By Stu Woo

LONDON -- Telecommunications giant Vodafone Group PLC has a

mantra: Be No. 1.

Or No. 2.

U.K.-based Vodafone, the world's second-biggest mobile carrier

by subscribers, is trying to keep that position by having the most

-- or second-most -- customers in each of its 26 countries.

"It's not really about being the leader," Chief Executive

Vittorio Colao told analysts last month. Vodafone believes the top

two players in telecom markets -- and it doesn't matter if they are

first or second -- are able to differentiate themselves through

superior networks and services. By focusing investments in these

two areas, the leading operators can justify higher prices.

"The gap versus No. 3s is not only stable, but even increasing,"

Mr. Colao said, adding "it's about really creating a two-tier

market."

Even after a $130 billion windfall from the 2014 sale of its

Verizon Wireless stake, Vodafone has so far eschewed big, global

expansion. Under Mr. Colao, a 55-year-old Italian reserve military

officer who took over as CEO in 2008, the company left the consumer

U.S. market and has plowed investment into Europe and the

developing world instead.

Vodafone's biggest competitors are typically formerly

state-owned fixed-line giants still catching up in the mobile age.

It earned GBP41 billion ($50 billion) in revenue for the last full

fiscal year and ranks below only China Mobile Ltd. in terms of

global subscribers.

Over two years, Mr. Colao spent about $24 billion across his

empire, which is concentrated in Europe, Africa and India, to

expand high-speed mobile networks, the pillar of its marketing

campaigns. Vodafone also spent about $20 billion in 2013 and 2014

to buy major cable operators in Germany and Spain, and it is

expanding its wired cable and internet network so it can sell the

telecom industry's Holy Grail: a "quad-play" package that offers

mobile, landline telephone, cable and internet services on one

bill.

The results so far are mixed: Vodafone said last month that its

plan was paying off in parts of Europe, but proving much more

expensive than anticipated in India.

Overall, Vodafone's organic revenue, which excludes

foreign-exchange movement, grew 2.2% in the third quarter of 2016,

outperforming the average 1.6% growth of major Europe-based telecom

firms, according to Raymond James analyst Stephane Beyazian.

Leading the way over the past six months was Germany, with 2.3%

organic growth, and Italy, at 1.7%. But Vodafone's organic revenue

declined 2.7% in its home market of the U.K. -- where it is the No.

3 mobile operator behind BT Group PLC, which operates the EE brand,

and Telefónica SA's O2. Mr. Colao blames the shortfall partly on

billing problems and customer-service complaints related to a new

computer system.

Even more costly has been defending its No. 2 status in India.

New mobile carrier Reliance Jio Infocomm Ltd., funded by India's

richest man, has offered free service for at least a month to get

new customers. Vodafone wrote down the value of its India business

by EUR5 billion ($5.3 billion) earlier this month, citing the

competition.

"It is very hard to compete with someone who gives stuff for

free," Mr. Colao said.

Vodafone was formed in Newbury, England, in 1984 and spun off

from military and electronics conglomerate Racal Electronics Group

in 1991. It was one of the world's first mobile-focused telecom

companies, and obtained licenses in a hodgepodge of countries early

in the cellphone era and via two big deals.

It merged with AirTouch Communications, a San Francisco-based

mobile carrier with world-wide holdings, in 1999. The next year, it

acquired Mannesmann AG, a German telecommunications business with

European operations.

In 1999, Vodafone merged its U.S. mobile operations with those

of Bell Atlantic Corp., with the latter renaming itself Verizon

Communications Inc. They called their joint venture Verizon

Wireless, with Verizon owning 55% and Vodafone the other 45%.

Verizon Communications had long tried to buy out Vodafone's shares,

but the two didn't reach an agreement until 2013. The sale closed

in 2014.

Vodafone gave back $84 billion from the sale to shareholders --

the largest single return in modern corporate history. A chunk of

the remainder went to pay taxes and reduce debt.

The rest of those funds helped bankroll Vodafone's two-year

network-improvement program. The project, which mostly wrapped up

this past spring, focused on expanding Vodafone's fourth-generation

mobile network, or 4G, in Europe and both its fourth- and

third-generation networks in emerging markets such as India.

For years, Vodafone and John Malone's Liberty Global PLC have

publicly flirted with the idea of a combination. The two companies

expect to complete a merger of their operations in the Netherlands

later this year, creating a 50-50 joint venture. Speaking at a

Morgan Stanley conference last month, Mr. Colao and Liberty Global

CEO Mike Fries said the Dutch tie-up wasn't necessarily indicative

of future deals. But Mr. Colao kept the door open.

"We see the world the same way," Mr. Colao told investors,

describing Mr. Fries. "Is this the first trial of something bigger?

Not necessarily....But of course it helps to know each other."

Write to Stu Woo at Stu.Woo@wsj.com

(END) Dow Jones Newswires

December 10, 2016 08:31 ET (13:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

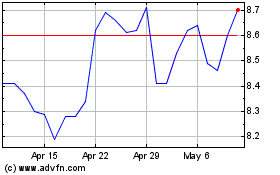

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

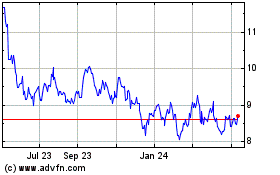

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024