- Net sales increased 29.4% from second

quarter 2016 to $344.0 million

- Comparable store sales increased 14.7%

from second quarter 2016

- Diluted earnings per share (“EPS”)

increased to $0.20 from $0.06 in the second quarter 2016; adjusted

diluted EPS increased 42.9% to $0.20 from $0.14 in the second

quarter 2016

- Raising full year financial outlook

reflecting year-to-date performance

Floor & Decor Holdings, Inc. (NYSE:FND) (“We,” the

“Company,” or “Floor & Decor”) announces its financial results

for the second quarter of fiscal 2017, which ended June 29,

2017.

Tom Taylor, Chief Executive Officer, stated, “We are very

pleased to report a strong second quarter that once again

demonstrates the positive response customers have to our highly

differentiated, multi-channel, hard surface flooring and

accessories business. Our success is a credit to our associates for

their exceptional service to our customers, which, together with

our broad in-stock assortment, makes shopping our stores an

experience unlike any other.”

Mr. Taylor continued, “Given our strong year-to-date

performance, we are raising our full year guidance. Looking ahead,

the growth opportunity for Floor & Decor is significant, and we

remain focused on disciplined execution of our key priorities to

profitably grow our store base, drive comparable store sales,

expand our connected customer experience and invest in our

professional customers.”

Unless indicated otherwise, the information in this release has

been adjusted to give effect to a 321.820-for-one stock split of

our common stock effected on April 24, 2017. See “Comparable Store

Sales” below for information on how the Company calculates its

comparable store sales growth.

For the Thirteen Weeks Ended June 29, 2017

- Net sales increased 29.4% to $344.0

million from $265.9 million in the second quarter of fiscal 2016.

Comparable store sales increased 14.7%.

- The Company opened one new store during

the second quarter of fiscal 2017, ending the quarter with 73

warehouse format stores. This represents a unit increase of 15.9%

over the second quarter of fiscal 2016.

- Operating income increased 220.9% to

$34.1 million from $10.6 million in the second quarter of fiscal

2016, which included a $14.0 million charge to reserve for a legal

settlement. Operating margin increased 590 basis points to

9.9%.

- Net income increased 307.6% to $20.4

million compared to $5.0 million in the second quarter of fiscal

2016; Net income per diluted share was $0.20 compared to $0.06 per

diluted share in the second quarter of fiscal 2016.

- Adjusted net income* increased 48.0% to

$20.5 million compared to $13.8 million in the second quarter of

fiscal 2016; Adjusted diluted EPS* was $0.20 compared to $0.14 in

the second quarter of fiscal 2016, an increase of 42.9%.

- Adjusted EBITDA* increased 36.5% to

$43.7 million compared to $32.0 million in the second quarter of

fiscal 2016.

For the Twenty-six Weeks Ended June 29, 2017

- Net sales increased 30.0% to $651.3

million from $501.2 million in the first half of fiscal 2016.

Comparable store sales increased 13.8%.

- The Company opened four new stores and

relocated one store during the first half of fiscal 2017.

- Operating income increased 130.9% to

$56.8 million compared to $24.6 million in the first half of fiscal

2016, which included a $14.0 million charge to reserve for a legal

settlement. Operating margin increased 380 basis points to

8.7%.

- Net income increased 160.5% to $31.6

million compared to $12.1 million in the second quarter of fiscal

2016; Net income per diluted share was $0.33 compared to $0.14 per

diluted share in the first half of fiscal 2016.

- Adjusted net income* increased 59.6% to

$33.5 million compared to $21.0 million in the first half of fiscal

2016; Adjusted diluted EPS* was $0.33 compared to $0.21 in the

first half of fiscal 2016, an increase of 57.1%.

- Adjusted EBITDA* increased 45.1% to

$75.6 million compared to $52.1 million in the first half of fiscal

2016.

*Non-GAAP financial measures. Please see “Non-GAAP

Financial Measures” and “Reconciliation of GAAP to Non-GAAP

Financial Measures” below for more information.

