FedEx Lifts Outlook as It Integrates TNT Express -- 3rd Update

September 20 2016 - 9:05PM

Dow Jones News

By Mike Esterl

FedEx Corp. said revenue and operating margins rose at its key

express and ground units in its fiscal first quarter and predicted

that income also would rise for the year despite being dragged down

by newly acquired TNT Express NV.

The Memphis, Tenn., delivery giant also said Tuesday it expects

another record shipping season during the peak holiday period,

lifted by e-commerce, even as it scaled back its broader economic

growth outlook.

FedEx reported Tuesday revenue in the quarter ended Aug. 31 rose

to $14.7 billion from $12.3 billion a year earlier, aided in part

by Dutch parcel delivery company TNT, which it acquired in May.

Net income rose to $715 million, or $2.65 a share, from $692

million, or $2.42 a share, in the year-earlier quarter.

FedEx estimated adjusted earnings for fiscal 2017 would see a

negative effect of $1 a share from its nearly $5 billion

acquisition of TNT, its biggest takeover to date. But it still

expects adjusted earnings to be $10.85 to $11.35 a share including

TNT, compared with $10.80 in fiscal 2016 without TNT.

Fred Smith, FedEx's chief executive, said during an earnings

call with analysts that TNT's integration was proceeding

"smoothly." Chief Financial Officer Alan Graf cautioned the

integration would take four years, at an aggregate cost of $700

million to $800 million, but that TNT would boost FedEx's earnings

by fiscal 2018.

FedEx shares were 2.7% higher at $167.05 in after-hours trading

on the New York Stock Exchange.

The company said it plans to hire more than 50,000 seasonal

workers for the peak holiday shopping season. Last year, it hired

55,000.

"We expect each of the four Mondays during the upcoming peak

period to be among the busiest in our corporate history," Michael

Glenn, head of market development, told analysts.

There is growing online demand to ship everything from

"large-screen TVs to mattresses and trampolines," Mr. Glenn

added.

The surge in e-commerce is in contrast to a more subdued overall

economy. FedEx expects U.S. gross domestic product to expand 1.6%

this year, down from its earlier 1.8% forecast. It expects global

GDP to expand 2.2%, compared with 2.3% earlier.

Operating margins at its express unit rose to 9.4% from 8.3% in

the year-earlier quarter, boosted by higher yields with a 1% rise

in domestic and international package volume.

Margins at the company's smaller ground unit inched higher to

14.2% from 14.0%. Volume grew 10%, lifted by growing

e-commerce.

Revenue at TNT totaled $1.80 billion, with an operating loss of

$14 million.

FedEx said costs from TNT's integration and restructuring

program dented earnings by 17 cents a share, while an intangible

asset amortization expense for TNT shaved another 8 cents off

per-share profit.

Excluding those items, adjusted per-share earnings rose to $2.90

a share. Analysts polled by Thomson Reuters had projected adjusted

per-share profit of $2.81 on $14.61 billion in revenue.

FedEx said annual synergies related to the TNT deal should total

$750 million starting in fiscal 2020. FedEx acquired the Dutch

company to expand its ground network in Europe.

One analyst, David Ross at Stifel Nicolaus, questioned during

the earnings call why FedEx was buying back stock rather than

paying down debt.

Mr. Graf, the CFO, said FedEx is committed to improving its debt

profile but will continue to buy back stock, increase dividends and

invest in the business. That's because management sees healthy

growth potential and believes the company's share price is

undervalued, he added.

FedEx reiterated it plans to make $5.6 billion in capital

expenditures in fiscal 2017, or nearly 10% of revenue. Much of the

money is earmarked for expanding its ground network to capitalize

on rising e-commerce demand and modernizing its air fleet to become

more efficient. Still, Mr. Graf said capital expenditures should

drop to 6% to 8% of revenue longer term.

FedEx's ratio of total debt to earnings before interest, taxes,

depreciation and amortization is 1.8, according to S&P Capital

IQ.

--Anne Steele contributed to this article.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

September 20, 2016 20:50 ET (00:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

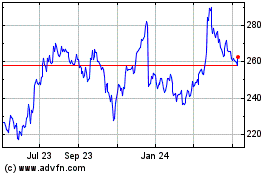

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

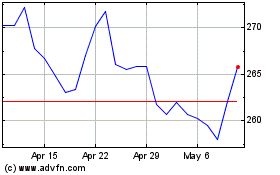

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024