TIDMFDP

RNS Number : 7177V

First Derivatives PLC

07 November 2017

7 November 2017

First Derivatives plc

("FD", the "Company" or the "Group")

Interim results for the six months ended 31 August 2017

FD (AIM:FDP.L, ESM:FDP.I) today announces its results for the

six months ended 31 August 2017.

Financial Highlights

Revenue GBP87.8m (H1 2017:

GBP72.4m) +21%

Adjusted EBITDA* GBP16.1m

(H1 2017: GBP13.6m) +19%

Adjusted** profit before tax

GBP11.4m (H1 2017: GBP10.1m) +13%

Profit before tax*** GBP6.3m

(H1 2017: GBP7.0m) -10%

Adjusted** fully diluted EPS

34.4p (H1 2017: 29.0p) +19%

Interim dividend 7.0p per

share (H1 2017: 6.0p) +17%

Net debt GBP13.1m (FY 2017:

GBP13.5m)

Business Highlights

- Strong growth in software revenue, up by 32% to GBP52.2m (H1

2017:GBP39.5m), with recurring software revenue up by 44% to

GBP19.6m (H1 2017: GBP13.6m)

- Strong demand and strategic progression in Managed Services

and Consulting with revenue growth of 8% to GBP35.6m (H1 2017:

GBP32.9m)

- FinTech revenue up 18% to GBP66.8m (H1 2017: GBP56.7m), driven

by 32% increase in recurring software revenue within our global

banking client base

- MarTech revenue up 30% to GBP18.3m (H1 2017: GBP14.1m), with

growth accelerating in the second quarter following the launch of

the latest version of our predictive analytics platform

- Signed initial contracts in multiple new sectors including

sensor data management, telecoms, healthcare and retail

- Hired 386 graduates calendar year-to-date to assist in the

delivery of growth across the Group, up 66% on the same period last

year

- Post period end, announced major investment in Kx to put

machine learning at the heart of future R&D developments,

strengthening Kx's competitive position and opening up new

markets

- Strong pipeline and positive start to the second half of the

financial year, with full year financial performance expected to be

slightly ahead of the Board's expectations.

*Adjusted for share based payments and acquisition costs

**Adjusted for amortisation of acquired intangibles, share based

payments, acquisition costs, finance translation income/charges

(and exceptional taxation for EPS)

***Includes foreign currency translation loss and deferred

consideration on prior acquisitions

Seamus Keating, Chairman of FD, commented:

"We have continued to position the Group to target several

high-value addressable markets, while maintaining our financial

discipline. Through our conversations with existing and potential

customers and partners, we remain convinced that demand for

ultra-high performance analytics capability will continue to grow

and that Kx technology leads this market in terms of its

performance and lower total cost of ownership.

Our managed services and consulting activities are also in high

demand and we are addressing this through record levels of

recruitment of high-calibre graduates. We have signed a number of

high value contracts in the first half and there is momentum behind

our commercial discussions across the Group. We therefore

anticipate a strong full year financial performance, slightly ahead

of the Board's expectations."

For further information, please contact:

First Derivatives plc +44(0)28 3025 2242

Brian Conlon, Chief Executive www.firstderivatives.com

Officer

Graham Ferguson, Chief Financial

Officer

Ian Mitchell, Head of Investor

Relations

Investec Bank plc

(Nominated Adviser and Broker)

Andrew Pinder

Carlton Nelson

Sebastian Lawrence +44 (0)20 7597 5970

Goodbody (ESM Adviser and

Broker)

Linda Hickey

Finbarr Griffin +353 1 667 0420

FTI Consulting

Matt Dixon

Dwight Burden

Darius Alexander

Niamh Fogarty +44 (0)20 3727 1000

About FD

FD is a global technology provider with 20 years of experience

working with some of the world's largest finance, technology,

retail, pharma, manufacturing and energy institutions. The Group's

Kx technology, incorporating the kdb+ time-series database, is a

leader in high-performance, in-memory computing, streaming

analytics and operational intelligence. Kx delivers the best

possible performance and flexibility for high-volume,

data-intensive analytics and applications across multiple

industries. FD operates from 14 offices across Europe, North

America and Asia Pacific, including its headquarters in Newry, and

employs more than 2,000 people worldwide.