Balance Sheet Highlights as of June 29, 2017

- Total liquidity was $156.1 million as

of June 29, 2017, which primarily was from the availability on our

revolving credit facility.

- Total debt was $181.8 million as of

June 29, 2017, consisting of outstanding current and long-term

portions of our secured term loan and revolving credit

facilities.

Third Quarter and Fiscal 2017

Outlook

(in millions, except EPS, percentages and

store count)

Thirteen Weeks Ended

9/28/17 Net sales $331 - $337 Comparable store sales growth 9%

to 11% GAAP diluted EPS $0.12 - $0.14 Adjusted diluted EPS $0.12 -

$0.14 Diluted weighted average shares outstanding 104.1 Adjusted

EBITDA $33.8 - $36.5 Warehouse format store count 79 - 80 New

warehouse format stores 6 - 7

Updated Guidance

Prior Guidance Twelve Months Twelve Months

Ended 12/28/17 Ended 12/28/17 Net sales $1,318 -

$1,331 $1,285 - $1,304 Comparable store sales growth 10% to 12% 8%

to 10% GAAP diluted EPS $0.57 - $0.60 $0.49 - $0.52 Adjusted

diluted EPS $0.57 - $0.60 $0.54 - $0.57 Adjusted diluted weighted

average shares outstanding 103.1 102.9 Adjusted EBITDA $143.1 -

$147.5 $137.9 - $142.0 Depreciation and amortization $35 $34

Interest Expense $14 $14 Tax rate 37% for the remainder of fiscal

2017 37% for the remainder of fiscal 2017 Warehouse format store

count 83 83 New warehouse format stores 14 14 Capital Expenditures

$100 - $104 $95 - $104

The above guidance includes certain non-GAAP financial measures

(namely adjusted diluted weighted average shares outstanding,

adjusted diluted EPS and adjusted EBITDA). Please see “Non-GAAP

Financial Measures” and “Reconciliation of GAAP to Non-GAAP

Financial Measures” below for more information.

Recent Developments

Secondary Offering

On July 25, certain of the Company’s stockholders completed a

secondary public offering (the “Secondary Offering”) of an

aggregate of 10,718,550 shares of common stock at a price to the

public of $40.00 per share. The underwriters also have the option

to exercise their option to purchase an additional 1,607,782 shares

of common stock at the public offering price less the underwriting

discounts and commissions. The Company did not sell any shares in

the Secondary Offering and did not receive any proceeds from the

sales of shares by the selling stockholders.

Non-GAAP Financial Measures

Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted

EBITDA (which are shown in the reconciliations below) have been

presented in this earnings release as supplemental measures of

financial performance that are not required by, or presented in

accordance with, accounting principles generally accepted in the

United States ("GAAP"). We define Adjusted net income as net income

adjusted to eliminate the impact of certain items that we do not

consider indicative of our core operating performance and the tax

effect related to those items. We define Adjusted diluted EPS as

adjusted net income divided by adjusted diluted weighted average

shares outstanding (i.e., the weighted average shares

outstanding during the relevant period plus the weighted average

impact of issuing shares in our initial public offering (our

“IPO”). We define EBITDA as net income before interest, loss on

early extinguishment of debt, taxes, depreciation and amortization.

We define Adjusted EBITDA as net income before interest, loss on

early extinguishment of debt, taxes, depreciation and amortization,

adjusted to eliminate the impact of certain items that we do not

consider indicative of our core operating performance.

Reconciliations of these measures to the equivalent measures under

GAAP are set forth in the tables below.

Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted

EBITDA are key metrics used by management and our board of

directors to assess our financial performance and enterprise value.

We believe that Adjusted net income, Adjusted diluted EPS, EBITDA

and Adjusted EBITDA are useful measures, as they eliminate certain

expenses that are not indicative of our core operating performance

and facilitate a comparison of our core operating performance on a

consistent basis from period to period. We also use Adjusted EBITDA

as a basis to determine covenant compliance with respect to our

credit facilities, to supplement GAAP measures of performance to

evaluate the effectiveness of our business strategies, to make

budgeting decisions, and to compare our performance against that of

other peer companies using similar measures. Adjusted net income,

Adjusted diluted EPS, EBITDA and Adjusted EBITDA are also used by

analysts, investors and other interested parties as performance

measures to evaluate companies in our industry.

Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted

EBITDA are non-GAAP measures of our financial performance and

should not be considered as alternatives to net income or diluted

EPS as a measure of financial performance, or any other performance

measure derived in accordance with GAAP and they should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items. Additionally,

Adjusted net income, EBITDA and Adjusted EBITDA are not intended to

be measures of liquidity or free cash flow for management's

discretionary use. In addition, these non-GAAP measures exclude

certain non-recurring and other charges. Each of these non-GAAP

measures has its limitations as an analytical tool, and you should

not consider them in isolation or as a substitute for analysis of

our results as reported under GAAP. In evaluating Adjusted net

income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA, you

should be aware that in the future we will incur expenses that are

the same as or similar to some of the items eliminated in the

adjustments made to determine Adjusted net income, Adjusted diluted

EPS, EBITDA and Adjusted EBITDA, such as stock compensation

expense, loss (gain) on asset disposal, executive

recruiting/relocation, and other adjustments. Our presentation of

Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted

EBITDA should not be construed to imply that our future results

will be unaffected by any such adjustments. Definitions and

calculations of Adjusted net income, Adjusted diluted EPS, EBITDA

and Adjusted EBITDA differ among companies in the retail industry,

and therefore Adjusted net income, Adjusted diluted EPS, EBITDA and

Adjusted EBITDA disclosed by us may not be comparable to the

metrics disclosed by other companies.

Please see “Reconciliation of GAAP to Non-GAAP Financial

Measures” below for reconciliations of non-GAAP financial measures

used in this release to their most directly comparable GAAP

financial measures.

Floor & Decor Holdings,

Inc.

Condensed Consolidated Income

Statements

(in thousands, except per share data)

(unaudited)

Thirteen Weeks Ended 6/29/2017

6/30/2016 % of

% of % Actual Sales Actual

Sales

Increase (Decrease)

Net sales $344,047 100.0 % $265,853 100.0 % 29.4 % Cost of sales

201,819 58.7 156,201 58.8 29.2 Gross profit 142,228 41.3 109,652

41.2 29.7 Selling & store operating expenses 85,650 24.9 66,787

25.1 28.2 General & administrative expenses 19,518 5.6 15,610

5.8 25.0 Pre-opening expenses 2,958 0.9 2,627 1.0 12.6 Litigation

settlement — — 14,000 5.3 (100.0) Operating income 34,102 9.9

10,628 4.0 220.9 Interest expense 3,353 1.0 2,475 0.9 35.5 Loss on

early extinguishment of debt 5,442 1.5 153 0.1 NM Income before

income taxes 25,307 7.4 8,000 3.0 216.3 Provision for income taxes

4,878 1.5 2,988 1.1 63.3 Net income $20,429 5.9 % $5,012 1.9 %

307.6 % Basic weighted average shares outstanding 90,861 83,385 9.0

% Diluted weighted average shares outstanding 99,919 87,898 13.7 %

Basic earnings per share $0.22 $0.06 266.7 % Diluted earnings per

share $0.20 $0.06 233.3 %

Twenty-six Weeks

Ended 6/29/2017 6/30/2016

% of % of %

Actual Sales Actual Sales

Increase (Decrease)

