LLOYDS BANKING

Restructuring, Bond Buybacks Hurt Profit

Lloyds Banking Group PLC said net profit fell sharply in the

first quarter, hit by restructuring charges and the cost of buying

back high-interest-paying bonds.

The British retail bank, which is about 9% owned by the U.K.

government, said revenue dropped 1% to GBP4.4 billion ($6.4

billion), while profit fell 44% to GBP531 million. Shares fell 1.7%

in London on Thursday.

Like other lenders, Lloyds has been struggling as low interest

rates eat into profitability. The bank said it was accelerating

cost-reduction plans, while ratcheting back mortgage lending as the

U.K. buy-to-let mortgage market starts to cool. Lloyds will review

its three-year strategy, launched in 2014, should it hit

cost-saving targets ahead of time, said Chief Financial Officer

George Culmer.

Lloyds took a GBP790 million hit buying back

high-interest-paying bonds it issued to investors during the

crisis.

This helped improve the bank's closely watched net interest

margin -- the difference between its cost of borrowing and the

price at which it lends -- to 2.74%.

--Max Colchester

BBVA

Currency, Trading Woes Slam Results

Banco Bilbao Vizcaya Argentaria SA reported a 54% drop in

first-quarter net profit, dragged down by currency turmoil, weaker

trading income and higher costs.

BBVA, Spain's second-biggest bank by market value, said net

profit in the first quarter was EUR709 million ($802.8 million), a

long shot from the EUR840 million that analysts had been expecting,

according to a poll by data provider FactSet. Its shares fell 6.8%

in Madrid.

"This set of results shows some weakness in revenues, especially

in Spain," Kepler Cheuvreux analyst Alfredo Alonso wrote in a

research report.

First-quarter net profit in 2015 had been high -- EUR1.54

billion -- boosted by BBVA's partial sale of a stake in a Chinese

lender. That made a comparison with the first quarter of this year

unfavorable from the get-go. But even excluding that impact, BBVA's

net profit would still have fallen 26%, Chief Executive Officer

Carlos Torres Vila told analysts on a conference call. Much of that

decline was driven by declines in currencies against the euro, he

added. BBVA has units from Mexico to Turkey and reports its

earnings in euros.

Net interest income was EUR4.15 billion, compared with EUR3.66

billion a year earlier. That also came in below analysts'

expectations of EUR4.3 billion.

The first quarter, Mr. Torres Vila told analysts, "has been an

abnormally low quarter in terms of earnings."

While results were "well below" what investors had anticipated,

Mr. Torres Vila acknowledged, the nosedive in the share price was

also partly a market correction following a strong stock

performance this year, he later told journalists. Some analysts

concurred.

BBVA's bank in Mexico, Bancomer, is the biggest driver of

profit. Net profit there declined to EUR489 million in the quarter

from EUR525 million a year earlier.

A decline in oil prices hit the Mexican peso hard in the first

quarter. Mexico relies on oil revenue to finance a large portion of

its annual budget.

"Despite low oil prices, [there's] no signs of credit stress as

the nonperforming loan ratio remains flat" quarter-on-quarter,

Bernstein analyst Johan De Mulder pointed out in a research

report.

BBVA's results in South America were weakened by currency

upheaval, too.

In Argentina, the peso has fallen sharply since December, when

newly-elected President Mauricio Macri unshackled the currency from

government controls to attract investors. Also, the Venezuelan

currency fell 72% in the first quarter of this year compared a year

earlier.

High inflation in those two countries also pushed BBVA's costs

higher in the region.

For BBVA's Spanish banking unit, executives painted a bleak

outlook as lenders in the country battle negative interest rates,

historically sluggish demand for mortgages and stiff competition on

business loans.

Spain's third-largest lender CaixaBank SA also reported a

decline in lending income on Thursday, further dimming the outlook

for Spanish banks. CaixaBank shares were down 3.5% in late

afternoon trading in Madrid.

"Loan volumes in Spain have not performed well," BBVA CFO Jaime

Sáenz de Tejada told analysts. It will be more of challenge to grow

total loan volume in Spain this year than executives had initially

anticipated, he added, as the rate at which borrowers repay their

existing loans continues to outpace the rate at which other

borrowers take out new loans.

Borrowers in the public sector in particular, Mr. Sáenz de

Tejada said, are deleveraging.

An 18% increase in costs in the Spanish banking unit was driven

by the incorporation of bailed-out Spanish lender Catalunya Banc in

April of last year. That helped to push up costs overall at BBVA in

the first quarter compared with a year earlier.

Trading income plummeted in Spain, which the bank attributed to

a "very complex quarter" in the markets. BBVA's Spanish banking

unit saw a decline in first-quarter net profit to EUR234 million

from EUR307 million.

The weak results in Spain are one factor likely to drive

downgrades on analysts' expectations of BBVA's earnings, Citigroup

analyst Stefan Nedialkov wrote in a research note Thursday. "BBVA's

performance is in stark contrast to Santander's beat yesterday,

especially in Spain," Mr. Nedialkov added.

On Wednesday, Spanish peer Banco Santander SA reported a 5%

decline in first-quarter profit on weaker lending and fee income,

as currency turmoil from the U.K. to recession-hit Brazil squeezed

profits. Analysts had expected weaker results and Santander's

shares closed up 1.6% on Wednesday in Madrid.

BBVA's U.S. unit saw a plunge in net profit in the first quarter

as the bank hiked loan-loss provisions as the decline in oil prices

has hit energy as well as metals and mining companies. "It has been

a bad quarter in the U.S.," Mr. Torres Vila said.

BBVA reported a slight increase in its capital ratio to 10.54%

as of March 31, under international regulations known as "fully

loaded" Basel III criteria. Mr. Torres Vila said the bank planned

to reach an 11% "fully loaded" ratio sometime next year.

Like other lenders, Lloyds has been struggling as low interest

rates eat into profitability. The bank said it was accelerating

cost-reduction plans, while ratcheting back mortgage lending as the

U.K. buy-to-let mortgage market starts to cool. Lloyds will review

its three-year strategy, launched in 2014, should it hit

cost-saving targets ahead of time, said Chief Financial Officer

George Culmer.

--Jeannette Neumann

(END) Dow Jones Newswires

April 29, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

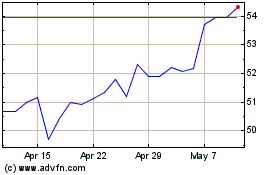

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024