Funds in multiple categories awarded

Five Columbia funds have received 2015 Lipper Fund Awards as

top-performing mutual funds in their respective Lipper

classifications for the period ending December 31, 2014:

- Columbia Select Large-Cap Value Fund

(R5 shares)Large-Cap Value Funds classification (90 funds1) –

10 years

- Columbia Greater China Fund (Z

shares)China Region Funds classification (11 funds1) – 10

years

- Columbia Global Technology Growth

Fund (Z shares)Science & Technology Funds classification

(39 funds1) – 3 years

- Columbia Contrarian Core Fund (Z

shares)Large-Cap Core Funds classification (177 funds1) – 10

years

- Columbia AMT-Free California

Intermediate Muni Bond Fund (Z shares)California Intermediate

Municipal Debt Funds classification (13 funds1) – 10 years

The U.S. Lipper Fund Awards recognize funds for their

consistently strong risk-adjusted three-, five-, and 10-year

performance, relative to their peers, based on Lipper’s proprietary

performance-based methodology2.

Past performance does not guarantee future results.

“We are pleased to have five funds recognized by Lipper for

their consistent, risk adjusted performance,” said Colin Moore,

Global Chief Investment Officer. “The awards underscore the

importance Columbia Threadneedle Investments places on rigorous

research and a disciplined investment process in the service of our

clients.”

This is the fourth consecutive year that Columbia Select

Large-Cap Value Fund has earned a Lipper Award in the Large-Cap

Value category. The fund received the award for 10-year performance

in 2014 (84 funds), for 5-year and 10-year performance in 2013 (102

funds and 84 funds), and for 5-year performance in 2012 (402

funds).

About Columbia Threadneedle Investments:Columbia

Threadneedle Investments is a leading global asset management group

that provides a broad range of actively managed investment

strategies and solutions for individual, institutional and

corporate clients around the world.

With more than 2000 people including over 450 investment

professionals based in North America, Europe and Asia, we manage

$506 billion (as of 12/31/14) of assets across developed and

emerging market equities, fixed income, asset allocation solutions

and alternatives.

Columbia Threadneedle Investments is the global asset management

group of Ameriprise Financial, Inc. (NYSE: AMP).

For more information, please visit columbiathreadneedle.com/us.

Follow us on Twitter @CTInvest_US.

Performance Chart

Average annualtotal returns as

of12/31/14

1 Year

3 Year 5 Year 10 Year

SinceInception

InceptionDate

Total GrossAnnual

OperatingExpenses5

Columbia SelectLarge-Cap ValueFund(R5

shares3)

12.17 18.56 16.33 8.71

8.37 04/25/19974 1.00%

Columbia GreaterChina Fund(Z shares)

10.83 9.09 7.33 11.98

10.59 05/16/1997 1.34%

Columbia GlobalTechnology GrowthFund(Z

shares)

16.14 22.51 19.09 11.21

5.93 11/09/2000 1.19%

ColumbiaContrarian CoreFund(Z shares)

15.97 19.15 17.02 10.58

9.63 12/14/1992 .87%

Columbia AMT-Free CaliforniaIntermediate

MuniBond Fund(Z shares)

5.12 3.48 4.87 4.44 4.20

08/19/2002 .71%

Source: Columbia Threadneedle Investments, as of

12/31/14.

Past performance does not guarantee future results.

1 Within the respective Lipper classification.

2 Lipper rankings are based on annualized total returns and do

not reflect sales charges.

3 Class Z an R shares are sold at net asset value and have

limited eligibility. Columbia Management Investment Distributors,

Inc. offers multiple share classes, not all necessarily available

through all firms, and the share class ratings may vary. Contact us

for details.

4 The inception date of Class R5 shares of Columbia Select

Large-Cap Value Fund is 11/30/2001. The returns shown for periods

prior to this date include the returns of the oldest share class of

the fund, adjusted to reflect higher class-related operating

expenses, as applicable. In addition, the returns shown include the

returns of any predecessor to the fund. Please visit

columbiamanagement.com/institutional/strategies-and-products/appended-performance

for more information.

5 The fund’s expense ratio is from the most recent prospectus.

The investment manager and certain of its affiliates have

contractually (for at least twelve months after the date of the

fund prospectus) agreed to waive certain fees and/or to reimburse

certain expenses of the fund.

The performance information shown represents past performance

and is not a guarantee of future results. The investment return and

principal value of an investment will fluctuate so that the shares,

when redeemed, may be worth more or less than their original

cost. Current performance may be lower or higher than the

performance information shown. You may obtain performance

information current to the most recent month-end by visiting

columbiathreadneedle.com/us.

The investment manager and certain of its affiliates have

contractually (for at least the current fiscal year) and/or

voluntarily agreed to waive certain fees and/or to reimburse

certain expenses of the Fund, as described in the Fund's

prospectus, unless sooner terminated. Contractual

waivers/reimbursements may be discontinued before their stated end

date at the sole discretion of the Fund’s board and voluntary

waivers/reimbursement arrangements, if any, may be discontinued at

any time. The Fund’s returns reflect the effect of any fee

waivers and/or reimbursements of Fund expenses. Without such fee

waivers/expense reimbursements, the Fund’s returns would have been

lower.