For further information, please visit

www.firstderivatives.com

Chairman's Statement

We are pleased to report another period of progress against our

strategic objectives and the continued delivery of strong growth as

we maintain our financial discipline. Group revenue increased by

21% to GBP87.8m and adjusted EBITDA was 19% higher at GBP16.1m,

despite continuing investment to position our software platform,

branded as Kx technology, within new vertical markets.

Adjusted earnings per share increased by 19% to 34.4p (H1 2017:

29.0p) with net debt (loans and borrowings less cash and cash

equivalents) at the period end of GBP13.1m (H1 2017: GBP16.3m). The

Board has declared payment of an interim dividend of 7.0p per share

(H1 2017: 6.0p per share). This will be paid on 6 December 2017 to

those shareholders on the register on 15 November 2017.

Our Kx software platform is the established market leader in the

analysis of market data for financial services (FinTech). Clients

include financial regulators, stock exchanges and the leading

global investment banks. Our competitive advantage is the ability

to capture, enhance and analyse extremely large volumes of data in

real-time, providing actionable insights from the data under

management. These insights can then be used to support risk

management, balance sheet optimisation and regulatory compliance

and reporting.

Revenue from FinTech increased by 18% to GBP66.8m with growth in

recurring revenue, a key indicator, strongly ahead by 32%. We

continue to invest in software development, pre-sales and bid

costs, sales and marketing, implementation and support teams to

achieve our growth targets.

We operate a direct sales model within FinTech, and in the

current period have successfully signed an increased number of

contracts compared to prior periods. We have added to our sales

capabilities through OEM arrangements such as that with Thomson

Reuters, where Kx is embedded within Reuters' Velocity Analytics

product. This relationship continues to deepen and good progress

has been made through the period.

In addition, we are a leading provider of professional services

to the capital markets industry, supporting business critical

systems for our global investment banking clients. Our strategy in

this area is to be the provider of choice within capital markets

for the support and transformation of mission critical applications

across asset classes, through front, middle and back office

environments.

Our strategy is to use Kx's established market reputation in

FinTech, not only to increase the use of Kx within our core market,

but also to bring our unique technological capabilities to new

markets. Expansion into these markets is being addressed through a

combination of direct sales and working with partners to extend our

market reach.

Our marketing technology (MarTech) business performed well, with

revenue increasing by 30% to GBP18.3m (H1 2017: GBP14.1m). Our

technology differentiates our products in a multi-billion dollar

addressable market by its ability to develop actionable insights

through interrogation of multiple data sources, each of which are

of significant scale. During the period we launched an upgraded

version of our end-to-end predictive analytics and lead management

service platform, MRP Prelytix, which has been well-received by

customers including SAP, Cisco and Oracle.

In other markets we continued to make progress. Of note, and in

response to market demand, we announced a significant investment in

machine learning, putting AI at the heart of our future development

plans. We have added to our strategic partners to increase our

routes to market, with agreements announced during the period with

Airbus and the European Space Agency. In recent months we have also

signed a number of important contract wins in markets which we

consider to have significant potential for the Group. These include

a deal with a Fortune 500 corporation to use Kx to provide fault

detection solutions, a contract win with Red Bull Racing for

cutting edge sensor data analytics and initial deals in telecoms,

healthcare and retail. These successes reinforce our view that Kx

has a competitive advantage in multiple high value addressable

markets, in line with our strategic objectives.

We remain committed to the delivery of sustainable, long term

growth. During the period the Group achieved a number of

milestones, not least of which was taking our headcount above 2,000

people. The skills and commitment of our staff are driving our

growth and give me confidence in our ambitious plans. We also

continue to evaluate strategic acquisitions where we believe such

deals would accelerate our organic growth ambitions.

Current Trading and Outlook

The Group has a strong pipeline and has made a positive start to

the second half of the financial year. We have signed a number of

high value contracts in the first half and there is momentum behind

our commercial discussions across the Group. We therefore

anticipate a strong full year financial performance, slightly ahead

of the Board's expectations.

I would like to thank the staff of FD and my Board colleagues

for their hard work in achieving another successful period of

growth for the Group.

Seamus Keating

Chairman

Chief Executive's Statement

This has been another important period in the development of FD

as we seek to build on the performance of our technology in FinTech

by establishing ourselves within a number of large and fast growing

markets.

