FedEx Takes Earnings Hit Following Cyberattack -- Update

September 19 2017 - 8:09PM

Dow Jones News

By Ezequiel Minaya and Michelle Ma

FedEx Corp. said Tuesday that a cyberattack earlier this year

dented earnings in its latest quarter by roughly $300 million,

prompting the package delivery giant to cut its profit forecast for

the rest of the fiscal year.

The company said that the June 27 attack, which security experts

dubbed Petya, dragged on per-share earnings by 79 cents, reduced

its quarterly earnings by a third, as its computer systems at its

TNT Express business were disrupted for weeks. The company said it

has restored most of TNT's services and critical technology, but it

is still working on some customer-specific systems.

"This was not an ordinary cyberattack," FedEx's finance chief,

Alan Graf, said during a conference call with analysts. "We believe

that this attack was the result of a nation-state targeting Ukraine

and companies that do business there."

The company expects TNT systems damaged by the attack to be

fully restored by the end of September.

FedEx, which wasn't covered by cyberinsurance, said it is

"re-examining where the market is" and is considering adding

coverage, Mr. Graf said. The company said the attack was contained

to TNT and didn't impact FedEx Express systems or its

customers.

FedEx shares fell 1.6% to $212.55 in after-hours trading. They

were up 16% so far this year.

FedEx acquired TNT Express last year for $4.8 billion, the

largest acquisition in FedEx's history as part of a move to

accelerate its growth abroad.

FedEx expects integration of the Dutch company to be finished in

2020. Integration expenses, including restructuring charges, are

expected to be about $800 million, with $350 million of that

expected to be incurred fiscal 2018.

Like rival United Parcel Service Inc., FedEx is making

preparations for the surge in holiday shipments from the boom in

online shopping, which has tested the two package-delivery giants.

Executives said Tuesday they expect to hire 50,000 employees for

the peak holiday season, about the same level as last year.

The company said it would also add surcharges on "the small

number" of large retail and e-commerce customers that drive the

surge on peak deliveries. It is also charging extra fees for

oversize packages for the entire holiday season. UPS announced

earlier this year plans to apply surcharges on all shipments on

certain peak-volume days.

For the fiscal first quarter ended Aug. 31, FedEx reported a

profit of $596 million, or $2.19 a share, down from $715 million,

or $2.65 a share, a year ago. It said the cyberattack reduced

per-share earnings by 79 cents in the period. Revenue rose 4% to

$15.3 billion.

The company lowered its profit targets for the rest of the

fiscal year. It now expects per-share earnings, excluding certain

items, to be between $12 and $12.80, down from its previous

estimate of between $13.20 and $14.

Starting Jan. 1, FedEx said it would FedEx Freight, Express,

Ground and Home Delivery shipping rates in the U.S. would increase

by an average of 4.9%.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

September 19, 2017 19:54 ET (23:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

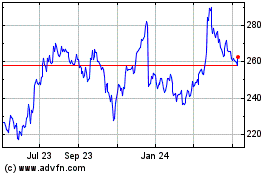

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

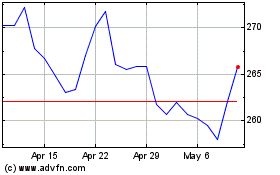

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024