Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

September 19 2017 - 5:07PM

Edgar (US Regulatory)

Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Filer: Clariant Ltd

Subject Company: Huntsman Corporation

Commission File Number: 001-32427

Media Release

Clariant reconfirms its full commitment to the planned merger of equals between Huntsman and Clariant and reiterates its strong strategic rationale

·

Clariant’s Board of Directors reconfirms its decision that the planned merger is the best value creating option for all stakeholders and will, therefore, not deviate from the binding agreement

·

White Tale’s open letter does not contain any additions to claims previously made; in particular no tangible alternative of superior value creation is presented

·

Since announcement the vast majority of Clariant’s shareholders have expressed their support for the deal

·

Clariant will continue the constructive dialogue with all its shareholders

Muttenz, September 19, 2017 — Clariant, a world leader in specialty chemicals, confirms that its Board has received a letter from White Tale Holdings, the Cayman Island-based vehicle created by hedge funds Corvex and 40 North. According to the letter, White Tale has increased its stake in Clariant above 15 percent. In addition, White Tale has stated that it maintains its opposition to the merger of equals between Huntsman and Clariant.

Clariant does not agree with the statements made by White Tale in their open letter. To the contrary we are convinced that:

·

The proposed merger

is a continuation

of Clariant’s strategy of becoming a world leader in specialty chemicals.

The merger creates one of the largest global specialty chemicals groups, with an attractive, balanced and resilient portfolio across diverse industry segments and geographies, benefitting from a strong growth outlook and substantial exposure to attractive markets. Through proactive and consistent portfolio management, Huntsman’s portfolio has evolved and is evolving into a primarily specialty chemicals businesses and is, therefore, an excellent match for Clariant.

·

The terms of the proposed merger do

not undervalue Clariant’s shares.

The exchange ratio has been agreed on the basis of the respective share prices prevailing at the time of the announcement, reflecting the historic equity value proportion and is in line with a similarly strong track record of total shareholder return of both companies over the last years. In addition, the fairness, from a financial point of view, to Clariant, of the exchange ratio was confirmed with the assistance of Clariant’s financial advisors.

·

The proposed merger offers

substantial value creation

to both sets of shareholders.

On top of the ambitious business plans of both companies over USD 3.5 billion of value will be created through cost synergies in excess of USD 400 million p.a. In addition to these cost synergies, tax synergies of USD 25 million and approximately USD 250 million additional organic revenues at approximately 20 percent EBITDA margin will be realized thanks to the complementary product portfolios. More so, significant further future potential will result from strengthening common R&D platforms and projects. This substantial value creation is unmatched by any other viable alternative.

·

Selling Plastics & Coatings today does not create value.

Whilst Clariant’s Plastics & Coatings Business Area has been earmarked for portfolio management since 2015, selling Plastic & Coatings as Clariant today would be value destructive in view of its significant cash contribution and cost coverage. Post consummation of the merger, the new company HuntsmanClariant will clearly have and use the greater flexibility of the enlarged Group to keep adjusting its portfolio to maximize value for its shareholders and build a leading specialty chemicals company.

·

Clariant has a strong record in cost management.

Clariant has established a competitive cost structure in line with its peers despite significant R&D spend which forms the foundation for sustainable future growth. Any further cost cutting exercise will impair the company’s ability to compete in the future. USD 300 million of stand-alone cost improvement as alleged by White Tale are neither sustainable nor in line with observed peer benchmarks.

·

In a merger of equals there is

no ceding of operational control.

The new company will be jointly led by both management teams under Swiss Corporate Governance, domiciled and headquartered in Switzerland. Hariolf Kottmann will become Chairman, Peter Huntsman will become CEO and Patrick Jany will become CFO of the new company. They will work together to deliver on their joint strategic vision for the merged company.

The Board of Directors of Clariant after carefully and diligently considering various strategic options during the last years remains deeply convinced that this combination in the form agreed in May 2017 is a perfect transaction at the right time to create substantial immediate and long-term shareholder value. It will accelerate the companies’ respective paths towards creating a global specialty chemicals leader.

