TIDMAHT

RNS Number : 8269F

Ashtead Group PLC

21 June 2012

Audited results for the year and unaudited results

for the fourth quarter ended 30 April 2012

Capitalising on structural change

Fourth quarter Year

2012 2011 Growth(1) 2012 2011 Growth(1)

GBPm GBPm % GBPm GBPm %

Underlying results(2)

Revenue 287.8 242.8 +17% 1,134.6 948.5 +21%

EBITDA 88.7 63.3 +37% 381.1 283.8 +36%

Operating profit 38.0 18.2 +102% 181.3 98.8 +87%

Profit before taxation 25.6 2.7 +736% 130.6 31.0 +332%

Earnings per share 4.0p 0.4p +820% 17.3p 4.0p +344%

Statutory results

Profit/(loss) before taxation 31.9 (19.9) n/a 134.8 1.7 -

Earnings per share 4.7p (2.6p) n/a 17.8p 0.2p -

(1) at constant exchange rates (2) before exceptionals,

intangible amortisation and fair value remeasurements

Highlights

-- Record Group pre-tax profit(2) for the year of GBP131m (2011: GBP31m)

-- Group EBITDA margins of 34% (2011: 30%)

-- GBP476m of capital invested in the business

-- Group RoI, including goodwill, grew to 12% (2011: 7%)

-- Net debt to EBITDA leverage reduced to 2.2 times (2011: 2.7 times)

-- Proposed final dividend of 2.5p making 3.5p for the year (2011: 3.0p)

Ashtead's chief executive, Geoff Drabble, commented:

"We are delighted to report record Group profits, encouragingly

delivered against a backdrop of end construction markets remaining

at historically low levels.

This performance demonstrates the success of our largely organic

investment strategy and our ability to generate significant revenue

growth from market share gains and translate this into stronger

margins through improved operational efficiency.

The momentum we have established, and the flexibility provided

by our strong balance sheet, allows us to anticipate further growth

with or without end market recovery. As a result, it is likely that

our profits in the coming year will be ahead of our previous

expectations."

Contacts:

Geoff Drabble Chief executive +44 (0)20 7726 9700

Ian Robson Finance director

Brian Hudspith Maitland +44 (0)20 7379 5151

Geoff Drabble, Ian Robson and Suzanne Wood will host a meeting

for equity analysts to discuss the results at 9.30 am on Thursday

21 June at the offices of Jefferies Hoare Govett at Vintners

Place,

68 Upper Thames Street, London, EC4V 3BJ. This meeting will be

webcast live via the Company's website at www.ashtead-group.com and

a replay will be available from shortly after the call concludes. A

copy of this announcement and the slide presentation used for the

meeting will also be available for download on the Company's

website. The usual conference call for bondholders will begin at

3pm (10am EST).

Analysts and bondholders have already been invited to

participate in the meeting and conference call but anyone not

having received dial-in details should contact the Company's PR

advisers, Maitland (Astrid Wright) at +44 (0)20 7379 5151.

Trading results

Revenue EBITDA Operating profit

2012 2011 2012 2011 2012 2011

Sunbelt in $m 1,506.6 1,224.7 540.8 388.2 289.9 162.1

Sunbelt in GBPm 945.7 782.7 339.4 248.1 181.9 103.6

A-Plant 188.9 165.8 49.5 43.1 7.3 2.7

Group central costs - - (7.8) (7.4) (7.9) (7.5)

Continuing operations 1,134.6 948.5 381.1 283.8 181.3 98.8

Net financing costs (50.7) (67.8)

Profit before tax, exceptionals,

remeasurements and amortisation 130.6 31.0

Exceptional items - (21.9)

Fair value remeasurements 7.3 (5.7)

Amortisation (3.1) (1.7)

Profit before taxation 134.8 1.7

Taxation (46.3) (0.8)

Profit attributable to equity holders of

the Company 88.5 0.9

Margins

Sunbelt 35.9% 31.7% 19.2% 13.2%

A-Plant 26.2% 26.0% 3.8% 1.6%

Group 33.6% 29.9% 16.0% 10.4%

Group revenue improved by 20% to GBP1,135m (2011: GBP949m)

reflecting strong growth in fleet on rent and yield in the US. This

revenue growth, continued cost control, lower net financing costs

and the business improvement programmes initiated over the last

three years combined to generate record underlying pre-tax profits

of GBP131m (2011: GBP31m). Exchange rate fluctuations did not have

a significant effect on year on year comparisons.

Rental revenue grew 23% in Sunbelt to $1,335m (2011: $1,084m)

including a 13% increase in average fleet on rent and 7% growth in

yield. Combined with new and used equipment, merchandise and

consumable sales, Sunbelt's total revenue also grew 23% to $1,507m

(2011: $1,225m). A-Plant's rental revenue growth was 9% to GBP168m

(2011: GBP154m). Fleet on rent grew 1% with yield increasing by

6%.

The strong performance seen all year at Sunbelt continued in the

fourth quarter when Sunbelt's rental revenue grew 19% including 13%

growth in fleet on rent and 6% yield improvement. A-Plant's Q4

rental revenue growth was 5% reflecting 3% yield improvement and a

1% increase in fleet on rent.

Operational efficiency enabled Sunbelt to deliver high

'drop-through' with its EBITDA increasing by $153m or 69% of the

net $222m increase in rental revenue, as adjusted to exclude the

$29m first-time impact of Empire's largely pass-through erection

and dismantling labour recovery billings. This high 'drop-through'

shows our significant operational gearing and meant that Sunbelt's

operating profit rose to $290m (2011: $162m). In a tough market,

A-Plant also delivered an improved performance with operating

profit of GBP7m (2011: GBP3m).

The strong 'drop-through' meant that Sunbelt's EBITDA margin

grew 4% to 36% whilst A-Plant's EBITDA margin held steady at 26%

despite a near doubling in its inherently lower margin non-rental

revenue to GBP21m. For the Group as a whole, the full year EBITDA

margin was 34% (2011: 30%).

Reflecting these operating results, Group EBITDA grew 34% to

GBP381m (2011: GBP284m). Depreciation expense increased 8% to

GBP200m reflecting the larger average fleet size whilst Group

operating profit grew 84% to GBP181m (2011: GBP99m). Net financing

cost reduced by GBP17m to GBP51m (2011: GBP68m) due principally to

the benefits of the debt refinancing undertaken in Spring 2011.

As a result, the underlying profit before tax for the Group

increased to GBP131m (2011: GBP31m). The tax charge for the year

was broadly stable at 34% (2011: 35%) of the underlying pre-tax

profit with underlying earnings per share increasing more than

four-fold to 17.3p (2011: 4.0p). After a non-cash credit of GBP7m

relating to the remeasurement to fair value of the early prepayment

option in our long-term debt and amortisation of acquired

intangibles of GBP3m (2011: GBP2m), the reported profit before tax

for the year was GBP135m (2011: GBP2m) whilst basic earnings per

share was 17.8p (2011: 0.2p).

Capital expenditure

We invested heavily in the past year to support our growth and

prepare for the future. Capital expenditure for the year was

GBP476m (2011: GBP225m) of which GBP426m was rental fleet

replacement with the balance spent on delivery vehicles, property

improvements and computers. Disposal proceeds were GBP90m (2011:

GBP65m), giving net capital expenditure in the year of GBP386m

(2011: GBP160m). The average net book value weighted age of the

Group's rental fleet at 30 April 2012 was 37 months (2011: 44

months).

