FedEx Trims Outlook on Weak Freight Demand--Update

September 16 2015 - 8:42AM

Dow Jones News

By Chelsey Dulaney

FedEx Corp. on Wednesday trimmed its earnings outlook for its

fiscal year as the package-delivery giant sees weak demand in its

freight segment and higher costs in its ground segment.

The downbeat guidance followed weaker-than-expected profit for

its August quarter.

FedEx said it is now expecting earnings of $10.40 to $10.90 for

the year ending next May, down from its previous guidance of $10.60

to $11.10 a share.

The shipper said it is benefiting from its restructuring plans,

but the company is seeing weak less-than-truckload demand at its

freight segment, high self-insurance reserves, and higher operating

costs at FedEx Ground.

FedEx "is performing solidly given weaker-than-expected economic

conditions, especially in manufacturing and global trade," Chief

Executive Frederick W. Smith said in a news release.

FedEx said it is seeing improvements from its cost-cutting

plans, but it is experiencing weaker less-than-truckload demand and

higher-than-expected self-insurance reserves, on top of higher

operating costs at FedEx Ground.

Shares of FedEx, which rose 2.5% Tuesday, fell 3.5% to $148.65

in premarket trading. Through Tuesday's close, the stock is down

0.4% over the past 12 months.

FedEx has been pouring money into its ground segment as it tries

to keep up with the boom in online shopping. Founded as an air

express company, FedEx is relatively new to ground delivery

compared with century-old rival United Parcel Service Inc. FedEx

only added its home delivery service in 2000 and has been rapidly

expanding its ground network to accommodate the big increase in

e-commerce packages.

On Tuesday, FedEx announced it would raise shipping rates at its

FedEx Express, FedEx Ground and FedEx Freight shipments starting

Jan. 4. In addition, FedEx said it would increase the surcharges

for shipments that exceed the published maximum dimensions in the

FedEx Ground network starting Nov. 2.

The move comes as FedEx heads into its crucial holiday shipping

season.

In the latest quarter, FedEx said results benefited from one

additional operating day at each of its transportation segments,

partially offset by higher incentive compensation and a slight

negative impact from fuel.

Overall, for the first quarter ended Aug. 31, FedEx posted a

profit of $692 million, or $2.42 a share, up from $653 million, or

$2.26 a share, in the year-earlier period.

Profit in the prior-year period included a benefit from its

recent pension accounting change.

Revenue rose to $12.3 billion from $11.7 billion a year ago.

Analysts polled by Thomson Reuters recently expected per-share

earnings of $2.46 on revenue of $12.3 billion.

At its ground segment, revenue jumped 29% to $3.83 billion,

helped by its acquisition of logistics provider GENCO Distribution

System Inc. and a 4% increase in volume due to continued growth in

home delivery.

At the company's biggest segment--express--revenue fell 4% to

$6.59 billion. A 1% increase in U.S. domestic package volume and

improved base rates were offset by lower fuel surcharges and

currency impacts.

FedEx said its freight segment's revenue was essentially flat at

$1.61 billion, as shipments for the less-than-truckload operation

edged down 1% amid weak industry demand.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 08:27 ET (12:27 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

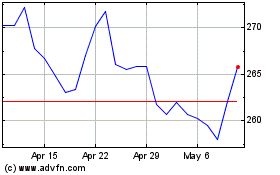

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

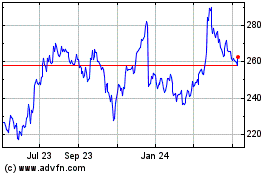

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024