Net sales $651,343 100.0 % $501,154 100.0 % 30.0 % Cost of sales

383,644 58.9 297,605 59.4 28.9 Gross profit 267,699 41.1 203,549

40.6 31.5 Selling & store operating expenses 166,401 25.5

128,836 25.7 29.2 General & administrative expenses 37,399 5.8

30,180 6.0 23.9 Pre-opening expenses 7,125 1.1 5,943 1.2 19.9

Litigation settlement — — 14,000 2.8 (100.0) Operating income

56,774 8.7 24,590 4.9 130.9 Interest expense 8,767 1.4 4,961 1.0

76.7 Loss on early extinguishment of debt 5,442 0.8 153 — NM Income

before income taxes 42,565 6.5 19,476 3.9 118.6 Provision for

income taxes 11,008 1.7 7,363 1.5 49.5 Net income $31,557 4.8 %

$12,113 2.4 % 160.5 % Basic weighted average shares outstanding

87,195 83,380 4.6 % Diluted weighted average shares outstanding

94,900 88,335 7.4 % Basic earnings per share $0.36 $0.15 140.0 %

Diluted earnings per share $0.33 $0.14 135.7 %

Condensed Consolidated Balance

Sheets

(in thousands, except share and per share

data)

(unaudited)

As of 6/29/2017 12/29/2016

Assets Current assets: Cash and cash equivalents $386 $451

Income tax receivable 2,081 — Receivables, net 38,500 34,533

Inventories, net 367,473 293,702 Prepaid expenses and other current

assets 7,648 7,529

Total current assets 416,088 336,215

Fixed assets, net 183,649 150,471 Intangible assets, net 109,378

109,394 Goodwill 227,447 227,447 Other assets 7,658 7,639

Total

long-term assets 528,132 494,951

Total assets $944,220

$831,166

Liabilities and stockholders’ equity Current

liabilities: Current portion of term loans $3,500 $3,500 Trade

accounts payable 243,584 158,466 Accrued expenses 53,828 61,505

Income taxes payable — 5,787 Deferred revenue 21,519 14,456

Total current liabilities 322,431 243,714 Term loans 146,525

337,243 Revolving line of credit 31,800 50,000 Deferred rent 22,605

16,750 Deferred income tax liabilities, net 35,385 28,265 Tenant

improvement allowances 23,682 20,319 Other liabilities 648 592

Total long-term liabilities 260,645 453,169

Total

liabilities 583,076 696,883 Commitments and contingencies

Stockholders’ equity Capital stock: Preferred stock, $0.001

par value; 10,000,000 shares authorized; 0 shares issued and

outstanding at June 29, 2017 and December 29, 2016 — — Common stock

Class A, $0.001 par value; 450,000,000 shares authorized;

87,809,134 shares issued and outstanding at June 29, 2017 and

76,847,116 issued and outstanding at December 29, 2016 87 77 Common

stock Class B, $0.001 par value; 10,000,000 shares authorized; 0

shares issued and outstanding at June 29, 2017 and 395,742 shares

issued and outstanding at December 29, 2016 — — Common stock Class

C, $0.001 par value; 30,000,000 shares authorized; 6,275,489 shares

issued and outstanding June 29, 2017 and December 29, 2016 6 6

Additional paid-in capital 313,323 117,270 Accumulated other

comprehensive income (loss), net (590) 176 Retained earnings 48,318

16,754

Total stockholders’ equity 361,144 134,283

Total

liabilities and stockholders’ equity $944,220 $831,166

Condensed Consolidated Statements of

Cash Flows

(in thousands)

(unaudited)

Twenty-six weeks Ended 6/29/2017

6/30/2016 Operating activities Net income $31,557

$12,113 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 18,058 13,696

Loss on early extinguishment of debt 5,442 153 Loss on asset

disposals — 263 Amortization of tenant improvement allowances

(1,547) (1,188) Deferred income taxes 7,586 1,546 Stock based

compensation expense 2,135 1,460 Changes in operating assets and

liabilities: Receivables, net (3,967) (535) Inventories, net

(73,771) (26,332) Other assets (1,643) (1,303) Trade accounts

payable 85,118 20,330 Accrued expenses (10,901) 16,597 Income taxes

(7,868) (2,711) Deferred revenue 7,063 3,707 Deferred rent 5,994

2,152 Tenant improvement allowances 3,124 3,283 Other 59 50 Net

cash provided by operating activities 66,439 43,281

Investing

activities Purchases of fixed assets (45,498) (30,920) Net cash

used in investing activities (45,498) (30,920)

Financing

activities Borrowings on revolving line of credit 111,700

89,650 Payments on revolving line of credit (129,900) (113,050)