The Lipper Fund Awards are part of the Thomson Reuters Awards

for Excellence, a global family of awards that celebrate

exceptional performance throughout the professional investment

community. The Thomson Reuters Awards for Excellence recognize the

world's top funds, fund management firms, sell-side firms, research

analysts, and investor relations teams. The Thomson Reuters Awards

for Excellence also include the Extel Survey Awards, the StarMine

Analyst Awards, and the StarMine Broker Rankings. For more

information, please contact markets.awards@thomsonreuters.com or

visit excellence.thomsonreuters.com.

Investors should consider the investment objectives, risks,

charges and expenses of a mutual fund carefully before investing.

For a free prospectus or a summary prospectus, which contains this

and other important information about the funds, visit

columbiathreadneedle.com/us. Read the prospectus carefully before

investing.

Columbia Select Large Cap-Value Fund: The market value of

securities may fall, fail to rise, or fluctuate, sometimes rapidly

and unpredictably. Market risk may affect a single issuer, sector

of the economy, industry, or the market as a whole. Value

securities involve the risk that they may never reach what the

portfolio managers believe is their full market value either

because the market fails to recognize the stock's intrinsic worth

or the portfolio managers misgauged that worth. They also may

decline in price, even though in theory they are already

undervalued. Because the Fund may hold a limited number of

securities, the Fund as a whole is subject to greater risk of loss

if any of those securities declines in price.

Columbia Greater China Fund: Market risk may affect a

single issuer, sector of the economy, industry or the market as a

whole. International investing involves certain risks and

volatility due to potential political, economic or currency

instabilities and different financial and accounting standards.

Risks are enhanced for emerging market issuers. Concentration in

the Greater China region, where issuers tend to be less developed

than U.S. issuers, presents increased risk of loss than a fund that

does not concentrate its investments. Investments in small- and

mid-cap companies involve risks and volatility greater than

investments in larger, more established companies. As a

non-diversified fund, fewer investments could have a greater effect

on performance.

Columbia Global Technology Growth Fund: Market risk may

affect a single issuer, sector of the economy, industry or the

market as a whole. The products of technology companies may be

subject to severe competition and rapid obsolescence, and

technology stocks may be subject to greater price fluctuations.

Growth securities, at times, may not perform as well as value

securities or the stock market in general and may be out of favor

with investors. Foreign investments subject the fund to risks,

including political, economic, market, social and others within a

particular country, as well as to currency instabilities and less

stringent financial and accounting standards generally applicable

to U.S. issuers. Risks are enhanced for emerging market issuers. As

a non-diversified fund, fewer investments could have a greater

effect on performance.

Columbia Contrarian Core Fund: Market risk may affect a

single issuer, sector of the economy, industry or the market as a

whole. Foreign investments subject the fund to risks, including

political, economic, market, social and others within a particular

country, as well as to currency instabilities and less stringent

financial and accounting standards generally applicable to U.S.

issuers. Growth securities, at times, may not perform as well as

value securities or the stock market in general and may be out of

favor with investors. Value securities may be unprofitable if the

market fails to recognize their intrinsic worth or the portfolio

manager misgauged that worth. The fund may invest significantly in

issuers within a particular sector, which may be negatively

affected by market, economic or other conditions, making the fund

more vulnerable to unfavorable developments in the sector.

Columbia AMT-Free California Intermediate Muni Bond Fund:

Fixed-income securities present issuer default risk. The

fund invests substantially in municipal securities and will

be affected by tax, legislative, regulatory, demographic or

political changes, as well as changes impacting a state’s

financial, economic or other conditions. A relatively small number

of tax-exempt issuers may necessitate the fund investing more

heavily in a single issuer and, therefore, be more exposed to the

risk of loss than a fund that invests more broadly. The value of

the fund’s portfolio may be more volatile than a more

geographically diversified fund. Prepayment and

extension risk exists as a loan, bond or other investment may

be called, prepaid or redeemed before maturity and that similar

yielding investments may not be available for purchase. A rise in

interest rates may result in a price decline of fixed-income

instruments held by the fund, negatively impacting its performance

and NAV. Falling rates may result in the fund investing in lower

yielding debt instruments, lowering the fund’s income and yield.

These risks may be heightened for longer maturity and duration

securities. Non-investment-grade (high-yield or junk)

securities present greater price volatility and more risk to

principal and income than higher rated securities. Market

risk may affect a single issuer, sector of the economy, industry or

the market as a whole. Federal and state tax rules apply to

capital gain distributions and any gains or losses on sales. Income

may be subject to state or local taxes. Liquidity risk is

associated with the difficulty of selling underlying investments at

a desirable time or price.

Columbia Funds are distributed by Columbia Management Investment

Distributors, Inc., member FINRA. Advisory services provided by

Columbia Management Investment Advisers, LLC.

Columbia Management Investment Distributors, Inc.225 Franklin

Street, Boston, MA 02110-2804

AdTrax 1158289

© 2015 Columbia Management Investment Advisers, LLC. All rights

reserved.

For Columbia Threadneedle Investments:Carlos Melville,

617-897-9384carlos.melville@ampf.com

Ameriprise Financial (NYSE:AMP)

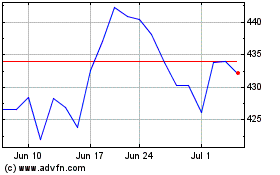

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024