RNS Number:3328B

Sinosoft Technology plc

11 April 2006

11 April 2006

SINOSOFT TECHNOLOGY PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 DECEMBER 2005

Sinosoft Technology plc ("Sinosoft" or the "Company"), the China based developer

and provider of e-Government software and services, which recently listed on

AIM, announces maiden preliminary results for the year ended 31 December 2005.

The Company (EPIC: SFT), has established itself as a market leader in the

provision of specialised export tax management software and e-Government

services in Jiangsu through its wholly owned subsidiaries Nanjing Skytech Co.

Ltd and Nanjing Skytech Software Co. Ltd (together referred to as "Skytech").

Skytech has contracts with a number of government bodies and has over 29,000

customers including subsidiaries of multinational companies like Hitachi and

Mitsubishi.

Highlights from the results include:

* Turnover up 24% to US$6.16 million (2004: US$4.98 million)

* Net profit up 34% to US$3.52 million (2004: US$2.63 million)

* Net profit margin increased to 57% (2004: 53%)

* Skytech awarded "Golden Tax Tender" by the Chinese State Administration of

Taxation. Roll out of automated export tax process to thirty six provincial

tax offices in China being finalized

* Successfully raised US$17 million and admitted to AIM

Commenting on the results Miss Xin, CEO of Sinosoft said: "The Sinosoft group

continues to benefit from China's technological advancement and the upsurge in

Chinese export activity. The successful fundraising has enabled the Group to

develop its strategy to grow beyond Jiangsu and to further develop our expanding

product suite. The board is confident that 2006 will be a year of exciting

growth and we look forward to continuing our development and delivering value

for shareholders."

For further information please contact:

Sinosoft Ms. Helen Xin, +86 025 84815959

Chief Executive Officer

Westhouse Securities Tim Metcalfe 020 7601 6100

Tavistock Communications Paul Dulieu 020 7920 3150

Matt Ridsdale

SINOSOFT TECHNOLOGY PLC

OPERATING COMPANIES' FINAL RESULTS

FOR THE YEAR ENDED 31 DECEMBER 2005

CHAIRMAN'S STATEMENT

I am pleased to announce the audited results of Sinosoft's trading subsidiaries,

namely, Nanjing Skytech Co. Ltd and Nanjing Skytech Software Co. Ltd (together

referred to as "Skytech") for the year ended 31 December 2005. These are the

first trading results announced since the Company was admitted to AIM on 6 March

2006.

The financial results for Skytech set out below relate entirely to the

pre-flotation period and have been prepared on a combined basis for Nanjing Sk

ytech Co. Ltd and Nanjing Skytech Software Co. Ltd. The results for Skytech's

holding companies, namely Infotech Holdings Pte. Ltd and Sinosoft have seen no

material change from the information disclosed in the AIM Admission Document

published on 28 February 2006.

Financial highlights

I am pleased that Skytech's results for the year ended 31 December 2005 are

better than market expectations. Skytech achieved a year-on-year growth in

turnover of 24%. In addition to strong revenue growth Skytech achieved im

provements in its margins with the net profit margin increasing from 53% to 57%.

The Company continues to work on expanding Skytech's product range and improving

the quality of its software products and services. This includes investing in

additional research and development facilities and new software products which

were specifically developed for Skytech and this investment will allow it to

enhance its current software range.

The increasing move by the Chinese government towards digitisation at all levels

is driving demand for all the Company's products, in particular its e-government

and export tax software.

We are delighted with the progress Sinosoft is making. We have had a successful

debut on AIM which has raised the profile of the enlarged group (being Sinosoft

and its subsidiaries (the "Group")) and has provided the funds to expand our

activities and further develop the business.

May I take this opportunity to thank all the board members, and particularly our

employees who have worked extremely hard to bring the Group to its current

position.

Mao Ning

Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

Operational update

It gives me great pleasure to release my first Chief Executive's statement. 2005

was a successful year for the Group at an operating level. During the year

Skytech focused on growing market share and this was achieved in all three of

the Group's principal revenue streams of e-government software, export tax

software and information integration. The awarding of the Golden Tax Tender by

the Chinese State Administration of Taxation ("SAT") will, in the opinion of the

board, enable Skytech to target exporting enterprises across China.

Since the publication of the AIM Admission Document on 28 February 2006 Sinosoft

and its subsidiaries have seen further developments in the business including:-

* Securing a contract for the provision of existing e-government products to

Yangzhou City for an initial value of $110,000. In addition to this one off

revenue this new contract will provide Skytech with ongoing support income

and enable Skytech to develop additional sales to agencies in Yangzhou.

* Following the awarding to Skytech of the Golden Tax Tender by the SAT,

Skytech has been working with the SAT to finalise the rollout across thirty

six provincial bureaus. The receipt of the Golden Tax Tender is an important

step in developing the Group's activities outside of Jiangsu province.

* Sales of the Group's export tax software continue to grow in Jiangsu

province. In the first three months of 2006 approximately 1,000 new

exporting enterprises have begun to use Skytech's export tax products. These

include subsidiaries of multinational companies including Hitachi, Atlas

Copco and Mitsubishi.