Gross expenditure exceeded the GBP425m guidance provided in

March because we elected to bring forward into April deliveries

originally scheduled for May. As a result, our capital expenditure

guidance for 2012/13 is now lowered to reflect those early

deliveries with our current plan being for gross additions of

around GBP450m. The early deliveries do not impact the timing of

when the expenditure will be paid for and accordingly we still

expect net payments for capex of approximately GBP400m after

disposal proceeds of approximately GBP100m. This level of

expenditure is consistent with our strategy at this stage in the

cycle of investing in organic growth, whilst both de-ageing our

fleet and continuing to reduce our leverage.

Return on Investment

Sunbelt's pre-tax return on investment (operating profit to the

sum of net tangible assets, goodwill and other intangibles) rose to

14.0% (2011: 8.6%). In the UK, return on investment remained weak

at 2.9% (2011: 1.1%). For the Group as a whole, pre-tax return on

investment of 12.0% (2011: 7.0%) is already significantly ahead of

our pre-tax cost of capital.

Cash flow and net debt

Despite investing more than twice depreciation in our fleet, we

were pleased to have achieved our objective of largely funding our

organic growth from cash flow with only a net GBP13m free cash

outflow (cash from operations less net capex, interest and tax) in

the year (2011: GBP54m inflow). In addition GBP22m was spent on

acquisitions (Topp - GBP21m & Empire deferred consideration -

GBP1m) whilst dividends paid totalled GBP15m.

Reflecting our strong earnings growth, net debt to EBITDA

leverage reduced to 2.2 times (2011: 2.7 times) whilst, including a

GBP21m translation increase, year-end net debt was GBP854m (2011:

GBP776m).

The Group's two debt facilities remain committed until 2016

(March 2016 for the senior bank facility and August 2016 for the

$550m senior secured notes). In light of the Group's strong growth,

the committed senior bank facility was recently increased in size

from $1.4bn to $1.8bn with no changes to its pricing or other

terms. At 30 April 2012, ABL availability under the enlarged

facility was $735m - substantially above the level at which the

Group's entire debt package is covenant free.

Dividends

In accordance with our progressive dividend policy, with

consideration to both profitability and cash generation at a level

that is sustainable across the cycle, the Board is recommending a

final dividend of 2.5p per share (2011: 2.07p) making 3.5p for the

year (2011: 3.0p).

Payment of the 2011/12 dividend will cost GBP17.5m in total and

is covered five times by underlying earnings. If approved at the

forthcoming Annual General Meeting, the final dividend will be paid

on 7 September 2012 to shareholders on the register on 17 August

2012.

Current trading and outlook

The good growth of the past year has carried forward into May

with encouraging levels of fleet on rent and yield improvement. For

the month, rental revenue grew by 15% in Sunbelt and by 5% in

A-Plant.

The momentum we have established, and the flexibility provided

by our strong balance sheet, allows us to anticipate further growth

with or without end market recovery. As a result, it is likely that

our profits in the coming year will be ahead of our previous

expectations.

Forward looking statements

This announcement contains forward looking statements. These

have been made by the directors in good faith using information

available up to the date on which they approved this report. The

directors can give no assurance that these expectations will prove

to be correct. Due to the inherent uncertainties, including both

business and economic risk factors underlying such forward looking

statements, actual results may differ materially from those

expressed or implied by these forward looking statements. Except as

required by law or regulation, the directors undertake no

obligation to update any forward looking statements whether as a

result of new information, future events or otherwise.

Directors' responsibility statement on the annual report

The responsibility statement below has been prepared in

connection with the Company's Annual Report & Accounts for the

year ended 30 April 2012. Certain parts thereof are not included in

this announcement.

"The Board confirms to the best of its knowledge (a) the

consolidated financial statements, prepared in accordance with IFRS

as issued by the International Accounting Standards Board and IFRS

as adopted by the EU, give a true and fair view of the assets,

liabilities, financial position and profit of the Group; and (b)

the Directors' Report includes a fair review of the development and

performance of the business and the position of the Group, together

with a description of the principal risks and uncertainties that it

faces.

By order of the Board 20 June 2012"

CONSOLIDATED INCOME STATEMENT FOR THE THREE MONTHS ENDED 30

APRIL 2012

2012 2011

Before

Before exceptional Exceptional

amortisation Amortisation items items

and and and and

remeasurements remeasurements Total amortisation amortisation Total

GBPm GBPm GBPm GBPm GBPm GBPm

Fourth quarter - unaudited

Revenue

Rental revenue 246.4 - 246.4 208.7 - 208.7

Sale of new equipment,

merchandise and consumables 11.6 - 11.6 10.5 - 10.5

Sale of used rental equipment 29.8 - 29.8 23.6 - 23.6

287.8 - 287.8 242.8 - 242.8

Operating costs

Staff costs (84.8) - (84.8) (77.4) - (77.4)

Used rental equipment sold (28.0) - (28.0) (20.2) - (20.2)

Other operating costs (86.3) - (86.3) (81.9) - (81.9)

(199.1) - (199.1) (179.5) - (179.5)

EBITDA* 88.7 - 88.7 63.3 - 63.3

Depreciation (50.7) - (50.7) (45.1) - (45.1)

Amortisation of intangibles - (1.0) (1.0) - (0.7) (0.7)

Operating profit 38.0 (1.0) 37.0 18.2 (0.7) 17.5

Investment income 1.1 7.3 8.4 0.9 - 0.9

Interest expense (13.5) - (13.5) (16.4) (21.9) (38.3)

Profit/(loss) on ordinary

activities before taxation 25.6 6.3 31.9 2.7 (22.6) (19.9)

Taxation:

- current (2.0) - (2.0) (1.5) 2.5 1.0

- deferred (3.8) (2.6) (6.4) 0.6 5.2 5.8

(5.8) (2.6) (8.4) (0.9) 7.7 6.8

Profit/(loss) attributable to

equity holders of the Company 19.8 3.7 23.5 1.8 (14.9) (13.1)

Basic earnings per share 4.0p 0.7p 4.7p 0.4p (3.0p) (2.6p)

Diluted earnings per share 3.9p 0.7p 4.6p 0.4p (3.0p) (2.6p)

* EBITDA is presented here as an additional performance measure

as it is commonly used by investors and lenders.

All revenue and profit for the period is generated from

continuing activities.

Details of principal risks and uncertainties are given in the

Review of Fourth Quarter, Balance Sheet and Cash Flow accompanying

these financial statements.

CONSOLIDATED INCOME STATEMENT FOR THE YEAR ENDED 30 APRIL

2012

2012 2011

Before

Before exceptionals, Exceptionals,

amortisation Amortisation amortisation amortisation

and and and and

remeasurements remeasurements Total remeasurements remeasurements Total

GBPm GBPm GBPm GBPm GBPm GBPm

Year to 30 April 2012 - audited

Revenue

Rental revenue 1,005.9 - 1,005.9 846.5 - 846.5

Sale of new equipment,

merchandise and consumables 44.7 - 44.7 41.4 - 41.4

Sale of used rental

equipment 84.0 - 84.0 60.6 - 60.6

1,134.6 - 1,134.6 948.5 - 948.5

Operating costs

Staff costs (334.0) - (334.0) (291.0) - (291.0)

Used rental equipment

sold (74.6) - (74.6) (55.0) - (55.0)

Other operating costs (344.9) - (344.9) (318.7) - (318.7)

(753.5) - (753.5) (664.7) - (664.7)

EBITDA* 381.1 - 381.1 283.8 - 283.8

Depreciation (199.8) - (199.8) (185.0) - (185.0)

Amortisation of intangibles - (3.1) (3.1) - (1.7) (1.7)

Operating profit 181.3 (3.1) 178.2 98.8 (1.7) 97.1

Investment income 4.2 7.3 11.5 3.7 - 3.7

Interest expense (54.9) - (54.9) (71.5) (27.6) (99.1)

Profit on ordinary

activities before taxation 130.6 4.2 134.8 31.0 (29.3) 1.7

Taxation:

- current (7.7) - (7.7) (6.0) 2.9 (3.1)

- deferred (36.7) (1.9) (38.6) (4.9) 7.2 2.3

(44.4) (1.9) (46.3) (10.9) 10.1 (0.8)

Profit attributable

to

equity holders of the

Company 86.2 2.3 88.5 20.1 (19.2) 0.9

Basic earnings per share 17.3p 0.5p 17.8p 4.0p (3.8p) 0.2p

Diluted earnings per

share 16.9p 0.4p 17.3p 4.0p (3.8p) 0.2p

* EBITDA is presented here as an additional performance measure

as it is commonly used by investors and lenders.

