TIDMFPO

RNS Number : 8863P

First Property Group PLC

23 November 2016

Date: 23 November 2016

On behalf First Property Group plc ("First

of: Property" or "the Group")

Embargoed: 0700hrs

First Property Group plc

Interim Results for the six months to 30 September 2016

First Property Group plc (AIM: FPO), the property fund manager

and investor, today announces its interim results for the six

months to 30 September 2016.

Highlights:

-- Profit before tax of GBP4.47m in line with the prior year

despite a significant reduction in one-off non-recurring items to

GBP290,000 (2015: GBP1.58 million);

-- Total assets under management up 43% to GBP405 million (2015: GBP283 million);

-- Adjusted NAV per share up 20% to 45.86 pence per share (2015:

38.27 pence per share restated);

-- Annualised fund management fee income at the period end,

excluding performance fees, increased by 46% to some GBP1.9 million

(2015: GBP1.3 million);

-- Weighted average unexpired fund management contract term

increased to 6.42 years (2015: 3.75 years);

-- Interim dividend up 3.9% to 0.40 pence per share (2015: 0.385 pence per share).

Financial performance summary:

Unaudited Unaudited Percentage Audited

Six months Six months change Year to

to 30 to 31 March

September 30 September 2016

2016 2015 Restated*

----------------------- ------------ ---------------- ----------- ----------

Income Statement:

----------------------- ------------ ---------------- ----------- ----------

Statutory profit GBP4.47m GBP4.46m +0.2% GBP7.35m

before tax

Non-recurring GBP0.29m GBP1.58m -81.6% GBP1.76m

items

Diluted earnings

per share 2.40p 2.89p -17.0% 4.28p

Dividend per share 0.400p 0.385p +3.9% 1.50p

Average EUR/GBP

rate used 1.217 1.386 1.363

----------------------- ------------ ---------------- ----------- ----------

Balance Sheet

at period end:

----------------------- ------------ ---------------- ----------- ----------

Net assets GBP36.43m GBP30.58m +19.1% GBP34.09m

Net assets per

share 29.50p 25.86p +14.1% 27.75p

Adjusted net assets GBP54.43m GBP45.40m +19.9% GBP51.03m

EPRA NNNAV per

share** 45.86p 38.27p +19.8% 43.01p

Cash Balances GBP14.12m GBP14.20m -0.6% GBP8.98m

Period-end EUR/GBP

rate 1.156 1.357 1.261

----------------------- ------------ ---------------- ----------- ----------

Group Property

Portfolio at period

end:

----------------------- ------------ ---------------- ----------- ----------

Group Properties GBP144.3m GBP125.9m +14.6% GBP134.5m

at book value***

Group Properties GBP170.3m GBP145.3m +17.2% GBP156.9m

at market value

Gross Debt secured GBP122.0m GBP108.3m +12.7% GBP114.8m

against Group

properties

LTV% 71.6% 74.5% 73.2%

----------------------- ------------ ---------------- ----------- ----------

Total assets under GBP405m GBP283m +43.1% GBP353m

management:

----------------------- ------------ ---------------- ----------- ----------

Poland 48.6% 53.8% 51.5%

United Kingdom 46.6% 43.6% 43.8%

Romania 4.8% 2.6% 4.7%

* 2015 restated in order to provide a like

for like prior year comparison to the period

** just ended, in which a provision has been

made for staff incentives pro-rated in

line with the full year's charge

EPRA - European Public Real Estate Association

providers of industry standards of NAV

calculations.

*** It is the Group's policy to hold assets

at the lower of cost or value adjusted

for prevailing FX rates.

Commenting on the results, Ben Habib, Chief Executive of First

Property Group, said:

"I am very pleased by the continued good progress made by the

Group.

"Assets under management have grown by 43% since the prior year

and we have additional commitments which, once invested, will

result in further growth.

"The quality of our earnings has continued to improve with very

nearly all our profits being earned from activities of a recurring

nature.

"The assets we own and manage are performing well, as are the

economies in which we operate and we expect continued earnings

growth.

"The contribution to earnings from Group Properties has

increased substantially in recent years as a result of us taking

advantage of opportunities for which we had no fund management

mandates. Going forward, we expect the relative contribution from

fund management to rise. The synergies between these two activities

further balance the business.

"We are confident that our strong balance sheet, operational

gearing and experienced team will continue to drive the Group's

growth and look forward to taking advantage of the in-built

opportunities available to us."

A briefing for analysts will be held at 10:30hrs today at the

headquarters of First Property Group plc, 32 St James's Street,

London, SW1A 1HD. Participants can also attend by telephone on +44

(20) 3043 2014 (pin 013555). A copy of the accompanying investor

presentation can be accessed simultaneously at

http://www.fprop.com/plc-results/81/88/. A recorded copy of the

audio call will subsequently be posted on the company website,

www.fprop.com.

For further information please contact:

First Property Group plc Tel: 020 7340

0270

Ben Habib (Chief Executive www.fprop.com

& Chief Investment Officer)

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners Tel: 020 7614

5900

Chris Hardie/ Ben Cryer

Redleaf Communications Tel: 020 7382

4747

Rebecca Sanders-Hewett/ Susie firstproperty@redleafpr.com

Hudson /

Henry Columbine

Notes to Investors and Editors:

First Property Group plc is an award winning property fund

manager and investor with operations in the United Kingdom and

Central Europe. Around one third of the shares in the Company are

owned by management and their families.

Its focus is on higher yielding commercial property with

sustainable cash flows. The company is flexible and takes an active

approach to asset management. Its earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property. FPAM currently

manages nine funds which are invested across the United Kingdom,

Poland and Romania. FPAM funds rank No.1 versus MSCI's Investment

Property Databank (IPD) Central & Eastern Europe (CEE) universe

for the ten years from the commencement of its operations in Poland

in 2005 to 31 December 2015, and for the annualised periods from

2005 to the end of each of the years between 31 December 2008 and

31 December 2015.

-- Group Properties - principal investments by the Group, to

earn a return on its own capital, usually in partnership with third

parties. Investments include eleven directly held properties in

Poland and Romania (including five held by Fprop Opportunities plc

[FOP], in which the Group is currently the majority shareholder),

and interests in six other funds managed by FPAM.