Following Sinosoft's admission to AIM the Group has repaid its borrowings of

US$2.3 million, invested in increasing its research and development capabilities

and begun the process of setting up a new office in Shanghai. I am pleased to

announce that we have recruited a number of new technical staff with the Group's

employees now totalling 160.

The Sinosoft group continues to benefit from China's technological advancement

and the upsurge in Chinese export activity. The successful fundraising has

enabled the Group to develop its strategy to grow beyond Jiangsu and to further

develop our expanding product suite. The board is confident that 2006 will be a

year of exciting growth and we look forward to continuing our development and

delivering value for shareholders.

Helen Xin

Chief Executive Officer

COMBINED INCOME STATEMENT

Year ended 31 Year ended 31

December 2005 December 2004

Notes Audited Audited

US$ US$

Revenue 6 6,155,852 4,979,029

Cost of sales (1,673,880) (1,458,877)

-----------------------------------

Gross profit 4,481,972 3,520,152

Other operating income 7 622,185 458,692

Research and development cost (519,462) (483,460)

Selling and distribution expenses (421,417) (315,378)

Administrative expenses (605,549) (434,866)

Other operating expenses (1,173) (3,226)

-----------------------------------

Profit from operations 8 3,556,556 2,741,914

Finance cost 9 (22,144) (18,981)

Finance income 10 26,348 10,687

Share of associates losses - (80,929)

Gain on disposal of subsidiary - 104,384

Trading investment loss - (88,116)

-----------------------------------

Profit before income tax 3,560,760 2,668,959

-----------------------------------

Taxation 11

-----------------------------------

Current tax 11(a) | - (4,477)|

Deferred tax 11(b) | (44,913) - |

-----------------------------------

(44,913) (4,477)

-----------------------------------

Net profit for the year 3,515,847 2,664,482

Minority interest - (32,049)

-----------------------------------

Profit for the year 3,515,847 2,632,433

===================================

COMBINED BALANCE SHEET

31 December 31 December

Notes 2005 2004

Audited Audited

US$ US$

ASSETS

Current assets

Cash and cash equivalents 3,956,182 1,596,822

Trade receivables 12 2,010,203 1,557,442

Other receivables 13 1,238,253 1,059,600

Inventories 14 557,415 236,195

-----------------------------------

Total current assets 7,762,053 4,450,059

-----------------------------------

Non-current assets

Property, plant and equipment 15 381,238 365,620

Intangible assets 16 1,238,636 469,304

Investments 17 185,795 181,598

-----------------------------------

Total non-current assets 1,805,669 1,016,522

-----------------------------------

Total assets 9,567,722 5,466,581

-----------------------------------

LIABILITIES & EQUITY

Current liabilities

Trade payables 369,598 258,340

Other payables 18 477,496 317,788

Bank loans 19 371,591 363,196

-----------------------------------

Total current liabilities 1,218,685 939,324

-----------------------------------

Non-current liabilities

Deferred income 148,636 48,426

Deferred tax 11(b) 45,636 -

-----------------------------------

Total non-current liabilities 194,272 48,426

-----------------------------------

Total liabilities 1,412,957 987,750

-----------------------------------

Capital and reserves

Share capital 20 1,452,785 1,452,785

General reserves 758,522 334,653

Retained earnings 5,783,371 2,691,393

Exchange reserve 160,087 -

-----------------------------------

Total shareholders' equity 8,154,765 4,478,831

-----------------------------------

Total liabilities & equity 9,567,722 5,466,581

-----------------------------------

COMBINED STATEMENT OF CASH FLOWS

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Income before taxation 3,560,760 2,668,959

Adjustments for:

Depreciation of property, plant and equipment 36,065 18,133

Amortisation of intangible assets 108,560 57,207

Provision for impairment on investment in associate - 80,929

Provision for balance due from associate - (35,522)

Loss on disposal of investment held for trading - 88,116

Provision for impairment for receivables 20,381 66,886

Interest income (26,348) (10,687)

Interest expense 22,144 18,981

-----------------------------------

Operating cash flows before working capital changes 3,721,562 2,953,002

Increase in trade and other receivables (582,268) (1,939,519)

Increase in inventories (310,761) (141,358)

Increase/(decrease) in trade and other payables 351,092 (146,185)

-----------------------------------

Cash used in operations (541,937) (2,227,062)

-----------------------------------

Income taxes paid - (4,477)

Interest paid (22,144) (18,981)

-----------------------------------

Net cash generated by operating activities 3,157,481 702,482

Cash flows from investing activities

Interest received 26,348 10,687

Cash held on deposit - 152,692

Proceeds on disposal of trading investments - 554,517

Purchase of property, plant and equipment (43,234) (175,952)

Purchase of intangible assets (867,045) (435,835)

Purchase of investments for trading - (193,705)

-----------------------------------

Net cash used in investing activities (883,931) (87,596)

-----------------------------------

Cash flows from financing activities

Capital injections from investors - 217,918

Repayment of borrowings (371,591) (363,196)

New borrowings 371,591 363,196

-----------------------------------

Net cash generated from financing activities - 217,918

-----------------------------------

Net increase in cash and cash equivalents 2,273,550 832,804

Cash and cash equivalent at the beginning of the financial year 1,596,822 764,018

