FedEx Authorizes New Share-Repurchase Program

January 26 2016 - 6:34PM

Dow Jones News

By Ezequiel Minaya

FedEx Corp. authorized on Tuesday a new share repurchase program

of up to 25 million shares, worth more than $3 billion.

Shares of the company inched up 0.3% to $127.67 in after-hours

trading.

FedEx said that since its 2014 fiscal year, it has repurchased

more than 57 million shares for nearly $8 billion. No time limit

was set for the latest share-buyback program. The prior

authorization, launched in September 2014 for 15 million shares,

has been completed, the company said.

The company is valued around $35 billion, according to

FactSet.

FedEx suffered a black eye over the holidays, saying last-minute

online orders and severe weather resulted in some packages arriving

late.

For the December quarter, FedEx reported a profit of $691

million, or $2.44 a share, up from year-earlier earnings of $663

million, or $2.31 a share. Excluding certain items, profit rose to

$2.58 a share from $2.16. Revenue increased 4% to $12.5

billion.

Earlier this month, European Union regulators approved FedEx's

acquisition of Dutch parcel company TNT Express NV, ending a

six-month antitrust investigation that had been one of the biggest

hurdles for the nearly $5 billion deal.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

January 26, 2016 18:19 ET (23:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

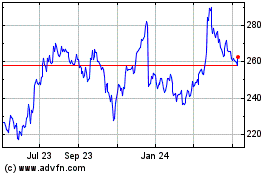

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

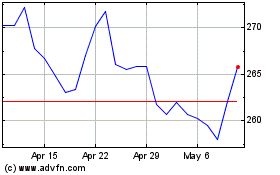

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024