Our Software division, branded as Kx technology ("Kx"), grew by

32%, powered by 44% growth in recurring revenue. Within FinTech we

are now established as a go-to provider of solutions for demanding

analytics challenges, as a result of which we are involved in a

number of strategic conversations with existing and potential

clients. In MarTech, the recent launch of the latest version of our

predictive analytics platform, MRP Prelytix 2.0, is being well

received, while in other markets we are making progress towards

greater commercialisation across a range of opportunities.

We again delivered solid growth with revenue up 21% and adjusted

EBITDA up 19%. Our high-margin revenue growth allowed us to

continue to deliver growth in profits while making significant

investments to position ourselves for future growth and to

strengthen our technology advantages. During the period we

announced significant investment in R&D in the form of machine

learning, as well as continuing to increase our marketing, direct

and indirect sales capabilities to enable us to bring our

technology to new markets.

From ongoing conversations across multiple industries we remain

convinced that our technology is ideally suited for markets as

diverse as healthcare and telecoms. This belief is reinforced by

recent announcements relating to strategic partnerships and

contract wins with the likes of the European Space Agency,

Scientific Revenue and Brainwave Bank.

In our Managed Services and Consulting division we remain on

track to deliver another year of double digit growth, driven by our

investment in training and development. One of our strengths is the

fungibility of our talent pool and this continued to be evidenced

by the deployment of consulting staff on software implementations

during the period to meet demand. To address the high levels of

demand across our business, we have increased our graduate

recruitment in 2017, with nearly 400 graduates recruited so far

this year, a 66% increase on the prior period.

This continued investment across the Group is a statement of our

belief in the scale FD can achieve.

Software

Our Kx software was designed to meet the most demanding data

challenges in terms of velocity and volume. We are now established

as the leading technology dealing with market data analytics where

our ability to deal with millions of events per second on commodity

hardware is unrivalled. The Group is now targeting a range of other

markets and industries where data volumes and frequency of updates

is rising rapidly, stretching the capability of other technologies

to cope. We have built specific applications in a number of

markets, while our technology can also be used by third parties as

a platform on which high performance, disruptive applications can

be built.

Our software solutions, for all end use cases, are based on a

common technology platform, driven by a single R&D team and

pooled 24/7 global support. This approach generates significant

economies of scale, reduces time to market for new products and

provides operational leverage given the low incremental cost of

acquiring and supporting new customers.

We have a significant market opportunity - estimates from

independent industry analysts such as IDC and ABI Research show a

combined total addressable target market in the sectors we are

targeting in excess of $60 billion per annum.

Our development road map remains focussed on extending Kx's

competitive position in areas such as sensor data and the

Industrial Internet of Things, cyber security, blockchain and

augmented / virtual reality. In September we announced a major

initiative to put machine learning at the heart of our future

technology developments and this has generated significant customer

interest, from which we have already signed our first customer

engagement with a global investment bank.

As data challenges continue to increase, we are confident that

the performance attributes of our Kx technology, combined with the

investment we are making to extend the use cases for which it is

ideally suited, will drive greater global uptake of Kx.

FinTech

Our FinTech software revenue continued to grow strongly, up 31%

to GBP31.2m (H1 2017: GBP23.8m). The Group continues to benefit

from the increasing recognition that Kx is ideally suited to the

industry's most demanding data analytics challenges. Kx is also

increasingly seen as an enterprise solution, which is leading to

larger average deal sizes and more strategic discussions with

existing and potential clients.

Within FinTech, our Kx software solutions are utilised by

investment banks, regulators and exchanges for purposes including

real-time market surveillance, regulatory reporting, risk reporting

and market data analytics.

Regulation remains a key driver of investment decisions, with

recognition within the industry that many systems that compete with

Kx lack the granularity of data capture that is required under

MiFID II and MAR, for example. We believe that we are well

positioned to continue to take market share within FinTech and that

there is considerable opportunity to expand within existing

customers as well as add new clients.

In addition to direct sales, the Group has increased its routes

to market in recent years through OEM agreements with Thomson

Reuters, where Kx is the analytics platform for its Velocity

Analytics product, as well as Quantile, a provider of counterparty

risk products, and Cobalt, which uses blockchain technology to

reduce post-trade cost and risk for financial market participants.

All of these technology partner deals are progressing well, in line

with our expectations, and offer incremental growth opportunities

for the Group.

MarTech

MarTech revenue increased by 30% to GBP18.3m (H1 2017:

GBP14.1m), with recurring revenue up 72% to GBP6.9m.