Effects of exchange rate changes 85,810 -

-----------------------------------

Cash and cash equivalent at the end of the financial year 3,956,182 1,596,822

===================================

STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

Share Retained Statutory Exchange

Capital Earnings Reserves Reserve Total

US$ US$ US$ US$ US$

Balance at 1 January 2004 1,210,654 358,274 35,339 - 1,604,267

Issue of share capital 242,131 - - - 242,131

Net profit for the year - 2,632,433 - - 2,632,433

Transfer to statutory reserve - (299,314) 299,314 - -

--------------------------------------------------------------------------

Balance at 31 December 2004 1,452,785 2,691,393 334,653 - 4,478,831

==========================================================================

Balance at 1 January 2005 1,452,785 2,691,393 334,653 - 4,478,831

Net profit for the year - 3,515,847 - - 3,515,847

Transfer to statutory reserve - (423,869) 423,869 - -

Translation difference - - - 160,087 160,087

--------------------------------------------------------------------------

Balance at 31 December 2005 1,452,785 5,783,371 758,522 160,087 8,154,765

==========================================================================

Notes to the financial information

1. The companies and their operation/general

Nanjing Skytech Co. Ltd was incorporated on 14 December 1998 in the People's

Republic of China ("PRC"). Its principal activity is that of the development and

sale of computer software, computer and external equipment and related

accessories for communication products, digital products and other electrical

appliances.

Nanjing Skytech Co. Ltd became a 100% subsidiary of Infotech Holdings Pte Ltd on

31 July 2004. On 20 January 2006 Infotech Holdings Pte Ltd became a wholly owned

subsidiary of Sinosoft Technology plc.

Nanjing Skytech Software Co. Ltd was incorporated on 2 July 2003 in the People's

Republic of China. Its principal activity is that of the development, sales and

service of computer software and technology.

Nanjing Skytech Software Co. Ltd was a 90% subsidiary of Nanjing Skytech Co. Ltd

from incorporation until 31 July 2004, when Nanjing Skytech Co. Ltd's investment

was acquired by Nanjing Sky Investment Information Co. Ltd. In January 2005,

Infotech Holdings Pte Ltd acquired 100% of the issued share capital of Nanjing

Skytech Software Co. Ltd.

The registered offices of Nanjing Skytech Co. Ltd and Nanjing Skytech Software

Co. Ltd are 3rd Floor, No. 50 Building, Jiangsu Software Park, No. 168 Long Pan

Zhong Road, Nanjing, People's Republic of China.

2. Basis of preparation of the financial information

This financial information has been prepared in accordance with International

Financial Reporting Standards ("IFRS"). The directors of Sinosoft Technology plc

are responsible for preparing the financial information.

The financial information represents the combination of the financial

information of Nanjing Skytech Co. Ltd and Nanjing Skytech Software Co. Ltd

("the combined entity"), which at 31 December 2005 are both 100% subsidiaries of

Infotech Holdings Pte Ltd. For the period during which Nanjing Skytech Software

Co. Ltd was a 90% subsidiary of Nanjing Skytech Co. Ltd the accounts have been

consolidated for the group.

For the subsequent period, the accounts of the two fellow subsidiary

undertakings have been combined but not consolidated. All transactions and

balances between the two companies have been eliminated in the preparation of

the financial information for the combined entities. The financial information

does not constitute a consolidation of the results of the two companies and does

not reflect the changes in the legal ownership and structure of the Infotech

'group' of companies during the year covered by the financial information.

The combined entity maintains its accounting records in Chinese Renminbi ("RMB")

and prepares its statutory financial statements in accordance with People's

Republic of China ("PRC") generally accepted accounting practices. The financial

information is based on the statutory records, with adjustments and

reclassifications recorded for the purpose of the fair presentation in

accordance with IFRS.

The financial information has been prepared under the historical cost convention

except as disclosed in the accounting policies below.

The financial information presented does not constitute statutory accounts for

the years under review.

Adoption of IFRS

The financial information has been prepared under IFRS standards currently in

issue as if they had been in issue for years covered by the financial

information.

The adoption of these standards did not result in substantial changes to the

combined entities accounting policies.

The principal accounting policies adopted by the combined entity are consistent

with those disclosed for the years in this financial information.

Management estimates

The presentation of financial information under IFRS requires management to make

prudent estimates and assumptions that affect the reported amounts of assets and

liabilities at the date of the financial information preparation and the

reported amounts of revenue and expenses during the reporting year. Estimates

have been made principally in respect of the amounts capitalised as, and the

useful economic life of, intangible assets, useful economic life of property,

plant and equipment, provisions for impairment of accounts receivable and

investments.

3. Significant accounting policies

3.1. Functional and presentation currency

The Chinese Renminbi (RMB) is the functional currency of the combined entity as

it is the currency of the primary economic environment in which it operates. The

United States Dollar ("US$") is the currency used to present the financial

information in order to improve the understanding of the results and the

financial position of the combined entity outside of the PRC.