All revenue and profit for the period is generated from

continuing activities.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited Audited

Three months Year to

to

30 April 30 April

2012 2011 2012 2011

GBPm GBPm GBPm GBPm

Profit/(loss) attributable to equity holders

of the Company for the period 23.5 (13.1) 88.5 0.9

Foreign currency translation differences (8.4) (9.0) 4.5 (17.5)

Actuarial (loss)/gain on defined benefit pension

scheme (6.2) 0.8 (6.2) 12.9

Tax on defined benefit pension scheme 1.5 0.5 1.5 (3.4)

Total comprehensive income for the period 10.4 (20.8) 88.3 (7.1)

CONSOLIDATED BALANCE SHEET AT 30 APRIL 2012

Audited

2012 2011

GBPm GBPm

Current assets

Inventories 13.4 11.5

Trade and other receivables 178.0 155.3

Current tax asset 2.6 2.3

Cash and cash equivalents 23.4 18.8

217.4 187.9

Non-current assets

Property, plant and equipment

- rental equipment 1,118.4 914.5

- other assets 145.0 121.7

1,263.4 1,036.2

Intangible assets - brand names and other acquired

intangibles 21.7 12.3

Goodwill 371.0 354.9

Deferred tax asset - 1.1

Defined benefit pension fund surplus 3.4 6.1

Other financial assets - derivatives 7.2 -

1,666.7 1,410.6

Total assets 1,884.1 1,598.5

Current liabilities

Trade and other payables 265.6 174.6

Current tax liability 2.8 2.4

Debt due within one year 2.1 1.7

Provisions 11.3 9.6

281.8 188.3

Non-current liabilities

Debt due after more than one year 875.6 792.8

Provisions 21.7 23.3

Deferred tax liabilities 150.3 112.7

1,047.6 928.8

Total liabilities 1,329.4 1,117.1

Equity

Share capital 55.3 55.3

Share premium account 3.6 3.6

Capital redemption reserve 0.9 0.9

Non-distributable reserve 90.7 90.7

Own shares held by the Company (33.1) (33.1)

Own shares held through the ESOT (6.2) (6.7)

Cumulative foreign exchange translation differences 7.1 2.6

Retained reserves 436.4 368.1

Equity attributable to equity holders of the

Company 554.7 481.4

Total liabilities and equity 1,884.1 1,598.5

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 APRIL 2012

Own Own Cumulative

Audited shares shares foreign

Share Capital Non- held held exchange

by

Share premium redemption distributable the through translation Retained

capital account reserve reserve Company the differences reserves Total

ESOT

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 May 2010 55.3 3.6 0.9 90.7 (33.1) (6.3) 20.1 369.1 500.3

Profit for the

period - - - - - - - 0.9 0.9

Other

comprehensive

income:

Foreign

currency

translation

differences - - - - - - (17.5) - (17.5)

Actuarial gain

on

defined

benefit

pension scheme - - - - - - - 12.9 12.9

Tax on defined

benefit

pension

scheme - - - - - - - (3.4) (3.4)

Total

comprehensive

income

for the period - - - - - - (17.5) 10.4 (7.1)

Dividends paid - - - - - - - (14.6) (14.6)

Own shares

purchased

by

the ESOT - - - - - (0.4) - - (0.4)

Share-based

payments - - - - - - - 1.6 1.6

Tax on

share-based

payments - - - - - - - 1.6 1.6

At 30 April

2011 55.3 3.6 0.9 90.7 (33.1) (6.7) 2.6 368.1 481.4

Profit for the

period - - - - - - - 88.5 88.5

Other

comprehensive

income:

Foreign

currency

translation

differences - - - - - - 4.5 - 4.5

Actuarial loss

on

defined

benefit

pension

scheme - - - - - - - (6.2) (6.2)

Tax on defined

benefit

pension scheme - - - - - - - 1.5 1.5

Total

comprehensive

income

for the period - - - - - - 4.5 83.8 88.3

Dividends paid - - - - - - - (15.3) (15.3)

Own shares

purchased

by

the ESOT - - - - - (3.5) - - (3.5)

Share-based

payments - - - - - 4.0 - (1.5) 2.5

Tax on

share-based

payments - - - - - - - 1.3 1.3

At 30 April

2012 55.3 3.6 0.9 90.7 (33.1) (6.2) 7.1 436.4 554.7

CONSOLIDATED CASH FLOW STATEMENT FOR THE YEAR ENDED 30 APRIL

2012

Audited

2012 2011

GBPm GBPm

Cash flows from operating activities

Cash generated from operations before exceptional

items and changes in rental equipment 364.6 279.7

Exceptional operating costs paid (3.3) (5.5)

Payments for rental property, plant and equipment (357.8) (182.2)

Proceeds from disposal of rental property, plant

and equipment 83.4 55.0

Cash generated from operations 86.9 147.0

Financing costs paid (net) (49.1) (66.7)

Exceptional financing costs paid - (6.5)

Tax paid (net) (7.4) (4.3)

Net cash from operating activities 30.4 69.5

Cash flows from investing activities

Acquisition of businesses (21.9) (34.8)

Payments for non-rental property, plant and

equipment (48.2) (20.4)

Proceeds from disposal of non-rental property,

plant and equipment 6.8 4.5

Payments for purchase of intangible assets (1.7) -

Net cash used in investing activities (65.0) (50.7)

Cash flows from financing activities

Drawdown of loans 153.8 597.8

Redemption of loans (94.3) (634.5)

Capital element of finance lease payments (1.5) (3.0)

Purchase of own shares by the ESOT (3.5) (0.4)

Dividends paid (15.3) (14.6)

Net cash from/(used in) financing activities 39.2 (54.7)

Increase/(decrease) in cash and cash equivalents 4.6 (35.9)

Opening cash and cash equivalents 18.8 54.8

Effect of exchange rate differences - (0.1)

Closing cash and cash equivalents 23.4 18.8

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

The financial statements for the year ended 30 April 2012 were

approved by the directors on 20 June 2012. This preliminary

announcement of the results for the year ended 30 April 2012

contains information derived from the forthcoming 2011/12 Annual

Report & Accounts and does not contain sufficient information

to comply with International Financial Reporting Standards (IFRS)

and does not constitute the statutory accounts for the purposes of

section 435 of the Companies Act 2006. The 2010/11 Annual Report

& Accounts has been delivered to the Registrar of Companies.

