First Property Group plc Sale of Group Property investment in Romania

March 28 2017 - 3:00AM

Business Wire

First Property Group plc (AIM:FPO), the property fund manager

and investor, is pleased to announce that it has agreed to sell one

of its three directly held properties in Romania, a logistics

warehouse in Ploiesti, for a total consideration of some €3.2

million. The sale will result in a profit before tax of just over

€1 million, all of which will be recognised in the current

financial year ended 31 March.

The purchaser, Aquila Part Prod SRL (“Aquila”), is also the

current occupier of the property. The lease to Aquila expires in

July 2017.

Payment of the consideration is scheduled to be made in

quarterly instalments between July 2017 and April 2023. The Group

will retain legal title to the property until full payment has been

received. Payments received would be non-refundable in the event of

a subsequent default by the purchaser.

Commenting on the sale, Ben Habib, Group Chief Executive,

said:

“This is an opportunistic sale to a tenant at the end of its

lease and is beneficial for both parties. I am pleased that the

Group has realised a profit on cost of just over €1 million,

representing a return on investment of some 50%.”

Catalin Ana, General Manager, First Property Asset Management

Romania SRL, said:

“The economic outlook for Romania is strong, with further GDP

growth forecast in 2017 and momentum building within the commercial

property market. As such First Property Group remains committed to

growing our presence there, and I look forward to updating the

market on our Romanian assets in due course.”

Notes to Investors and Editors:

First Property Group plc is an award winning property fund

manager and investor with operations in the United Kingdom and

Central Europe. Around one third of the shares in the Company are

owned by management and their families.

Its focus is on higher yielding commercial property with

sustainable cash flows. The company is flexible and takes an active

approach to asset management. Its earnings are derived from:

- Fund management - via its FCA regulated

and AIFMD approved subsidiary, First Property Asset Management Ltd

(FPAM), which earns fees from investing for third parties in

property. FPAM currently manages ten funds which are invested

across the United Kingdom, Poland and Romania. FPAM funds rank No.1

versus MSCI’s Investment Property Databank (IPD) Central &

Eastern Europe (CEE) universe for the ten years from the

commencement of its operations in Poland in 2005 to 31 December

2015, and for the annualised periods from 2005 to the end of each

of the years between 31 December 2008 and 31 December 2015.

- Group Properties - principal

investments by the Group, to earn a return on its own capital,

usually in partnership with third parties. Investments include

eleven directly held properties in Poland and Romania (including

five held by Fprop Opportunities plc [FOP], in which the Group is

currently the majority shareholder), and interests in six other

funds managed by FPAM.

Listed on AIM the Company has offices in London and Warsaw.

Further information about the Company and its products can be found

at: www.fprop.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170328005609/en/

First Property Group plcBen Habib (Chief Executive

Officer)George Digby (Group Finance Director)Jeremy Barkes

(Director, Business Development)Catalin Ana (General Manager for

Romania)Tel: +44 (20) 7340

0270www.fprop.cominvestor.relations@fprop.comorArden

Partners (NOMAD & Broker)Chris Hardie (Director, Corporate

Finance)Ben Cryer (Corporate Finance)Tel: + 44 (20) 7614

5900orRedleaf Communications (PR)Rebecca Sanders-Hewett /

Henry Columbine /Susie HudsonTel:+ 44 (20) 7382

4734firstproperty@redleafpr.com

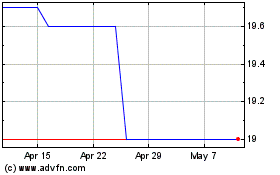

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

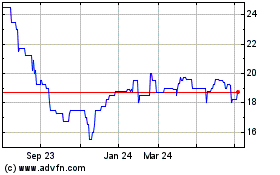

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024