RNS Number:8991C

Redrow PLC

14 September 2004

Tuesday 14 September 2004

Redrow plc today announces its Preliminary results for the 12 months to 30 June

2004:

Highlights:

June 2004 June 2003 Increase

#m except where indicated

Turnover 670.3 608.3 +10.2%

Operating Profit 132.7 113.7 +16.7%

Profit before tax 124.1 106.1 +17.0%

Return on capital employed 29.4% 31.3%

Earnings per share - basic (pence) 54.8 46.9 +16.8%

Dividend per share (pence) 9.0 7.5 +20.0%

* Profit before tax 17.0% higher at #124.1m (2003: #106.1m)

* Proposed full year dividend per share increased by 20.0% to 9.0p (2003: 7.5p)

with commitment to increase by the same amount extended to financial years

ended June 2005 and June 2006

* Full year operating margins in Homes at 19.8% (2003: 18.7%) with operating

margins in the second half of the financial year at 20.0% (H2 2003: 19.0%)

* Current land bank increased to 17,400 plots (June 2003: 16,000) representing

4 years' supply with another year of significant contribution from the

forward land bank

* Record forward sales position of #398m (2003: #304m)

Commenting on the results, Robert Jones, Chairman of Redrow plc said:

"Redrow has again performed strongly, setting a new record for profit before tax

of #124.1m.

Looking to the future, Redrow entered the new financial year with record forward

sales and a strong and efficient land bank. The Group has been positioned to

meet the challenges of tomorrow and to deliver profitable and sustainable

growth."

Enquiries:

Paul Pedley, Chief Executive Redrow plc

David Arnold, Group Finance Director 0207 404 5959 (14 September)

01244 520044 (thereafter)

Patrick Handley/Nina Coad Brunswick Public Relations

0207 404 5959

Further information on Redrow plc can be found at www.redrow.co.uk including,

from 9.00 am, a copy of the Preliminary Results Presentation Pack.

CHAIRMAN'S STATEMENT

Redrow has again performed strongly, setting a new record for profit before tax

of #124.1m in the year to June 2004, an increase of 17.0% on the previous year.

I am therefore pleased to confirm that the Board is recommending a final

dividend of 6.0p per share that will bring the total for the year to 9.0p, an

increase of 20.0%, in line with the announcement made in December 2003.

The Company remains committed to planning and managing the business to deliver

profitable and sustainable growth. During the last three years, a number of

successful initiatives have been undertaken to further this objective, in

particular our geographical expansion, our investment in people, the development

of our product range and the expansion of our land holdings. This enables the

Board to be confident about the Group's capabilities in the future and, as a

result, I am pleased to confirm that the Board intends, subject to unforeseen

circumstances, not only to increase the dividend by 20.0% in the years to June

2004 and 2005 but to extend that commitment by a further year to June 2006.

The Company has increased the number of legal completions in every year since

1990 whilst enhancing the quality of its financial returns with operating

margins and return on capital employed both continuing to be maintained at the

top end of sector performance. In the year to June 2004, operating margins

increased to 19.8% and return on capital employed was 29.4%. Since the

flotation in June 1994, the quality of returns coupled with our belief in

listening to the views of our shareholders has resulted in Redrow delivering a

compound annual growth rate of 21.4% in reported earnings per share and a 12.2%

compound annual growth rate in dividend per share. Total shareholder return

over the period has been 13.1% per annum.

The quality of people in our business is critical to our future. The Redrow

team, in its widest sense, is exceptionally strong, harnessing talented and hard

working employees at every level together with its supplier and sub-contractor

base. Our collective futures lie in the mutual objective of delivering to our

customers high quality products in which to live and work in first class

environments and we are grateful to all of them for their enthusiasm and

commitment.

At the core of ensuring the quality of the Redrow team is our strategy to make

Redrow the employer of choice within our industry. This requires Redrow not

only to offer competitive remuneration packages at all levels but also to

provide opportunities for our employees to meet their full potential and thereby

contribute to the future success of the Company. The new training centre

coupled with enhanced induction and appraisal processes are important elements

in achieving this goal and are already contributing to a reduced level of staff

turnover.

At Board level, the talents and experience of non-executive directors provide an

important contribution in support of the Executive Team. I would like to take

this opportunity to thank Bob Williams, who retired in November 2003, for his

invaluable assistance over 9 years, especially in his role as Audit Committee

Chairman and for his experience on commercial property development. We are

pleased to welcome Malcolm King, Senior Partner at King Sturge, in his place and

look forward to his contribution to the Board.