Our Marketing Cloud platform applies sophisticated predictive

analytics to billions of data points per day from internet

searches, web site traffic, CRM data and other sources to determine

buying intent globally. Delivered on a self-serve subscription

basis, the data can be leveraged for lead generation in addition to

optimising the digital marketing spend by granular targeting of

advertisements. We believe our end-to-end marketing platform is a

unique offering.

During the period we continued to develop our platform, with the

release of MRP Prelytix 2.0. Key new features include increased

data sources and analytics, improved Account Based Marketing (ABM)

scoring, the ability for clients to customise algorithms and

streamlined integration of MRP Prelytix into clients' systems.

These advances are reflected in highly impressive return on

investment figures for clients using our platform. Clients using

MRP Prelytix have a 257% greater response rate, a 197% higher

chance of converting leads into closed business and achieve a 208%

increase in average deal size compared to the same sales and

marketing tactics not informed by MRP Prelytix.

Other Markets

A key element of our strategy is to establish Kx technology in

other markets. While reported revenue remains low (GBP2.7m during

the period, up 74% on H1 2017) we are pleased with the traction we

are seeing across a number of nascent markets.

In particular, a selection of the progress made during the

period includes:

-- Sensor analytics - we announced an important contract win

with a Fortune 500 engineering solutions company for the use of Kx

as the high-performance data historian and analytics engine in the

client's fault detection product range. This is a high value

contract where Kx's superior analytics performance, delivering

millions of sensor reads per second, allowed us to displace the

incumbent solution and will allow us to showcase Kx's capabilities

within the Industrial Internet of Things. After the period end we

also announced that Red Bull Racing had selected Kx for analytics

on sensor data from its Formula 1 cars. This reinforces the cutting

edge performance of Kx for sensor analytics and provides domain

expertise for our push into the automotive market generally.

-- Commercial Space market - we announced agreements with NASA

and the European Space Agency that support earlier announcements

with Airbus and 3DEO around analytics on Earth Observation imagery.

Kx is gaining traction within this market and is ideally suited to

the intensive computational requirements to turn digital imagery

into useful insights.

-- Telecoms - we signed a contract to support the monitoring of

a telecoms network to identify performance issues. Although at an

early stage, this has the potential to grow significantly and to be

a showcase for the use of Kx in this large and important

market.

-- Healthcare - after the period end, we signed an agreement

with BrainwaveBank for Kx to power its neuroscience platform as it

seeks to build the world's first Big Data collection of brainwave

activity data. This will allow individuals to measure and track

their own cognitive health and again showcases the power,

performance and flexibility of Kx.

This is a small but illustrative sample of progress made in some

of the markets in which we are seeking to establish Kx. We are

encouraged by the numerous discussions we are having across

industries and while we recognise it will take time to establish

our presence within them; nonetheless we believe the compelling

performance and cost of ownership advantages of Kx will enable us

to deliver on these opportunities.

Managed Services and Consulting

Managed Services and Consulting continued to grow, with revenues

increasing by 8% to GBP35.6m (H1 2017: GBP32.9m). Demand for our

expertise remained high, although the reported growth rate was

lower than in recent years as a result of a redeployment of our

data scientists onto software implementations, in response to

demand.

Our managed service activities focus on the support of mission

critical systems within global investment banks. The Group assists

clients by deploying its data scientists to assist in the

development of more effective data architectures, to rationalise

their application landscape and implement regulatory change.

We have more than 20 years of experience working with software

from third party providers such as Murex, Calypso and Summit as

well as a range of legacy and in-house systems. In addition to

implementation, development and support services we have developed

a number of complementary offerings such as managing regulatory and

compliance initiatives. This enables us to assemble

multi-disciplined teams to provide upgrades, testing, customisation

and development of interfaces for our clients.

FD's services are provided both at the client's site and

remotely from near shore centres including our headquarters in

Newry. We operate a comprehensive training programme to provide our

consultants with expertise in data science and domain knowledge in

capital markets. This investment in our data science professionals

differentiates us from our competitors and, combined with our

repeat and recurring revenue, drives our growth each year.

While the high level of Kx sales and consequent implementation

work has required some redeployment of our data science consultants

from managed services into Kx implementation, there is no let-up in

demand for FD's capability in third party managed services and

consulting. This is evidenced by some significant new multi-year

contracts signed during the period including:

-- The implementation of a large third party system for a New

York-based investment bank, representing one of the largest

contracts in the Group's history.

