TIDMAFN

RNS Number : 5102Q

ADVFN PLC

20 October 2011

ADVFN PLC

Audited Results for the Year Ended 30 June 2011

ADVFN, Europe's leading stocks and shares website, announces its

audited results for the year ended 30 June 2011

Highlights:

-- Turnover up 7% to GBP9,167,000 (2010 restated: GBP8,591,000)

-- EBITDA* profit of GBP348,000 (2010 restated: GBP1,256,000)

-- Cash and gilts balance to GBP2,397,000 (2010: GBP2,300,000)

-- P&L (GBP862,000) (2010 restated: profit of GBP146,000)

-- Positive cash flow; 'net cash generated from operations' GBP595,000 (2010: GBP1,417,000)

-- ADVFN's registered users base now over 2,200,000

(2010: 2,000,000)

For further information, please contact:

Clem Chambers,

ADVFN PLC CEO

0207 0700 909

Gerry Beaney

Grant Thornton Corporate Finance (Nominated Adviser)

0207 7383 5100

*EBITDA is calculated as the operating loss for the year before

depreciation and amortisation charges.

CHIEF EXECUTIVE'S STATEMENT

ADVFN has had another strong year with turnover up 7% to

GBP9,167,000. 2011 has been a pivotal year where we have begun the

next phase of growth outside the UK.

We have made very good progress this year against a background

which could hardly be described as easy. Our product and

geographical diversity has served us well so that we have avoided

many of the challenges other media players have had to contend

with.

Subscriptions have been robust and advertising income has led

our growth. The advertising lead growth is a vanguard of growth as

it accelerates the broadening of our business to important new

markets

Having strong sites in the UK, US and Brazil, we believe we have

the necessary template now to expand into the emerging markets

where audiences are vibrant and huge. Our strategy is to penetrate

markets via sales offices, using advertising income to fund growth

in the territories that warrant it most.

In line with this we have been opening regional sales offices in

Japan, India and the Middle East and we have been focusing on

expanding in these territories. This process is delivering the

platform for growth in the coming years leveraging the considerable

investment we have made over the last 10 years.

All sites have performed robustly against a backdrop of global

financial uncertainty. The UK continues to prosper, Brazil has

remained strong and continues to develop and the US continues to

grow for our ADVFN and Investors Hub brands. We feel very positive

about next year's prospects whatever the outcome of the markets and

expect to see further progress even in the teeth of another

crash.

Financial overview

These accounts have been prepared under International Financial

Reporting Standards (IFRS) as adopted by the European Union.

These figures show an increase in sales of 7%, an EBITDA of

GBP348,000 and cash flow from operations of GBP595,000.

We have been operating against a backdrop of a weakening dollar

which has masked further underlying growth but as we are earning

income in euro, US dollar, UK pounds and Yen we are to some extent

hedged against the currency fluctuations of recent times.

Strategy

We are building out the business for the next phase of ADVFN's

development which we see as taking us towards sales of

GBP20,000,000 a year.

This year is another year of growth; a yearly goal we have

achieved every year for the last 11 years.

The market opportunity for us in India, The Middle East, Mexico

and the Philippines is large and involves a modest level of

investment. The bulk of our platform for entering such large

markets is already made so that each new office is a small measured

risk. We expect each territory to come on stream in a 12 month set

up window and to be quickly income generative thereafter.

Exposure to fast growing economies with active markets is the

way forward for us, taking positive developments in each market and

feeding them back into our global offering.

The size of the opportunity is sufficiently large to keep us

very busy for a long time to come.

Operating Costs

We spend a great deal of time focusing on our cost base making

sure we optimise the return on our outgoings where ever possible.

As we enter this new phase we are earmarking resources to invest in

growth. We have been hiring, increasing our technical platform and

increasing marketing. This has been funded solely from positive

cash flow which represents a strong financial and operational

performance.

Research and Development

As always ADVFN never stops developing its technology and

platform. With growing traffic and giant spikes of usage set off by

the global economic chaos of recent times, ADVFN has adapted to

supply the demand of a world hungry for updates the moment

financial information is available. These demands have grown and

grown over the years and we have seamlessly managed to keep up with

growth on all fronts. This process will continue and represents a

valuable and unique asset.