The securing of land opportunities whilst meeting the challenges of the planning

system remains one of the distinguishing characteristics of Redrow, and we have

made further progress this year, expanding the land bank with planning

permission to 15,000 plots. This is, however, only part of an extensive land

pipeline which not only includes land with planning but not yet taken into

ownership, but also sites being taken through the planning system, and

identified as allocated residential land within emerging local plans. This

places Redrow in a very strong position with regard to future development, with

the vast majority of the land necessary to develop the Company over the next

three years already under our control. Redrow is therefore well positioned to

continue its expansion, should market conditions be appropriate. Furthermore

the vast majority of the land is both brownfield and in sustainable locations

and therefore in accordance with the Government's own declared planning

objectives.

In March 2004, the Barker Review of Housing Supply was published. Redrow

welcomed its publication believing it to be a balanced assessment of the housing

issues facing the UK and the Review included many sensible recommendations to

address the critical question of how to secure the country's future housing

needs. Redrow played an active role in providing information for the original

report and continues to engage constructively with Government in the

consultation process, principally through the industry's representative body,

the House Builders Federation. Redrow hopes to see a positive outcome from this

consultation process, which would manifest itself in the increased availability

of land for development and a more responsive planning system. Whilst the Group

is extremely well placed to capitalise on such an outcome there remains,

nevertheless, a number of significant challenges before the recommendations of

the Barker Review can be said to have been fully embraced by the Government. It

is the Board's view therefore that any significant change for the good arising

from the Barker Review is more likely to be felt in the medium to long term.

Meanwhile, we continue to witness a lengthening in the time taken to achieve

planning across the UK and, in the North West of England, the introduction of a

moratorium on new planning consents which is at odds with pronouncements from

Government seeking to increase housing supply.

Building methods continue to change, recognising both the development of new

materials and modern methods of construction. Against a background of

continuing skill shortages, these initiatives are of considerable importance if

we are to continue to deliver a substantial building programme. Our joint

venture with Corus, Framing Solutions, is an important ingredient in achieving

these objectives, as are the initiatives stemming from our own research and

development function.

Redrow recognises its wider corporate social responsibilities. I would

particularly like to highlight the considerable progress made in the areas of

Health and Safety, where in 2004 we received a RoSPA award, and Customer

Service, where new procedures were implemented across the Group from July 2004.

The Board believes it has a responsibility to the communities in which it

operates and in particular takes a very active role in educating schoolchildren

about the housebuilding industry and especially the Health and Safety issues

associated with construction sites.

Looking to the future, Redrow entered the new financial year with record forward

sales and a strong and efficient land bank. Whilst the recent strength of the

market has moderated back to a more sedate and sustainable level, the

fundamentals of the housing market remain robust and the deficit between

people's aspirations to own a home and national supply remains considerable. In

the context of continuing economic confidence and high levels of employment,

home owning remains the preferred choice of the vast majority of our fellow

citizens. Redrow has been positioned to meet the challenges of tomorrow and to

deliver profitable and sustainable growth for not only the benefit of our

shareholders, but also our staff, customers and the community as a whole.

Robert Jones

Chairman

CHIEF EXECUTIVE'S REVIEW

This year represents the 30th anniversary of the formation of Redrow and its

10th anniversary as a quoted company. Over those ten years, profit before tax

has increased from #21.3m to #124.1m, and reported earnings per share from 7.9p

to 54.8p, representing compound annual growth of 19.3% and 21.4% respectively,

the growth in earnings per share being enhanced by the #115.0m share buy back

effected in September 2000. Financial returns, in particular operating margin

and return on capital employed, have been maintained at the forefront of sector

performance, whilst Redrow's commitment to quality and corporate social

responsibility has been acknowledged through a number of important awards.

The most significant recent achievement, however, has been the positioning of

Redrow to meet the challenges of tomorrow. The first fundamental key to success

is our people. Accordingly, our management teams have been strengthened to

ensure that the clear communication of Redrow objectives is complemented by

effective management within the operating companies. Furthermore, the

development teams and project management capability of Redrow Commercial have

been embedded within the overall Group structure, so providing an improved focus

on and delivery of mixed use developments.

