Finance Watch -- WSJ

November 01 2016 - 3:02AM

Dow Jones News

ITAU UNIBANCO

Brazil's Recession Cited as Net Falls

Itau Unibanco Holding SA, Brazil's second-largest bank by

assets, reported a 9.3% drop in net profit for the third quarter,

as recession reduced demand for new loans and the bank assumed more

provisions for nonperforming loans.

Profit was 5.4 billion Brazilian reais ($1.7 billion) compared

with 5.95 billion reais a year earlier.

After nearly a decade of profit increases, the bank's earnings

have shown signs of deterioration in recent quarters due to the

country's struggling economy.

Brazil's gross domestic product contracted 3.8% last year and is

expected to shrink around 3.2% this year, according to

economists.

Itau Unibanco ended the third quarter with a credit portfolio of

605.7 billion reais, down 11% from 680.1 billion reais a year

earlier.

The decline was attributed to poor demand from companies. Its

corporate-loan portfolio declined nearly 17%. Individual loans fell

1.9%.

Total assets were valued at 1.39 trillion reais, down from 1.44

trillion reais a year earlier.

--Rogerio Jelmayer

ANZ

Lender Intensifies Retreat in Asia

Australia & New Zealand Banking Group Ltd. is further

scaling back in Asia, selling its retail and wealth-management

businesses in five markets to focus on institutional banking in the

region.

Facing the need to invest more to build up the Asia retail

business, ANZ said it had instead agreed to sell operations in

mainland China, Hong Kong, Indonesia, Singapore and Taiwan to

Singapore's DBS Group Holdings Ltd. The businesses include about 11

billion Australian dollars (US$8.36 billion) in gross loans and

A$17 billion in deposits.

Major banks in Australia and around the world are focused on

building capital and improving returns under the pressure of

sluggish revenue growth, low interest rates and rising funding

costs.

ANZ, which expanded in Asia more energetically than its local

peers, said it continues to look at opportunities to exit from

other businesses.

"It is all about focus," Chief Executive Shayne Elliott said,

adding that the bank remains committed to Asia but is consolidating

resources in core areas such as trade finance, debt capital markets

and cash management. Returns and capital ratios have become

increasingly important for all major banks, and Asia is a

competitive market, served by a large number of local banks plus

global heavyweights, said David Ellis, an analyst at

Morningstar.

--Robb M. Stewart

Standard Chartered

Chief Steps Down at Unit Under Scrutiny

Greg Karpinski is stepping down as chief executive of Maxpower

Group Pte. Ltd., a power company in Indonesia controlled by

Standard Chartered PLC that is at the heart of a U.S. investigation

into alleged bribery.

Mr. Karpinski, who left Standard Chartered's Singapore

private-equity unit to become Maxpower's CEO last year, will be

succeeded by Syamsurizal Munaf, a longtime executive in Indonesia's

oil-and-gas industry, a person familiar with the matter said.

Possible bribery and other misconduct at Maxpower were

identified last year in a legal review of an internal audit and

have led to a U.S. Justice Department investigation into whether

Standard Chartered had adequate controls in place at its investment

and whether bank executives were aware of, or approved, the alleged

misconduct, The Wall Street Journal has reported. The Justice

Department has declined to comment.

Maxpower and Mr. Karpinksi didn't respond to requests for

comment about a change in leadership. Maxpower has previously said

it was investigating allegations of misconduct, had shaken up

management and had enhanced internal controls.

Standard Chartered declined to comment about a CEO change. The

bank has previously said it conducted its own review into the

alleged misconduct and "proactively" notified authorities about the

matter.

--Margot Patrick, Ben Otto

(END) Dow Jones Newswires

November 01, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

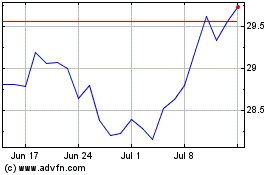

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024