaining additional adequate capital to fund additional operating losses until we become profitable. If we are unable to obtain adequate capital, we could be forced to cease operations.

The following table presents a summary of our net cash provided by (used in) operating, investing and financing activities for the periods ended March 31, 2015 and 2014:

| |

Three Months Ended

|

|

| |

March 31,

|

|

| |

2015

|

|

2014

|

|

|

Net cash used in operating activities

|

|

$

|

(83,609

|

)

|

|

$

|

79,155

|

|

|

Net cash used in investing activities

|

|

|

(4,354

|

)

|

|

|

(166,430

|

)

|

|

Net cash provided by financing activities

|

|

|

110,000

|

|

|

|

90,933

|

|

|

Net increase in cash

|

|

$

|

22,037

|

|

|

$

|

3,658

|

|

For the three months ended March 31, 2015, we incurred a net loss of $2,033,243. Net cash used in operating activities was $83,609, net cash used in investing activities was $4,354 and net cash provided by financing activities was $110,000. For the three months ended March 31, 2014, we incurred a net loss of $77,078. Net cash used in operating activities was $79,155, net cash used in investing activities was $166,430 and net cash provided by financing activities was $90,933.

Working Capital Information - The following table presents a summary of our working capital at the end of each period:

|

Category

|

|

March 31, 2015

|

|

|

December 31, 2014

|

|

|

December 31, 2013

|

|

|

Cash

|

|

$

|

43,508

|

|

|

$

|

21,471

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

158,967

|

|

|

|

138,112

|

|

|

|

30,737

|

|

|

Current liabilities

|

|

|

3,953,422

|

|

|

|

3,745,630

|

|

|

|

1,184,339

|

|

|

Working capital deficiency

|

|

$

|

(3,794,455

|

)

|

|

$

|

(3,607,518

|

)

|

|

$

|

(1,153,602

|

)

|

|

Change from the previous period

|

|

|

5.2

|

%

|

|

|

212.7

|

%

|

|

|

20.2

|

%

|

As of March 31, 2015, the Company had a working capital deficiency of $3,794,455, compared to $3,607,518 at December 31, 2014, or an increase in working capital deficit of $186,937 (5.2%). As of March 31, 2015, the Company had cash and cash equivalents of $43,508 as compared to $21,471 on December 31, 2014. For March 31, 2015, current assets increased $20,855 (15.1%) due to increases of $22,037 in cash. Current liabilities increased $207,792 (5.55%), with an increase in accounts payable and accrued expenses of $112,792 (3.9%), an increase in shareholder loans of $51,000 (9.04%), and an increase in notes payable of $44,000 (15.36%).

As of December 31, 2014, the Company had a working capital deficiency of $3,607,518, compared to $1,153,602 at December 31, 2013, or an increase in working capital deficit of $2,453,916 (212.72%). As of December 31, 2014, the Company had cash and cash equivalents of $21,471 as compared to $0 on December 31, 2013. For 2014, current assets increased $107,375 (349.33%) primarily due to an increase of $75,000 in franchise fee receivable and $12,360 in prepaid expenses. Current liabilities increased $2,561,291 (216.26%), with an increase in accounts payable and accrued expenses of $2,233,226 (337.42%), an increase in shareholder loans of $86,268 (18.05%), and an increase in notes payable of $241,797 (541.72%).

Funding Requirements: We expect to incur substantial expenses and generate ongoing operating losses for the foreseeable future as we prepare for the ongoing development and launch of our sports bar business, grow the existing base of our coffee store locations and support business and further expand this business into additional facilities and locations. If we are unable to raise an adequate amount of capital, however, we could be forced to curtail or cease operations. Our future capital uses and requirements depend on numerous forward-looking factors.

