SHANGHAI—China's foreign-car factories, once among the world's

busiest, are starting to slack off.

New weakness in the world's largest car market has led companies

such as General Motors Co. and Volkswagen AG to run their plants

there at less than full capacity for the first time, according to

industry data.

The global auto makers, which have been some of the biggest

beneficiaries of Chinese consumers' increasing appetite for upscale

goods, have already announced a slowdown in sales there as the

economy cools. Though the auto makers expect the market to grow

over the long-term, the production curb suggests the easy boom

times are over, signaling a bumpier ride for global companies that

made large bets on soaring Chinese demand.

During the first half of 2015, the aggregate utilization rate of

23 significant car-making joint ventures—China requires foreign

companies to build cars with local partners—fell below 100% for the

first time, averaging 94.3% utilization versus 107.4% a year

earlier, according to a study by Sanford C. Bernstein. Plants are

able to exceed 100% capacity utilization by adding extra work

shifts to meet high demand.

SAIC General Motors, a joint venture between GM and China's

largest auto maker SAIC Motor Corp., built 2.4% fewer cars in the

first half of the year compared with a year earlier, according to

data from the China Passenger Car Association, a trade

organization. FAW-Volkswagen Automobile Co., one of Volkswagen's

joint ventures in China, produced 1.2% fewer cars over the same

period.

Volkswagen's joint venture with SAIC was one of only three

manufacturers to increase capacity utilization during the first

half, according to Bernstein.

"From July through year-end we can have 10 days off a month. We

were usually given two days off [a month]," said Eric Shi, an

engineer for a General Motors plant in Shanghai, who said he used

to work a lot of weekends. "The situation seems worse than that of

2008" during the global financial crisis.

SAIC GM, owner of the plant, directed inquiries to GM's Chinese

headquarters, which said it manages production volumes to maintain

inventories within a healthy range, and it is closely monitoring

market conditions.

Global car makers such as GM, Volkswagen and BMW AG have been

particularly sensitive to slowing China growth because after years

of chasing rising sales there, they now get a significant amount of

their revenue from the country. China accounts for 35% of the

Volkswagen group's global vehicle sales, 35% of GM's and 20% of

BMW's, according to the companies' corporate filings.

China passenger-vehicle sales fell for a second consecutive

month in July, registering a 6.6% year-to-year decline. Sales of

foreign branded cars fell 1.5% in the first half from a year

earlier, compared with a 4.8% year-to-year rise in the overall

Chinese car market—a disappointing growth figure compared with

booming double-digit percentage growth in prior years.

The percentage declines in production are in line with

first-half losses in sales volumes. SAIC GM shipped 4.8% fewer cars

to dealers compared with a year earlier, and the Volkswagen

group—the No. 1 foreign car maker in China by sales volume—sold 4%

fewer cars in China. Volkswagen generates more than half of its

profit in the country.

Global car makers have built more plants in China than anywhere

else since 2008, but now they are canceling shifts and curtailing

hours, as well as increasing incentives for dealers and cutting car

prices.

Car makers reap big profits if their factories run near 100% of

capacity, but their losses mount rapidly if the utilization rate

falls below 80%.

Companies such as Volkswagen and GM are now slashing prices to

boost sales. In the second quarter of this year cars in China were

sold at a discount of more than 10%, compared with 7% a year

earlier, according to Ways Consulting, a Guangzhou-based consulting

firm focused on the Chinese automotive industry.

The plants are still operating near full capacity and the

industry is still profitable, so the companies are nonetheless

planning to add capacity, banking on continued growth in China,

albeit at a slower pace.

GM plans to raise its capacity in China to five million vehicles

a year by 2018 from about 3.5 million now. Volkswagen intends to

raise its China capacity to five million vehicles a year by 2019, a

rise of more than 40% from current levels. Toyota Motor Corp. is

spending $440 million to add a manufacturing line to an existing

facility in China, while Hyundai Motor Co. is building two new

plants in the country, each with an annual production capacity of

300,000 vehicles.

"We expect a more volatile market in China as growth moderates,"

a spokeswoman for GM said. "It hasn't changed our long-term view of

China. We continue to believe that the market will grow."

A Ford spokeswoman said: "Given the overall industry slowdown in

China, we have made production adjustments to balance supply and

demand." Ford's China capacity doubled to more than 1.2 million

vehicles in the past three years.

VW didn't immediately respond to a request for comment.

Bill Peng, a Beijing-based partner with Strategy&, the

global strategy consulting team at PricewaterhouseCoopers, said

many auto executives made expansion plans based on an expectation

that at least 30 million cars could be sold in China per year by

2020. But he said that with the economic slowdown making that

target look challenging, companies that haven't expanded yet should

think twice.

"If their products or managing executives are not overwhelmingly

competitive, cutting production will be inevitable when the

factories are completed," he said. "It's time for foreign car

makers to consider how to control cost."

Rose Yu

Access Investor Kit for "Toyota Motor Corp."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=JP3633400001

Access Investor Kit for "Toyota Motor Corp."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US8923313071

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 23, 2015 22:05 ET (02:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

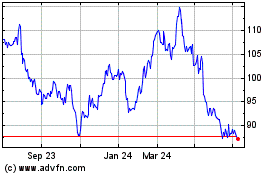

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

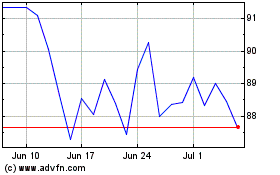

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Apr 2023 to Apr 2024