The functional currency transactions are translated into the presentation

currency using the average exchange rate of US$1:RMB8.2033 during the financial

year (FY2004: fixed rate at US$1:RMB8.26). Functional currency assets and

liabilities are translated into the presentation currency at the rates of

exchange prevailing at the balance sheet date of US$1:RMB8.0734 (FY2004: fixed

rate at US$1:RMB8.26). All resulting exchange differences are taken to the

foreign currency translation reserve.

Fixed exchange rate of US$:RMB was used for FY2004 as the RMB held a fixed

exchange rate with the US$ during the previous financial year until July 2005

when the currency began to float against a 'basket of currencies'.

3.2. Investments in associates

An associate is an entity over which the combined entity exercises significant

influence and is neither a subsidiary nor an interest in a joint venture.

Significant influence is the power to participate in the financial and operating

policy decisions of the investee but is not control or joint control over those

policies.

The results and assets and liabilities of associates are incorporated in this

financial information using the equity method of accounting, except when the

investment is classified as held for sale, in which case it is accounted for

under IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. Under

the equity method, investments in associates are carried in the consolidated

balance sheet at cost as adjusted for post-acquisition changes in the combined

entity's share of the net assets of the associate, less any impairment in the

value of the individual investments. Losses of an associate in excess of the

combined entity's interest in that associate (which includes any long-term

interests that, in substance, form part of the combined entity's net investment

in the associate) are not recognised.

Any excess of the cost of acquisition over the net entity's share of the net

fair value of the identifiable assets, liabilities and contingent liabilities of

the associate recognised at the date of acquisition is recognised as goodwill.

The goodwill is included within the carrying amount of the investment and is

assessed for impairment as part of the investment. Any excess of the combined

entity's share of net fair value of the identifiable assets, liabilities and

contingent liabilities over the cost of acquisition, after reassessment, is

recognised immediately in profit or loss.

Where the combined entity transacts with an associate of the combined entity,

profits and losses are eliminated to the extent of the combined entity's

interest in the relevant associate.

3.3. Revenue recognition

Revenue is measured at the fair value of consideration received or receivable

and represents amounts receivable for goods and services provided in the normal

course of business, net of discounts and sales related taxes.

Revenue from the sale of goods is recognised when the significant risks and

rewards of ownership are transferred to the buyer and the amount of revenue and

the costs of the transaction can be measured reliably.

Revenue from installation contracts is recognised in accordance with the

combined entities' accounting policy on installation contracts (see below).

Revenue from rendering of services that are of a short duration is recognised

when the services are completed.

Other income includes Value Added Tax (VAT) rebates, which are recognised on an

accruals basis.

Interest income is accrued on a time proportionate basis, by reference to the

principal outstanding and at the interest rate applicable, on an effective yield

basis.

3.4. Installation contracts

When the outcome of a contract for the installation of network systems can be

estimated reliably, revenue and costs are recognised on the percentage of

completion method, measured by reference to the proportion that costs incurred

to date bear to estimated total costs for each contract, except where this would

not be representative of the stage of completion. Variations in contract work,

claims and incentive payments are included to the extent that they have been

agreed with the customer.

When the outcome of a contract cannot be estimated reliably, revenue is

recognised to the extent of contract costs incurred that it is probable that

they are recoverable. Contract costs are recognised as expenses in the period in

which they are incurred.

When it is probable that the total contract costs will exceed total contract

revenue, the expected loss is recognised as an expense immediately.

3.5. Government grants

Government grants relating to expenditure that is not capitalised is credited to

the income statement to match the related expenditure when it is incurred.

Government grants relating to the purchase of property, plant and equipment are

included in the balance sheet by deducting the grant in arriving at the carrying

amount of the assets.

3.6. Employee benefits

Post-employment benefit plans cost

Defined contribution plans are post-employment benefit plans under which Skytech

pays fixed contributions into separate entities such as the Mandatory Provident

Fund ("MPF") scheme, and will have no legal or constructive obligation to pay

further contributions if any of the funds do not hold sufficient assets to pay

all employee benefits relating to employee service in the current and preceding

financial years. Skytech's contribution to defined contribution plans are

recognised in the financial year to which they relate.

3.7. Taxation

Income tax expense represents the sum of tax currently payable and deferred tax.

Current taxation

The tax currently payable is based on the taxable profit for the year. Taxable

profit differs from profit as reported in the income statement because it

excludes items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or deductible. The

combined entity's liability for current tax is calculated using tax rates that

have been enacted or substantially enacted by the relevant balance sheet date.

Deferred taxation

Deferred tax is determined on the basis of tax effect accounting, using the

liability method, and it is applied to all significant temporary differences

arising between the carrying amount of assets and liabilities in the financial

statements and the corresponding tax bases used in the computation of taxable

profit, except that the potential tax savings relating to a tax loss carry

forward is not recorded as an asset unless there is a reasonable expectation of

realisation in the foreseeable future.

Deferred tax assets and liabilities are measured using the tax rates that are

expected to apply to the period when the asset is realised or the liability is

settled, based on tax rates (and tax laws) that have been enacted or

substantially enacted by the balance sheet date. Deferred tax is charged or

credited to the profit or loss statement, except when it relates to items

charged or credited to equity, in which case the deferred tax is also dealt with

in equity. Deferred tax assets and liabilities are offset when they relate to

income taxes levied by the same tax authority.