These factors include the following:

|

· |

the time and expense needed to complete the successful launch of the sports bar business; |

|

· |

the expense associated with building a network of coffee shops to market the brand; |

|

· |

the degree and speed of developing our franchises with BMOC. |

During 2014, we entered joint venture agreements to launch franchises in new states and as well to develop a sports bar. We have yet to achieve profitability as a result of the Company's non-operating expenses, and the issuance of shares of our common stock to third parties for various services rendered. As we grow, the use of our common stock as currency will decline when our cash availability grows.

In view of these matters, realization of certain of the assets in the accompanying balance sheet is dependent upon our continued operations, which in turn is dependent upon our ability to meet our financial requirements, raise additional financing, and the success of our future operations.

Additional funding may not be available to us on acceptable terms or at all. In addition, the terms of any financing may adversely affect the holdings or the rights of our stockholders. For example, if we raise additional funds by issuing equity securities or by selling debt securities, if convertible, further dilution to our existing stockholders would result. To the extent our capital resources are insufficient to meet our future capital requirements, we will need to finance our future cash needs through public or private equity offerings, collaboration agreements, debt financings or licensing arrangements.

If adequate funds are not available, we may be required to terminate, significantly modify or delay the development and launch of our businesses, reduce our planned commercialization efforts, or obtain funds through means that may require us to relinquish certain rights that we might otherwise seek to protect and retain. Further, we may elect to raise additional funds even before we need them if we believe the conditions for raising capital are favorable.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Recent Accounting Pronouncements

The Company has adopted all recently issued accounting pronouncements that management believes to be applicable to the Company. The adoption of these accounting pronouncements, including those not yet effective, is not anticipated to have a material effect on the financial position or results of operations of the Company.

The company's corporate offices are located at 411 Washington Avenue N., Kent, Washington 98032.

The issuer's subsidiary, Pangea Networks, leases approximately 2,000 square feet at its corporate headquarters and training facility which allows it to store goods and services, train employees, build, maintain or convert its locations, and conduct general business activities. In addition it leases and operates ten drive-through locations, which are approximately 300 square feet, each varying by location. The Company does not own any real property.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth as of March 31, 2015 , the number and percentage of the outstanding shares of common stock which, according to the information supplied to the Company, were beneficially owned by (i) each person who is currently a director, (ii) each executive officer, (iii) all current directors and executive officers as a group, and (iv) each person who, to our knowledge, is the beneficial owner of more than 5% of the outstanding common stock.

|

Title of Class

|

Name and address of beneficial owner

|

|

Nature of

Beneficial Ownership

|

|

Amount of beneficial

ownership( 1, 2, 3, 4 )

|

|

|

Percent of class

|

|

|

Common Stock

|

Barry Henthorn

411 Washington Ave., Kent, WA 98032

|

|

Direct

|

|

|

70,754,217

|

|

|

|

18.85

|

%

|

|

Common Stock

|

T. Scot Steciw

411 Washington Ave., Kent, WA 98032

|

|

Direct

|

|

|

61,693,561

|

|

|

|

16.48

|

%

|

|

|

All directors and executive officers as a group (2 persons)

|

|

|

|

|

132,240,778

|

|

|

|

35.33

|

%

|

|

(1) |

In determining beneficial ownership of our common stock as of a given date, the number of shares shown includes shares of common stock which may be acquired on exercise of warrants or options or conversion of convertible securities within 60 days of that date. In determining the percent of common stock owned by a person or entity on March 31, 2015: (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including un-issued share earned from services, shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) the total shares of common stock outstanding on March 31, 2015 (299,683,313), and (ii) the total number of shares that the beneficial owner may acquire upon conversion of the preferred stock, convertible debt, and on exercise of the warrants and options. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of his, her or its shares. There are currently insufficient shares of common stock authorized to allow conversion of all preferred shares, which violates the terms of the Certificate of Designation. |

|

(2) |

Includes 27,328,358 shares of the Company's Preferred A Stock. Each Preferred A share may be converted into one (1) share of the Company's common stock without additional consideration. As of March 31, 2015, Barry Henthorn owned 12,762,358 shares of preferred stock and T. Scott Steciw owned 12,866,000 shares of preferred stock. |

|

(3) |