Listed on AIM the Company has offices in London and Warsaw.

Further information about the Company and its products can be found

at: www.fprop.com.

CHIEF EXECUTIVE'S STATEMENT

Financial Results

I am pleased to report interim results for the six months ended

30 September 2016.

Revenue earned by the Group amounted to GBP11.12 million (2015:

GBP10.95 million) yielding a profit before tax of GBP4.47 million

(2015: GBP4.46 million restated). Profit before tax was maintained

without any contribution from performance fees (2015: GBP864,000)

or from development profits from Fprop PDR (2015: GBP163,000) and

despite the discontinuation of the fund management contract with

Universities Superannuation Scheme (USS) last year (2015:

GBP301,000).

The main new sources of income which replaced this non-recurring

income were:

-- Foreign exchange gains - the Euro was on average some 12%

stronger versus Sterling during the period at EUR1.217 (2015:

EUR1.386). This resulted in Group profit before tax being

GBP620,000 higher than if on a constant currency basis;

-- Additional income from co-investments - our share of results

in associates increased to GBP271,000 (2015: GBP65,000) mainly due

to our co-investment in two new funds established in Poland and in

Romania in the last financial year;

-- Fund management fees of GBP253,000 from increased investment

by the Shipbuilding Industries Pension Scheme (SIPS) and from the

establishment of the two new funds referred to above; and

-- A realised profit of GBP144,000 from the strategic sale of

shares in Fprop Opportunities plc (FOP).

Diluted earnings per share were 2.40 pence (2015: 2.89 pence

restated). The reduction was mainly due to a higher provision for

deferred tax liabilities of GBP645,000 (2015: GBP73,000) resulting

from the impact of foreign exchange movements and changes in

accounting treatment under UK GAAP.

The Group ended the period with reported net assets of GBP36.43

million (2015: GBP30.58 million restated). It is the accounting

policy of the Group to carry its properties and interests in

associates at the lower of cost or market value. The net assets of

the Group when adjusted to their market value less any deferred tax

liabilities, stood at GBP54.43 million (2015: GBP45.40 million

restated). The increase in net assets is attributable mainly to a

stronger Euro versus Sterling at the period end.

Group cash balances stood at GBP14.12 million (2015: GBP14.20

million) at the period end. Of this GBP5.34 million (2015: GBP3.26

million) was held by FOP (74% owned by the Group) and GBP326,000

(2015: GBP461,000) was held by Corp Sp z o,o. (90% owned by the

Group), the property management company for Blue Tower in Warsaw.

Our cash reserves enable us to take advantage of opportunities as

they arise as well as to co-invest in new funds established by

FPAM.

Dividend

The Directors have resolved to increase the interim dividend by

3.9% to 0.40 pence per share (2015: 0.385 pence per share) which

will be paid on 30 December 2016 to shareholders on the register at

2 December 2016, with an ex-dividend date of 1 December 2016.

Review of Operations:

PROPERTY FUND MANAGEMENT - (First Property Asset Management Ltd

or FPAM)

As at 30 September 2016 aggregate assets under management,

calculated by reference to independent third party property

valuations, stood at GBP405 million (2015: GBP283 million),

including some GBP170.3 million (2015: GBP145.3 million) of

properties held by the Group and FOP. Of these 48.6% were located

in Poland, 46.6% in the UK and 4.8% in Romania.

Fund management fees are levied monthly by FPAM by reference to

the value of properties under management.

The reconciliation of movement in funds under management during

the period is shown below:

Funds managed Group Totals

for third parties Properties

(including funds (including

in which the Group FOP)

is a minority

shareholder)

---------------- ----------------------------------- ----------------- -----------------

UK CEE Total No. All No. AUM No.

GBPm. GBPm. GBPm. of CEE of GBPm. of

prop's GBPm. prop's prop's

---------------- ------- ------- ------- -------- ------- -------- ------- --------

As at 1

April 2016 154.7 41.5 196.2 50 156.9 11 353.1 61

---------------- ------- ------- ------- -------- ------- -------- ------- --------

Purchases 37.7 - 37.7 6 - - 37.7 6

Sales - - - - - - -

Property

Depreciation - - - - (0.8) - (0.8) -

Property

Revaluation (4.0) 0.7 (3.3) - (0.1) - (3.4) -

FX Revaluation - 3.9 3.9 - 14.3 - 18.2 -

As at 30

Sept 2016 188.4 46.1 234.5 56 170.3 11 404.8 67

---------------- ------- ------- ------- -------- ------- -------- ------- --------

Revenue earned by this division amounted to GBP918,000 (2015:

GBP1.85 million), resulting in a profit before unallocated central

overheads and tax of GBP273,000 (2015: GBP1.19 million) and

representing 4.5% (2015: 18.5%) of Group profit before unallocated

central overheads and tax.

The decline in revenue, in spite of the increase in assets under

management, was due to the absence of performance fees (2015:

GBP864,000) and the expiry last year of FPAM's fund management

contract with USS (2015: GBP301,000).

