Finance Watch

January 22 2017 - 5:12PM

Dow Jones News

HSBC

Investment Bankers

To Face Job Cuts

HSBC Holdings PLC is cutting around 100 senior investment

bankers, adding to staff reductions last year from a restructuring

in its global banking business.

HSBC said the bank reviews performance in its Global Banking and

Markets business annually and makes "appropriate changes to

strengthen and grow the business."

In June, several top bankers departed as part of a

reorganization of the global banking division under new co-head

Matthew Westerman.

HSBC has been cutting tens of thousands of jobs across its

operations as part of a broader effort to improve returns. The bank

is scheduled to disclose its results for the fourth quarter on Feb.

21.

--Margot Patrick

Guotai Junan

IPO Could Raise

$2 Billion or More

Guotai Junan Securities Co., China's third-largest brokerage

firm by assets, has filed for a Hong Kong initial public offering

that people familiar with the situation say could raise $2 billion

or more by midyear.

The Shanghai-based firm filed for its IPO with the Hong Kong

stock exchange on Friday. A spokeswoman for Guotai Junan didn't

respond to a request to comment.

Chinese brokerages have been tapping the offshore market to fund

expansion plans. Citigroup Inc.'s China securities joint-venture

partner, Orient Securities Co., China Merchants Securities Co. and

Everbright Securities Co., all launched multibillion-dollar

offerings in Hong Kong last year. All three companies are trading

marginally below their listing prices.

Guotai Junan, which listed in Shanghai in 2015, plans to use

proceeds from the IPO to develop its prime brokerage,

personal-financial services and investment-management businesses,

as well as for overseas expansion and the growth of other divisions

within the firm, according to the filing.

--Alec Macfarlane and Ese Erheriene

SOCIÉTÉ GÉNÉRALE

Lender to Settle Mortgage Claims

Société Générale SA has agreed to pay a $50 million civil fine

to settle federal claims that it defrauded investors, including

financial institutions, in the marketing and sale of a residential

mortgage-backed security, the Brooklyn U.S. Attorney's office said

Friday.

As part of the settlement, the French bank admitted that it

didn't tell investors that loans underlying the security were

underwritten outside of the loan originators' underwriting

guidelines. The bank also falsely told investors that none of the

values of mortgages on properties within the security exceeded the

value of these properties, according to the agreement.

"Société Générale is pleased to have resolved this legacy matter

involving a business that the firm exited in 2008," said James

Gavlion, a spokesman for the firm.

--Erica Orden

(END) Dow Jones Newswires

January 22, 2017 16:57 ET (21:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

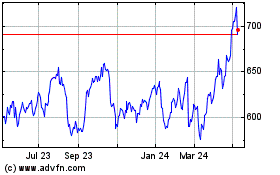

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

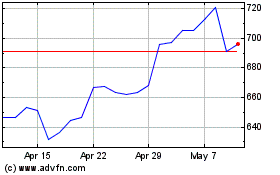

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024