FedEx Offers Lackluster Outlook

June 21 2016 - 5:30PM

Dow Jones News

FedEx Corp. issued lackluster guidance for its new fiscal year

as the package-delivery giant said its also will spend more again

this year to bulk up its ground operations to tackle higher volume

from online shopping.

Shares fell 1.5% to $161.50 after hours, although the company's

adjusted per-share earnings and revenue beat expectations.

For the fiscal year ending in May of 2017, the Memphis, Tenn.,

company forecast adjusted per-share earnings of $11.75 to $12.25.

Analysts polled by Thomson Reuters expected per-share profit of

$12.05.

The company also said it is raising capital spending for the

fiscal current year to $5.1 billion, up from $4.8 billion in the

recently completed year.

For the period ended May 31, FedEx reported a loss of $70

million, or 26 cents a share, compared with a year-earlier loss of

$895 million, or $3.16 a share. Excluding pension-accounting

adjustments, TNT acquisition- and integration-related expenses and

other items, adjusted per-share earnings rose to $3.30 from

adjusted earnings of $2.66 a share. Revenue increased 7.4% to $13

billion.

Analysts polled by Thomson Reuters expected per-share profit of

$3.28 and revenue of $12.78 billion.

Investors and analysts likely will be listening to FedEx's

earnings call for any details about the integration of FedEx's

nearly $5 billion acquisition of Dutch parcel firm TNT Express

NV.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

June 21, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

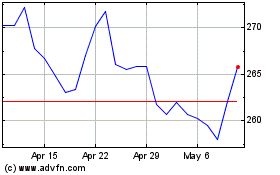

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

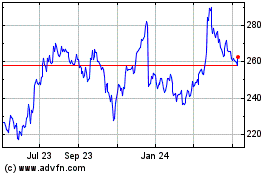

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024