HSBC

Market Volatility Pinches Earnings

HSBC Holdings PLC reported an 18% drop in first-quarter profit,

saying market volatility at the beginning of 2016 crimped its

performance.

"Our first-quarter performance was resilient in tough market

conditions that affected the entire banking sector," Chief

Executive Stuart Gulliver said. "Profits were down against a very

strong first quarter of 2015, but we increased market share in many

of the product areas that are critical to our strategy."

First-quarter net profit fell to $4.3 billion from $5.26 billion

a year earlier. Revenue fell 5.8% to $14.98 billion, mainly because

unpredictable markets dented client activity in its global banking

and markets unit. Life insurance also brought in less revenue.

Loan-impairment charges totaled $1.16 billion, up from $570 million

a year earlier, driven by the oil-and-gas and metals-and-mining

sectors.

The bank said it increased market share in key areas, including

Asian debt capital markets, China mergers and acquisitions and

syndicated lending in Asia.

HSBC has joined the top ranks of takeover deal makers in China

over the past year. The bank is advising China National Chemical

Corp. on its $43 billion takeover of Swiss pesticides and seed

maker Syngenta AG, China's biggest overseas deal.

Net interest income rose 10% to $1.82 billion.

Once a sprawling bank across 87 countries, HSBC has exited from

swaths of businesses around the globe to improve profit and cope

with tougher regulations since the financial crisis. Its main

regions now are Asia, the U.K. and North America.

The bank has been hit this year by darkening sentiment toward

commodities and emerging markets, two key planks of its business.

HSBC executives have said Asia will continue to drive growth for

the bank, a strategy that may pay off in the future but is seen as

a short-term drag on earnings.

Some investors and analysts have raised concerns about HSBC's

strategy in the Pearl River Delta region, including uncertainty

over foreign banks' ability to compete for lending and deposits

against big state-owned banks. HSBC's ambitions could also be

tempered by China's slowdown and a weaker operating environment in

the Asia-Pacific region.

Moody's Investors Service revised its ratings outlook on HSBC in

March to "negative" from "stable," saying that "Hong Kong's

increasing economic and financial linkages with China...give rise

to potential negative spillovers" from that country "and ultimately

weaker growth."

Mr. Gulliver acknowledged last month that the share price "isn't

where we want it to be" and said that keeping costs down and

revenue up are big challenges for the bank this year because of

weak economic conditions.

He said on Tuesday that the bank was on track with its

cost-savings program and its plan to reduce riskier assets on its

balance sheet.

Operating expenses totaled $8.26 billion in the first quarter,

down 7% from a year earlier. Excluding an increased credit related

to a bank levy from the previous year, the bank said "costs were

broadly unchanged."

HSBC "has been cutting costs for more than five years now, and

there [isn't] much they can do incremental to current plans in the

near term," analysts at Bernstein Research said in a note on

Tuesday after earnings were released.

On a separate issue, the bank said it faces one final regulatory

hurdle -- a decision from Brazil's Competition Agency -- before the

sale of its Brazil business can be approved.

HSBC announced last year it would sell its Brazilian business

for $5.2 billion.

--Julie Steinberg, Anjie Zheng

COMMERZBANK

Low Rates Took Toll On Quarterly Profit

Commerzbank AG cast further doubt over its full-year outlook

Tuesday, as first-quarter net profit more than halved, with the

German bank battling ultralow interest rates and sluggish activity

in capital markets.

"In view of the subdued nature of the first quarter, it will be

more challenging to reach the net profit" of EUR1.06 billion ($1.22

billion) posted in 2015, Germany's second-largest lender said.

In the first quarter, net profit fell to EUR163 million from

EUR338 million a year earlier. Revenue dropped to EUR2.31 billion

from EUR2.8 billion. Analysts polled by The Wall Street Journal on

average expected net profit of EUR156 million and EUR2.33 billion

in revenue. Its shares fell 9.6% Tuesday.

Commerzbank said its net return on equity roughly halved to

2.3%. Finance chief Stephan Engels told analysts the bank is trying

to counter this by introducing fees for paper-based transactions,

increasing market share and by pushing clients to invest more in

securities.

Commerzbank kept its core tier capital ratio stable at 12%. The

ratio is a measure of how well the bank can absorb potential

financial shocks. The lender also set aside five cents a share for

a dividend payment.

Commerzbank is intensifying efforts to mitigate the effects of

negative interest rates, saying that it aims to keep costs stable

this year. Retail operations bucked the weaker trend and increased

operating profit to EUR191 million from EUR157 million a year

earlier on higher lending business, lower costs and fewer

provisions for souring loans.

--Eyk Henning

(END) Dow Jones Newswires

May 04, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

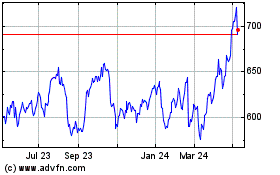

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

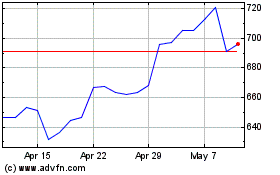

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024