The 2011/12 Annual Report & Accounts will be delivered to the

Registrar of Companies and made available on the Group's website at

www.ashtead-group.com in July 2012. The auditor's reports in

respect of both years are unqualified, do not include a reference

to any matter by way of emphasis without qualifying the report and

do not contain a statement under section 498(2) or (3) of the

Companies Act 2006.

The results for the year ended and quarter ended 30 April 2012

have been prepared in accordance with relevant IFRS and the

accounting policies set out in the Group's Annual Report &

Accounts for the year ended 30 April 2011 except for the adoption

of the 'Amendments to IFRS 7 Financial instruments: disclosures -

transfers of financial assets'. This amendment has no impact on the

consolidated results or financial position of the Group.

The financial statements have been prepared on the going concern

basis. After reviewing the Group's annual budget, plans and

financing arrangements, the directors consider that the Group has

adequate resources to continue in operation for the foreseeable

future and consequently that it is appropriate to adopt the going

concern basis in preparing the financial statements.

The figures for the fourth quarter are unaudited.

The exchange rates used in respect of the US dollar are:

2012 2011

Average for the quarter ended 30 April 1.59 1.62

Average for the year ended 30 April 1.59 1.56

At 30 April 1.62 1.67

2. Segmental analysis

Operating

profit before Operating

Revenue amortisation Amortisation profit

Three months to 30 April GBPm GBPm GBPm GBPm

2012

Sunbelt 237.2 38.4 (0.5) 37.9

A-Plant 50.6 1.9 (0.5) 1.4

Corporate costs - (2.3) - (2.3)

287.8 38.0 (1.0) 37.0

2011

Sunbelt 198.2 20.5 (0.3) 20.2

A-Plant 44.6 (0.4) (0.4) (0.8)

Corporate costs - (1.9) - (1.9)

242.8 18.2 (0.7) 17.5

Year to 30 April

2012

Sunbelt 945.7 181.9 (1.4) 180.5

A-Plant 188.9 7.3 (1.7) 5.6

Corporate costs - (7.9) - (7.9)

1,134.6 181.3 (3.1) 178.2

2011

Sunbelt 782.7 103.6 (0.8) 102.8

A-Plant 165.8 2.7 (0.9) 1.8

Corporate costs - (7.5) - (7.5)

948.5 98.8 (1.7) 97.1

Other

financial

Taxation assets -

Segment assets Cash assets derivatives Total assets

At 30 April 2012

Sunbelt 1,549.4 - - - 1,549.4

A-Plant 301.4 - - - 301.4

Corporate items 0.1 23.4 2.6 7.2 33.3

1,850.9 23.4 2.6 7.2 1,884.1

At 30 April 2011

Sunbelt 1,284.4 - - - 1,284.4

A-Plant 291.8 - - - 291.8

Corporate items 0.1 18.8 3.4 - 22.3

1,576.3 18.8 3.4 - 1,598.5

3. Operating costs

2012 2011

Before Before

amortisation Amortisation Total amortisation Amortisation Total

GBPm GBPm GBPm GBPm GBPm GBPm

Three months to 30 April

Staff costs:

Salaries, bonuses and commissions 76.0 - 76.0 69.8 - 69.8

Social security costs 7.2 - 7.2 7.1 - 7.1

Other pension costs 1.6 - 1.6 0.5 - 0.5

84.8 - 84.8 77.4 - 77.4

Used rental equipment sold 28.0 - 28.0 20.2 - 20.2

Other operating costs:

Vehicle costs 21.0 - 21.0 20.1 - 20.1

Spares, consumables & external

repairs 17.1 - 17.1 15.1 - 15.1

Facility costs 11.3 - 11.3 11.5 - 11.5

Other external charges 36.9 - 36.9 35.2 - 35.2

86.3 - 86.3 81.9 - 81.9

Depreciation and amortisation:

Depreciation 50.7 - 50.7 45.1 - 45.1

Amortisation of acquired

intangibles - 1.0 1.0 - 0.7 0.7

50.7 1.0 51.7 45.1 0.7 45.8

249.8 1.0 250.8 224.6 0.7 225.3

Year to 30 April

Staff costs:

Salaries, bonuses and commissions 304.0 - 304.0 266.1 - 266.1

Social security costs 24.1 - 24.1 22.6 - 22.6

Other pension costs 5.9 - 5.9 2.3 - 2.3

334.0 - 334.0 291.0 - 291.0

Used rental equipment sold 74.6 - 74.6 55.0 - 55.0

Other operating costs:

Vehicle costs 84.2 - 84.2 75.6 - 75.6

Spares, consumables & external

repairs 62.8 - 62.8 58.8 - 58.8

Facility costs 47.0 - 47.0 45.4 - 45.4

Other external charges 150.9 - 150.9 138.9 - 138.9

344.9 - 344.9 318.7 - 318.7

Depreciation and amortisation:

Depreciation 199.8 - 199.8 185.0 - 185.0

Amortisation of acquired

intangibles - 3.1 3.1 - 1.7 1.7

199.8 3.1 202.9 185.0 1.7 186.7

953.3 3.1 956.4 849.7 1.7 851.4

4. Exceptional items, amortisation and fair value remeasurements

Exceptional items are those items of financial performance that

are material and non-recurring in nature. Amortisation relates to

the periodic write off of acquired intangible assets. Fair value

remeasurements relate to embedded call options in the Group's

senior secured note issue. The Group believes these items should be

disclosed separately within the consolidated income statement to

assist in the understanding of the financial performance of the

Group. Underlying revenue, profit and earnings per share are stated

before exceptional items, amortisation of acquired intangibles and

fair value remeasurements.

Exceptional items, amortisation and fair value remeasurements

are set out below:

Three months to Year to 30 April

30 April

2012 2011 2012 2011

GBPm GBPm GBPm GBPm

Write off of deferred financing

costs - 15.4 - 15.4

Early redemption fee - 6.5 - 6.5

Fair value remeasurements (7.3) - (7.3) 5.7

Amortisation of acquired intangibles 1.0 0.7 3.1 1.7

(6.3) 22.6 (4.2) 29.3

Taxation 2.6 (7.7) 1.9 (10.1)

(3.7) 14.9 (2.3) 19.2

Fair value remeasurements relate to the changes in fair value of

the embedded call options in our senior secured note issue.

The items detailed in the table above are presented in the

income statement as follows:

Three months to Year to 30 April

30 April

2012 2011 2012 2011

GBPm GBPm GBPm GBPm

Amortisation of acquired intangibles 1.0 0.7 3.1 1.7

Charged in arriving at operating

profit 1.0 0.7 3.1 1.7

Investment income (7.3) - (7.3) -

Interest expense - 21.9 - 27.6

Charged in arriving at profit before

taxation (6.3) 22.6 (4.2) 29.3

Taxation 2.6 (7.7) 1.9 (10.1)

(3.7) 14.9 (2.3) 19.2

5. Financing costs

Three months to Year to 30 April

30 April

2012 2011 2012 2011

GBPm GBPm GBPm GBPm

Investment income:

Expected return on assets of defined

benefit

pension plan (1.1) (0.9) (4.2) (3.7)

Interest expense:

Bank interest payable 4.0 3.2 16.9 15.7

Interest payable on second priority

senior

secured notes 7.8 10.8 31.1 45.3

Interest payable on finance leases - - 0.2 0.2

Non-cash unwind of discount on defined

benefit

pension plan liabilities 0.7 0.9 3.0 3.5

Non-cash unwind of discount on self-insurance

provisions 0.4 0.3 1.3 1.4

Amortisation of deferred costs of

debt raising 0.6 1.2 2.4 5.4

Total interest expense 13.5 16.4 54.9 71.5

Net financing costs before exceptional

items and remeasurements 12.4 15.5 50.7 67.8

Exceptional items - 21.9 - 21.9

Fair value remeasurements (7.3) - (7.3) 5.7

Net financing costs 5.1 37.4 43.4 95.4

6. Taxation

The tax charge for the period has been computed using an

estimated effective rate for the year of 39% in the US (2011: 21%)

and 27% in the UK (2011: 31%). The blended effective rate for the

Group as a whole is 34% (2011: 35%).