In addition, the geographical coverage of Redrow has been extended, with the

formation of Redrow Homes (South Midlands) last year and Redrow Homes (West

Country) this year. We intend to extend this coverage further to encompass the

East Midlands region in the near future whilst, at the same time, establishing a

"Regeneration Team" to focus on the highly important East Thames Corridor so as

to capitalise on this major area of growth. Redrow is a truly national provider

of homes and the expanded corporate and management structure will have the

potential to deliver 7,000 legal completions per annum.

The second fundamental key to success is land. As a result of our long term

land strategy, the financial year to June 2004 has witnessed significant growth

in our land holdings, so underpinning the future development of the Group.

However, it is important that the strength of our land bank is complemented by

an efficient portfolio of well designed homes and, as previously reported, our

new housing range was launched this year. The new range combines the kerb

appeal and the quality of design with which Redrow has become synonymous, with

enhanced cost control and improved construction methods, particularly through

the use of increased off-site prefabrication.

The Barker Report, published in March 2004, highlighted the continuing

under-supply of new homes in the UK and the deficiencies of the current planning

regime. However, it also identified key challenges for our industry,

particularly in the areas of customer service, increased build efficiency and

training. The Group has already risen to these challenges so ensuring that

Redrow remains at the forefront of our sector.

RESIDENTIAL DEVELOPMENT

Redrow Homes has again reported record results, with turnover increasing by

11.2% to #662.7m and operating profit by 17.7% to #131.2m. These results were

secured from 4,284 (2003: 4,031) legal completions with an average selling price

of #154,700 (2003: #147,900). As is traditional for Redrow Homes, the legal

completion profile was marginally weighted towards the second half of the

financial year, reflecting the underlying level of organic growth, with 1,996

(46.6%) and 2,288 (53.4%) legal completions in the first and second halves

respectively.

I referred last year to the significant variations in our regional markets with

the Western and Northern Regions experiencing stronger market conditions than

the Southern Region. This trend continued through to Spring 2004, when, as a

result of increased interest rates and cautionary statements by the Governor of

the Bank of England, the housing market resumed its "soft landing", first

experienced in the Southern Region eighteen months earlier. As a result, the

rate of increase in selling prices is moderating, which, when combined with the

underlying level of demographic growth, a continuing shortage of quality housing

and sound consumer confidence driven by high levels of employment, should result

in a sustainable "normal" housing market.

To balance the impact of a "normal" housing market, Redrow Homes has capitalised

on the strength of its land bank and continued to expand the number of active

developments to in excess of 100. Reservations in the financial year to June

2004 totalled 4,566, in line with the previous year, although, as reported last

year, this comparison includes the highly successful launch, in January 2003, of

Altolusso, the In the City development in Cardiff, where 155 reservations were

secured over the initial launch period with a further 87 reservations prior to

the end of that financial year. This continuing strong sales performance

enabled Redrow Homes to end the year with a record forward sales position of

2,344 units with a sales value of #398m, representing increases of 13.7% and

30.9% respectively on last year.

Due to continuing cost pressures, particularly in relation to skilled trades,

the focus within Redrow Homes remains on innovation and the continuing

development of key relationships with major suppliers and subcontractors.

Whilst initially, new build techniques may be slightly more expensive, their

wider utilisation combined with increased efficiency will tend to reduce future

costs by comparison with traditional building methods. In particular, our

utilisation of light steel frames continues to increase and approximately 15% of

production in the year to June 2005 is expected to incorporate this method of

construction, almost double the level of the previous year. This will deliver

benefits to both Redrow Homes and its customers through reduced build times,

improved quality and lower maintenance.

Operating margins in Redrow Homes have continued to increase, recording levels

of 19.5% and 20.0% in the first and second halves respectively. The overall

annual operating margin of 19.8% compares with 18.7% last year. This

improvement is in part due to the strength of the sales market, particularly in

the Western and Northern Regions; it equally reflects the quality of the Group's

land bank and the active management of costs. However, the Board continues to

believe that, as house price inflation returns to its historical relationship

with earnings, operating margins will, over a period, fall to around 17.0% to

17.5%, a level which is currently considered to be sustainable in "normal"

market conditions. The period over which operating margins return to these

levels will be dependent upon the rate at which the inflationary element

currently contained within the Group's land bank unwinds.

