First Property Group PLC Increased investment commitment by SIPS (4519L)

October 03 2016 - 2:00AM

UK Regulatory

TIDMFPO

RNS Number : 4519L

First Property Group PLC

03 October 2016

Date: 3 October 2016

On behalf First Property Group plc ("First

of: Property", "the Company" or the "Group")

Embargoed: 0700hrs

First Property Group plc

Increased investment commitment by SIPS

First Property Group plc (AIM: FPO), the property fund manager

and investor, is pleased to announce that the Shipbuilding

Industries Pension Scheme (SIPS) has increased its minimum

commitment to the fund managed on its behalf by First Property

Asset Management Ltd (FPAM) from GBP125 million to GBP170 million.

This account was established in January 2015 to invest in income

producing property in the United Kingdom.

As at 30 September FPAM had drawn down GBP112 million of this

commitment and is in negotiations to invest in several additional

opportunities.

Commenting on this increased commitment by SIPS, Ben Habib,

Chief Executive, said:

"The current volatility in the market has created a very

attractive investment environment for us, and as a niche, proactive

fund manager and investor we are ideally positioned to benefit from

the opportunities that arise.

"I am delighted that the Shipbuilding Industries Pension Scheme

has increased its commitment to GBP170 million so that we may take

advantage of these market opportunities. I am also flattered by

their continued endorsement of our management team and we look

forward to continuing to deliver good returns for them."

-Ends-

For further information please contact:

First Property Group plc Tel: +44 (20)

7340 0270

Ben Habib (Chief Executive www.fprop.com

Officer) investor.relations@fprop.com

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners (NOMAD & Broker) Tel: + 44 (20)

7614 5900

Chris Hardie (Director, Corporate

Finance)

Ben Cryer (Corporate Finance)

Redleaf Communications (PR) Tel:+ 44 (20)

7382 4734

Rebecca Sanders-Hewett / firstproperty@redleafpr.com

Henry Columbine / Susie Hudson

Notes to Investors and Editors:

First Property Group plc is a property fund manager and investor

with operations in the United Kingdom and Central Europe. Its

earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property:

o Management fees are levied by reference to the value of

properties under management;

o Performance fees are levied where appropriate, usually payable

upon realisation of profits above an agreed hurdle.

-- Group Properties - principal investments by the Group, to

earn a return on its own capital, usually in partnership with third

parties.

FPAM funds rank No.1 versus MSCI's Investment Property Databank

(IPD) Central & Eastern Europe (CEE) Benchmark for the ten

years from the commencement of its operations in Poland in 2005 to

31 December 2015, and for the annualised periods from 2005 to the

end of each of the years between 31 December 2008 and 31 December

2015.

First Property Asset Management Limited is authorised and

regulated by the Financial Conduct Authority. Further information

about the Company and its products can be found at:

www.fprop.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAEEAELLKFAF

(END) Dow Jones Newswires

October 03, 2016 02:00 ET (06:00 GMT)

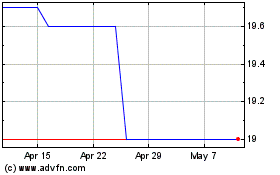

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

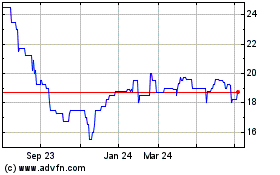

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024