The tax charge of GBP44.4m (2011: GBP10.9m) on the underlying

pre-tax profit of GBP130.6m (2011: GBP31.0m) can be explained as

follows:

Year to 30 April

2012 2011

GBPm GBPm

Current tax

- current tax on income for the year 8.1 7.3

- adjustments to prior years (0.4) (1.3)

7.7 6.0

Deferred tax

- origination and reversal of temporary differences 37.7 2.8

- adjustments to prior years (1.0) 2.1

36.7 4.9

Tax on underlying activities 44.4 10.9

Comprising:

- UK tax 10.1 11.0

- US tax 34.3 (0.1)

44.4 10.9

In addition, the tax charge of GBP1.9m (2011: credit of

GBP10.1m) on exceptional items, amortisation and fair value

remeasurements of GBP4.2m (2011: loss of GBP29.3m) consists of a

current tax credit of GBPnil (2011: GBP2.9m) relating to the UK, a

deferred tax credit of GBP0.5m (2011: GBP0.2m) relating to the UK

and a deferred tax charge of GBP2.4m (2011: credit of GBP7.0m)

relating to the US.

7. Earnings per share

Basic and diluted earnings per share for the three and twelve

months ended 30 April 2012 have been calculated based on the profit

for the relevant period and the weighted average number of ordinary

shares in issue during that period (excluding shares held in

treasury and by the ESOT over which dividends have been waived).

Diluted earnings per share is computed using the result for the

relevant period and the diluted number of shares (ignoring any

potential issue of ordinary shares which would be anti-dilutive).

These are calculated as follows:

Three months to Year to

30 April 30 April

2012 2011 2012 2011

Profit/(loss) for the financial period

(GBPm) 23.5 (13.1) 88.5 0.9

Weighted average number of shares

(m) - basic 498.8 497.7 498.3 497.7

-

diluted 509.7 505.6 511.2 504.2

Basic earnings per share 4.7p (2.6p) 17.8p 0.2p

Diluted earnings per share 4.6p (2.6p) 17.3p 0.2p

Underlying earnings per share (defined in any period as the

earnings before exceptional items, amortisation of acquired

intangibles and fair value remeasurements for that period divided

by the weighted average number of shares in issue in that period)

and cash tax earnings per share (defined in any period as

underlying earnings before other deferred taxes divided by the

weighted average number of shares in issue in that period) may be

reconciled to the basic earnings per share as follows:

Three months to Year to

30 April 30 April

2012 2011 2012 2011

Basic earnings per share 4.7p (2.6p) 17.8p 0.2p

Exceptional items, amortisation of acquired

intangibles and fair value remeasurements (1.2p) 4.6p (0.9p) 5.9p

Tax on exceptionals, amortisation and

remeasurements 0.5p (1.6p) 0.4p (2.1p)

Underlying earnings per share 4.0p 0.4p 17.3p 4.0p

Other deferred tax 0.7p (0.1p) 7.4p 1.0p

Cash tax earnings per share 4.7p 0.3p 24.7p 5.0p

8. Dividends

During the year, a final dividend in respect of the year ended

30 April 2011 of 2.07p (2010: 2.0p) per share and an interim

dividend for the year ended 30 April 2012 of 1.0p (2011: 0.93p) per

share were paid to shareholders costing GBP15.3m (2011:

GBP14.6m).

9. Property, plant and equipment

2012 2011

Rental Rental

equipment Total equipment Total

Net book value GBPm GBPm GBPm GBPm

At 1 May 914.5 1,036.2 969.7 1,101.6

Exchange difference 22.4 25.0 (55.9) (62.5)

Reclassifications (0.6) - (0.5) -

Additions 426.2 476.4 202.4 224.8

Acquisitions 2.1 2.8 11.7 12.1

Disposals (71.3) (77.2) (50.9) (54.8)

Depreciation (174.9) (199.8) (162.0) (185.0)

At 30 April 1,118.4 1,263.4 914.5 1,036.2

10. Called up share capital

Ordinary shares of 10p each:

2012 2011 2012 2011

Number Number GBPm GBPm

Authorised 900,000,000 900,000,000 90.0 90.0

Allotted, called up and

fully paid 553,325,554 553,325,554 55.3 55.3

At 30 April 2012, 50m shares were held by the Company and a

further 4.6m shares were held by the Company's Employee Share

Ownership Trust.

11. Notes to the cash flow statement

Year to 30 April

2012 2011

GBPm GBPm

a) Cash flow from operating activities

Operating profit before exceptional items and

amortisation 181.3 98.8

Depreciation 199.8 185.0

EBITDA before exceptional items 381.1 283.8

Profit on disposal of rental equipment (9.4) (5.6)

Profit on disposal of other property, plant and

equipment (1.1) (0.8)

Increase in inventories (0.4) (2.6)

Increase in trade and other receivables (20.2) (21.2)

Increase in trade and other payables 12.1 24.7

Exchange differences - (0.2)

Non-cash share-based remuneration expense 2.5 1.6

Cash generated from operations before exceptional

items

and changes in rental equipment 364.6 279.7

b) Reconciliation of net debt

(Increase)/decrease in cash in the period (4.6) 35.9

Increase/(decrease) in debt through cash flow 58.0 (39.7)

Change in net debt from cash flows 53.4 (3.8)

Exchange differences 20.6 (73.1)

Non-cash movements:

* deferred costs of debt raising 2.4 21.0

* capital element of new finance leases 2.2 2.6

Increase/(reduction) in net debt in the period 78.6 (53.3)

Opening net debt 775.7 829.0

Closing net debt 854.3 775.7

c) Analysis of net debt

1 May Exchange Cash Non-cash 30 April

2011 movement flow movements 2012

GBPm GBPm GBPm GBPm GBPm

Cash (18.8) - (4.6) - (23.4)

Debt due within 1

year 1.7 - (1.5) 1.9 2.1

Debt due after 1

year 792.8 20.6 59.5 2.7 875.6

Total net debt 775.7 20.6 53.4 4.6 854.3

d) Acquisitions

Year to 30 April

2012 2011

GBPm GBPm

Cash consideration paid 21.9 34.8

Details of the Group's cash and debt are given in the Review of

Fourth Quarter, Balance Sheet and Cash Flow accompanying these

financial statements.

12. Contingent liabilities

The Group is subject to periodic legal claims in the ordinary

course of its business, none of which is expected to have a

significant impact on the Group's financial position.

As previously reported, in Spring 2011, following audits of the

tax returns of the Group's US subsidiaries for the four years ended

30 April 2009, the US Internal Revenue Service ("IRS") issued

revised assessments and associated notices of interest and

penalties arising from its proposed reclassification of certain US

intercompany debt in those years from debt to equity and its

consequent proposed recharacterisation of US interest payments to

the UK as equity-like distributions. The revised assessments would

have resulted in additional net tax payments due of $31m together

with interest and penalties of $15m. We disagreed with these

assessments and defended our position vigorously.