Environmental policy

The company as a whole continues to look for ways to develop our

environmental policy. It remains our objective to improve our

performance in this area.

Cash and GILTS

We are very happy to say that our improved general performance

has directly translated to our cash and gilts balance. Our cash and

GILTS balance at the end of the year was up GBP97,000 to

GBP2,397,000, an increase of 4%

Summary of key performance indicators

2011 2011 2010 2010

Actual Target Actual Target

------------------------ ------- ------- ------- -------

Average head count 54 60 46 50

------------------------ ------- ------- ------- -------

ADVFN registered users 2.2M 2.1M 2.0M 1.9M

------------------------ ------- ------- ------- -------

Future outlook for the business

We are very comfortable of the prospects for next year and for

that matter the years ahead. We are now rolling out ADVFN to more

global audiences and feel assured that we have the people, the

offerings and the technology to continue along the path we have set

to be a global markets website with GBP100,000,000 in sales. In

percentage terms we are as far away from that target today as we

were from today's sales when we started out in 2001.

Principal risks and uncertainties:

Economic downturn

An extended economic down turn is not to be taken lightly.

However the recent turmoil has been easily overcome and may even

have benefitted the company. In addition this is the third time in

the company's short life that it has had to navigate a financial

crash and both times it has come through bigger and stronger.

High proportion of fixed overheads and variable revenues

A major proportion of the company's overheads are reasonably

fixed. There is the risk that any significant changes in revenue

may lead to the inability to cover such costs. Management closely

monitor fixed overheads against budget on a monthly basis and cost

saving exercises are implemented on a constant review basis. We

have had a strong period of cost optimisations since our finance

function was reorganised and this process continues.

Product obsolescence

The technology that we use and develop is always in flux.

Products are subject to technological change and advance and

resultant obsolescence. We are constantly innovating to keep up

with growing demand, change in product and new developments both at

a technical and a marketing level. The directors are committed to

the Research and Development strategy in place, and are confident

that the company is able to react effectively to the developments

within the market.

Fluctuations in currency exchange rates

A growing proportion of our turnover relates to overseas

operations. As a company, we are therefore exposed to foreign

currency fluctuations. The company manages its foreign exchange

exposure on a net basis, and if required uses forward foreign

exchange contracts and other derivatives/financial instruments to

reduce the exposure. Currently hedging is not employed. If currency

volatility was extreme and hedging activity did not mitigate the

exposure, then the results and the financial condition of the

company might be adversely impacted by foreign currency

fluctuations.

People

We have a very dedicated team that is focused on creating the

best possible service we can provide. We are constantly building

this team and have been hiring to enable us to grow during the next

phase of our development. I would like to thank them all for their

hard work and dedication over the past year.

Clem Chambers

CEO

19 October 2011

Consolidated income statement

12 months 12 months

to to

30 June 30 June

2011 2010

Note GBP'000 GBP'000

Restated

Revenue 9,167 8,591

Cost of sales (538) (404)

---------- ----------

Gross profit 8,629 8,187

Share based payment (84) (43)

Amortisation of intangible assets (1,089) (1,149)

All other administrative expenses (8,241) (6,963)

---------- ----------

Total administrative expenses (9,414) (8,155)

Operating (loss)/profit (785) 32

Finance income 7 23

Finance expense (5) (8)

Gain on bargain purchase and associated

fair value loss on previously held equity

investment - (214)

Result from associates after taxation - (18)

Loss before tax (783) (185)

Taxation (79) 331

---------- ----------

(Loss)/profit for the period attributable

to shareholders of the parent (862) 146

(Loss)/earnings per share - from continuing

operations

Basic and diluted (pence per share) 3 (0.14) 0.02

Consolidated statement of comprehensive

income

12 months 12 months

to to

30 June 30 June

2011 2010

GBP'000 GBP'000

Restated

(Loss)/profit for the period (862) 146

Other comprehensive income:

Exchange differences on translation of

foreign operations 253 (8)