Proceeds from term loans — 12,000 Payments on term loans (195,750)

(733) Debt issuance costs (993) (197) Net proceeds from initial

public offering 192,082 — Proceeds from exercise of stock options

1,855 34 Net cash used in financing activities (21,006) (12,296)

Net (decrease) increase in cash and cash equivalents (65) 65 Cash

and cash equivalents, beginning of the period 451 318 Cash and cash

equivalents, end of the period $386 $383

Supplemental

disclosures of cash flow information Cash paid for interest

$11,682 $4,194 Cash paid for income taxes $11,134 $8,692 Fixed

assets accrued at the end of the period $8,472 $8,459 Fixed assets

acquired as part of lease - paid for by lessor $1,786 $—

Reconciliation of GAAP to Non-GAAP

Financial Measures

(in thousands, except per share data)

(unaudited)

Adjusted diluted weighted average shares outstanding

Thirteen Weeks Ended 6/29/2017

6/30/2016 Diluted weighted average shares outstanding (GAAP)

99,919 87,898 Adjustments for issuance of shares at IPO 3,011

10,147 Adjusted diluted weighted average shares outstanding 102,930

98,045

Twenty-six Weeks Ended 6/29/2017

6/30/2016 Diluted weighted average shares outstanding (GAAP)

94,900 88,335 Adjustments for issuance of shares at IPO 6,579

10,147 Adjusted diluted weighted average shares outstanding 101,479

98,482

Adjusted net income and Adjusted diluted

EPS Thirteen Weeks Ended 6/29/2017

6/30/2016 Net income (GAAP): $20,429 $5,012 Interest due to

IPO 1,365 2,730 Loss on early extinguishment of debt 5,442 153

Secondary offering costs 285 — Tax benefit of stock option

exercises (4,408) — Legal settlement — 14,000 Interest due to

refinancing of credit facilities — (2,928) Repricing amendment to

term loan facility — 293 Tax impact of adjustments to net income

(2,624) (5,414) Adjusted net income $20,489 $13,846 Adjusted

diluted weighted average shares outstanding 102,930 98,045 Adjusted

diluted EPS $0.20 $0.14

Twenty-six Weeks Ended

6/29/2017 6/30/2016 Net income (GAAP): $31,557

$12,113 Interest due to IPO 4,095 5,460 Loss on early

extinguishment of debt 5,442 153 Secondary offering costs 285 — Tax

benefit of stock option exercises (4,408) — Legal settlement —

14,000 Interest due to refinancing of credit facilities — (5,856)

Repricing amendment to term loan facility 295 588 Tax impact of

adjustments to net income (3,743) (5,451) Adjusted net income

$33,523 $21,007 Adjusted diluted weighted average shares

outstanding 101,479 98,482 Adjusted diluted EPS $0.33 $0.21

EBITDA and Adjusted EBITDA

Thirteen Weeks Ended 6/29/2017

6/30/2016 Net income (GAAP): $20,429 $5,012

Depreciation and amortization 8,026 6,447 Interest expense 3,353

2,475 Loss on early extinguishment of debt 5,442 153 Income tax

expense 4,878 2,988 EBITDA 42,128 17,075 Stock compensation expense

1,250 706 Loss on asset disposal — 211 Legal settlement — 14,000

Other 303 — Adjusted EBITDA $43,681 $31,992

Twenty-six Weeks Ended 6/29/2017 6/30/2016 Net

income (GAAP): $31,557 $12,113 Depreciation and amortization 15,794

11,784 Interest expense 8,767 4,961 Loss on early extinguishment of

debt 5,442 153 Income tax expense 11,008 7,363 EBITDA 72,568 36,374

Stock compensation expense 2,135 1,461 Loss on asset disposal — 258

Legal settlement — 14,000 Other 875 — Adjusted EBITDA $75,578

$52,093

Comparable Store Sales

“Comparable store sales”’ includes net sales from the Company’s

stores beginning on the first day of the thirteenth full fiscal

month following the store’s opening. Because the Company’s

e-commerce sales are fulfilled by individual stores, they are

included in comparable store sales only to the extent such

fulfilling store meets the above mentioned store criteria.