Sunbelt and its advisers recently reached a satisfactory

preliminary agreement with the IRS Appeals team on these matters.

This preliminary agreement is expected to be documented and

formally agreed following further internal review within the IRS

during the coming fiscal year. There was no significant impact on

the 2012 financial statements as a result of the preliminary

agreement and the Board does not anticipate these issues generating

any material impact on the Group's future results or financial

position.

13. Acquisition of Topp Construction Services, Inc. ("Topp")

Sunbelt acquired the entire issued share capital of Topp

Construction Services, Inc. and its related company, Precision

Steel Works, LLC ("Precision") for US$33.5m (GBP21m) on 3 April

2012. Estimated additional consideration of US$1.9m (GBP1.2m) is

expected to become payable later in 2012 by way of tax

equalisation.

Topp is a specialist rental provider of air conditioning,

heating and dehumidification equipment based in Philadelphia with

16 branches located principally in major cities across the United

States. Precision runs a small assembly and manufacturing facility

in support of Topp's business.

The net assets acquired and the provisional goodwill arising on

the acquisition are as follows:

Acquiree's At provisional

book value fair value

GBPm GBPm

Net assets acquired

Trade and other receivables 1.6 1.6

Inventory 1.1 1.1

Cash and cash equivalents 0.1 0.1

Property, plant and equipment

- rental equipment 1.5 2.4

- other assets 0.7 0.7

Intangible assets (brand name, distribution

and non-

compete agreements and customer relationships) - 10.5

Trade and other payables (1.2) (1.2)

3.8 15.2

Consideration:

- cash paid 21.0

- deferred consideration (tax equalisation)

payable in cash 1.2

22.2

Goodwill 7.0

The goodwill arising can be attributed to the key management

personnel and workforce of the acquired business and to the

benefits the Group expects to derive from the acquisition. Subject

to agreement and payment to the vendor of the tax equalisation

charge, this goodwill will become deductible for tax purposes and

has been treated as such.

Trade receivables at acquisition were GBP1.5m at fair value, net

of GBP0.1m provision for debts which may not be collected, and had

a gross face value of GBP1.6m.

Topp's revenue and operating loss in the period from the date of

acquisition to 30 April 2012 were GBP0.5m ($0.8m) and GBP0.3m

($0.5m) respectively. Had the acquisition taken place on 1 May 2011

then Group reported revenue and operating profit for the year ended

30 April 2012 would have been higher by GBP12.9m ($20.6m) and

GBP2.9m ($4.7m) respectively.

REVIEW OF FOURTH QUARTER, BALANCE SHEET AND CASH FLOW

Fourth quarter Revenue EBITDA Operating profit

2012 2011 2012 2011 2012 2011

Sunbelt in $m 376.6 321.0 124.3 90.2 61.1 33.7

Sunbelt in GBPm 237.2 198.2 78.3 55.4 38.4 20.5

A-Plant 50.6 44.6 12.6 9.8 1.9 (0.4)

Group central costs - - (2.2) (1.9) (2.3) (1.9)

287.8 242.8 88.7 63.3 38.0 18.2

Net financing costs (12.4) (15.5)

Profit before tax, exceptionals,

remeasurements and amortisation 25.6 2.7

Exceptional items - (21.9)

Fair value remeasurements 7.3 -

Amortisation (1.0) (0.7)

Total Group profit before taxation 31.9 (19.9)

Margins

Sunbelt 33.0% 28.1% 16.2% 10.5%

A-Plant 24.8% 22.0% 3.6% -1.0%

Group 30.8% 26.1% 13.2% 7.5%

Fourth quarter results reflect continued progress at Sunbelt

with its rental revenue growing 19% to $323m (2011: $273m). This

comprised a 13% increase in average fleet on rent and 6% higher

yield. In the UK, A-Plant's fourth quarter rental revenue grew by

5% to GBP43m (2011: GBP41m) including 3% yield improvement and 1%

growth in average fleet on rent.

Total revenue growth for the Group of 19% included higher used

equipment sales revenue of GBP30m (2011: GBP24m) as we increased

capital expenditure and hence sold more used equipment.

Costs remained under close control as reflected in the high

'drop-through' seen all year with Sunbelt's EBITDA increasing by

$34m or 67% of the $50m increase in fourth quarter rental revenue.

Both businesses grew Q4 operating profit significantly with A-Plant

notably avoiding a loss in the seasonally weak fourth quarter this

year.

Group pre-tax profit before fair value remeasurements and

amortisation was GBP26m (2011: GBP3m). This reflected the operating

profit growth and lower net financing costs of GBP12m (2011:

GBP15m), mainly as a result of the benefits of the debt refinancing

undertaken in the fourth quarter of 2010/11. After a non-cash

credit of GBP7m relating to the remeasurement to fair value of the

early prepayment option in our long-term debt and GBP1m of

intangible amortisation, the statutory profit before tax was GBP32m

(2011: loss of GBP20m).

Balance sheet

Fixed assets

Capital expenditure in the year was GBP476m (2011: GBP225m) with

GBP426m invested in the rental fleet (2011: GBP202m). Capital

expenditure by division is as follows:

2012 2011

Growth Maintenance Total Total

Sunbelt in $m 295.9 300.3 596.2 295.0

Sunbelt in GBPm 182.2 185.0 367.2 176.9

A-Plant 14.6 44.4 59.0 25.5

Total rental equipment 196.8 229.4 426.2 202.4

Delivery vehicles, property improvements

and computers 50.2 22.4

Total additions 476.4 224.8

Expenditure on rental equipment was 89% of total capital

expenditure with the balance relating to the delivery vehicle

fleet, property improvements and computer equipment.

With good demand in the US, $296m of rental equipment capital

expenditure was spent on growth while $300m was invested in

replacement of existing fleet. The growth proportion is estimated

on the basis of the assumption that maintenance capital expenditure

in any period is equal to the original cost of equipment sold.

The average age of the Group's serialised rental equipment,

which constitutes the substantial majority of our fleet, at 30

April 2012 was 37 months (2011: 44 months) weighted on a net book

value basis. Sunbelt's fleet had an average age of 36 months (2011:

44 months) while A-Plant's fleet had an average age of 41 months

(2011: 42 months).

The original cost of the Group's rental fleet and the dollar and

physical utilisation for the year ended 30 April 2012 is shown

below:

Rental fleet at original cost LTM LTM

LTM LTM rental dollar physical

30 April 30 April average revenue utilisation utilisation

2012 2011

Sunbelt in $m 2,453 2,151 2,319 1,335 58% 70%

Sunbelt in GBPm 1,511 1,289 1,428 838 58% 70%

A-Plant 358 343 352 168 48% 65%

1,869 1,632 1,780 1,006

Dollar utilisation is defined as rental revenue divided by

average fleet at original (or "first") cost and, in the year ended

30 April 2012, was 58% at Sunbelt (2011: 51%) and 48% at A-Plant

(2011: 47%). Physical utilisation is time-based utilisation, which

is calculated as the daily average of the original cost of

equipment on rent as a percentage of the total value of equipment

in the fleet at the measurement date and, in the year ended 30

April 2012, was 70% at Sunbelt (2011: 68%) and 65% at A-Plant

(2011: 69%). At Sunbelt, physical utilisation is measured for

equipment with an original cost in excess of $7,500 which comprised

approximately 90% of its fleet at 30 April 2012.