The Government has significantly increased the focus on housing, particularly

through the commissioning of the Barker Report which clearly endorses the need

for a substantial increase in the provision of new homes. This provision is

weighted towards the South-East via the key growth areas of Milton Keynes,

Stansted, Ashford and the East Thames Corridor. The restructuring of the

Southern Region reported last year has been successfully implemented. Redrow

Homes (Southern) has relocated to Basingstoke in Hampshire and Redrow Homes

(Eastern) to Laindon, near Basildon in Essex. Redrow Homes (South Midlands),

based in Northampton, has delivered a meaningful contribution to profitability

in its first full year of trading. This restructuring, combined with the

establishment of a "Regeneration Team" to focus on the East Thames Corridor has

placed Redrow Homes in a strong position to benefit from the existing and future

Government initiatives to increase housing supply in these areas.

REGIONAL PERFORMANCE

It is the Group's regional coverage that provides the opportunity for future

growth. As currently structured, each of the three regions has the potential to

deliver between 2,000 and 2,500 legal completions per annum.

Northern, the Group's longest established region, delivered 2,108 legal

completions as compared with 1,982 in the previous year, an increase of 6.4%,

representing 49.2% (2003: 49.2%) of total completions. The average selling

price increased by 12.8% to #144,900 reflecting both an enhanced mix and the

strength of the housing market. Overall, turnover increased by 19.9% to #305.4m.

Southern achieved 1,042 (2003: 1,091) legal completions representing 24.3%

(2003: 27.1%) of total completions, with an average selling price of #180,300

(2003: #186,400). Both legal completions and average selling price were

marginally below the levels of the previous year due to the timing of

completions on In the City developments. Turnover for Southern totalled #187.9m

as compared with #203.4m in the previous year.

Western continues to make significant progress, with legal completions

increasing by 18.4% to 1,134 units and the average selling price by 3.9% to

#149,600 (2003: #144,000). As a result, turnover grew during the year by 23.0%

to #169.6m, to yield an increase over the last three years of 78.8%. This

clearly demonstrates Redrow's ability to deliver organic growth in new

geographical areas.

THE REDROW PORTFOLIO

The positioning of our product range in the market place, with an average

selling price substantially in line with the market average, and the maintenance

of a broad portfolio of designs are key components of Redrow's marketing

strategy. The retention of our distinct specifications, with the Contemporary

range more focused on newer customers to the homes market, the Sapphire and

Emerald ranges satisfying the needs of established home owners and our In the

City schemes meeting the aspirations of city dwellers, enables Redrow to fulfil

the requirements of a broad range of customers. Indeed, this targeting of a

broad range of customers is fundamental to maximising our potential market

share.

This diversity, however, must be tempered with the need for standardisation

within the construction process, so as to enhance build efficiency and maintain

sound cost control. The new housing range enables the achievement of all these

objectives. Based upon a highly flexible portfolio of generic house styles, the

new range combines the quality of design, both internally and externally, which

characterised the Heritage and Harwood ranges, with standardisation within the

construction process. It also maintains flexibility in elevational treatments

so as to match the local vernacular and satisfy the expectations of planning

authorities.

In reviewing the product portfolio over the last three years, the most

significant trend has been the increased contribution from the Contemporary

(formerly Harwood) specification. Whilst the Sapphire and Emerald (formerly

Heritage) specifications still represent, at 57.1%, the majority of legal

completions, over the last three years the contribution from the Contemporary

specification has risen to 32.2%, representing an increase from 695 to 1,379

legal completions. The average selling price of the Sapphire and Emerald ranges

combined was #178,300 whilst that of Contemporary was #114,800, representing

increases on the previous year of 7.4% and 13.9% respectively.

To complement the standard Redrow portfolio, several In the City developments

continue to be undertaken. The number of such schemes is carefully controlled

due to the significant management time involved in ensuring the successful

development of each scheme and, from a financial viewpoint, their capital

intensive nature. During the year, In the City schemes contributed 10.7% of

total legal completions, with an average selling price of #148,700. Of

particular significance was Velocity in Leeds which was completed during the

financial year and delivered 241 legal completions. In addition, Jupiter, the

continuing scheme in Birmingham, contributed 175 legal completions. Other In

the City schemes under development include Odyssey in London, Altolusso in

Cardiff, Neptune Marina in Ipswich and The Boardwalk in Eastbourne. To balance

the higher capital investment associated with In the City schemes, it is

important to maintain a very strong forward sales position. It is therefore

pleasing to report that by the financial year end 623 (2003: 595) forward sales

had been secured.