-- A major upgrade to a third party system deployed in the U.S.

by a major European financial institution.

These major contract awards are in growing recognition of our

reputation for both delivery and client satisfaction and the

growing breadth and depth of our skills base. This allows us to bid

for increasingly larger projects, to lock-in recurring revenue and

to cross-sell software products.

Regulation and compliance, including MiFID II, Know Your Client,

Anti Money Laundering, the General Data Protection Regulation

(GDPR), the Market Abuse Regulation (MAR) as well as the

Consolidated Audit Trail (CAT) in the US, remain key drivers of our

business. As we deepen our relationships with key clients we are

taking increasing responsibility for assisting them to meet these

and other regulations across geographies.

The contract wins referenced above provide further visibility

over growth and we also have a strong pipeline of potential new

engagements with existing and new clients. Key to the delivery of

this growth is our industrialised recruitment and training process,

with record recruitment in the period designed to provide us with

the resources needed to capitalise on the opportunities we see in

our pipeline.

These factors provide us with confidence in a return to historic

growth levels in Managed Services and Consulting in the second half

of our financial year and beyond.

Management and Personnel

The Group now employs more than 2,000 people, up from over 1,700

people at the same time last year. In the year to date we have

hired nearly 400 graduates, reflecting our expectation of future

growth. The opportunity to work with leading edge technology in

premier locations around the world continues to help us secure new

talent and achieve high retention rates. We continue to emphasise

training and continued development of our talent, which is another

key driver of employee retention.

Once again I would like to thank all FD employees for the

contribution they have made to our growth through their hard work,

talent and flexibility.

Summary

We continue to make good progress towards our strategic

objectives while delivering strong growth and disciplined

investment. In FinTech we are regarded as a key software provider

whose solutions are able to cope with the most demanding data

challenges within the industry and we have a client list that

showcases our credentials. In MarTech the release of an upgraded

version of MRP Prelytix widens the gap between ourselves and

competing solutions, while we can clearly demonstrate a compelling

return on investment for our clients. In other high value markets

we have made good progress and have high hopes that we can make

further breakthrough contract wins to add to our deal with a

Fortune 500 engineering company within the Industrial Internet of

Things, secured earlier this year.

In Managed Services and Consulting we continue to see strong

demand for our capabilities and have increased our graduate

recruitment programme to ensure we can deliver against this

opportunity, delivering growth in line with historic levels.

The Group provides compelling software and managed service

solutions across a number of very large addressable markets. Based

on the pipeline of opportunities and ongoing strategic

conversations with clients, I remain confident that we can continue

to deliver significant returns for shareholders.

Brian Conlon

Chief Executive Officer

Financial Review

Group revenue increased by 21% to GBP87.8m (H1 2017: GBP72.4m),

all of which was organic. An analysis of revenue is provided in the

table below.

H1 H1

2018 2017 Change

GBP000 GBP000

Managed services

and consulting 35,636 32,887 8%

Software:

Recurring revenue 19,618 13,633 44%

Implementation

and support 30,261 22,995 32%

Perpetual 2,322 2,841 -18%

Software total 52,201 39,469 32%

Total 87,837 72,356 21%

FinTech Revenue 66,848 56,691 18%

MarTech Revenue 18,260 14,097 30%

Other 2,729 1,568 74%

Total 87,837 72,356 21%

Adjusted EBITDA increased by 19% to GBP16.1m (H1 2017:

GBP13.6m), with an adjusted EBITDA margin of 18.3% for the period

(H1 2017: 18.7%), a strong performance given the ongoing investment

to deliver future growth. In addition to the investments in areas

such as machine learning and MRP Prelytix highlighted earlier, we

have continued to invest across the Group to position ourselves in

new markets, adding to our delivery, sales and marketing

capabilities.

The adjusted profit after tax for the period of GBP9.2m (H1

2017: GBP7.5m) represented growth of 23%. The Group does not

operate a currency hedging policy, with the structure of the

Group's geographical operations providing a hedge against currency

movements. The impact of currency movements overall during the

period was again broadly neutral to the Group's earnings, with a

small benefit to revenue and adjusted EBITDA balanced by an

increase in dollar-denominated interest payments and the currency

translation of taxation charges.