3.8. Cash and cash equivalents

Cash and cash equivalents comprise cash in hand and cash held on demand with

banks, and other short-term highly liquid investments that are readily

convertible to a known amount of cash and are subject to an insignificant risk

of changes in value.

3.9. Inventories

Inventories are measured at the lower of cost and net realisable value. Cost

includes all costs of purchase, cost of conversion and other costs incurred in

bringing the inventories to their present location and condition. Cost is

calculated using the first in first out method. Net realisable value is the

estimated selling price less all estimated costs to completion and costs to be

incurred in marketing, selling and distribution.

3.10. Investments

Investments are recognised and derecognised on a trade-date basis and are

initially measured at cost, including transaction costs.

At subsequent reporting dates, debt securities that the combined entity has the

expressed intention and ability to hold to maturity (held-to-maturity debt

securities) are measured at amortised cost, less any impairment loss recognised

to reflect irrecoverable amounts. The annual amortisation of any discount or

premium on the acquisition of a held-to-maturity security is aggregated with

other investment income receivable over the term of the instrument so that the

revenue recognised in each period represents a constant yield on the investment.

An impairment loss is recognised in profit or loss when there is objective

evidence that the asset is impaired, and is measured as the difference between

the investment's carrying amount and the present value of estimated future cash

flows discounted at the effective interest rate computed at initial recognition.

Impairment losses are reversed in subsequent periods when an increase in the

investment's recoverable amount can be related objectively to an event occurring

after the impairment was recognised, subject to the restriction that the

carrying amount of the investment at the date of the impairment is reversed

shall not exceed what the amortised cost would have been had the impairment not

been recognised.

Investments other than held-to-maturity debt securities are classified as either

held-for-trading or available-for-sale, and are measured at subsequent reporting

dates at fair value. Where securities are held for trading purposes, gains and

losses arising from changes in fair value are included in profit and loss for

the period. For available-for-sale investments, gains and losses arising from

changes in fair value are recognised directly in equity, until the security is

disposed of or is determined to be impaired, at which time the cumulative gain

or loss previously recognised in equity is included in the net profit or loss

for the period. Impairment losses recognised in profit or loss for

debt-instruments classified as available-for sale are subsequently reversed if

an increase in the fair value of the instrument can objectively be related to an

event occurring after recognition of the impairment loss.

3.11. Property, plant and equipment

Property, plant and equipment are recorded at historic cost, less accumulated

depreciation and any impairment loss where the recoverable amount of the asset

is estimated to be lower than its carrying amount.

Property in the course of construction for production or administrative purposes

is carried at cost, less any recognised impairment loss. Cost includes

professional fees and, for qualifying assets, borrowing costs capitalised in

accordance with the combined entity's accounting policy. Depreciation of these

assets commences when the assets are ready for their intended use.

Depreciation is charged so as to write off the cost of the assets over their

estimated useful lives, using the straight-line method, as follows:

Property - 20 years

Electronic equipment, furniture and fixtures - 5 years

Motor vehicles - 8 years

The assets' residual values and useful lives are reviewed, and adjusted, if

appropriate, at each balance sheet date.

The gain or loss arising on the disposal or retirement of an item of property,

plant and equipment is determined as the difference between the sales proceeds

and the carrying amount of the asset and is recognised in profit or loss.

3.12. Internally generated intangible assets - research and development

expenditure

Research expenditure is recognised as an expense as incurred.

Costs incurred on development projects are recognised as internally generated

intangible assets only if all of the following conditions are met:

* an asset is created that can be identified (such as software and new

processes);

* it is probable that the asset created will generate future economic

benefits; and

* the development cost of the asset can be measured reliably.

Internally generated intangible assets are amortised on a straight-line basis

over their estimated useful lives, from the commencement of commercial

production.

Development costs that have been capitalised as intangible assets are amortised

on a straight-line basis over the period of its expected benefits, which

normally does not exceed 3 years.

3.13. Patents and trademarks

Patents and trademarks are measured initially at purchase cost and are amortised

on a straight-line basis over their estimated useful economic lives.

Patents - 3 years

Trademarks - 2 years

3.14. Impairment of tangible and intangible assets

At each balance sheet date, the combined entity reviews the carrying amounts of

its assets to determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated to determine the extent of the impairment loss

(if any).

When it is not possible to estimate the recoverable amount of an individual

asset, the combined entity estimates the recoverable amount of the

cash-generating unit to which the asset belongs.

Recoverable amount is the higher of fair value less costs to sell and value in

use.

If the recoverable amount of an asset is estimated to be less than its carrying

amount, the carrying amount of the asset is reduced to its recoverable amount.

Impairment losses are recognised as an expense immediately.

When an impairment loss subsequently reverses, the carrying amount of the asset

is increased to the revised estimate of its recoverable amount, to the extent

that the increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised for the asset

in prior years. A reversal of an impairment loss is recognised as income

immediately.