Over the last few years, the Government's focus on brownfield development,

particularly in our towns and cities, has resulted in a marked shift in the mix

of new homes provided by our industry. Indeed last year, the industry built

more apartments than detached homes. Redrow is not immune from this trend,

although as previously stated, the investment in capital intensive schemes is

carefully controlled. As a corollary to this mix change, over the last twelve

months the average size of a Redrow home has reduced by 4.5% to approximately

1,000 sq. ft. It is important in formulating future housing policy that the

Government recognises the needs and aspirations of all existing and future home

occupiers and maintains a balanced approach to the provision of new homes.

DEVELOPING A SUSTAINABLE FUTURE

Land is one of the fundamental keys to success and represents a major component

in the Group's future growth, profitability and sustainability. During the

financial year, the current land bank has been extended from 16,000 plots to

17,400 plots, representing, on an historic basis, a four year land supply. Of

these plots, 15,000 are owned with planning, an increase on the previous year of

1,000 plots. The balance of 2,400 plots is held under contract, awaiting, in

the vast majority of cases, the granting of a satisfactory planning consent.

However, it is the effectiveness of this land bank that is of primary

importance. Redrow Homes owns with planning all the land required to deliver

the budgeted completions for the new financial year. In addition, virtually

100% of the currently anticipated legal completions for the year ended June 2006

are on land owned or controlled by the Group. This places Redrow Homes in an

extremely strong position to continue to deliver sustainable growth in the

future.

During the financial year approximately 5,300 plots were acquired for a total

consideration of #179.1m, representing an average plot cost of #33,900. This

plot cost reflects an increasing trend due to the rebalancing of the overall

land bank in favour of the Western and Southern Regions to support future

growth. To a large degree, this trend is matched by a corresponding increase in

the average selling price of the homes to be constructed on the land acquired.

At the financial year end, the average plot cost of the land bank had increased

from #22,900 to #27,300, which, when expressed as a percentage of the average

future sales revenue, represents an increase from 14.8% last year to 16.1% for

the current year. At this level, our land bank remains one of the most cost

effective in the industry.

The forward land bank remains a major provider of development land, with 28% of

the land acquired during the current financial year sourced through this route,

complementing the 30% contribution during the previous financial year. At the

financial year end the forward land bank contained 1,800 plots where planning

permission has been secured and negotiations are proceeding for the acquisition

of the land. An additional 6,200 plots are allocated in either draft or

adopted local plans. The forward land with planning includes future major

developments at Dunfermline, Fife (700 homes) and Bracknell, Berkshire (750

homes). Our forward land bank, the quality of which is clearly demonstrated by

its planning pedigree and the annual contribution of development land, will

continue to support our financial returns in the future.

MIXED USE DEVELOPMENT

The combination of residential and commercial development expertise continues to

be an important component in the overall sourcing of future schemes. The

Government's focus on sustainable development, combined with major land

opportunities created by the drive for efficiency within the U.K.'s

manufacturing base, has provided Redrow with a number of opportunities to

utilise this mixed use expertise in tandem with our planning and project

management capabilities.

The most significant example of this approach secured during the financial year

is the 2,500 acre brownfield site at Bishopton near Glasgow. Redrow has

entered into a development agreement with BAE SYSTEMS to promote the site

through the planning system with the potential to provide to the Group a 100

acre commercial and retail development, together with a residential scheme of

approximately 1,500 homes.

At Buckshaw Village, near Chorley, Lancashire, significant progress has been

made during the year. Following the grant of a satisfactory planning

permission, the 31 acre land sale to Aldi Stores Ltd, for a 650,000 sq. ft.

distribution warehouse, was completed. In addition, a further 14,000 sq. ft.

industrial unit on the initial speculative phase was sold to complement a land

sale for the construction of a 110,000 sq. ft. distribution centre. Finally, as

regards the commercial element, an agreement to lease has been entered into with

Vernon Carus Ltd for a 100,000 sq. ft. unit, with the resulting investment

having already been pre-sold. Both practical and legal completion should occur

during the new financial year. Residentially, following a highly successful

sales launch twelve months ago, this multi-phased development has yielded

approaching 100 legal completions during the financial year, with in excess of a

further 50 forward sales.

