First Property Group PLC Director's Shareholding & Ordinary Shares in Issue (6047B)

October 08 2015 - 2:00AM

UK Regulatory

TIDMFPO

RNS Number : 6047B

First Property Group PLC

08 October 2015

Date: 8 October 2015

On behalf First Property Group plc ("First

of: Property", "the Company" or the "Group")

Embargoed: 0700hrs

First Property Group plc

Director's Shareholding and Ordinary Shares in Issue

The Board of First Property Group plc (AIM:FPO) announces that

the Company has issued from Treasury 13,371 Ordinary Shares of one

pence each in the Company ("Ordinary Shares") to Mr Peter Moon, a

non-executive Director, in satisfaction of part of his emoluments

for the six months ended 30 April 2015.

Under the terms of his appointment Mr Moon is due to receive 40%

of his emoluments, equating to GBP11,000 annually, in Ordinary

Shares based on the average closing price of the Company's Ordinary

Shares for the five day period following the announcement of the

half year and annual results. In this case the average closing

mid-price per Ordinary Share for the five business days between 12

June 2015 and 18 June 2015, following the Company's Preliminary

results, was 41.13 pence. A similar announcement is expected in

February 2016 following the publication of the Group's half year

results.

As a result of this allotment of shares, Mr Moon's shareholding

in the Company is 385,385 Ordinary Shares, which equates to 0.34%

of the enlarged issued Ordinary Share capital.

Following the sale from Treasury, the Company has in issue

114,205,912 Ordinary Shares. The figure of 114,205,912 Ordinary

Shares may be used by shareholders as the denominator for

calculations by which to determine if they are required to notify

their interest in, or a change to their interest in the Company

under the FCA's Disclosure and Transparency Rules. 645,203 Ordinary

Shares remain in Treasury.

-Ends-

For further information please contact:

First Property Group plc Tel: +44 (20)

7340 0270

Ben Habib (Chief Executive www.fprop.com

Officer) investor.relations@fprop.com

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners (NOMAD & Broker) Tel: + 44 (20)

7614 5900

Chris Hardie (Director, Corporate

Finance)

Benjamin Cryer (Corporate

Finance)

Redleaf Communications (PR) Tel:+ 44 (20)

7382 4730

Richard Gotla / Henry Columbine firstproperty@redleafpr.com

Notes to investors and editors:

First Property Group plc is a property fund manager and investor

with operations in the United Kingdom and Central Europe. Its

earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property in the UK and

Central Europe (mainly Poland);

-- Group Properties - principal investments by the Group, currently comprising:

o Six directly owned properties in Poland and Romania;

o Five properties in Poland held by Fprop Opportunities plc

(FOP), an FPAM managed fund in which the Group is a 76.2%

shareholder;

o Non-controlling interests in four other funds managed by

FPAM.

FPAM funds have ranked No.1 versus the Investment Property

Databank (IPD) Central & Eastern Europe (CEE) universe for the

annualised periods from the commencement of its operations in

Poland in 2005 to the end of each of the years between 31 December

2008 and 31 December 2014.

First Property Asset Management Limited is authorised and

regulated by the Financial Conduct Authority. Further information

about the Company and its products can be found at:

www.fprop.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMRBBTMBTMTJA

(END) Dow Jones Newswires

October 08, 2015 02:00 ET (06:00 GMT)

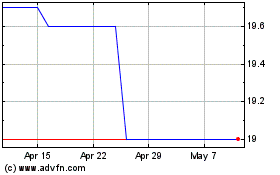

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

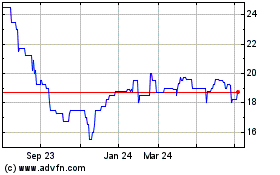

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024