3.15. Financial assets

The principal financial assets are cash, trade receivables, other receivables

and other investments. Trade and other receivables are stated at their nominal

value as reduced by appropriate allowances for estimated irrecoverable amounts.

The accounting policy of other investments is outlined above.

3.16. Financial liabilities and equity

Financial liabilities and equity instruments are classified according to the

substance of the contractual arrangements entered into. Significant financial

liabilities include interest-bearing short-term bank loans, trade and other

payables.

Interest-bearing short-term bank loans are recorded at the proceeds received,

net of direct issue costs. Finance charges, including premiums payable on

settlement or redemption, are accounted for on an accrual basis and are added to

the carrying amount of the instrument to the extent that they are not settled in

the period in which they arise. Finance costs are accounted for on an accrual

basis (effective yield method) and are added to the carrying amount of the

instrument to the extent that they are not settled in the period in which they

arise.

Trade and other payables are stated at their nominal value.

Equity instruments are recorded at the fair value of consideration received, net

of direct issue costs.

3.17. Borrowings and borrowing costs

Borrowings are recognised initially at fair value, net of transaction costs

incurred. Borrowings are subsequently stated at amortised cost; any difference

between the proceeds (net of transaction costs) and the redemption value is

taken to the profit and loss statement over the period of the borrowings using

the effective interest method.

All borrowing costs are taken to the profit and loss statement over the period

of borrowing using the effective interest method.

3.18. Foreign currency transactions

In preparing the financial statements of the individual entities, transactions

in currencies other than the entity's functional currency (RMB) are recorded at

rates of exchange prevailing on the dates of the transactions. At each balance

sheet date, monetary balances denominated in foreign currencies are retranslated

at the rates ruling at the balance sheet date.

Exchange differences arising on the settlement of monetary items, and on the

retranslation of monetary items, are included in the income statement for the

year.

3.19. Provisions

Provisions are recognised when the combined entity has a present legal or

constructive obligation as a result of a past event where it is probable that

the obligation will result in an outflow of economic benefits that can be

reasonably estimated.

3.20. Leases

Leases where the lessor retains substantially all the risks and benefits of

ownership of the asset are classified as operating leases. Initial direct costs

incurred in negotiating an operating lease are added to the carrying amount of

the leased asset and recognised over the lease term on the same bases as the

lease income. Operating lease payments are recognised as an expense in the

income statement on a straight-line basis over the lease term.

3.21. Segment reporting

A business segment is a group of assets and operations engaged in providing

products or services that are subject to risks and returns that are different

from those of other business segments. A geographical segment is engaged in

providing products or services within a particular economic environment that are

subject to risks and returns that are different from those of segments operating

in other economic environments.

3.22. Statutory reserve

Statutory reserve is in respect of the PRC companies and has been set aside in

accordance with the legislation in the country.

4. Financial risks and management

4.1. Financial risk factors

The combined entity's activities expose it to a variety of financial risks. The

combined entity's overall risk management programme focuses on the

unpredictability of financial markets and seeks to minimise potential adverse

effects on the financial performance of the combined entity.

Risk management is carried out by Sinosoft's Board of Directors. The Board

identifies and evaluates financial risks in close co-ordination with the combin

ed entity's operating units. The Board provides principles for overall risk

management, as well as policies covering specific areas such as credit risk,

interest rate risk, foreign currency risk and liquidity risk.

(i) Credit risk

The combined entity has no significant concentration of credit risk. The

combined entity has policies in place to ensure that sales are made to

customers with an appropriate credit history.

(ii) Interest rate risk

The combined entity obtains additional financing through bank

borrowings. The combined entity's policy is to obtain the most

favourable interest rates available. The terms and interest rates

payable are disclosed in Note 19 to the financial information.

Surplus funds are placed with reputable banks.

(iii) Foreign currency risk

The combined entity's sales and purchases are mainly denominated in

Chinese Renminbi. The residual risk after the natural hedging effects of

any foreign currency denominated assets and liabilities are not expected

to have a significant impact on the combined entity's financial position

and future cash flows.

(iv) Liquidity risk

The combined entity has sufficient cash and cash equivalents to meet its

operational requirements.

(v) Fair values of financial assets and financial liabilities

The carrying amounts of financial assets and financial liabilities

reported in the balance sheet approximate their fair values.

5. Segment information

The combined entity is principally engaged in the development and sales of

computer software, computer and external equipment, and related accessories for

communication products, digital products and other electrical appliances in the

PRC and all of its customers are based in the PRC. In addition, all identifiable

assets of the combined entity are located principally in the PRC. Accordingly,

no segmental analysis is presented.

6. Revenue

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Software 4,338,422 3,345,002

System Integration 1,817,430 1,634,027

-----------------------------------

6,155,852 4,979,029

===================================

For management purpose, the combined entity's operations are organised into one

operating division namely software development which includes sales of software

products and system integration.