Clariant and Huntsman will continue to progress in defining the new company and will release a further merger update in the coming weeks.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Clariant Ltd (“Clariant”) and Huntsman Corporation (“Huntsman”) have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this communication include, without limitation, statements about the anticipated benefits of the contemplated transaction, including future financial and operating results and expected synergies and cost savings related to the contemplated transaction, the plans, objectives, expectations and intentions of Clariant, Huntsman or the combined company, the expected timing of the completion of the contemplated transaction. Such statements are based on the current expectations of the management of Clariant or Huntsman, as applicable, are qualified by the inherent risks and uncertainties surrounding future expectations generally, and actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. Neither Clariant nor Huntsman, nor any of their respective directors, executive officers or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause results to differ from expectations include: uncertainties as to the timing of the contemplated transaction; uncertainties as to the approval of Huntsman’s stockholders and Clariant’s shareholders required in connection with the contemplated transaction; the possibility that a competing proposal will be made; the possibility that the closing conditions to the contemplated transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; the effects of disruption caused by the announcement of the contemplated transaction making it more difficult to maintain relationships with employees, customers, vendors and other business partners; the risk that stockholder litigation in connection with the contemplated transaction may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; ability to refinance existing indebtedness of Clariant or Huntsman in connection with the contemplated transaction; other business effects, including the effects of industry, economic or political conditions outside of the control of the parties to the contemplated transaction; transaction costs; actual or contingent liabilities; disruptions to the financial or capital markets, including with respect to the financing activities related to the contemplated transaction; and other risks and uncertainties discussed in Huntsman’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the “Risk Factors” sections of Huntsman’s annual report on Form 10-K for the fiscal year ended December 31, 2016 and the quarterly report on Form 10-Q for the six month period ended June 30, 2017. You can obtain copies of Huntsman’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and neither Clariant nor Huntsman undertakes any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

Important Additional Information and Where to Find It

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the contemplated transaction, Clariant intends to file a registration statement on Form F-4 with the SEC that will include the Proxy Statement/Prospectus of Huntsman. The Proxy Statement/Prospectus will also be sent or given to Huntsman stockholders and will contain important information about the contemplated transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CLARIANT, HUNTSMAN, THE CONTEMPLATED TRANSACTION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Clariant and Huntsman through the website maintained by the SEC at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

Huntsman and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Huntsman investors and shareholders in connection with the contemplated transaction. Information about Huntsman’s directors and executive officers is set forth in its proxy statement for its 2017 Annual Meeting of Stockholders and its annual report on Form 10-K for the fiscal year ended December 31, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov. Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the Proxy Statement/ Prospectus that Huntsman intends to file with the SEC.

|

CORPORATE MEDIA RELATIONS

|

INVESTOR RELATIONS

|

|

|

|

|

JOCHEN DUBIEL

Phone +41 61 469 63 63

jochen.dubiel@clariant.com

|

ANJA POMREHN

Phone +41 61 469 63 73

anja.pomrehn@clariant.com

|

|

|

|

|

CLAUDIA KAMENSKY

Phone +41 61 469 63 63

claudia.kamensky@clariant.com

|

MARIA IVEK

Phone +41 61 469 63 73

maria.ivek@clariant.com

|

|

|

|

|

THIJS BOUWENS

Phone +41 61 469 63 63

thijs.bouwens@clariant.com

|

|

Follow us on Twitter, Facebook, Google Plus, LinkedIn.

www.clariant.com

Clariant is a globally leading specialty chemicals company, based in Muttenz near Basel/Switzerland. On 31 December 2016 the company employed a total workforce of 17 442. In the financial year 2016, Clariant recorded sales of CHF 5.847 billion for its continuing businesses. The company reports in four business areas: Care Chemicals, Catalysis, Natural Resources, and Plastics & Coatings. Clariant’s corporate strategy is based on five pillars: focus on innovation through R&D, add value with sustainability, reposition portfolio, intensify growth, and increase profitability.

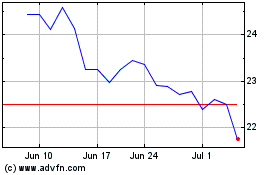

Huntsman (NYSE:HUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

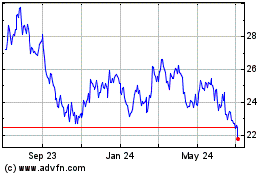

Huntsman (NYSE:HUN)

Historical Stock Chart

From Apr 2023 to Apr 2024