By Sara Schonhardt

JAKARTA--When Newmont Mining Corp. began exploring for gold in

Indonesia in the 1980s, the country's wealth of untapped resources

was seen as the Colorado-based miner's ticket to the big

leagues.

The Batu Hijau copper and gold mine in eastern Indonesia was one

of the largest undeveloped deposits in the world, and Newmont's

billion-dollar investment put it on the path to becoming the

world's No. 2 gold miner by output.

More than three decades later, Newmont's exit from Indonesia

illustrates that the country has become a more difficult place for

foreign miners to operate, say analysts. Newmont in June agreed to

sell its 48.5% economic interest in the local unit that runs the

mine, PT Newmont Nusa Tenggara , to a group of local investors led

by Indonesian-listed oil-and-gas company PT Medco Energi

Internasional Tbk. Japan's Sumitomo Corp., with which Newmont

operates the mine, is selling its stake to the group as well.

This came a few weeks after BHP Billiton's sale of its coal

interests in Indonesia to a unit of local energy group PT Adaro

Energy Tbk.

Heavier regulation was a factor in the decision to leave,

Newmont Chief Executive Gary Goldberg told The Wall Street Journal

earlier this month.

In recent years Indonesia has required foreign miners to

gradually reduce their stakes to less than half, raised the taxes

and royalties they pay and mandated they process ore

locally--requiring a major investment in smelters at a time when

commodity-price uncertainty has miners around the world tightening

their belts.

Newmont has had "good success" with the Batu Hijau deposit over

the years, Mr. Goldberg said, but the company had an investment

decision to make: The next phase of mining would require an

additional $2 billion over the next five years, he said, and

company executives were concerned about how long it would take to

get a return.

Newmont, which has mines across the globe including in the U.S.,

Australia, Ghana and Peru, has spent the past few years overhauling

its business--cutting production costs, buying and selling mines

and paying down debt, which at roughly $2.7 billion is about half

what it was three years ago.

During a conference call to discuss the sale, Mr. Goldberg said

the company is consolidating assets around high-margin projects in

lower-risk areas and turning its focus back to gold.

A Sumitomo spokesman cited concerns in Indonesia including

"changes in regulations or laws, restrictions to foreign investment

and weak rupiah currency." It agreed to sell along with Newmont "to

maximize the asset value of Batu Hijau," the spokesman said, adding

that the "Indonesian market is still promising and we continue to

expand our business field there."

Vast deposits of copper, nickel and coal have drawn foreign

miners to Indonesia for decades, and mining has contributed greatly

to the country's economic growth. But growing nationalism, policy

uncertainty and some officials' desire for the state to take

control of natural resources has raised risks for foreign miners,

analysts say.

By law, miners are required to eventually shift from long-term

contracts of work to a licensing system in which they say their

rights are more limited. Analysts say the rules have made Indonesia

an increasingly difficult place to do business and have deterred

exploration investment.

"Major multinational mining companies increasingly just see

Indonesia as too hard for them," said Bill Sullivan, a

Jakarta-based legal adviser to mining-related companies.

Earlier this year, mining giant BHP Billiton Ltd. said it agreed

to sell its 75% interest in IndoMet Coal to PT Alam Tri Abadi to

pursue other options that BHP said were more attractive for future

investment.

The government says foreign miners are still willing to invest

in Indonesia. Bambang Gatot Ariyono, director-general of minerals

and coal at the energy ministry, said several companies have signed

amended contracts, and the government is working with miners to

revise and clarify rules.

A spokeswoman for Medco said that as a domestic company it sees

long-term value in investing in Indonesia and is confident it will

secure the licenses needed to keep the mine operating.

Some major miners, such as U.S. gold and copper producer

Freeport McMoRan, are sitting on resources too valuable to abandon,

say industry players. A spokesman for PT Freeport Indonesia said

that the company intends to continue to cooperate with the

government.

However, many smaller miners have suspended operations and some

large-scale operations have reduced mining activities and exports

due to uncertainty over contract extensions, say analysts.

Indonesia's ban on the export of unrefined ores--meant to

increase the value of the country's exports--hit some companies

particularly hard. To receive an export permit, companies had to

demonstrate progress on refining. After the ban took effect in

2014, Newmont's local unit ceased exports for more than eight

months and declared force majeure on existing contracts.

Newmont's exit sends a signal to other miners that Indonesian

mining projects are no longer competitive, said Ian Wollff, a

longtime geologist and independent consultant to the mining

industry. "They [Newmont] are saying...'We've got money, but why

should we spend it there? Maybe we're better off spending it

somewhere else.'"

Rhiannon Hoyle in Sydney contributed to this article.

Write to Sara Schonhardt at Sara.Schonhardt@wsj.com

(END) Dow Jones Newswires

August 30, 2016 08:18 ET (12:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

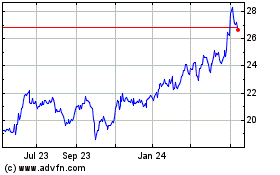

Sumitomo (PK) (USOTC:SSUMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

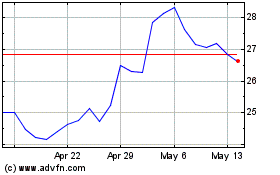

Sumitomo (PK) (USOTC:SSUMY)

Historical Stock Chart

From Apr 2023 to Apr 2024