FPAM now manages nine (2015: eight) closed-end funds. A brief

synopsis of the value of assets and maturity of each of these

vehicles is set out below:

Fund Country Fund Assets % of total Assets

of investment expiry under assets under

management under management

at market management at market

value value

at at

30 September 30 September

2016 2015

-------------------- --------------- -------- -------------- ------------ --------------

SAM Property UK Rolling * * *

Company Ltd

(SAM)

Regional Poland Aug GBP7.0m 1.7% GBP6.3m

Property 2020

Trading Ltd

(RPT)

5(th) Property Poland Dec GBP8.5m 2.1% GBP7.8m

Trading Ltd 2022

(5PT)

UK Pension UK Feb GBP93.1m 23% GBP95.1m

Property 2017

Portfolio

LP (UK PPP)

Fprop PDR UK May Nil - Nil

LP 2018 (commitment

of GBP42m)

SIPS Property UK Jan GBP95.3m 23.6% GBP28.0m

Nominee Ltd 2025 (commitment

(SIPS) of GBP170m)

Fprop Romanian Romania Jan GBP10.2m 2.5% -

Supermarkets 2026

Ltd (FRS)

Fprop Galeria Poland Jan GBP20.4m 5.0% -

Corso Ltd 2026

(FGC)

-------------------- --------------- -------- -------------- ------------ --------------

Sub Total GBP234.5 57.9% GBP137.2m

m

-------------------- --------------- -------- -------------- ------------ --------------

Fprop Opportunities Poland Oct GBP67.0m 16.6% GBP55.5m

plc (FOP) 2020

Group Properties Poland n/a GBP103.3m 25.5% GBP89.8m

& Romania

-------------------- --------------- -------- -------------- ------------ --------------

Sub Total GBP170.3m 42.1% GBP145.3m

-------------------- --------------- -------- -------------- ------------ --------------

Total GBP404.8m 100% GBP282.5m

-------------------- --------------- -------- -------------- ------------ --------------

* Not subject to recent revaluation

We have made good progress in investing the SIPS fund, awarded

to us in January 2015. At 30 September the value of the properties

acquired by it stood at GBP95.3 million. We have since completed

the purchase of a further GBP14.6 million of commercial property on

its behalf, and have a further GBP47.1 million of property under

offer. In October 2016 SIPS increased its minimum commitment to the

fund from GBP125 million to GBP170 million. We expect this fund to

be fully invested before the financial year-end.

At the period end FPAM's fund management fee income, excluding

performance fees, was being earned at an annualised rate of GBP1.9

million (2015: GBP1.3 million), a year on year increase of 46%. We

expect this rate to increase as we continue to invest on behalf of

SIPS and as we win new contracts. FPAM's weighted average unexpired

fund management contract term increased to 6.42 years (2015: 3.75

years).

GROUP PROPERTIES

Group Properties comprises eleven commercial properties in

Poland and Romania, including five held by FOP (in which the Group

is currently the majority shareholder), and non-controlling

interests in six of the nine funds managed by FPAM, as set out in

the tables below. New investments by Group Properties are expected

to be non-controlling interests.

It is the Group's policy to carry its properties and interests

in associates at the lower of cost or market value for accounting

purposes, and to recognise dividends when received.

1. Properties held at 30 September 2016:

Country No. Book Market Contribution Contribution

of properties value value to Group to Group

profit profit

before before

tax period tax period

to 30 to 30

September September

2016 2015

------------ --------------- ---------- ---------- ------------- -------------------

Poland 3 GBP79.6m GBP94.0m GBP3.15m GBP2.79m

Romania 3 GBP6.0m GBP9.3m GBP0.58m GBP0.45m

FOP (All 5 GBP58.7m GBP67.0m GBP1.92m GBP1.72m

in Poland)

------------ --------------- ---------- ---------- ------------- -------------------

Total 11 GBP144.3m GBP170.3m GBP5.65m GBP4.96m

------------ --------------- ---------- ---------- ------------- -------------------

2. Non-controlling interests in funds and joint ventures managed by FPAM at 30 September 2016:

Fund % owned Book Current Group's Group's

by value market share share

First of First value of pre-tax of pre-tax

Property Property's of holdings profits profits

Group share earned earned

in by fund by fund

fund 30 September 30 September

2016 2015

----- ---------- ------------- ------------- -------------- --------------

Interest in associates

5PT 37.8% GBP560,000 GBP1,012,000 GBP61,000 GBP59,000

RPT 28.6% GBP185,000 GBP220,000 GBP26,000 GBP6,000

FRS 24.1% GBP766,000 GBP764,000 GBP83,000 -

FGC 28.2% GBP1,587,000 GBP1,661,000 GBP101,000 -

----- ---------- ------------- ------------- -------------- --------------

Sub Total GBP3,098,000 GBP3,657,000 GBP271,000 GBP65,000

----------------- ------------- ------------- -------------- --------------

Investments

UK PPP 0.9% GBP905,000 GBP905,000 GBP18,000 GBP29,000

Fprop 5% GBP13,000 GBP13,000 - GBP163,000

PDR LP

-------- ----- ----------- ----------- ---------- -----------

Sub Total GBP918,000 GBP918,000 GBP18,000 GBP192,000

--------------- ----------- ----------- ---------- -----------

Total GBP4,016,000 GBP4,575,000 GBP289,000 GBP257,000

------ ------------- ------------- ----------- -----------

Revenue from Group Properties amounted to GBP10.20 million

(2015: GBP9.10 million), generating a profit before unallocated

central overheads and tax of GBP5.84 million (2015: GBP5.22

million) and representing 95.5% (2015: 81.5%) of Group profit

before unallocated central overheads and tax.

The contribution to Group earnings by the Group's eleven

properties, but excluding its non-controlling interests in funds

managed by FPAM, is detailed below:

Six months to Six months to

30 Sep 2016 30 Sep 2015

EURm. EURm.

--------------------- -------------- --------------

Net operating

income (NOI) 9.66 9.69

Interest expense

on bank loans

/ finance leases (1.67) (1.92)

--------------------- -------------- --------------

NOI after interest

expense 7.99 7.77

Current tax (0.61) (0.53)

Debt amortisation (3.60) (3.47)

Capital expenditure (0.46) (1.38)

--------------------- -------------- --------------

Free cash 3.32 2.39

--------------------- -------------- --------------

Market value

of properties EUR196.87 EUR197.16

Average yield

on market value 9.8% 9.8%

Bank loans/ finance

leases outstanding EUR141.00 EUR146.96

Loan to value

(LTV) 71.6% 74.5%

Weighted average 3.73yrs 4.39yrs

unexpired lease

term (WAULT)

Vacancy rate 1.8% 4.0%

--------------------- -------------- --------------

The loans secured against these eleven properties are each held

in separate non-recourse special purpose vehicles.