Trade receivables

Receivable days at 30 April were 44 days (2011: 46 days). The

bad debt charge for the year ended 30 April 2012 as a percentage of

total turnover was 0.7% (2011: 0.8%). Trade receivables at 30 April

2012 of GBP149m (2011: GBP132m) are stated net of provisions for

bad debts and credit notes of GBP14m (2011: GBP14m) with the

provision representing 8.5% (2011: 9.4%) of gross receivables.

Trade and other payables

Group payable days were 70 days in 2012 (2011: 57 days) with

capital expenditure-related payables, which have longer payment

terms, totalling GBP133m (2011: GBP58m). Payment periods for

purchases other than rental equipment vary between seven and 45

days and for rental equipment between 30 and 120 days.

Cash flow and net debt

Year to 30 April

2012 2011

GBPm GBPm

EBITDA before exceptional items 381.1 283.8

Cash inflow from operations before exceptional

items and changes in rental equipment 364.6 279.7

Cash conversion ratio* 95.7% 98.6%

Maintenance rental capital expenditure paid (222.4) (182.2)

Payments for non-rental capital expenditure (49.9) (20.4)

Rental equipment disposal proceeds 83.4 55.0

Other property, plant and equipment disposal proceeds 6.8 4.5

Tax paid (7.4) (4.3)

Financing costs paid (49.1) (66.7)

Cash flow before growth capex and payment of exceptional

costs 126.0 65.6

Growth rental capital expenditure paid (135.4) -

Exceptional operating costs paid (3.3) (12.0)

Free cash flow (12.7) 53.6

Business acquisitions (21.9) (34.8)

Total cash (absorbed)/generated (34.6) 18.8

Dividends paid (15.3) (14.6)

Purchase of own shares by the ESOT (3.5) (0.4)

(Increase)/decrease in net debt (53.4) 3.8

* Cash inflow from operations before exceptional items and

changes in rental equipment as a percentage of EBITDA before

exceptional items.

Cash inflow from operations rose 30% to GBP365m (2011: GBP280m)

reflecting the 34% growth in EBITDA and good cash conversion. The

cash conversion ratio fell slightly to 96% (2011: 99%) due to the

higher gains on sale this year (GBP10.5m in 2011/12 v GBP6.4m in

2010/11) and the need to fund higher receivables which was partly

offset by higher payables.

Total payments for capital expenditure (rental equipment, other

PPE and purchased intangibles) during the year were GBP408m (2011:

GBP203m). Disposal proceeds received totalled GBP90m, giving net

payments for capital expenditure of GBP318m in the year (2011:

GBP143m). Interest payments reduced to GBP49m (2011: GBP67m)

reflecting the benefit of the debt refinancing undertaken in the

fourth quarter of 2010/11, whilst tax payments were GBP7m (2011:

GBP4m). Interest payments differ from the GBP51m net accounting

charge in the income statement due to non-cash interest

charges.

The Group generated GBP126m of net cash inflow before growth

capex in the year whilst there was a GBP13m outflow (2011: inflow

of GBP54m) after growth capex and the payment of exceptional costs

provided in earlier years relating to closed premises.

After GBP22m spent on acquisitions and GBP19m distributed to

shareholders through dividends and share purchases by our ESOT, the

increase in net debt from cash flow was GBP53m.

Net debt

2012 2011

GBPm GBPm

First priority senior secured bank debt 539.9 467.1

Finance lease obligations 3.8 3.0

9% second priority senior secured notes,

due 2016 334.0 324.4

877.7 794.5

Cash and cash equivalents (23.4) (18.8)

Total net debt 854.3 775.7

Net debt at 30 April 2012 was GBP854m (30 April 2011: GBP776m)

which includes a translation increase in the year of GBP21m

reflecting the weakening of the pound against the dollar. The

Group's EBITDA for the year ended 30 April 2012 was GBP381m and the

ratio of net debt to EBITDA was therefore 2.2 times at 30 April

2012 (2011: 2.7 times).

At year end $1.4bn was committed by our senior lenders under the

asset-based bank facility until March 2016 while the amount

utilised was $918m (including letters of credit totalling $25m).

Since year end the Company has obtained additional commitments from

its lenders which have increased the size of the asset-based bank

facility by $400m to $1.8bn with no other changes to its terms or

to the March 2016 maturity. The $550m 9% senior secured notes are

committed until August 2016.

Our debt facilities therefore remain committed for the long

term, with an average of 4.1 years remaining at 30 April 2012. The

weighted average interest cost of these facilities (including

non-cash amortisation of deferred debt raising costs) is

approximately 5%.

Financial performance covenants under the 9% senior secured note

issue are only measured at the time new debt is raised. There are

two financial performance covenants under the asset-based first

priority senior bank facility:

-- funded debt to LTM EBITDA before exceptional items not to exceed 4.0 times; and

-- a fixed charge ratio (comprising LTM EBITDA before

exceptional items less LTM net capital expenditure paid in cash

over the sum of scheduled debt repayments plus cash interest, cash

tax payments and dividends paid in the last twelve months) which

must be equal to or greater than 1.1.

These covenants do not, however, apply when availability (the

difference between the borrowing base and facility utilisation)

exceeds 12% of the facility size ($216m following the recent

increase in the facility size to $1.8bn discussed above). At 30

April 2012 excess availability under the enlarged bank facility was

$735m ($479m at 30 April 2011) meaning that covenants were not

measured at 30 April 2012 and are unlikely to be measured in

forthcoming quarters.

As a matter of good practice, we still, however, calculate the

covenant ratios each quarter. At 30 April 2012, as a result of the

significant investment in our rental fleet, the fixed charge ratio

did not meet the covenant requirement whilst the leverage ratio did

so comfortably. The fact the fixed charge ratio is currently below

1.1 times does not cause concern given the strong availability and

management's ability to flex capital expenditure downwards at short

notice. Accordingly, the accounts are prepared on the going concern

basis.

Financial risk management

The Group's trading and financing activities expose it to

various financial risks that, if left unmanaged, could adversely

impact on current or future earnings. Although not necessarily

mutually exclusive, these financial risks are categorised

separately according to their different generic risk

characteristics and include market risk (foreign currency risk and

interest rate risk), credit risk and liquidity risk.

Market risk

The Group's activities expose it primarily to interest rate and

currency risk. Interest rate risk is monitored on a continuous

basis and managed, where appropriate, through the use of interest

rate swaps whereas the use of forward foreign exchange contracts to

manage currency risk is considered on an individual non-trading

transaction basis. The Group is not exposed to commodity price risk

or equity price risk as defined in IFRS 7.

Interest rate risk

The Group has fixed and variable rate debt in issue with 38% of

the drawn debt at a fixed rate as at 30 April 2012. The Group's

accounting policy requires all borrowings to be held at amortised

cost. As a result, the carrying value of fixed rate debt is

unaffected by changes in credit conditions in the debt markets and

there is therefore no exposure to fair value interest rate risk.

The Group's debt that bears interest at a variable rate comprises

all outstanding borrowings under the senior secured credit

facility. The interest rates currently applicable to this variable

rate debt are LIBOR as applicable to the currency borrowed (US

dollars or pounds) plus 225bp.

The Group periodically utilises interest rate swap agreements to

manage and mitigate its exposure to changes in interest rates.

However, during the year ended and as at 30 April 2012, the Group

had no such outstanding swap agreements. The Group also holds cash

and cash equivalents, which earn interest at a variable rate.