At St. David's Park, following the successful completion of Optima, the next

phase of the office park, Vista, a 30,000 sq. ft. office complex, is nearing

practical completion. The investment sale of Evolution, the nursery office unit

scheme totalling approximately 15,000 sq. ft., was financially completed in July

2003. Outline planning permission has been secured for a further phase of

residential development with the associated detailed consent for 75 homes

currently being progressed.

Finally, at Stamford Park, Altrincham near Manchester, the construction of a

20,000 sq. ft. office, representing the second phase of this commercial

development, has recently been completed. The marketing launch is scheduled for

the autumn to coincide with the completion of the major infrastructure works

required to service the associated residential development of approximately 450

homes.

THE CHALLENGES OF THE BARKER REPORT

Kate Barker was commissioned by the Government to undertake a review of housing

supply. Her report represents one of the most authoritative reviews of our

industry and the 36 recommendations extend beyond the pure issues of land and

planning. Indeed, the report states that "Easier access to land and a

simplified planning system should encourage housebuilders to focus their efforts

on meeting the needs of customers."

The Barker Report identifies a number of key challenges of which three in

particular are fundamental to the future performance of our industry:

"The housebuilding industry must demonstrate increased levels of customer

satisfaction." During early 2003, Redrow undertook a detailed review of its

business methods.

A substantial part of that review focused on our interaction with our customers

and our ability, or otherwise, to satisfy them during what has become known as "

the customer journey". As a result of the review, new customer service

procedures were launched in July 2004, with management at all levels focused on

the expectations of our customers.

"The industry should develop a strategy to address barriers to modern methods of

construction." The formation three years ago of a dedicated research and

development team has enabled the Group to both focus on and evaluate various

modern methods of construction. In particular the team was instrumental in the

formation and subsequent management of Framing Solutions, our joint venture

company formed to develop and manufacture light steel frames for use in the

housebuilding industry.

"Housebuilders (must evaluate whether they) are investing sufficiently in their

own workforce training as well as addressing the skills needed for modern

methods of construction." One of the milestones of the last financial year was

the launch of training@redrow, our in-house training facility at Tamworth. Our

objective in establishing this facility was to provide a proper induction

programme combined with access to high quality training for all our staff. The

Centre will assist our staff in realising their career aspirations, help reduce

staff turnover and promote Redrow as the employer of choice within our industry.

During the last nine months, over 14,000 hours of staff training have been

provided, equating to 2,600 filled places, with an average attendance of two

training events per employee. Further, training@redrow was instrumental in

supporting the launch of the new customer service procedures.

THE FUTURE

Our primary objective is to deliver value to our Shareholders. To achieve this

objective, Redrow must deliver sustainable and profitable growth. As the

housing market returns to more "normal" levels, both operating margins and

future growth in selling prices will moderate. As a result, although mindful of

potential acquisition opportunities, our focus on the delivery of sustainable

organic growth whilst maintaining operating margins and return on capital at the

forefront of sector performance, will be of paramount importance. Redrow has

delivered growth in legal completions every year since 1990, arguably the peak

of the last housing market cycle, an achievement unique amongst our peer group.

Furthermore, Redrow has entered the new financial year with a record forward

sales position, a highly effective land bank to support future growth, together

with a broad portfolio of homes and a focused customer service strategy to

satisfy the requirements and aspirations of our customers.

Accordingly, barring the impact of factors totally outside the control of the

Group, Redrow can look forward with confidence to maintaining its record of

delivering long term sustainable growth and by so doing deliver value to our

Shareholders.

Paul Pedley

Chief Executive

CONSOLIDATED PROFIT AND LOSS ACCOUNT

12 MONTHS ENDED 30 JUNE 2004

Continuing Operations

2004 2003

Note #m #m

Turnover - total 2 670.3 608.3

- share of joint venture (0.4) (0.4)

Group turnover 669.9 607.9

Cost of sales (497.0) (457.7)

Gross Profit 172.9 150.2

Net operating expenses 2 (39.0) (35.7)

Operating profit 2 133.9 114.5

Share of operating loss of joint venture (1.2) (0.8)

Operating profit including share of joint 132.7 113.7

venture

Interest payable 2 (8.6) (7.6)

Profit on ordinary activities before taxation 2 124.1 106.1

Tax on profit on ordinary activities 3 (37.2) (31.8)

Profit on ordinary shares after taxation 86.9 74.3

Dividends 4 (14.3) (11.9)

Retained profit 72.6 62.4

Earnings per ordinary share

- basic 5 54.8p 46.9p

- diluted 5 54.6p 46.8p

Dividend per ordinary share 4 9.0p 7.5p

The Group has no material recognised gains or losses other than as shown above.