In order to mitigate potential interest rate rises we have fixed

the interest rate on a proportion of the loans. A one percentage

point increase from current market interest rates would increase

the annual interest bill by GBP602,000 per annum. The current

weighted average borrowing cost is 2.59% (2015: 2.87%) per

annum.

The income return from our four associate shareholdings in funds

managed by FPAM contributed GBP271,000 (2015: GBP65,000) to Group

profit before tax prior to the deduction of unallocated central

overheads, representing 4.6% of the contribution by Group

Properties. This represents a net increase of GBP206,000 from the

same period last year and is primarily a result of the new

investments in Fprop Romanian Supermarkets Ltd and Fprop Galeria

Corso Ltd, both made in the second half of the last financial

year.

Now that FOP is fully invested and generating the kind of

returns we had hoped of it at its establishment in 2010, the Group

has begun to sell some of its shareholding. During the period it

sold GBP370,000 of shares and loan notes, resulting in a profit of

GBP144,000. It is the Group's long term aim to continue to reduce

its interest in FOP until it ceases to be consolidated in the

Group's results, following which the Group will recognise only its

share of FOP's profits and FPAM will recognise fund management fees

earned from it.

Commercial Property Markets Outlook

Poland:

GDP growth in Poland continues to exceed that of most other EU

nations, and is forecast to be 3.7% in 2016 and 3.6% in 2017.

Inflation has been negative since the second half of 2014 but is

expected to turn positive in the next few months. Government debt

remains low by international standards at some 54% of GDP. There

are concerns that economic growth may slow in due course due to the

populist policies of the new government (elected Oct-2015) but the

government is showing pragmatism by implementing its policies on

generally milder terms than first proposed.

Rent levels for office property in Warsaw and other main cities

have generally softened over the past couple of years, as the pace

of new development has increased. Capital values for prime property

have increased but for good secondary property, of the sort we

favour, values remain largely unchanged from their credit crunch

lows, yielding around one third more than equivalent property in

Western Europe.

Investment demand from international investors remains high and

transaction volumes in 2016 are expected to exceed the EUR4 billion

recorded in 2015, which was the second highest year on record in

Poland and the highest since the onset of the credit crunch.

Government plans to introduce REIT legislation in Poland should

lead to increased domestic demand for commercial property in due

course.

Romania:

The economic backdrop in Romania is favourable for property

investment. Growth in GDP is expected to top 4% this year.

Occupier demand as well as investor demand for commercial

property is picking up albeit from a relatively low level.

Meanwhile bank lending margins, which started the year at more

than twice those available in Poland, are beginning to reduce,

which should boost investment demand for commercial property.

United Kingdom:

Economic growth in the UK following the Referendum has been much

stronger than very nearly all economists and the Bank of England

predicted. The UK remains on track to finish 2016 as the fastest

growing G7 nation (with GDP growth of around 2%).

Growth in GDP is expected to slow in 2017 but the forecast rate

is still a respectable 1.5% and is likely to exceed expectations

again.

Commercial property values fell in the wake of the Referendum,

in particular for properties with shorter leases, or requiring

asset management. Prime properties with longer leases were less

affected, apart from in Scotland, due to heightened fears of a

second referendum on Scottish independence.

It is our view that values will recover. The occupier market

remains robust and the Bank of England's decision in August to cut

the base rate from 0.5% to 0.25% and institute a further round of

QE will provide substantial support.

Current Trading and Prospects

I am very pleased by the continued good progress made by the

Group.

Assets under management have grown by 43% since the prior year

and we have additional commitments which, once invested, will

result in further growth.

The quality of our earnings has continued to improve with very

nearly all our profits being earned from activities of a recurring

nature.

The assets we own and manage are performing well, as are the

economies in which we operate and we expect continued earnings

growth.

The contribution to earnings from Group Properties has increased

substantially in recent years as a result of our taking advantage

of opportunities for which we had no fund management mandates.

Going forward, we expect the relative contribution from fund

management to rise. The synergies between these two activities

further balance the business.

We are confident that our strong balance sheet, operational

gearing and experienced team will continue to drive the Group's

growth and look forward to taking advantage of the in-built

opportunities available to us.

Ben Habib

Chief Executive

23 November 2016

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months to 30 September 2016

Notes Six months Six months Year to

to to

30 Sept 30 Sept 31 March

2016 (unaudited) 2015 (unaudited) 2016

Restated (audited)

Total Total Total

results results results

-------------------------- ------ ------------------- ------------------- -----------

GBP'000 GBP'000 GBP'000

Revenue 2 11,121 10,947 21,955

-------------------------- ------ ------------------- ------------------- -----------

Cost of sales (1,893) (1,773) (4,255)

Gross profit 9,228 9,174 17,700

Reversal of impairment

loss to

investment properties 142 556 462

Operating expenses (3,897) (4,080) (8,404)

Operating profit 2 5,473 5,650 9,758

Profit on sale of 144 - -

subsidiary investment

Share of results in

associates 271 65 170

Distribution income 18 192 223

Interest income 3 81 69 126

Interest expense 3 (1,514) (1,518) (2,931)

Profit before tax 2 4,473 4,458 7,346

Tax charge 4 (1,220) (661) (1,687)

-------------------------- ------ ------------------- ------------------- -----------

Profit for the period 3,253 3,797 5,659

Attributable to:

Owners of the parent 2,849 3,417 5,008

Non-controlling interest 404 380 651

3,253 3,797 5,659

Earnings per Ordinary

1p share

-basic 5 2.46p 2.99p 4.37p

-diluted 5 2.40p 2.89p 4.28p

-------------------------- ------ ------------------- ------------------- -----------

