FedEx, UPS Gear Up for Holiday Orders

September 30 2016 - 10:50AM

Dow Jones News

Holiday hiring is expected to be flat at package-delivery giants

FedEx Corp. and United Parcel Service Inc., but that masks efforts

behind the scenes to prepare for the coming wave of e-commerce

orders.

FedEx is opening four new hubs and "dozens" of small, satellite

facilities to receive, sort and ship an expected surge in packages

between Thanksgiving and Christmas, executives said this week. UPS

is expanding a network of temporary sorting hubs and is increasing

its use of software to help sort packages faster, a spokeswoman

said.

Both companies have also invested in automation so they can

process more packages over the holidays while keeping staffing

levels relatively steady. If their projections hold, FedEx and UPS

will have kept the number of seasonal workers steady for two years

running, at over 50,000 and 95,000 workers respectively, after

sharply ramping up holiday hiring earlier in the decade.

"We've been able to hold the line and sustain the number of

seasonal workers" despite having more volume, said Susan Rosenberg,

a UPS spokeswoman.

Many of FedEx's new facilities will have automation technology

that moves and scans packages at a faster pace, which helps offset

its reliance on hard-to-find seasonal workers, said Raj

Subramaniam, an executive vice president at FedEx. The company saw

volumes reach 25 million shipments in a day three times during the

peak holiday period last year, he said. The Memphis, Tenn., company

ultimately kept on seasonal workers into 2016 because of growing

e-commerce demand throughout the year.

FedEx spokesman Glen Brandow said the projected holiday hiring

number could grow, and said there is no link between the company's

technology and its flat projection.

The automated satellite facilities also bring more FedEx

services closer to its retail customers, said Satish Jindel,

president of tracking software developer ShipMatrix Inc. FedEx is

"realigning the network for the new e-commerce world…They are

recognizing that the world of parcel has changed as a result of

rapid growth of online retail," he said.

UPS's additional "mobile delivery centers," first introduced in

2014, are often built in clusters and are located near population

centers where e-commerce is growing quickly. They can be activated

to help the Atlanta-based carrier handle the peak rush without

further increasing seasonal hires, and deactivated when they aren't

needed, Ms. Rosenberg said.

UPS is also increasing its use of technology. Instead of

memorizing zip codes, software and automation technology help route

packages, reducing training time and increasing accuracy. The

system also enables UPS to more easily workers between different

tasks and units.

The changes come as logistics and transportation companies are

dealing with the increased complexity and higher costs of

fulfilling online orders, which have to be collected, sorted, then

sent out to widely scattered addresses in shorter windows of time.

As shoppers grow more accustomed to last-minute gift orders, FedEx

and UPS, as well as retailers and their other logistics providers,

have struggled in recent years to deliver so many packages in time

for the holidays.

Adding to the complexity, U.S. consumers are also increasingly

buying oversized items online, such as exercise bicycles and

mattresses, which require manual handling because they cannot be

fed onto conveyor belts in automated facilities along with smaller

packages.

FedEx and UPS have both raised prices for delivering large

packages, and FedEx is allocating separate space at six of its

facilities this year to sort and ship the bulky items, an attempt

to prevent surging volumes of appliances and furniture from gumming

up the works at its main sorting centers. In total, FedEx expects

capital spending for its current fiscal year to reach $5.6 billion,

up from $4.8 billion last year.

FedEx and UPS collectively make up 40% to 45% of deliveries,

with the U.S. Postal Service making up most of the rest of the

market, according to Shipmatrix.

Mike Esterl contributed to this article

Write to Loretta Chao at loretta.chao@wsj.com

(END) Dow Jones Newswires

September 30, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

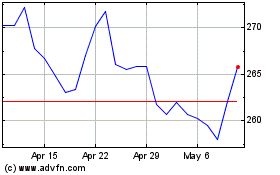

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

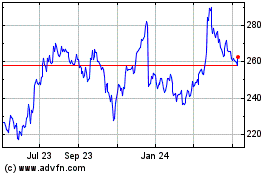

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024