Finance Watch -- WSJ

July 22 2016 - 3:02AM

Dow Jones News

EARNINGS

Catastrophe Claims Dent Travelers Net

Travelers Cos. said its second-quarter operating earnings fell

19%, depressed by claims from catastrophes such as the Fort

McMurray wildfires in Alberta, Canada, and hail storms in various

parts of the U.S.

The New York-based insurer, which posted record quarterly net

written premiums, a closely watched measure of revenue growth,

reported a profit of $664 million, or $2.24 a share, down from $812

million, or $2.53 a share, a year earlier.

Catastrophe losses totaled $333 million, up sharply from $221

million. Net written premiums increased 2.9% to $6.35 billion amid

strong retention of business, positive renewal premium changes and

increases in new-business volumes in each of its segments.

Operating profit, which excludes realized capital gains and

losses in investment portfolios, of $649 million, or $2.20 a share,

compared with $806 million, or $2.52 a share, a year earlier.

--Tess Stynes, Leslie Scism

M&A DEALS

MasterCard to Buy VocaLink Holdings

MasterCard Inc. said it was buying most of VocaLink Holdings

Ltd., a bank-owned technology company in the U.K. that provides the

backbone for noncard transactions such as employer payroll deposits

and consumer bill payments. The deal is valued at about $920

million.

In addition to providing the technology backbone for noncard

payments, VocaLink also unites the infrastructure of Britain's

automated-teller-machine network among its participating banks.

VocaLink reported $240 million in revenue last year and processed

more than 11 billion transactions.

--Robin Sidel

E*TRADE FINANCIAL

Trading Pickup Helps Revenue Rise 10%

E*Trade Financial Corp. said its second-quarter revenue rose 10%

as trading picked up and its allowance for loan losses shrunk,

though the pace of the online broker's new-account openings

slowed.

Earnings totaled $133 million, or 48 cents a share, down from

$292 million, or 99 cents a share, in a year-earlier period that

included a $220 million tax benefit. Revenue rose to $474 million

from $429 million. Analysts polled by Thomson Reuters expected

earnings of 38 cents a share on revenue of $471 million.

"The quarter closed in a frenzy of market activity that impelled

a single-day record of net buying as customers seized opportunities

following sharp market declines," Chief Executive Paul Idzik said,

referring to the steep market selloff after the U.K.'s decision to

leave the European Union on June 23.

Daily average revenue trades increased 2% to 152,000 from a year

earlier but decreased 8% from the first quarter.

--Lauren Pollock

(END) Dow Jones Newswires

July 22, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

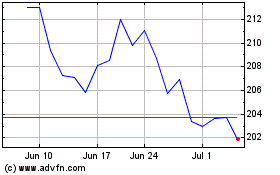

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024