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

for the six months to 30 September 2016

Notes Six months Six months Year to

to 30 to 31 March

Sept 2016 30 Sept 2016

2015

unaudited unaudited audited

----------------------------------- ------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

----------------------------------- ------- ----------- ----------- ----------

Profit for the period 3,253 3,797 5,659

-------------------------------------------- ----------- ----------- ----------

Other comprehensive

income

Exchange difference

on retranslation of

foreign subsidiaries 286 (3,161) (1,346)

Revaluation of available-for-sale

financial assets - 13 11

Taxation - - -

Total comprehensive

income for the period 3,539 649 4,324

-------------------------------------------- ----------- ----------- ----------

Total comprehensive

income for the period:

Owners of the parent 3,321 659 3,486

Non-controlling interest 218 (10) 838

-------------------------------------------- ----------- ----------- ----------

3,539 649 4,324

------------------------------------------- ----------- ----------- ----------

CONDENSED CONSOLIDATED BALANCE SHEET

as at 30 September 2016

Notes As at As at As at

30 Sept 30 Sept 31 March

2016 (unaudited) 2015 (unaudited) 2016 (audited)

Restated

------------------------------ ------ ------------------ ------------------ ----------------

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 153 153 153

Investment properties 6 129,333 112,956 120,718

Property, plant and

equipment 181 162 186

Interest in associates 7a 3,098 675 3,044

Other financial assets 7b 918 916 914

Other receivables 8 139 228 186

Deferred tax assets 3,430 4,100 3,016

------------------------------ ------ ------------------ ------------------ ----------------

Total non-current

assets 137,252 119,190 128,217

Current assets

Inventories - land

and buildings 14,998 12,958 13,894

Current tax assets 123 52 56

Trade and other receivables 8 5,307 5,378 10,128

Cash and cash equivalents 14,115 14,202 8,975

------------------------------ ------ ------------------ ------------------ ----------------

Total current assets 34,543 32,590 33,053

Current liabilities

Trade and other payables 9 (7,685) (7,869) (7,938)

Financial liabilities 10a (8,383) (6,101) (7,668)

Current tax liabilities (187) (162) (200)

------------------------------ ------ ------------------ ------------------ ----------------

Total current liabilities (16,255) (14,132) (15,806)

------------------------------ ------ ------------------ ------------------ ----------------

Net current assets 18,288 18,458 17,247

------------------------------ ------ ------------------ ------------------ ----------------

Total assets less

current liabilities 155,540 137,648 145,464

------------------------------ ------ ------------------ ------------------ ----------------

Non-current liabilities

Financial liabilities 10b (115,519) (104,061) (108,992)

Deferred tax liabilities (3,593) (3,003) (2,382)

Net assets 36,428 30,584 34,090

------------------------------ ------ ------------------ ------------------ ----------------

Equity

Called up share capital 1,166 1,149 1,166

Share premium 5,777 5,508 5,773

Foreign Exchange Translation

Reserve (1,679) (3,389) (2,151)

Investment revaluation

reserve (38) (36) (38)

Share-based payment

reserve 203 218 203

Retained earnings 28,789 26,076 27,231

------------------------------ ------ ------------------ ------------------ ----------------

Equity attributable

to the owners of the

parent 34,218 29,526 32,184

Non-controlling interest 2,210 1,058 1,906

------------------------------ ------ ------------------ ------------------ ----------------

Total equity 36,428 30,584 34,090

------------------------------ ------ ------------------ ------------------ ----------------

Net assets per share 5 29.50p 25.86p 27.75p

------------------------------ ------ ------------------ ------------------ ----------------

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

for the six months to 30 September 2016

Share Share Share Foreign Purchase/Sale Investment Retained Non-controlling TOTAL

capital premium Based Exchange of own Shares Revaluation Earnings Interest Restated

Payment Translation Reserve Restated

Reserve Reserve

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

At 1 April 2015 1,149 5,505 203 (618) (173) (49) 23,908 1,094 31,019

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

Profit for the

period

Fair value (or

revaluation)

gains on - - - - - - 3,797 - 3,797

available- for-

sale assets - - - - - 13 - - 13

Movement on

foreign exchange - - - (2,771) - - - (390) (3,161)

Share based

payments - - 15 - - - - - 15

New shares issued - - - - - - - - -

Non-controlling

interest - - - - - - (380) 380 -

Sale of treasury

shares - 3 - - 66 - - - 69

Dividends paid - - - - - - (1,142) (26) (1,168)

At 30 Sept 2015 1,149 5,508 218 (3,389) (107) (36) 26,183 1,058 30,584

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

Profit for the

period - - - - - - 1,862 - 1,862

Fair value (or

revaluation)

gains on

available- for-

sale assets - - - - - (2) - - (2)

Movement on

foreign exchange - - - 1,238 - - - 577 1,815

Share based

payments - - (15) - - - - - (15)

New shares issued 17 258 - - - - - - 275

Non-controlling

interest - - - - - - (271) 271 -

Sale of treasury

Shares - 7 - - 4 - - - 11

Dividends paid - - - - - - (440) - (440)

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

At 1 April 2016 1,166 5,773 203 (2,151) (103) (38) 27,334 1,906 34,090

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

Profit for the

period

Change in

proportion held

by non - - - - - - 3,253 - 3,253

controlling

interest - - - - - - - 100 100

Movement on

foreign exchange - - - 472 - - - (186) 286

Share based - - - - - - - - -

payments

Non-controlling

interest - - - - - - (404) 404 -

Sale of treasury

shares - 4 - - 2 - - - 6

Dividends paid - - - - - - (1,293) (14) (1,307)

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

At 30 Sept 2016 1,166 5,777 203 (1,679) (101) (38) 28,890 2,210 36,428

------------------ -------- -------- -------- ------------ -------------- ------------ --------- ---------------- ---------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months to 30 September 2016

Six months Six months Year to

to to 30

Sept 2015

(unaudited)