The Group continued to invest in R&D to maintain its

technology lead, albeit with a greater proportion of spend written

off and an increase in the amortisation of previously capitalised

development costs. As a result, the net benefit to the Income

Statement fell again during the period, as detailed in the table

below.

H1 H1

2018 2017

GBP000 GBP000

Capitalisation

of R&D costs 3,766 3,686

Amortisation of

R&D (3,052) (1,993)

Net capitalisation 714 1,693

Proportion of

software revenue 1% 4%

Reported profit before tax decreased by 10% (H1 2017: up 27%)

primarily as a result of a loss on foreign currency translation and

an increase in acquisition costs as a result of deferred

consideration on prior acquisitions.

The Group's effective tax rate was 27.4% (H1 2017: 28.8%) which

was broadly in line with the full year tax rate for FY 2017. The

fully diluted average number of shares in issue increased to 26.8m

(H1 2017: 25.9m). This resulted in fully diluted earnings per share

of 34.4p, representing growth of 19% for the period (H1 2017:

29.0p).

The calculation of adjusted profit after tax is detailed

below.

H1 H1

2018 2017

GBP'000 GBP'000

Reported profit for

the year 4,578 5,008

Adjustments for:

Amortisation of acquired

intangibles 2,335 2,376

Share based payment

and related costs 1,006 1,077

Acquisition costs,

associate disposal

costs and contingent

purchase consideration 1,364 492

Loss/(Gain) on foreign

currency translation 350 (898)

Share of loss of Associate 41

Tax effect of the above (466) (557)

-------- --------

Adjusted profit after

tax 9,208 7,498

======== ========

Adjusted EPS (fully

diluted) 34.4p 29.0p

The Group generated GBP13.0m of cash from operating activities

before taxation payments (H1 2017: GBP12.4m), representing an 81%

conversion rate of adjusted EBITDA (H1 2017: 91%) due to the timing

of remuneration payments and the payment profile of recurring

revenue.

At the period end, net debt was GBP13.1m (H1 2017: GBP16.3m, FY

2017: GBP13.5m), after the payment of GBP3.0m in dividends and

GBP4.4m of capital on associates and investments for the

penetration of new markets and prior year acquisitions. Total

assets at 31 August 2017 were GBP251.3m compared to GBP234.4m at 31

August 2016.

Consolidated statement of comprehensive income (unaudited)

6 months 6 months

ended 31 ended 31

August August

2017 2016

Notes GBP'000 GBP'000

Revenue 2 87,837 72,356

Cost of sales (62,778) (51,509)

Gross profit 25,059 20,847

Other income 596 776

Administrative expenses (18,468) (14,886)

Results from operating activities 7,187 6,737

Acquisition costs and contingent

purchase consideration 1,364 492

Share-based payments 1,006 1,077

Depreciation and amortisation 4,218 2,885

Amortisation of acquired

intangible assets (IFRS3) 2,335 2,376

Adjusted EBITDA 16,110 13,567

----------------------------------- ------ ---------- ----------

Financial income 1 1

Financial expense (490) (604)

(Loss)/Gain on foreign currency

translation (350) 898

Net financing (expense)/income (839) 295

Share of loss of associate (41) -

using the equity method,

net of tax

Profit before tax 6,307 7,032

Income tax expense (1,729) (2,024)

Profit for the period 4,578 5,008

========== ==========

Pence Pence

Earnings per Share

Basic 4 18.2 20.5

Diluted 17.1 19.4

========== ==========

Consolidated statement of changes in equity

Share Currency

Share Share option translation Retained Total

capital premium reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2016 120 65,903 7,217 370 39,654 113,264

-------- -------- -------- ------------ --------- -------

Total comprehensive income

for the period

Profit for the period - - - - 5,008 5,008

Other comprehensive income

Net gain on net investment

in foreign subsidiary and associate - - - 2,630 - 2,630

Net profit on hedge of movement

in foreign subsidiary and associate - - - 2,041 - 2,041

-------- -------- -------- ------------ --------- -------

Total comprehensive income

for the period - - - 4,671 5,008 9,679

Transactions with owners, recorded

directly in equity

Income tax on share options - - 756 - - 756

Exercise or issue of shares 3 2,654 - - - 2,657

Share-based payment charge - - 510 - - 510

Dividends to equity holders - - - - (2,918) (2,918)