Currency exchange risk

Currency exchange risk is limited to translation risk as there

are no transactions in the ordinary course of business that take

place between foreign entities. The Group's reporting currency is

the pound sterling. However, a majority of our assets, liabilities,

revenue and costs is denominated in US dollars. The Group has

arranged its financing such that virtually all of its debt is also

denominated in US dollars so that there is a natural partial offset

between its dollar-denominated net assets and earnings and its

dollar-denominated debt and interest expense. At 30 April 2012,

dollar denominated debt represented approximately 75% of the value

of dollar-denominated net assets (other than debt). Based on the

current currency mix of our profits and on dollar debt levels,

interest and exchange rates at 30 April 2012, a 1% change in the US

dollar exchange rate would impact pre-tax profit by GBP1.3m.

The Group's exposure to exchange rate movements on trading

transactions is relatively limited. All Group companies invoice

revenue in their respective local currency and generally incur

expense and purchase assets in their local currency. Consequently,

the Group does not routinely hedge either forecast foreign exchange

exposures or the impact of exchange rate movements on the

translation of overseas profits into sterling. Where the Group does

hedge, it maintains appropriate hedging documentation. Foreign

exchange risk on significant non-trading transactions (e.g.

acquisitions) is considered on an individual basis.

Credit risk

The Group's financial assets are cash and bank balances and

trade and other receivables. The Group's credit risk is primarily

attributable to its trade receivables. The amounts presented in the

balance sheet are net of allowances for doubtful receivables. The

credit risk on liquid funds and derivative financial instruments is

limited because the counterparties are banks with high credit

ratings assigned by international credit rating agencies.

The Group has a large number of unrelated customers, serving

almost 500,000 during the financial year, and does not have any

significant credit exposure to any particular customer. Each

business segment manages its own exposure to credit risk according

to the economic circumstances and characteristics of the markets

they serve. The Group believes that management of credit risk on a

devolved basis enables it to assess and manage credit risk more

effectively. However, broad principles of credit risk management

practice are observed across the Group, such as the use of credit

rating agencies and the maintenance of a credit control

function.

Liquidity risk

Liquidity risk is the risk that the Group could experience

difficulties in meeting its commitments to creditors as financial

liabilities fall due for payment.

The Group generates significant free cash flow (defined as cash

flow from operations less replacement capital expenditure net of

proceeds of asset disposals, interest paid and tax paid). This free

cash flow is available to the Group to invest in growth capital

expenditure, acquisitions and dividend payments or to reduce

debt.

In addition to the free cash flow from normal trading

activities, additional liquidity is available through the Group's

ABL facility. At 30 April 2012, excess availability under the

enlarged $1.8bn facility was $735m (GBP453m).

Principal risks and uncertainties

The Group faces a number of risks and uncertainties in its

day-to-day operations and it is management's role to mitigate and

manage these risks. The Board has established a formal risk

management process which has identified the following principal

risks and uncertainties which could affect employees, operations,

revenue, profits, cash flows and assets of the Group.

Economic conditions

Potential impact

The construction industry, from which we earn the majority of

our revenue, is cyclical and typically lags the general economic

cycle by between six and eighteen months. Our performance is

currently ahead of the economic cycle and we therefore expect to

see further upside as the economy returns to growth.

Mitigation

-- Prudent management through the different phases of the cycle.

-- Flexibility in the business model.

-- Capital structure and debt facilities arranged in recognition

of the cyclical nature of our market.

Competition

Potential impact

The already competitive market could become even more

competitive and we could suffer increased competition from large

national competitors or small companies operating at a local level

resulting in reduced market share and lower revenue.

Mitigation

-- Create commercial advantage by providing the highest level of

service, consistently and at a price which offers value.

-- Excel in the areas that provide barriers to entry to

newcomers: industry-leading IT, experienced personnel and a broad

network and equipment fleet.

-- Regularly estimate and monitor our market share and track the

performance of our competitors.

Financing

Potential impact

Debt facilities are only ever committed for a finite period of

time and we need to plan to renew our facilities before they mature

and guard against default. Our loan agreements also contain

conditions (known as covenants) with which we must also comply.

Mitigation

-- Maintain conservative 2-3 times net debt to EBITDA leverage

which helps minimise our refinancing risk.

-- Maintain long debt maturities - currently four years.

-- Use of asset-based senior facility means none of our debt

contains quarterly financial covenants when availability under the

enlarged facility ($735m at year end) exceeds $216m.

Business continuity

Potential impact

We are heavily dependent on technology for the smooth running of

our business given the large number of both units of equipment we

rent and our customers. A serious uncured failure in our point of

sale IT platforms would have an immediate impact, rendering us

unable to record and track our high volume, low transaction value

operations.

Mitigation

-- Robust and well protected data centres with multiple data

links to protect against the risk of failure.

-- Detailed business recovery plans which are tested periodically.

-- Separate near-live back-up data centres which are designed to

be able to provide the necessary services in the event of a failure

at the primary site.

People

Potential impact

Retaining and attracting good people is key to delivering

superior performance and customer service.

Excessive staff turnover is likely to impact on our ability to

maintain the appropriate quality of service to our customers and

would ultimately impact our financial performance adversely.

Mitigation

-- Provide well structured and competitive reward and benefit

packages that ensure our ability to attract and retain the

employees we need.

-- Ensure that our staff have the right working environment and

equipment to enable them to do the best job possible and maximise

their satisfaction at work.

-- Invest in training and career development opportunities for

our people to support them in their careers.

Health and safety

Potential impact

Accidents could happen which might result in injury to an

individual, claims against the Group and damage to our

reputation.

Mitigation

-- Maintain appropriate health and safety policies and

procedures to reasonably guard our employees against the risk of

injury.

-- Induction and training programmes reinforce health and safety policies.

-- Programmes to support our customers exercising their

responsibility to their own workforces when using our

equipment.

Compliance with laws and regulations

Potential impact

Failure to comply with the frequently changing regulatory

environment could result in reputational damage or financial

penalty.

Mitigation

-- Maintaining a legal function to oversee management of these

risks and to achieve compliance with relevant legislation.

-- Group-wide ethics policy and whistle blowing arrangements.

-- Policies and practices evolve to take account of changes in legal obligations.

-- Training and induction programmes ensure our staff receive

appropriate training and briefing on the relevant policies.

Environmental

Potential impact

We need to comply with the numerous laws governing environmental

protection and occupational health and safety matters. These laws

regulate such issues as wastewater, stormwater, solid and hazardous

wastes and materials, and air quality. Breaches potentially create

hazards to our employees, damage to our reputation and expose the

Group to, amongst other things, the cost of investigating and

remediating contamination and also fines and penalties for

non-compliance.

Mitigation

-- Policies and procedures in place at all our stores regarding

the need to adhere to local law and regulations.

-- Procurement policies reflect the need for the latest

available emissions management and fuel efficiency tools in our

fleet.

-- Monitoring and reporting of carbon emissions.

OPERATING STATISTICS

Profit centre numbers Staff numbers

2012 2011 2012 2011

Sunbelt 376 356 6,605 6,231

A-Plant 109 106 1,939 1,921

Corporate office - - 11 11

Group 485 462 8,555 8,163

Sunbelt's profit centre numbers include 16 stores resulting from

the acquisition of Topp.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FMMPTMBMTBBT

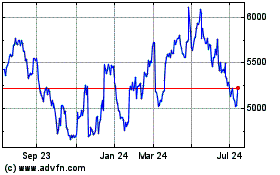

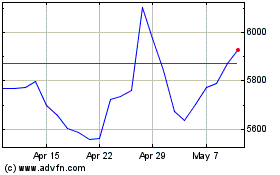

Ashtead (LSE:AHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashtead (LSE:AHT)

Historical Stock Chart

From Apr 2023 to Apr 2024