30 Sept Restated 31 March

2016 (unaudited) 2016

(audited)

----------------------------------- ------ ------------------- ------------- ------------

Notes GBP'000 GBP'000 GBP'000

----------------------------------- ------ ------------------- ------------- ------------

Cash flows from operating

activities

Operating profit 5,473 5,650 9,758

Adjustments for:

Depreciation of investment

property, and property,

plant & equipment 976 815 1,704

Reversal of impairment

loss to investment properties 6 (142) (556) (462)

Share based payments - 15 -

(Increase)/decrease

in inventories (135) (141) (291)

(Increase)/decrease

in trade and other receivables (122) 307 903

Increase/(decrease)

in trade and other payables (364) 241 (356)

Other non-cash adjustments 40 43 460

Cash generated from

operations 5,726 6,374 11,716

Income taxes paid (667) (357) (922)

----------------------------------- ------ ------------------- ------------- ------------

Net cash flow from operating

activities 5,059 6,017 10,794

----------------------------------- ------ ------------------- ------------- ------------

Cash flow from investing

activities

Capital expenditure

on investment properties (176) (1,009) (1,216)

Proceeds from partial

disposal of available-for-sale

assets 153 627 628

Purchase of property,

plant and equipment (16) (125) (197)

Consideration from the 244 - -

sale of FOP shares

Investment in shares

of new associates - - (2,293)

Dividends from associates 7a 64 62 90

Distributions received 18 192 223

Interest received 3 81 69 126

----------------------------------- ------ ------------------- ------------- ------------

Net cash flow from /(used

in) investing activities 368 (184) (2,639)

----------------------------------- ------ ------------------- ------------- ------------

Cash flow from financing

activities

Net repayment of shareholder

loans in subsidiaries (75) (48) (95)

Interest paid 3 (1,455) (1,462) (2,825)

Proceeds from bank loan - 7,813 8,993

Repayment of finance

leases/bank loans (2,958) (9,015) (11,787)

Short term loan to an

associate 5,083 - (4,729)

Sale of shares held

in Treasury 6 69 80

Proceeds from the issue

of share capital - - 275

Dividends paid (1,293) (1,142) (1,582)

Dividends paid to non-controlling

interest (14) (26) (26)

----------------------------------- ------ ------------------- ------------- ------------

Net cash flow (used

in) financing activities

of continuing operations (706) (3,811) (11,696)

Net increase/(decrease)

in cash and cash equivalents 4,721 2,022 (3,541)

----------------------------------- ------ ------------------- ------------- ------------

Cash and cash equivalents

at the beginning of

period 8,975 12,240 12,240

----------------------------------- ------ ------------------- ------------- ------------

Currency translation

gains/(losses) on cash

and cash equivalents 419 (60) 276

----------------------------------- ------ ------------------- ------------- ------------

Cash and cash equivalents

at the end of the period 14,115 14,202 8,975

----------------------------------- ------ ------------------- ------------- ------------

NOTES TO THE CONDENSED CONSOLIDATED RESULTS

for the six months ended 30 September 2016

1. Basis of Preparation

-- These interim condensed consolidated financial statements for

the six months ended 30 September 2016 have not been audited or

reviewed and do not constitute statutory accounts within the

meaning of section 435 of the Companies Act 2006. They have been

prepared in accordance with the Group's accounting policies as set

out in the Group's latest annual financial statements for the year

ended 31 March 2016 and are in compliance with IAS 34 "Interim

Financial Reporting". These accounting policies are drawn up in

accordance with International Accounting Standards (IAS) and

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board and as adopted by the

European Union (EU).

-- The comparative figures for the half year ended 30 September

2015 have been restated from those previously reported. The

restated figures include one adjustment for GBP1,471,000 being an

accrual for staff incentives pro-rated in line with the full year's

charge. There has been no re-statement for the comparative figure

for the full year ended 31 March 2016. See note 5 for a

reconciliation of the restated earnings and net assets.

-- The comparative figures for the financial year ended 31 March

2016 are not the statutory accounts for the financial year but are

abridged from those accounts prepared under IFRS which have been

reported on by the Group's auditors and delivered to the Registrar

of Companies. The report of the auditors was unqualified, did not

include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

-- These interim financial statements were approved by a

committee of the Board on 22 November 2016.

2. Segmental Analysis

Segment reporting six months to 30 September 2016

The parent holding company costs and related listing costs are

shown separately under unallocated central costs.

Property fund Group properties Group fund Unallocated central TOTAL

management properties ("FOP") overheads

--------------------- --------------------- ----------------- -------------------- --------------------- --------

GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Total Revenue 918 6,800 3,403 - 11,121

Depreciation and

amortisation (17) (864) (95) - (976)

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Operating profit

Existing operations 273 4,422 2,427 (1,649) 5,473

Profit on sale of

subsidiary

investment - 144 - - 144

Share of results in

associates - 271 - - 271

Distribution income - 18 - - 18

Interest income - 51 20 10 81

Interest expense - (719) (795) - (1,514)

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Profit/(loss) before

tax 273 4,187 1,652 (1,639 ) 4,473

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Analysed as:

Before performance

fees and related

items:

273 5,235 1,576 (445) 6,639

Performance fees - - - - -

Reversal of

impairment loss to

investment

properties - - 142 - 142

Depreciation - (812) - - (812)

Staff incentives - - - (1,113) (1,113)

Realised foreign

currency loss - (236) (66) (81) (383)

Profit/(loss) before

tax 273 4,187 1,652 (1,639) 4,473

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Revenue for the six months to 30 September 2016 from continuing

operations consists of revenue arising in the United Kingdom 6%

(2015: 14%) and Central and Eastern Europe 94% (2015: 86%) and all

relates solely to the Group's principal activities.

