Finance Watch -- WSJ

May 25 2016 - 3:02AM

Dow Jones News

UNICREDIT

CEO Agrees to Quit

The chief executive of UniCredit SpA, Italy's largest bank, has

agreed to step down, clearing the way for the board to begin a

search for his successor.

UniCredit said CEO Federico Ghizzoni will step down once a new

chief executive is found, to ensure a smooth transition.

Speculation about the future of Mr. Ghizzoni, who became chief

executive in 2010, has been mounting for months, as investors

pummeled the bank's stock and major shareholders grew increasingly

convinced that new leadership was needed to restore confidence.

People familiar with the situation said the board is seeking an

outsider who can spearhead a capital increase. Some said UniCredit

needs to raise as much as EUR9 billion ($10.1 billion) in fresh

funds. Those funds could come from a rights issue, asset sales or

both, they said. The bank has about EUR80 billion in bad loans,

more than any other bank in Europe.

Moreover, investors have grown increasingly concerned the bank's

capital cushion is too thin. UniCredit, which is the only

systemically important bank in Italy under new international

guidelines, has reported its core capital dropped during the first

quarter.

Mr. Ghizzoni came under particular criticism for the bank's

decision to underwrite the EUR1.5 billion capital increase of Banca

Popolare di Vicenza SpA. Earlier this spring, regulators grew

concerned investor sentiment toward Italian banking stocks was so

poor that the capital increase could fail, leaving UniCredit owning

the troubled bank. As a result, the government stepped in and

organized a fund supported by Italian financial institutions to

take over the transaction.

UniCredit's shares have lost more than 40% since the start of

the year. In recent days, it has risen on expectations of Mr.

Ghizzoni's resignation. In Tuesday's trading in Milan, the stock

rose 4.9%.

--Deborah Ball

IPO MARKET

Food Firm Seeks Up to $500 Million

A Chinese food company known for its spicy dried-duck snacks

plans an initial public offering in Hong Kong.

Zhouheiya Food Co. is expected to file an application for a Hong

Kong listing in the next couple of weeks, looking to raise up to

US$500 million, said people familiar with the matter.

Zhouheiya, which sells dried-duck heads and necks among other

snacks, could be the first food company to go public in Hong Kong

this year.

Chinese private snack-and-beverage group Dali Foods Group raised

US$1.15 billion in November in the sector's biggest IPO last year,

according to Dealogic. Dali Foods is currently trading around 20%

below its IPO price.

WH Group Ltd.'s US$2.4 billion float in July 2014 is the biggest

food-and-beverage sector IPO on record in Hong Kong, Dealogic data

show.

Founded in 2006, Zhouheiya has chain stores and factories in

more than 10 cities in China, with online shops on Chinese

e-commerce sites such as Alibaba's Tmall and JD.com. It recorded a

net profit of 306 million yuan ($46.7 million) in 2015, according

to data from China's company-registration website. Its investors

include Shenzhen private-equity firm Tiantu Capital.

Credit Suisse Group AG and Morgan Stanley are sponsors, or banks

responsible for the IPO, the people said.

--Alec Macfarlane, Kane Wu

(END) Dow Jones Newswires

May 25, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

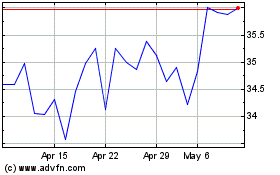

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024