Strong Earnings Growth Expected in Fiscal

2015

FedEx Corp. (NYSE: FDX) today reported earnings of $2.46 per

diluted share for the fourth quarter ended May 31. Last year’s

fourth quarter earnings were $2.13 per diluted share, excluding a

$0.98 per diluted share business realignment program charge and a

$0.20 per diluted share noncash aircraft impairment charge at FedEx

Express. Including last year’s charges, earnings were $0.95 per

diluted share.

“An outstanding fourth quarter helped FedEx post solid results

for fiscal 2014, and we believe we are well positioned for a strong

fiscal 2015,” said Frederick W. Smith, FedEx Corp. chairman,

president and chief executive officer. “I would like to extend my

sincere appreciation to the entire FedEx team for their

contribution to our results and their continued commitment to

providing outstanding service to our customers and connecting

people and possibilities around the world.”

Fourth Quarter Results

FedEx Corp. reported the following consolidated results for the

fourth quarter:

Fiscal 2014

Fiscal 2013

Adjusted(non-GAAP)

As

Reported(GAAP)

Revenue $11.8 billion $11.4 billion $11.4 billion Operating Income

$1.18 billion $1.10 billion $502 million Operating Margin 10.0 %

9.6 % 4.4 % Net Income $730 million $679 million $303 million

Diluted EPS $ 2.46 $ 2.13 $ 0.95

Excluding business realignment program costs and aircraft

impairment charges last year, operating results improved on higher

volumes and operational efficiencies at FedEx Freight, increased

volumes and yields at FedEx Ground, and better revenue and cost

performance at FedEx Express.

During the fourth quarter, the company acquired 9.9 million

shares of FedEx common stock, increasing the fiscal 2014 purchase

total to 36.8 million shares. As of May 31, 2014, 5.3 million

shares remained under the existing share repurchase authorizations.

Share repurchases benefited fourth quarter earnings by $0.12 per

diluted share.

Full Year Results

FedEx Corp. reported the following consolidated results for the

full year:

Fiscal 2014

Fiscal 2013

Adjusted(non-GAAP)

As

Reported(GAAP)

Revenue $45.6 billion $44.3 billion $44.3 billion Operating Income

$3.45 billion $3.21 billion $2.55 billion Operating Margin 7.6 %

7.3 % 5.8 % Net Income $2.10 billion $1.98 billion $1.56 billion

Diluted EPS $ 6.75 $ 6.23 $ 4.91

Capital spending for fiscal 2014 was $3.5 billion.

Outlook

For fiscal 2015, FedEx projects earnings to be $8.50 to $9.00

per diluted share. The outlook assumes no net year-over-year fuel

impact and continued moderate economic growth. Capital spending for

fiscal 2015 is expected to increase to approximately $4.2 billion,

which includes planned aircraft deliveries to support the company’s

fleet modernization program and continued expansion of the FedEx

Ground network.

“Fiscal 2014 was a good year for FedEx and we expect fiscal 2015

to be even better,” said Alan B. Graf, Jr., FedEx Corp. executive

vice president and chief financial officer. “With continued modest

economic improvement, our results in fiscal 2015 should benefit

from base performance improvement and ongoing execution of our

profit improvement initiatives at FedEx Express, continued

profitable growth at FedEx Ground and FedEx Freight, and our share

repurchase program. We remain committed to improving earnings, cash

flows, returns on invested capital and returns to shareowners, with

the most recent example of the latter being our announced 33%

increase in the quarterly dividend.”

FedEx Express Segment

For the fourth quarter, the FedEx Express segment reported:

• Revenue of $7.00 billion, up slightly from last year’s $6.98

billion

• Operating income of $475 million, up 3% from an adjusted $460

million a year ago. Including charges, last year’s operating income

was $0.

• Operating margin of 6.8%, up from an adjusted 6.6% the

previous year. Including charges, last year’s operating margin was

0.0%.

Revenue increased due to 2% higher package volume and higher

base package yields, partially offset by the effects of one fewer

operating day, lower fuel surcharges and lower express freight

revenues. U.S. domestic average daily volume increased 3%, while

U.S. domestic revenue per package was flat as lower fuel surcharges

offset higher weight per package and favorable service mix.

International export revenue per package grew 2%, as improved

rates, higher weight per package and favorable service mix more

than offset lower fuel surcharges. International export volume grew

2%, as FedEx International Economy grew 5% while FedEx

International Priority® was flat despite reduced lower-yielding

distribution services volume.

Operating results increased as higher base package yields and

volume, along with lower pension expense, more than offset the

significant negative net impact of fuel, lower freight revenue and

one fewer operating day.

On May 1, 2014, Express completed the acquisition of Supaswift

businesses in South Africa and six other countries: Botswana,

Malawi, Mozambique, Namibia, Swaziland and Zambia. The acquisition

of Supaswift will increase FedEx’s capabilities in one of the

world’s most rapidly developing regions and offer tremendous

opportunities for both local and international customers to access

new markets.

FedEx Ground Segment

For the fourth quarter, the FedEx Ground segment reported:

• Revenue of $3.01 billion, up 8% from last year’s $2.78

billion

• Operating income of $586 million, up 5% from an adjusted $557

million a year ago. Including charges, last year’s operating income

was $464 million.

• Operating margin of 19.5%, down from an adjusted 20.1% the

previous year. Including charges, last year’s operating margin was

16.7%.

FedEx Ground average daily volume grew 8% in the fourth quarter,

primarily driven by growth in e-commerce. Revenue per package

increased 2% due to rate increases and higher residential

surcharges, partially offset by lower fuel surcharges. FedEx

SmartPost average daily volume decreased 8% while net revenue per

package was up 8% due to rate increases and improved customer mix,

partially offset by higher postage costs.