7. Other operating income

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

VAT refund 565,998 456,261

Government grants and rebates 56,187 2,431

-----------------------------------

622,185 458,692

===================================

8. Profit from operations

The profit from operations is stated after charging/(crediting) the following:

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Staff costs (excluding directors' remuneration) 579,742 378,183

Less:

Staff costs included in research and development costs (359,632) (200,418)

-----------------------------------

220,110 177,765

===================================

Directors' remuneration 149,696 107,506

Cost of defined contribution plans included in staff costs 114,478 41,214

Provision against trade receivables 20,381 66,886

Provision against receivables from associate - (35,522)

Depreciation charge 36,065 18,133

Amortisation charge 108,560 57,207

Provision for impairment in investment - 80,929

===================================

Number of employees - year end 142 117

===================================

9. Finance cost

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Interest on bank loans 22,144 18,981

===================================

10. Finance income

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Interest income 26,348 10,687

===================================

Interest income is calculated at 2.07% per annum (2004: 2.07 %).

11. Taxation

(a) Current tax

Year ended 31 Year ended 31

December 2005 December 2004

Audited Audited

US$ US$

Current tax - 4,477

===================================

The charge for the year can be reconciled to the results of the combined entity

as follows:

US$ US$

Profit before tax 3,560,760 2,668,959

-----------------------------------

Tax at applicable income tax rate of 33% 1,175,051 880,756

Tax effect of non-deductible expenses 34,857 414,269

Tax effect of exempt income (980,459) (656,367)

Tax effect of income not taxable (229,449) (634,181)

-----------------------------------

Tax expense for the year - 4,477

===================================

(b) Deferred tax

The following are the major deferred tax liabilities recognised by the combined

entity and the movements thereon during the current and prior reporting periods:

Accelerated depreciation &

amortisation for tax purposes

US$

As at 1 January 2004 and 31 December 2004 -

===================================

At 1 January 2005 -

Current year charge 44,913

Translation difference 723

-----------------------------------

At 31 December 2005 45,636

===================================

12. Trade receivables

31 December 2005 31 December 2004

Audited Audited

US$ US$

Trade receivables 2,118,782 1,640,546

Less: provision for doubtful debts (108,579) (83,104)

-----------------------------------

2,010,203 1,557,442

===================================

13. Other receivables

31 December 2005 31 December 2004

Audited Audited

US$ US$

Other receivables 162,009 196,370

Amount due from parent company 435,231 142,254

VAT receivable 82,391 24,753

Prepayments 375,676 609,298

Deposits 182,946 86,925

-----------------------------------

1,238,253 1,059,600

===================================

Amount due from parent company is unsecured, interest free, and have no fixed

terms of repayment.

14. Inventories

31 December 2005 31 December 2004

Audited Audited

US$ US$

Goods for resale 536,031 230,322

Work in progress 21,384 5,873

-----------------------------------

557,415 236,195

===================================

15. Property, plant and equipment

Land and Properties Plant and Motor Total

buildings under equipment vehicles

construction

US$ US$ US$ US$ US$

Cost

Balance at 1 January 2005 48,382 206,402 42,660 93,298 390,742

Additions 36,812 - 6,422 - 43,234

Reclassification 211,173 (211,173) - - -

Translation difference 1,118 4,771 986 2,155 9,030

--------------------------------------------------------------------------

Balance at 31 December 2005 297,485 - 50,068 95,453 443,006

--------------------------------------------------------------------------

Accumulated depreciation

Balance at 1 January 2005 3,132 - 11,008 10,982 25,122

Depreciation charge 12,176 - 12,554 11,335 36,065

Translation difference 72 - 255 254 581

--------------------------------------------------------------------------

Balance at 31 December 2005 15,380 - 23,817 22,571 61,768

--------------------------------------------------------------------------

Net book value

Balance at 31 December 2005 282,105 - 26,251 72,882 381,238

==========================================================================

Balance at 1 January 2005 45,250 206,402 31,652 82,316 365,620

==========================================================================

16. Intangible assets

Development Patents and Total

costs trademarks

US$ US$ US$

Cost

At 1 January 2005 631,962 12,205 644,167

Additions 867,045 - 867,045

Translation difference 14,606 283 14,889

----------------------------------------------------

At 31 December 2005 1,513,613 12,488 1,526,101

----------------------------------------------------

Accumulated amortisation

At 1 January 2005 162,698 12,165 174,863

Charge for the year 108,518 42 108,560

Translation difference 3,761 281 4,042

----------------------------------------------------

At 31 December 2005 274,977 12,488 287,465

----------------------------------------------------

Net book value

Balance at 31 December 2005 1,238,636 - 1,238,636

====================================================

Balance at 1 January 2005 469,264 40 469,304

====================================================

17. Investments

31 December 2005 31 December 2004

Audited Audited

US$ US$

Associate:

Investment, at cost - 242,131

Share of post acquisition results - (161,202)

Provision for impairment - (80,929)

-----------------------------------

- -

Other equity investments, at cost 185,795 181,598

-----------------------------------

185,795 181,598

===================================

The details of the associate are described below:

Name of associate Country of Principal activity Effective equity

incorporation/ held by the

business combined entity

Nanjing Nanhua People's Development and

Consulting Co. Republic of sales of hardware 33%

Ltd * China and software and

systems integration

services

* The associate had been placed under liquidation in 2005, which a provision for

impairment has been made in respect of the combined entity's investment in

FY2004.