There is no material difference between the profit on ordinary activities before

taxation and the retained profit for the period stated above and their historic

cost equivalents.

CONSOLIDATED BALANCE SHEET

AS AT 30 JUNE 2004

Restated

As at As at

30 June 2004 30 June 2003

Note #m #m

Fixed assets

Tangible assets 22.5 16.5

Investment in joint venture 1.8 2.1

Other investments - 0.1

24.3 18.7

Current assets

Stocks and work in progress 7 713.4 579.0

Debtors 11.6 11.0

Bank and cash deposits 8 1.2 6.2

726.2 596.2

Creditors

Creditors due within one year (235.6) (174.5)

Creditors due after more than one year (134.4) (134.7)

Provisions for liabilities and charges (3.9) (3.7)

(373.9) (312.9)

Net assets 376.6 302.0

Capital and Reserves

Called up share capital 15.9 15.9

Share premium account 53.2 52.3

Revaluation reserve 0.3 0.3

Revaluation of shares in subsidiary - -

companies

Capital redemption reserve 7.0 7.0

Consolidation reserve 0.9 0.9

Profit and loss account 299.3 225.6

Equity shareholders' funds 6 376.6 302.0

CONSOLIDATED CASH FLOW STATEMENT

12 MONTHS ENDED 30 JUNE 2004

2004 2003

Note #m #m

Cash inflow from operating activities 10 24.5 59.6

Returns on investments and servicing of

finance

Net interest paid (8.0) (7.3)

Issue costs of new bank borrowings - (0.5)

Net cash (outflow) from returns on (8.0) (7.8)

investments and servicing of finance

Corporation tax paid (34.1) (29.2)

Capital expenditure and financial investment

Net (purchases)/sales of tangible fixed assets (7.1) (2.4)

Payment to joint venture (0.5) (2.7)

Acquisitions

Net overdrafts acquired - (7.9)

Dividends paid (12.7) (10.4)

Net cash (outflow) before financing (37.9) (0.8)

Financing and liquid resources

Issue of ordinary share capital 0.5 0.3

Cash deposits - restricted use (0.6) (0.6)

Net movement in bank borrowings 10.0 55.0

Net cash inflow from financing 9.9 54.7

(Decrease)/Increase in cash in period (28.0) 53.9

Cash deposits - restricted use 0.6 0.6

Net movement in bank borrowings (10.0) (55.0)

Net movement in issue costs of bank borrowings (0.1) 0.4

Change in net (debt) (37.5) (0.1)

Net (debt) at start of period (93.2) (93.1)

Net (debt) at end of period (130.7) (93.2)

NOTES

1. Basis of preparation

The above results and the accompanying notes do not constitute statutory

accounts within the meaning of Section 240 of the Companies Act 1985. They are

based on the full accounts which have received an unqualified report by the

auditors and will be filed with the Registrar of Companies. The Group has

adopted UITF Abstract 38 'Accounting for ESOP Trusts' which also amended UITF 17

'Employee Share Schemes' and as a result, the comparative figures for 2003 have

been restated (see Note 6).

2. Segmental information

Restated

2004 2003

#m #m

Turnover

Homes 662.7 596.0

Commercial 7.2 11.9

669.9 607.9

Share of Framing Solutions JV 0.4 0.4

670.3 608.3

Profit on ordinary activities before taxation

Homes 131.2 111.5

Commercial 2.7 3.0

133.9 114.5

Share of Framing Solutions JV (1.2) (0.8)

132.7 113.7

Interest (8.6) (7.6)

124.1 106.1

Net assets

Homes 487.1 376.9

Commercial 18.4 16.2

Share of Framing Solutions JV 1.8 2.1

507.3 395.2

Net (debt) (130.7) (93.2)

376.6 302.0

In 2004, net operating expenses were comprised of #39.7m administrative expenses

and other operating income of #0.7m in respect of the sale of an office.