Operating results benefited from higher Ground volume and

revenue per package, partially offset by higher network expansion

costs and one fewer operating day.

FedEx Freight Segment

For the fourth quarter, the FedEx Freight segment reported:

• Revenue of $1.55 billion, up 12% from last year’s $1.39

billion

• Operating income of $122 million, up 51% from an adjusted $81

million a year ago. Including charges, last year’s operating income

was $38 million.

• Operating margin of 7.9%, up from an adjusted 5.8% the

previous year. Including charges, last year’s operating margin was

2.7%.

Less-than-truckload (LTL) average daily shipments grew 12%,

including a 14% increase in demand for Priority service. Weight per

shipment grew 2%, driving a 1% increase in revenue per

shipment.

Operating results improved due to the positive impacts of higher

average daily shipments, higher weight per shipment and improved

operational efficiencies, partially offset by one fewer operating

day.

Effective June 2, 2014, FedEx Freight increased its published

fuel surcharge indices by three percentage points.

Corporate Overview

FedEx Corp. (NYSE: FDX) provides customers and businesses

worldwide with a broad portfolio of transportation, e-commerce and

business services. With annual revenues of $46 billion, the company

offers integrated business applications through operating companies

competing collectively and managed collaboratively, under the

respected FedEx brand. Consistently ranked among the world's most

admired and trusted employers, FedEx inspires its more than 300,000

team members to remain "absolutely, positively" focused on safety,

the highest ethical and professional standards and the needs of

their customers and communities. For more information, visit

news.fedex.com.

Additional information and operating data are contained in the

company’s annual report, Form 10-K, Form 10-Qs and fourth quarter

fiscal 2014 Statistical Book. These materials, as well as a webcast

of the earnings release conference call to be held at 8:30 a.m. EDT

on June 18 are available on the company’s website at investors.fedex.com. A replay of the conference

call webcast will be posted on our Web site following the call.

Certain statements in this press release may be considered

forward-looking statements, such as statements relating to

management's views with respect to future events and financial

performance. Such forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from historical experience or from future results

expressed or implied by such forward-looking statements. Potential

risks and uncertainties include, but are not limited to, economic

conditions in the global markets in which we operate, our ability

to execute on our profit improvement program at FedEx Express,

legal challenges or changes related to FedEx Ground’s

owner-operators, new U.S. domestic or international government

regulation, the impact from any terrorist activities or

international conflicts, our ability to effectively operate,

integrate and leverage acquired businesses, changes in fuel prices

and currency exchange rates, our ability to match capacity to

shifting volume levels and other factors which can be found in

FedEx Corp.'s and its subsidiaries' press releases and filings with

the SEC.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURESTO GAAP FINANCIAL MEASURES

The company believes that meaningful analysis of our financial

performance requires an understanding of the factors underlying

that performance and our judgments about the likelihood that

particular factors will repeat. Excluding charges associated with

the business realignment program and a noncash aircraft impairment

charge at FedEx Express from prior period results will allow for

more accurate comparisons of the company’s operating performance.

Where applicable, the impacts of these events are shown net of

incentive compensation impacts. As required by SEC rules, the

tables below present a reconciliation of our presented non-GAAP

measures to the most directly comparable GAAP measures.

Fourth Quarter

Fiscal 2013

FedEx Corporation

Diluted

Operating

Net

Earnings

Dollars in millions, except EPS

Income

Margin

Income

Per Share

Non-GAAP Measure $ 1,098 9.6 % $ 679 $ 2.13

Business Realignment Program

(496

)

(4.3

%)

(313

)

(0.98

)

Aircraft Impairment

(100 )

(0.9 %) (63

) (0.20 ) GAAP

Measure

$ 502 4.4

% $ 303

$ 0.95

Dollars in millions,except EPS

FedEx

ExpressOperating

FedEx

GroundOperating

FedEx

FreightOperating

Income

Margin

Income

Margin

Income

Margin

Non-GAAP Measure

$

460

6.6

%

$

557

20.1

%

$

81

5.8

%

Business Realignment Program

(360

)

(5.2

%)

(93

)

(3.4

%)

(43

)

(3.1

%)

Aircraft Impairment

(100

)

(1.4

%)

—

—

—

—

GAAP Measure

$ 0

0.0 % $ 464

16.7 % $

38 2.7 %

Full Year Fiscal

2013

FedEx Corporation

Diluted

Earnings

Dollars in millions, except EPS

Operating

Net

Income

Margin

Income

Per

Share1

Non-GAAP Measure

$

3,211

7.3

%

$

1,977

$

6.23

Business Realignment Program

(560

)

(1.3

%)

(353

)

(1.11

)

Aircraft Impairment

(100

)

(0.2

%)

(63

)

(0.20

)

GAAP Measure

$

2,551

5.8

%

$

1,561

$

4.91

1 – Does not sum to total due to

rounding.

The financial section of this release is provided on the

company's website at investors.fedex.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20140618005389/en/

FedEx Corp.Media Contact:Patrick Fitzgerald,

901-818-7300orInvestor Contact:Mickey Foster, 901-818-7468Home

Page: fedex.com

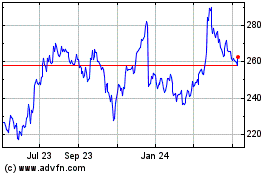

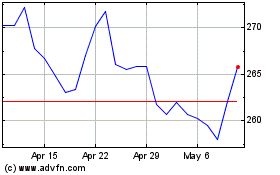

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024