Deferred tax on translation of foreign (46) -

held assets

---------- ----------

Total comprehensive income for the year

attributable to shareholders of the parent (655) 138

========== ==========

Consolidated balance sheet

30 June 30 June 1 July

2011 2010 2009

GBP'000 GBP'000 GBP'000

Assets Restated Restated

Non-current assets

Property, plant and equipment 106 84 92

Goodwill 1,697 1,590 1,590

Intangible assets 2,584 2,973 2,297

Investments in associates - - 905

Trade and other receivables 119 113 204

--------- --------- ---------

4,506 4,760 5,088

Current assets

Trade and other receivables 1,121 890 977

Current tax recoverable 75 92 65

Other financial assets (available

for sale) 712 709 32

Cash and cash equivalents 1,716 1,599 1,509

--------- --------- ---------

3,624 3,290 2,583

--------- --------- ---------

Total assets 8,130 8,050 7,671

========= ========= =========

Equity and liabilities

Equity

Issued capital 6,249 6,238 6,156

Share premium 7,941 7,900 7,758

Merger reserve 221 221 221

Share based payment reserve 533 485 456

Foreign exchange reserve 181 (26) (18)

Retained earnings (10,007) (9,181) (9,341)

--------- --------- ---------

5,118 5,637 5,232

Non-current liabilities

Deferred tax 533 342 314

Borrowings - obligations under

finance leases 1 6 11

--------- --------- ---------

534 348 325

Current liabilities

Trade and other payables 2,455 2,052 2,085

Current tax 18 - -

Borrowings - obligations under

finance leases 5 13 29

--------- --------- ---------

2,478 2,065 2,114

--------- --------- ---------

Total liabilities 3,012 2,413 2,439

--------- --------- ---------

Total equity and liabilities 8,130 8,050 7,671

========= ========= =========

Consolidated statement of changes in equity

Share Share Merger Share Foreign Retained Total

capital premium reserve based exchange earnings equity

payment reserve

reserve

Restated Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2009 as previously

stated 6,156 7,758 221 456 (18) (8,789) 5,784

Prior year adjustment - - - - - (552) (552)

--------- --------- --------- --------- ---------- ---------- ----------

6,156 7,758 221 456 (18) (9,341) 5,232

Issue of shares 82 142 - - - - 224

Exercise of share options - - - (14) - 14 -

Equity settled share

options - - - 43 - - 43

--------- --------- --------- --------- ---------- ---------- ----------

Transactions with owners 82 142 - 29 - 14 267

Profit for the period

after tax - - - - - 146 146

Other comprehensive

income

Exchange differences

on translation of foreign

operations - - - - (8) - (8)

--------- --------- --------- --------- ---------- ---------- ----------

Total comprehensive

income for the year - - - - (8) 146 138

At 30 June 2010 6,238 7,900 221 485 (26) (9,181) 5,637

Issue of shares 11 41 - - - - 52

Exercise of share options - - - (36) - 36 -

Equity settled share

options - - - 84 - - 84

--------- --------- --------- --------- ---------- ---------- ----------

Transactions with owners 11 41 - 48 - 36 136

Loss for the period

after tax - - - - - (862) (862)

Other comprehensive

income

Exchange differences

on translation of foreign

operations - - - - 253 - 253

Deferred tax on translation

of foreign held assets - - - - (46) - (46)

--------- --------- --------- --------- ---------- ---------- ----------

Total comprehensive

income for the year - - - - 207 (862) (655)

At 30 June 2011 6,249 7,941 221 533 181 (10,007) 5,118

========= ========= ========= ========= ========== ========== ==========

Consolidated cash flow statement

12 months 12 months

to to

30 June 30 June

2011 2010

GBP'000 GBP'000

Restated

Cash flows from operating activities

Loss for the period before tax (783) (185)

Net finance income in the income statement (2) (15)

Loss from associates - 18

Depreciation of property, plant & equipment 44 75

Amortisation 1,089 1,149

Gain on bargain purchase and associated

fair value loss on previously held equity

investment - 214

Impairment of financial assets (3) 24

Share based payments 84 43

Decrease in trade and other receivables (237) 236

Increase/(decrease) in trade and other

payables 403 (142)

Net cash generated from operations 595 1,417

Interest paid (5) (8)

Income tax (payable) / receivable 101 (17)

---------- ----------

Net cash generated by operating activities 691 1,392

Cash flows from investing activities

Interest received 7 23

Payments for property plant and equipment (66) (30)

Purchase of intangibles (571) (570)

Purchase of UK Government gilts - (701)

