Finance Watch

May 02 2016 - 12:08PM

Dow Jones News

WESTPAC

Impairment Charges Weigh on Profit

Westpac Banking Corp. reported a modest rise in its half-year

profit but cautioned that it had to increase loan-loss provisions

in its institutional banking arm.

The institutional operation was stung by lower margins and asset

impairments primarily related to four large exposures, which added

252 million Australian dollars (US$191.7 million) to provisions for

the period, Westpac said Monday. Still, the bank said that its

larger consumer division recorded strong home-loan and deposit

growth. Margins remained stable on the business-banking side of the

company.

Westpac said net profit rose 2.5% to A$3.7 billion in the six

months through March, from A$3.61 billion a year earlier.

Cash earnings -- a figure followed by analysts that strips out

certain income and costs -- were up 3.3% at A$3.9 billion. The

median estimate among eight analysts surveyed by The Wall Street

Journal was for a result of A$4 billion.

--Robb M. Stewart

ALLIANZ

Insurer Is on Track For Earnings Goal

Allianz SE, Europe's biggest insurer by revenue, reported a 21%

jump in quarterly profit and said it is on track to meet its

full-year earnings target.

Net profit rose to EUR2.2 billion ($2.51 billion) from EUR1.8

billion in the first three months of last year, in part as a result

of gains in the value of Allianz's investment portfolio. Lower

payouts for claims related to natural disasters and wider profit

margins on new life and health policies also contributed to

Allianz's performance, the insurer said on Monday.

In contrast, third-party assets under management at the group's

asset-management business continued to shrink, evidence that a

turnaround at Allianz's U.S. fund manager Pacific Investment

Management Company LLC, or Pimco, is still around the corner.

Pimco is under pressure this year to prove it can reverse the

substantial net asset outflows seen since co-founder Bill Gross

abruptly left in September 2014. Outflows have eased over the

quarters since Mr. Gross's exit and a management shake-up at

Pimco.

Allianz said third-party assets under management fell 2.7% to

EUR1.242 trillion at March 31 from EUR1.276 trillion a year

earlier.

Revenue was under pressure at the start of the year, falling

6.4% to EUR35.4 billion in the quarter, while operating profit was

down a more modest 3.5% to EUR2.8 billion.

In the asset-management business, third-party assets under

management fell 2.7% from a year earlier to EUR1.242 trillion as of

March 31.

Allianz said it is sticking its full-year guidance for operating

earnings. "We had a strong start to 2016, reinforcing our

confidence that we will be able to reach our outlook for 2016

despite the fact that this is a challenging year for the

financial-services industry," Chief Executive Oliver Bäte said.

"Despite the market volatility and low interest rates, we

continue to expect an operating profit for the full year of EUR10.5

billion, plus or minus EUR500 million."

--Ulrike Dauer

(END) Dow Jones Newswires

May 02, 2016 11:53 ET (15:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

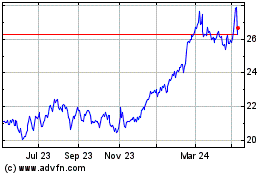

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

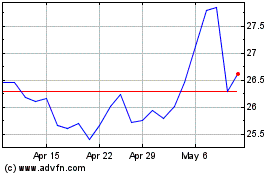

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Apr 2023 to Apr 2024