Segment reporting six months to 30 September 2015 as

restated

Property fund Group properties Group fund Unallocated TOTAL

management properties ("FOP") central overheads As restated

-------------------- -------------------- ----------------- ------------------- ------------------- -------------

GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Total Revenue 1,845 6,099 3,003 - 10,947

Depreciation and

amortisation (13) (747) (55) - (815)

-------------------- -------------------- ----------------- ------------------- ------------------- -------------

Operating profit

Existing operations 1,188 3,952 2,471 (1,961) 5,650

Share of results in

associates - 65 - - 65

Distribution income - 192 - - 192

Interest income - 14 45 10 69

Interest expense - (721) (797) - (1,518)

-------------------- -------------------- ----------------- ------------------- ------------------- -------------

Profit/(loss)

before tax 1,188 3,502 1,719 (1,951) 4,458

-------------------- -------------------- ----------------- ------------------- ------------------- -------------

Analysed as:

Before performance

fees and related

items: 324 4,324 1,242 (480) 5,410

Performance fees 864 - - - 864

Reversal of

impairment loss to

investment

properties - - 556 - 556

Depreciation - (717) - - (717)

Staff incentives as

restated - - - (1,471) (1,471)

Realised foreign

currency loss - (105) (79) - (184)

Profit/(loss)

before tax 1,188 3,502 1,719 (1,951) 4,458

-------------------- -------------------- ----------------- ------------------- ------------------- -------------

Segment reporting year to 31 March 2016

Property Group Group Unallocated TOTAL

fund properties fund central

management properties overheads

("FOP")

----------------------- ------------ ------------ ------------ ------------ ----------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------------ ------------ ------------ ------------ ----------

Total revenue 2,895 12,894 6,166 - 21,955

----------------------- ------------ ------------ ------------ ------------ ----------

Depreciation

and amortisation (31) (1,535) (138) - (1,704)

----------------------- ------------ ------------ ------------ ------------ ----------

Operating profit 1,384 7,316 3,962 (2,904) 9,758

Share of results

in associates - 170 - - 170

Distribution

income - 223 - - 223

Interest income - 101 5 20 126

Interest expense - (1,424) (1,507) - (2,931)

Profit/(loss)

before tax 1,384 6,386 2,460 (2,884) 7,346

----------------------- ------------ ------------ ------------ ------------ ----------

Analysed as:

Before performance

fees and related

items 783 8,268 2,321 (899) 10,473

Performance

fees 1,131 - - - 1,131

Reversal of

impairment

loss to investment

properties - - 462 - 462

Depreciation - (1,450) - - (1,450)

Provision (49) (17) (17) (663) (746)

Staff incentives (481) (169) (164) (1,610) (2,424)

Realised foreign

currency gain/(loss) - (246) (142) 288 (100)

Profit/(loss)

before tax 1,384 6,386 2,460 (2,884) 7,346

----------------------- ------------ ------------ ------------ ------------ ----------

Assets - Group 497 88,670 62,283 6,776 158,226

Share of net

assets of associates - 3,352 - (308) 3,044

Liabilities (249) (76,454) (48,132) (2,345) (127,180)

----------------------- ------------ ------------ ------------ ------------ ----------

Net Assets 248 15,568 14,151 4,123 34,090

----------------------- ------------ ------------ ------------ ------------ ----------

Assets, liabilities and costs that relate to Group central

activities (including free cash) have not been allocated to

business segments.

3. Interest income/(expense)

Sept 2016 Sept 2015 March

2016

----------------------- ---------- ---------- --------

GBP'000 GBP'000 GBP'000

Interest income -

bank deposits 18 18 36

Interest income -

other 63 51 90

Total interest income 81 69 126

----------------------- ---------- ---------- --------

Sept 2016 Sept 2015 March

2016

------------------------ ---------- ---------- --------

GBP'000 GBP'000 GBP'000

Interest expense -

property loans (1,141) (1,153) (2,254)

Interest expense -

bank and other (59) (51) (106)

Finance charges on

finance leases (314) (314) (571)

------------------------ ---------- ---------- --------

Total interest expense (1,514) (1,518) (2,931)

------------------------ ---------- ---------- --------

4. Tax Expense

The tax charge is based on a combination of actual current and

deferred tax charged at an effective rate that is expected to apply

to the profits for the full year.

Sept 2016 Sept 2015 March

2016

-------------- ---------- ---------- --------

GBP'000 GBP'000 GBP'000

Current tax (575) (588) (1,203)

Deferred tax (645) (73) (484)

-------------- ---------- ---------- --------

Total (1,220) (661) (1,687)

-------------- ---------- ---------- --------

5. Earnings/NAV per share

The basic earnings per ordinary share is calculated on the

profit on ordinary activities after taxation and after

non-controlling interests on the weighted average number of

ordinary shares in issue, during the period.

Figures in the table below have been used in the

calculations.

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 Restated 2016

--------------------------- ------------ --------------- ------------

Basic - pence per

Share 2.46p 2.99p 4.37p

Diluted - pence per

Share 2.40p 2.89p 4.28p

--------------------------- ------------ --------------- ------------

Number Number

--------------------------- ------------ --------------- ------------

Weighted average number

of ordinary shares

in issue for basic 115,967,888 114,177,240 114,543,523

Share options 2,700,000 4,450,000 2,700,000

--------------------------- ------------ --------------- ------------

Total for diluted 118,667,888 118,627,240 117,243,523

--------------------------- ------------ --------------- ------------

GBP'000 GBP'000 GBP'000

--------------------------- ------------ --------------- ------------

Basic earnings as

previously reported 2,849 4,888 5,008

Restatement for staff - (1,471) -

incentive

--------------------------- ------------ --------------- ------------

Basic earnings as

restated 2,849 3,417 5,008

--------------------------- ------------ --------------- ------------

Adjustment for dilution 4 7 8

Diluted earnings assuming

full dilution 2,853 3,424 5,016

--------------------------- ------------ --------------- ------------

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

Restated

---------------------- ----------- ----------- ----------

Net assets per share 29.50p 25.86p 27.75p

Adjusted net assets

per share 45.86p 38.27p 43.01p

---------------------- ----------- ----------- ----------

The following numbers have been used to calculate both the net

assets and adjusted net assets per share.