Acquisition of subsidiary (net of cash

with subsidiary) - (22)

Net cash used in investing activities (630) (1,300)

Cash flows from financing activities

Proceeds from issue of equity shares 52 27

Loans repaid (finance leases) (13) (21)

Net cash generated by financing activities 39 6

---------- ----------

Net increase in cash and cash equivalents 100 98

Exchange differences 17 (8)

---------- ----------

Total increase in cash and cash equivalents 117 90

Cash and cash equivalents at the start

of the period 1,599 1,509

---------- ----------

Cash and cash equivalents at the end of

the period 1,716 1,599

========== ==========

1. Prior year adjustment

During the year the Group upgraded its reporting systems for its

subscription website which enabled it to generate more accurate

information over the unexpired level of live subscriptions at any

period end. The information generated by the new reports has

enabled the Group to accurately quantify the level of deferred

subscription levels at 30 June 2011 and prior year ends. In prior

years the Group had calculated deferred revenue using the

information available to it, together with certain estimation

techniques.

The new reports have identified that the deferred income

calculated and reflected in the financial statements for prior

periods was materially incorrect. In accordance with IAS 8

'Accounting Policies, Changes in Accounting Estimates and Errors'

the comparative financial statements have been restated. The effect

of the prior year adjustment on each line item within the prior

year financial statements is set out below:

Consolidated income statement

As originally

reported As restated

12 months Prior year 12 months

to 30 June adjustment to 30 June

2010 2010

GBP'000 GBP'000 GBP'000

Revenue 8,475 116 8,591

Profit for the period attributable

to shareholders of the parent 30 116 146

(Loss)/earnings per share - from

continuing operations

Basic and diluted (pence per

share) - 0.02 0.02

Consolidated statement of comprehensive

income

As originally

reported As restated

12 months Prior year 12 months

to 30 June adjustment to 30 June

2010 2010

GBP'000 GBP'000 GBP'000

Restated

Total comprehensive income for

the year attributable to shareholders

of the parent 22 116 138

============== ============ =============

Consolidated cash flow statement

As originally

reported As restated

12 months Prior year 12 months

to 30 June adjustment to 30 June

2010 2010

Loss for the period before tax (301) 116 (185)

Decrease in trade and other payables (26) (116) (142)

Other movements 1,744 - 1,744

Net cash generated from operations 1,417 - 1,417

2. Segmental analysis

The directors identify reportable segments based upon the

information which is regularly reviewed by the chief operating

decision maker. The Group considers that the chief operating

decision maker is the Board of Directors. The Group has identified

two reportable operating segments, being that of the provision of

financial information and that of research services. The provision

of financial information is made via the Group's various website

platforms. Research activities are provided by the Group's staff,

primarily to corporate customers.

Two minor operating segments, for which IFRS 8's quantitative

thresholds have not been met, are currently combined below under

'other'. The main sources of revenue for these operating segments

is the provision of financial broking services and other internet

services not related to financial information. Segment information

can be analysed as follows for the reporting period under

review:

2011 Provision Research Other Total

of financial services

information

GBP'000 GBP'000 GBP'000 GBP'000

Revenue from external customers 8,422 604 141 9,167

Depreciation and amortisation (1,177) (6) (3) (1,186)

Other operating expenses (8,254) (589) 45 (8,798)

Segment operating (loss)/profit (1,009) 9 183 (817)

Interest income 7 - - 7

Interest expense (4) (1) - (5)

Segment assets 9,178 216 23 9,417

Segment liabilities (2,357) (162) (5) (2,524)

Purchases of non-current assets (662) - - (662)

============== ========== ======== ========

2010 Provision Research Other Total

of financial services

information

GBP'000 GBP'000 GBP'000 GBP'000

Restated Restated

Revenue from external customers 7,979 526 102 8,607

Depreciation and amortisation (1,327) (7) (3) (1,337)

Other operating expenses (6,514) (684) (61) (7,259)

-------------- ---------- -------- ---------

Segment operating (loss)/profit 138 (165) 38 11

Results from associates (18) - - (18)

Interest income 23 - - 23

Interest expense (5) (3) - (8)

Segment assets 9,618 196 26 9,840

Segment liabilities (1,958) (127) (8) (2,093)