In 2003, net operating expenses were comprised entirely of administrative

expenses.

3. Tax on Profit on Ordinary Activities

2004 2003

#m #m

Current year

UK corporation tax at 30% (2003:30%) 36.8 30.1

Under provision in respect of prior year 0.4 -

Share of Framing Solutions' taxation credit (0.4) (0.2)

36.8 29.9

Deferred tax

Origination and reversal of timing differences 0.4 1.9

37.2 31.8

Reconciliation of current taxation charge

Tax on total profits @ 30% (2003:30%) 37.2 31.8

Under provision in respect of prior year 0.4 -

Origination and reversal of timing differences (0.4) (1.9)

Rolled over capital gains net of expenses (0.4) -

not deductible for tax purposes

Current tax charge 36.8 29.9

4. Dividends

The final dividend of 6.0p will be recommended to shareholders for approval at

the Annual General Meeting on 3 November 2004. This dividend will be paid on 19

November 2004 to shareholders whose names are on the Register of Members at

close of business on 24 September 2004. The shares will become ex-dividend on

22 September 2004. This dividend, when added to the interim, makes a total

dividend for the year of 9.0p (2003: 7.5p).

5. Earnings per share

The calculation of the basic earnings per share of 54.8p (2003: 46.9p) is based

on Group profit on ordinary activities after taxation of #86.9m (2003: #74.3m)

and on the weighted average number of 10p ordinary shares in issue of 158.6m

(2003:158.3m). The average reflects an adjustment in respect of surplus shares

held in trust under the Redrow Long Term Share Incentive Plan.

Diluted earnings per share has been calculated in accordance with FRS 14 based

on the weighted average number of 10p ordinary shares in issue of 159.2m (2003:

158.8m).

6. Reconciliation of movement in equity shareholders' funds

Restated

2004 2003

#m #m

Opening shareholders' funds 302.0 239.2

Retained profit for the period 72.6 62.4

Shares issued 0.9 0.5

Credit in respect of LTSIP 1.6 0.1

Contribution to QUEST (0.5) (0.2)

Closing shareholders' funds 376.6 302.0

The change in accounting policy resulting from the adoption of UITF 38 and the

amended UITF 17 has resulted in the comparative figures for 2003 being restated

as follows:

Shareholders'

Funds

#m

At 1 July 2003 as previously reported 301.3

Shares owned by Employee Benefit Trust (0.5)

Credit in respect of UITF 17 amounts expensed 1.2

At 1 July 2003 as restated 302.0

7. Stocks and work-in-progress

2004 2003

#m #m

Land held for development 419.0 327.3

Work-in-progress 316.4 257.9

Stock of showhomes 7.0 9.4

742.4 594.6

Cash on account (29.0) (15.6)

713.4 579.0

8. Bank and cash deposits

Bank and cash deposits at 30 June 2004 of #1.2m (2003:#6.2m) represent balances

on deposit accounts.

9. Amounts due in respect of development land

2004 2003

#m #m

Due within one year 56.1 35.2

Due after more than one year 29.7 40.1

85.8 75.3

10. Analysis of cash flow from operating activities

2004 2003

#m #m

Total operating profit 132.7 113.7

Add back share of joint venture operating loss 1.2 0.8

Group operating profit 133.9 114.5

Depreciation, including profits and losses on

disposal of fixed assets 1.1 1.7

Increase in stock and work-in-progress (134.4) (61.1)

Movement in debtors, creditors

and provisions 23.9 4.5

Cash inflow from operating activities 24.5 59.6

11. Half Year Comparison

6 months to 6 months to

30 June 31 December

2004 2003

Unit sales 2,288 1,996

#m #m

Turnover 359.3 311.0

Operating profit 72.1 60.6

Interest (4.7) (3.9)

67.4 56.7

12. Annual General Meeting

The Annual General Meeting of Redrow plc will be held at St. David's Park Hotel,

St. David's Park, Flintshire on 3 November 2004, commencing at 12.00 noon.

A copy of this statement is available for inspection at the registered office.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFDFIDSLSEFU

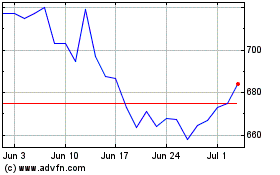

Redrow (LSE:RDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Redrow (LSE:RDW)

Historical Stock Chart

From Apr 2023 to Apr 2024