First Property Group PLC Financial year-end trading statement (3977J)

April 07 2015 - 2:01AM

UK Regulatory

TIDMFPO

RNS Number : 3977J

First Property Group PLC

07 April 2015

Date: 7 April 2015

On behalf First Property Group plc ("First

of: Property", "the Company" or the "Group")

Embargoed: 0700hrs

First Property Group plc

Financial year-end trading statement

First Property Group plc (AIM: FPO), the property fund manager

and investor, is pleased to announce that its trading and profit

before tax for the year to 31 March 2015 is expected to be in line

with market expectations.

Cash at the year-end was some GBP12 million, the majority of

which is available for investment and of which some GBP3 million is

held by Fprop Opportunities plc.

Commenting on the trading update, Ben Habib, CEO of First

Property Group plc, said:

"The financial year just ended has been transformational for the

Group with a very significant increase in the underlying

sustainable earnings of the Group. These earnings, which are mainly

derived from new investments we have made, should comfortably

exceed the lost fee income resulting from the expiry, in August

this year, of the fund management contract with USS.

"Our balance sheet remains strong, with a cash balance of GBP12

million, enabling us to make additional investments if and when

opportunities arise."

-Ends-

For further information please contact:

First Property Group plc Tel: 020 7340 0270

Ben Habib (Chief Executive www.fprop.com

& Chief Investment Officer)

George Digby (Group Finance

Director)

Jeremy Barkes (Director, Business investor.relations@fprop.com

Development)

Arden Partners Tel: 020 7614 5900

Chris Hardie (Director Corporate

Finance)

Michael McNeilly (Corporate

Finance)

Redleaf Polhill Tel: 020 7382 4763

George Parrett / Henry Columbine firstproperty@redleafpr.com

Notes to investors and editors:

First Property Group plc is a property fund manager and investor

with operations in the United Kingdom and Central Europe. Its

earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property in the UK and

Central Europe (principally Poland);

-- Group Properties - principal investments by the Group, currently comprising:

o 6x directly owned properties in Poland and Romania;

o 5x properties in Poland held by Fprop Opportunities plc (FOP),

an FPAM managed fund in which the Group is a 76.2% shareholder;

o Shares in 4x funds managed by FPAM.

The investment performance of the Group's funds under management

in Poland and in Central Europe is ranked No.1 versus the

Investment Property Databank (IPD) universe for Central &

Eastern Europe (CEE) over the eight years to 31 December 2013,

having previously ranked No.1 versus the IPD CEE universe over the

three, four, five, six and seven years to 31 December 2008, 2009,

2010, 2011 and 2012 respectively.

First Property Asset Management Limited is authorised and

regulated by the Financial Conduct Authority. Further information

about the Company and its products can be found at:

www.fprop.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBLGDSCGGBGUX

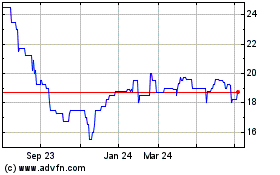

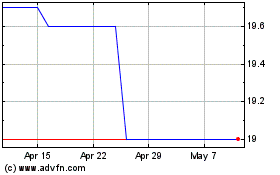

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024