Summarised financial information in respect of the combined entity's associates

is set out below:

31 December 2005 31 December 2004

Audited Audited

US$ US$

Total assets - 404,244

Total liabilities - 248,974

-----------------------------------

Net assets - 155,270

-----------------------------------

Combined entity's share of associate's net assets - 51,757

===================================

Revenue - 461,733

-----------------------------------

Loss of the year - (87,516)

-----------------------------------

Combined entity's share of associate's loss for the period - -

-----------------------------------

18. Other payables

31 December 2005 31 December 2004

Audited Audited

US$ US$

Deposits received 52,435 60,166

Other tax payable 72,066 33,265

Dividend payable 61,346 59,961

Other payables 291,649 164,396

-----------------------------------

Total 477,496 317,788

===================================

19. Bank loans

31 December 2005 31 December 2004

Audited Audited

US$ US$

Bank loans 371,591 363,196

===================================

The bank loan is a revolving bank loan secured by corporate guarantee. The

guarantee for the loan was provided by Nanjing Nanhua Consulting Co. Ltd until

31 December 2004. From 1 January 2005 the guarantee was provided by Nanjing

Skytech Software Co. Ltd. The loan facility expired on 6 January 2006 and was

repaid accordingly.

The average interest rates paid were 6.26% (2004:5.54%) per annum as at 31

December 2005.

20. Share capital

31 December 2005 31 December 2004

Audited Audited

US$ US$

Registered capital:

Nanjing Skytech Co. Ltd 1,210,654 1,210,654

Nanjing Skytech Software Co. Ltd 242,131 242,131

-----------------------------------

1,452,785 1,452,785

===================================

The registered capital of Nanjing Skytech Co. Ltd increased as follows:

- investment of US$ 242,131 on 8 November 2002;

- investment of US$ 605,327 on 2 August 2003.

Nanjing Skytech Software Co. Ltd had registered capital of US$ 242,131 on

incorporation.

21. Operating lease arrangements

31 December 2005 31 December 2004

US$ US$

Minimum lease payments under operating leases included in the income statement 111,650 78,639

===================================

At the balance sheet date, the commitments in respect of non-cancellable

operating leases for office building, workshop and warehouses with a term of

more than one year were as follows:

31 December 2005 31 December 2004

US$ US$

Future minimum lease payments payable:

Within one year 118,511 83,274

In two to five years 12,551 191,012

-----------------------------------

131,062 274,286

===================================

22. Related party transactions

From 31 July 2004, the immediate parent company of Nanjing Skytech Co. Ltd was

Infotech Holdings Pte Ltd.

From incorporation until 31 July 2004, the immediate parent company of Nanjing

Skytech Software Co. Ltd was Nanjing Skytech Co. Ltd. From 31 July 2004 until

January 2005 the immediate parent undertaking was Nanjing Sky Investment

Information Co. Ltd. From January 2005, the immediate parent undertaking was

Infotech Holdings Pte Ltd, a company incorporated in Singapore.

At the date of this report the immediate parent company of each of the companies

making up the combined entity was Infotech Holdings Pte Ltd, a company

incorporated in Singapore. The ultimate parent undertaking was Sinosoft

Technology plc, a company incorporated in England.

The ultimate controlling party throughout the year of this report was Ms Xin

Yingmei by virtue of her majority shareholding in the companies or their

immediate and ultimate parent undertakings.

Transactions between the companies that form the combined entity, which are

related parties, have been eliminated in the preparation of the financial

information set out in this report and are not disclosed in this note.

During the financial year ended 31 December 2004, Nanjing Skytech Co. Ltd made

working capital loans to Infotech Holdings Pte Ltd of US$142,254. This balance

was outstanding at that year end. During the financial year ended 31 December

2005, further working capital loans of US$292,976 were made to Infotech Holdings

Pte Ltd. The balance outstanding at the year end was US$435,231. This loan is

unsecured, interest free and has no fixed repayment terms.

Included within other payables at 31 December 2005 was a balance of US$61,346

(2004:US$59,961) in relation to dividends payable to a former minority

shareholder, Ning Yingmei, in Nanjing Skytech Software Co. Ltd.

Included within other receivables at 31 December 2005 was a balance of US$

40,875 (2004:nil) in relation to working capital loan to Nanjing Sky Investment

Information Co., Ltd, which was the immediate parent company of Nanjing Skytech

Software Co., Ltd from July 2004 until January 2005, and the majority sharehol

der of the company is Ms Xin Yingmei. This balance is unsecured, interest free

and has been repaid after year ended.

23. Comparative figures

Certain comparative figures have been reclassified to conform with the current

year's presentation.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR AKKKPFBKDKQD

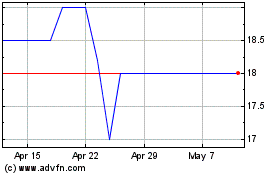

Software Circle (LSE:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

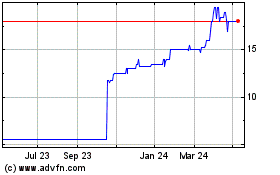

Software Circle (LSE:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024