Guidance Reconciliation - Third Quarter

2017(in millions, except per share data)(unaudited)

Adjusted diluted weighted average

shares outstanding Thirteen Weeks Ended 9/28/2017

9/29/2016 Low End High End Actual

Diluted weighted average shares outstanding (GAAP) 104.1 104.1 88.4

Adjustments for issuance of shares at IPO — — 10.1 Adjusted diluted

weighted average shares outstanding 104.1 104.1 98.5

Adjusted net income and Adjusted diluted EPS Thirteen

Weeks Ended 9/28/2017 9/29/2016 Low End

High End Actual Net income (GAAP): $12.7 $14.4 $14.2

Interest due to refinancing of credit facilities — — (2.9) Interest

due to IPO — — 2.7 Repricing amendment to term loan facility — —

0.3 Legal settlement — — (3.5) Secondary offering expenses 0.4 0.4

— Tax impact of adjustments to net income (0.2) (0.2) 1.3 Adjusted

net income $12.9 $14.6 $12.1 Adjusted weighted average shares

outstanding 104.1 104.1 98.5 Adjusted diluted EPS $0.12 $0.14 $0.12

EBITDA and Adjusted EBITDA Thirteen Weeks

Ended 9/28/2017 9/29/2016 Low End High

End Actual Net income (GAAP): $12.7 $14.4 $14.2

Depreciation and amortization 9.1 9.1 6.2 Interest expense 2.6 2.6

2.4 Income tax expense 7.5 8.5 7.9 EBITDA 31.9 34.6 30.7 Stock

compensation expense 1.5 1.5 0.8 Loss on asset disposal — — 0.2

Legal settlement — — (3.5) IPO costs 0.4 0.4 — Adjusted EBITDA

$33.8 $36.5 $28.2

Guidance Reconciliation - Fiscal

Year 2017

(in millions, except per share data)

(unaudited)

Adjusted diluted weighted average

shares outstanding

Fiscal Year 12/28/2017

12/29/2016 Low End High End

Actual Diluted weighted average shares outstanding (GAAP)

99.8 99.8 88.4 Adjustments for issuance of shares at IPO 3.3 3.3

10.1 Adjusted diluted weighted average shares outstanding 103.1

103.1 98.6

Adjusted net income and Adjusted diluted

EPS Fiscal Year 12/28/2017 12/29/2016

Low End High End Actual Net income (GAAP):

$56.6 $59.4 $43.0 Interest due to refinancing of credit facilities

— — (8.8) Interest due to IPO 4.1 4.1 10.9 Repricing amendment to

term loan facility 0.3 0.3 1.2 Legal settlement — — 10.5 Secondary

offering expenses 0.7 0.7 — Loss on early extinguishment of debt

5.4 5.4 1.8 Tax benefit of stock option exercises (4.4) (4.4) — Tax

benefit of 2016 dividend — — (8.5) Tax impact of adjustments to net

income (3.9) (3.9) (5.9) Adjusted net income $58.8 $61.6 $44.2

Adjusted weighted average shares outstanding 103.1 103.1 98.6

Adjusted diluted EPS $0.57 $0.60 $0.45

EBITDA and

Adjusted EBITDA Fiscal Year 12/28/2017

12/29/2016 Low End High End Actual Net

income (GAAP): $56.6 $59.4 $43.0 Depreciation and amortization 34.7

34.7 25.1 Interest expense 14.1 14.1 12.8 Loss on early

extinguishment of debt 5.4 5.4 1.8 Income tax expense 25.7 27.3

11.5 EBITDA 136.5 140.9 94.2 Stock compensation expense 5.0 5.0 3.2

Loss on asset disposal 0.2 0.2 0.5 Legal settlement — — 10.5

Offering costs 1.4 1.4 — Adjusted EBITDA $143.1 $147.5 $108.4

Note: Certain numbers may not sum due to rounding

Conference Call Details

A conference call to discuss the second quarter fiscal 2017

financial results is scheduled for today, July 27, 2017, at 4:30

p.m. Eastern Time. A live audio webcast of the conference call,

together with related materials, will be available online at

ir.flooranddecor.com.