Purchases of non-current assets (895) (10) (1) (906)

============== ========== ======== =========

The Group's revenues, which wholly relate to the sale of

services, from external customers and its non-current assets are

divided into the following geographical areas:

Revenue Non-current Revenue Non-current

assets assets

2011 2011 2010 2010

GBP'000 GBP'000 GBP'000 GBP'000

Restated

UK (domicile) 4,802 4,326 4,906 3,119

USA 3,419 1,456 3,071 1,641

Other 946 - 630 -

-------- ------------ --------- ------------

9,167 5,782 8,607 4,760

======== ============ ========= ============

Revenues are allocated to the country in which the customer

resides. During both 2011 and 2010 no single customer accounted for

more than 10% of the Group's total revenues.

The segmental information regularly reviewed by the Board is

presented under UK GAAP and, as a result, a key reconciling item

between the segmental and the Group financial information relates

to IFRS conversion.

The totals presented for the Group's operating segments

reconcile to the entity's key financial figures as presented in its

financial statements as follows:

2011 2010

GBP'000 GBP'000

Restated

Segment revenues

Total segment revenues 9,167 8,607

Consolidation adjustments - (16)

-------- ---------

9,167 8,591

======== =========

Segment profit or loss

Total segment operating (loss)/profit (817) 11

Consolidation adjustments (324) (15)

IFRS conversion adjustments 356 36

-------- ---------

Group operating (loss)/profit (785) 32

Finance income 7 23

Finance expense (5) (8)

Negative goodwill and associated fair value

loss on previously held equity investment - (214)

Result from associate after taxation - (18)

-------- ---------

Group loss before tax (783) (185)

======== =========

2011 2010 2009

GBP'000 GBP'000 GBP'000

Restated Restated

Segment assets

Total segment assets 9,417 9,840 7,950

Consolidation adjustments (2,113) (1,777) (1,382)

IFRS conversion adjustments 826 (13) 1,103

-------- --------- ---------

Total Group assets 8,130 8,050 7,671

======== ========= =========

Segment liabilities

Total segment liabilities (2,524) (2,093) (2,128)

Consolidation adjustments (46) - -

IFRS conversion adjustments (442) (320) (311)

-------- --------- ---------

Total Group liabilities (3,012) (2,413) (2,439)

======== ========= =========

Consolidation adjustments primarily relate to the elimination of

investments and the calculation of goodwill. IFRS conversion

adjustments primarily relate to the different accounting bases for

the Group's intangible and tangible assets under IFRS and UK

GAAP.

3. (Loss) / earnings per share

12 months 12 months

to to

30 June 30 June

2011 2010

GBP'000 GBP'000

(Loss) / profit for the year from continuing

operations attributable to equity shareholders (862) 146

============ ============

(Loss) / earnings per share from continuing

operations

Basic (loss) / earnings per share (pence) (0.14) 0.02

Diluted (loss) / earnings per share (pence) (0.14) 0.02

Shares Shares

Issued ordinary shares at start of the year 623,764,505 615,568,903

Ordinary shares issued in the year (Note 23) 1,149,999 8,195,602

------------ ------------

Issued ordinary shares at end of the year 624,914,504 623,764,505

============ ============

Weighted average number of shares in issue for

the year 624,207,656 622,267,954

Dilutive effect of options - 7,100,433

------------ ------------

Weighted average shares for diluted earnings

per share 624,207,656 629,368,387

============ ============

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

4. Publication of Non Statutory Accounts

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006.

The consolidated balance sheet at 30 June 2011 and the

consolidated income statement, consolidated statement of

comprehensive income, consolidated statement of changes in equity,

consolidated cash flow statement and associated notes for the year

then ended have been extracted from the Company's 2011 statutory

financial statements upon which the auditors' opinion is

unqualified and does not include any statement under Section 498(2)

or (3) of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DKCDPOBDDPKD

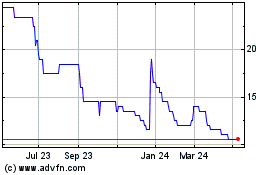

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

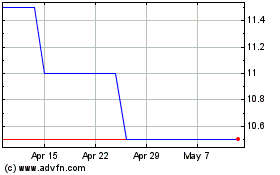

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024