Number Number Number

---------------------------- ------------ ------------ ------------

Number of shares in

issue at period end 115,980,040 114,192,541 115,967,111

---------------------------- ------------ ------------ ------------

GBP'000 GBP'000 GBP'000

Restated

---------------------------- ------------ ------------ ------------

Net assets excluding

non- controlling interest 34,218 29,526 32,184

Adjusted net assets Number Number Number

per share

---------------------------- ------------ ------------ ------------

Number of shares in

issue at period end 115,980,040 114,192,541 115,967,111

Number of share options

assumed to be exercised 2,700,000 4,450,000 2,700,000

---------------------------- ------------ ------------ ------------

Total 118,680,040 118,642,541 118,667,111

---------------------------- ------------ ------------ ------------

Adjusted net assets GBP'000 GBP'000 GBP'000

per share

---------------------------- ------------ ------------ ------------

Net assets excluding

non-controlling interest 34,218 30,997 32,184

Restatement of net - (1,471) -

assets

Adjustments for market

value of assets less

deferred tax 19,359 14,814 18,133

Other adjustments 850 1,059 716

---------------------------- ------------ ------------ ------------

Total 54,427 45,399 51,033

---------------------------- ------------ ------------ ------------

6. Investment Properties

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

------------------------------ ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- ----------

1 April 120,718 114,262 114,262

Capital expenditure 176 1,009 1,216

Depreciation (947) (786) (1,654)

Fair value adjustment 142 556 462

Foreign exchange translation 9,244 (2,085) 6,432

End of period 129,333 112,956 120,718

------------------------------ ----------- ----------- ----------

7. Interest in Associates and Other Financial Assets

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

----------------------------- ----------- ----------- ----------

a) Associated undertakings GBP'000 GBP'000 GBP'000

Cost of investment

at beginning of period 3,044 671 671

Additions - - 2,293

Disposals (153) - -

Share of associates

profit after tax 271 66 170

Dividends received (64) (62) (90)

Cost of investment

at end of period 3,098 675 3,044

----------------------------- ----------- ----------- ----------

Investments in associated

undertakings

5(th) Property Trading

Ltd 868 838 871

Regional Property

Trading Ltd 185 145 159

Fprop Romanian Supermarkets

Ltd 766 - 737

Fprop Galeria Corso

Ltd 1,587 - 1,585

----------------------------- ----------- ----------- ----------

3,406 983 3,352

Less: Group share

of profit after tax

withheld on sale of

property to an associate

in 2007 (308) (308) (308)

----------------------------- ----------- ----------- ----------

Cost of investment

at end of period 3,098 675 3,044

----------------------------- ----------- ----------- ----------

b) Other financial

assets and investments

----------------------------- ----------- ----------- ----------

Cost of investment

at beginning of period 914 1,531 1,531

Additions 4 - -

Disposal - (627) (628)

Net increase in fair

value - 12 11

----------------------------- ----------- ----------- ----------

Cost of investment

at end of period 918 916 914

----------------------------- ----------- ----------- ----------

8. Trade and Other Receivables

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

------------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Current assets

Trade receivables 1,758 1,756 1,684

Other receivables 3,159 2,971 7,554

Prepayments and accrued

income 390 651 890

5,307 5,378 10,128

------------------------- ----------- ----------- ----------

Non-current assets 139 228 186

------------------------- ----------- ----------- ----------

9. Trade and Other Payables

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

-------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Trade payables 2,787 2,144 2,189

Other taxation and

social security 673 1,336 575

Other payables and

accruals 4,214 4,378 5,163

Deferred income 11 11 11

7,685 7,869 7,938

-------------------- ----------- ----------- ----------

10. Financial Liabilities

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2016 2015 2016

---------------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

a) Current liabilities

Loans repayable by

subsidiary (FOP) to

third party shareholders 1,918 - 1,841

Bank loans 3,340 3,426 3,014

Finance leases 3,125 2,675 2,813

8,383 6,101 7,668

---------------------------- ----------- ----------- ----------

b) Non-current liabilities

Loans repayable by - 1,888 -

subsidiary (FOP) to

third party shareholders

Bank loans 66,022 57,413 62,038

Finance leases 49,497 44,760 46,954

---------------------------- ----------- ----------- ----------

115,519 104,061 108,992

---------------------------- ----------- ----------- ----------

c) Total obligations under financial liabilities

Repayable within one

year 8,383 6,101 7,668

Repayable within one

and five years 99,041 67,584 93,150

Repayable after five

years 16,478 36,477 15,842

---------------------------- ----------- ----------- ----------

123,902 110,162 116,660

---------------------------- ----------- ----------- ----------

Loans repayable by Fprop Opportunities plc (FOP) to third party

shareholders are unsecured and repayable on demand.

Eight bank loans and three finance leases (all denominated in

Euros) totalling GBP121,984,000 (31 March 2016: GBP114,819,000)

included within financial liabilities are secured against

investment properties owned by the Group and Fprop Opportunities

plc (FOP), and one property owned by the Group shown under

inventories. These bank loans and finance leases are otherwise

non-recourse to the Group's assets.

The interim results are being circulated to all shareholders and

can be downloaded from the company's web site (www.fprop.com).

Further copies can be obtained from the registered office at 32 St

James's Street, London SW1A 1HD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLLLLQFFXFBQ

(END) Dow Jones Newswires

November 23, 2016 02:00 ET (07:00 GMT)

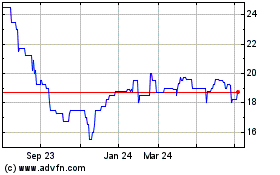

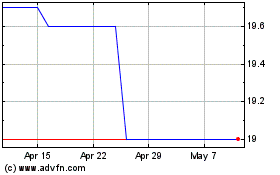

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024