Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

February 05 2016 - 6:12AM

Edgar (US Regulatory)

Filed by: Suncor Energy Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Canadian Oil Sands Limited

Form F-80 File No.: 333-207268; 333-209087

Explanatory Note: The following is an excerpt from a transcript of a conference call first made available in audio form by Suncor Energy Inc. on

February 4, 2016.

“And of course the other development on the growth front was our offer to purchase Canadian Oil Sands Limited in an all-share

deal valued at approximately $6.6 billion. We made the offer early in the fourth quarter and in mid-January the Canadian Oil Sands Board agreed to support our amended offer. We’re now working together to reach out to Canadian Oil Sands

shareholders and encourage them to tender their shares before tomorrow’s deadline, which is at 4 p.m. Mountain Time.”

NOTICE TO U.S.

HOLDERS

The Offer (as defined herein) described in the Offer Documents (as defined herein) is being made for the securities of a Canadian issuer by

a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare the Offer Documents in accordance with the disclosure requirements of Canada. Shareholders in the United States should be

aware that such requirements are different from those of the United States. The financial statements included or incorporated by reference in the Offer Documents have been prepared in accordance with International Financial Reporting Standards, and

are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of U.S. companies.

Shareholders in the United States should be aware that the disposition of their Shares (as defined herein) and the acquisition of Suncor common shares by

them as described in the Offer Documents may have tax consequences both in the United States and in Canada. Such consequences for shareholders who are resident in, or citizens of, the United States may not be described fully in the Offer Documents.

The enforcement by shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that each of Suncor

Energy Inc. (“Suncor”) and Canadian Oil Sands Limited (“COS”) are incorporated under the laws of Canada, that some or all of their respective officers and directors may be residents of a foreign country, that some or all of the

experts named in the Offer Documents may be residents of a foreign country and that all or a substantial portion of the assets of Suncor and COS and said persons may be located outside the United States.

THE SUNCOR COMMON SHARES OFFERED AS CONSIDERATION IN THE OFFER DOCUMENTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION (“SEC”) OR ANY U.S. STATE SECURITIES COMMISSION NOR HAS THE SEC OR ANY U.S. STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF

THE OFFER DOCUMENTS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Shareholders

should be aware that, during the period of the Offer, Suncor or its affiliates, directly or indirectly, may bid for or make purchases of Suncor common shares or Shares, or certain related securities, as permitted by applicable law or regulations of

the United States, Canada or its provinces or territories.

Suncor filed registration statements on Form F-80, which include the Offer Documents,

with the SEC in respect of the Offer on October 5, 2015 and January 22, 2016. This transcript excerpt is not a substitute for such registration statements or any other documents that Suncor has filed or may file with the SEC or send to

shareholders in connection with the Offer. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS ON FORM F-80, AS THEY MAY BE AMENDED FROM TIME TO TIME, AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN

CONNECTION WITH THE OFFER AS THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain a free copy of the registration statements on

Form F-80, as well as other filings containing information about Suncor, at the SEC’s website (www.sec.gov).

OFFER DOCUMENTS

This transcript excerpt does not constitute an offer to buy or sell, or an invitation or a solicitation of an offer to buy or sell, any securities of Suncor or

COS. The exchange offer (the “Offer”) by Suncor to purchase the COS common shares and any accompanying rights (together, the “Shares”) in exchange for common shares of Suncor is being made exclusively by means of, and subject to

the terms and conditions set out in, the Offer to Purchase and Take-Over Bid Circular dated October 5, 2015, as it may be amended from time to time, along with the accompanying Letter of Transmittal, Notice of Guaranteed Delivery and other

related Offer materials (collectively, the “Offer Documents”). While Suncor expects that the Offer will be made to all COS shareholders, the Offer will not be made or directed to, nor will deposits of Shares be accepted from or on behalf

of, holders of Shares in any jurisdiction in which the making or acceptance of the Offer would not be in compliance with the laws of such jurisdiction. However, Suncor may, in its sole discretion, may deem necessary to extend the Offer to holders of

Shares in any such jurisdiction. The information provided in this transcript excerpt is a summary only, does not purport to be complete and is qualified in its entirety by reference to the complete text of the Offer Documents. The Offer Documents

contain important information that should be read carefully before any decision is made with respect to the Offer.

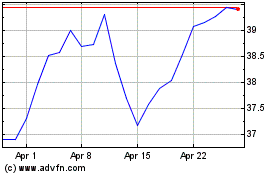

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024