-------- -------- -------- ------------ --------- -------

Balance at 31 August 2016 123 68,557 8,483 5,041 41,744 123,948

======== ======== ======== ============ ========= =======

Share Fair value Currency

Share Share option reserve translation Retained Total

capital premium reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2017 124 72,275 10,225 - 8,335 40,772 131,731

-------- -------- -------- ---------- ------------ --------- -------

Total comprehensive income

for the period

Profit for the period - - - - - 4,578 4,578

Other comprehensive income

Net gain on net investment

in foreign subsidiary and associate - - - - (2,240) - (2,240)

Net profit on hedge of movement

in foreign subsidiary and associate - - - - 964 - 964

-------- -------- -------- ---------- ------------ --------- -------

Total comprehensive income

for the period - - - - (1,276) 4,578 3,302

Transactions with owners, recorded

directly in equity

Income tax on share options - - 1,959 - - - 1,959

Exercise or issue of shares - 3,753 - - - - 3,753

Share-based payment charge - - 600 - - - 600

Dividends to equity holders - - - - - (3,533) (3,533)

-------- -------- -------- ---------- ------------ --------- -------

Balance at 31 August 2017 124 76,028 12,784 - 7,059 41,817 137,812

======== ======== ======== ========== ============ ========= =======

Consolidated statement of financial position (unaudited)

As at As at As at

31 August 31 August 28 February

2017 2016 2017

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 6,610 6,601 6,628

Intangible assets and

goodwill 158,826 158,589 163,391

Trade and other receivables 2,686 1,248 3,630

Investment in equity -

associated investees 1,948 - 1,548

Other financial assets 3,452 1,902 3,121

Deferred tax asset 17,503 11,726 14,859

----------- ----------- -------------

Non-current assets 191,025 180,066 193,177

Trade and other receivables 46,509 40,481 43,738

Cash and cash equivalents 13,738 13,888 16,250

Current assets 60,247 54,369 59,988

Total assets 251,272 234,435 253,165

----------- ----------- -------------

Equity

Share capital 124 123 124

Share premium 76,028 68,557 72,275

Shares option reserve 12,784 8,483 10,225

Currency translation adjustment

reserve 7,059 5,041 8,335

Retained earnings 41,817 41,744 40,772

Equity attributable to

shareholders 137,812 123,948 131,731

=========== =========== =============

Liabilities

Loans and borrowings 23,460 26,798 26,357

Trade and other payables 33,912 33,727 35,114

Deferred tax liabilities 12,474 12,639 12,932

Contingent deferred consideration 2,850 1,176 3,169

Non-current liabilities 72,696 74,340 77,572

Loans and borrowings 3,378 3,397 3,404

Trade and other payables 27,881 25,300 33,681

Current tax payable 1,051 1,626 426

Employee benefits 6,870 3,147 5,492

Contingent deferred consideration 1,584 2,677 859

Current liabilities 40,764 36,147 43,862

Total liabilities 113,460 110,487 121,434

----------- ----------- -------------

Total equity and liabilities 251,272 234,435 253,165

=========== =========== =============

Consolidated statement of cash flows (unaudited)

6 months 6 months

ended 31 ended 31

August 2017 August

2016

GBP'000 GBP'000

Cash flows from operating

activities

Profit for the period 4,578 5,008

Adjustments for:

Net finance costs 839 (295)

Depreciation of property,

plant and equipment 1,161 892

Amortisation of intangible

assets 5,384 4,369

Increase in deferred consideration 1,023 439

Equity settled share-based

payment transactions 1,006 1,077

Grant income (596) (776)

Share of loss on associate -

Tax expense 1,729 2,024

------------- ----------

15,124 12,738

Changes in:

Trade and other receivables 1,687 1,057

Trade and other payables (3,794) (1,407)

------------- ----------

Cash generated from operating

activities 13,017 12,388

Taxes paid (3,471) (3,577)

------------- ----------

Net cash from operating activities 9,546 8,811

Cash flows from investing

activities

Interest received 1 1

Acquisition of other investments

and associates (950) (1,902)

Net increase in loans to (2,167) -

other investments

Acquisition of property,

plant and equipment (1,442) (956)

Acquisition of intangible

assets (3,766) (3,686)

Deferred consideration paid (1,237) (480)

Net cash used in investing

activities (9,561) (7,023)

Cash flows from financing

activities

Proceeds from issue of share

capital 3,344 2,090

Repayment of borrowings (1,812) (1,634)

Payment of finance lease

liabilities (30) (31)

Interest paid (490) (599)

Dividends paid (3,030) (2,839)

Net cash from financing activities (2,018) (3,013)

Net increase/(decrease) in

cash and cash equivalents (2,033) (1,225)

Cash and cash equivalents

at 1 March 16,250 15,100

Effects of exchange rate

changes on cash held (479) 13

Cash and cash equivalents

at 31 August 13,738 13,888

------------- ----------

Notes to the Interim Results

1 Basis of Preparation

The results for the six months ended 31 August 2017 are

unaudited and have not been reviewed by the Company's Auditors.