A recorded replay of the conference call is expected to be

available approximately two hours of the conclusion of the call and

can be accessed both online at ir.flooranddecor.com and by dialing

844-512-2921 (international callers please dial 412-317-6671). The

pin number to access the telephone replay is 8629077. The replay

will be available until August 3, 2017.

About Floor & Decor Holdings, Inc.

Floor & Decor is a multi-channel specialty retailer of hard

surface flooring and related accessories, offering a broad in-stock

assortment of tile, wood, laminate and natural stone flooring along

with decorative and installation accessories at everyday low

prices.

Forward-Looking Statements

This release and the associated webcast/conference call contain

forward-looking statements, including with respect to the Company’s

estimated net sales, comparable store sales growth, GAAP EPS,

adjusted diluted EPS, diluted share count, adjusted EBITDA,

warehouse format store count and new warehouse format stores for

both the thirteen weeks ended 9/28/17 and all of fiscal 2017 and

with respect to the Company’s estimated depreciation and

amortization expenses, interest expense, tax rate and capital

expenditures for fiscal 2017. All statements other than statements

of historical fact contained in this release, including statements

regarding the Company’s future operating results and financial

position, business strategy and plans and objectives of management

for future operations, are forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

important factors that may cause the Company’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements.

In some cases, you can identify forward-looking statements by

terms such as “may,” “will,” “should,” “expects,” “intends,”

“plans,” “anticipates,” “could,” “seeks,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“budget,” “potential,” “focused on” or “continue” or the negative

of these terms or other similar expressions. The forward-looking

statements in this release are only predictions. Although the

Company believes that the expectations reflected in the

forward-looking statements in this release are reasonable, the

Company cannot guarantee future events, results, performance or

achievements. A number of important factors could cause actual

results to differ materially from those indicated by the

forward-looking statements in this release or the associated

webcast/conference call, including, without limitation, those

factors described in “Risk Factors,” “Special Note Regarding

Forward-Looking Statements,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” and “Business”

sections and elsewhere in the Company’s final prospectus, dated

April 26, 2017 and filed with the SEC in accordance with Rule

424(b) of the Securities Act of 1933 on April 28, 2017.

Because forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified, you should not rely on these forward-looking statements

as predictions of future events. The forward-looking statements

contained in this release or the associated webcast/conference call

speak only as of the date hereof. New risks and uncertainties arise

over time, and it is not possible for the Company to predict those

events or how they may affect the Company. If a change to the

events and circumstances reflected in the Company’s forward-looking

statements occurs, the Company’s business, financial condition and

operating results may vary materially from those expressed in the

Company’s forward-looking statements. Except as required by

applicable law, the Company does not plan to publicly update or

revise any forward-looking statements contained herein or in the

associated webcast/conference call, whether as a result of any new

information, future events or otherwise, including the Company’s

estimated net sales, comparable store sales growth, GAAP EPS,

adjusted diluted EPS, diluted share count, adjusted diluted

weighted average shares outstanding, adjusted EBITDA, warehouse

format store count and new warehouse format stores for both the

thirteen weeks ended 9/28/17 and all of fiscal 2017 and with

respect to the Company’s estimated depreciation and amortization

expenses, interest expense, tax rate and capital expenditures for

fiscal 2017.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727006499/en/

Investor Contacts:Floor & Decor Holdings, Inc.Matthew

McConnell770-257-1374InvestorRelations@flooranddecor.comorICR,

Inc.Farah Soi/Rachel

Schacter203-682-8200InvestorRelations@flooranddecor.com

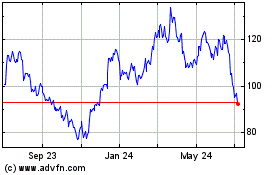

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Apr 2023 to Apr 2024