They have been prepared on accounting bases and policies that are

consistent with those used in the preparation of the financial

statements of the Company for the year ended 28 February 2017.

The financial statements contained in this report do not

constitute statutory accounts within the meaning of Section 477 of

the Companies Act 2006. The results for the period ended 28

February 2017 were prepared under International Financial Reporting

Standards (IFRSs) as adopted by the EU ("adopted IFRSs") and

reported on by the auditors and received an unqualified audit

report. Full accounts for the period ended 28 February 2017 have

been delivered to the Registrar of Companies.

2 Segmental Reporting

Revenue by industry

2017 2016

GBP'000 GBP'000

FinTech 66,848 56,691

MarTech 18,260 14,097

Other 2,729 1,568

______ ______

Total 87,837 72,356

______ ______

Revenue by category

2017 2016

GBP'000 GBP'000

Managed services and consulting 35,636 32,887

Software 52,201 39,469

______ ______

Total 87,837 72,356

______ ______

Geographical location analysis

2017 2016

GBP'000 GBP'000

UK 28,978 24,403

Rest of Europe 14,317 11,026

Americas 34,781 32,823

Australasia 9,760 4,104

______ ______

Total 87,837 72,356

______ ______

3 Dividends

An Interim Dividend of 7.0p per share will be made for the six

months to 31 August 2017. This will be paid to shareholders on 6

December 2017 to shareholders on the register on 15 November 2017.

The shares will be marked Ex-Dividend on 16 November 2017.

4 Earnings per Share

Basic earnings per share for the six months ended 31 August 2017

has been calculated on the basis of the reported profit after

taxation of GBP4.6m (H1 2017: GBP5.0m) and the weighted average

number of shares for the period of 25,135,875 (H1 2017:

24,461,620). This provides basic earnings per share of 18.2 pence

(H1 2017: 20.5 pence).

Diluted earnings per share for the six months ended 31 August

2017 has been calculated on the basis of the reported profit after

taxation of GBP4.6m (H1 2017: GBP5.0m) and the weighted average

number of shares after adjustment for the effects of all dilutive

potential ordinary shares 26,790,129 (H1 2017: 25,867,614). This

provides diluted earnings per share of 17.1 pence (H1 2017: 19.4

pence).

The Board considers that adjusted earnings is an important

measure of the Group's financial performance. Adjusted earnings in

the period was GBP9,208k (H1 2017: GBP7,498k), which excludes the

amortisation of acquired intangibles of GBP2,335k, (H1 2017:

GBP2,376k) share-based payments of GBP1,006k (H1 2017: GBP1,077k),

acquisition costs of GBP1,364k (H1 2017: GBP492k), loss on foreign

currency translation of GBP350k (H1 2017: gain GBP898k), share of

loss of associate GBP41k (H1 2017: GBPnil) and associated taxation

impact of these adjustments of GBP466k (H1 2017: GBP557k). Using

the same weighted average of shares as above provides adjusted

basic earnings per share of 36.6 pence (H1 2017: 30.7 pence) and

adjusted diluted earnings per share of 34.4 pence (H1 2017: 29.0

pence).

5 Interim Report

Copies can be obtained from the Company's head and registered

office: 3 Canal Quay, Newry, Co. Down, BT35 6BP and are available

to download from the Company's website

www.firstderivatives.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VQLFBDFFXFBB

(END) Dow Jones Newswires

November 07, 2017 02:00 ET (07:00 GMT)

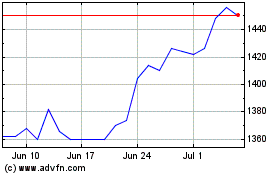

Fd Technologies Public (LSE:FDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fd Technologies Public (LSE:FDP)

Historical Stock Chart

From Apr 2023 to Apr 2024