Feature Analyst Alert and 4 Brief Updates

November 10 2015 - 8:00AM

InvestorsHub NewsWire

NEW YORK, NY – November 10, 2015 -- InvestorsHub NewsWire

-- Small Cap Street makes the connection between sophisticated

investors and high quality micro and small cap companies that are

currently undervalued. We are an issuer of reports written by

experienced financial analysts and who provide a straight forward

assessment of a profiled company. They include stocks traded in the

NYSE, NASDAQ, and OTCBB exchanges.

*Feature Analyst Alert*

This week's NASDAQ alert is the lowest priced with the most upside

potential that we have covered in a long time. Another reason we

like this one so much their technology is proprietary.

(NASDAQ: AMDA) is in the hot biotech /

biomaterial space currently holding 56 patents issued and another

37 patents pending. As if that's not enough to get you excited,

(NASDAQ: AMDA) has earnings due this week Thursday November 12th,

2015.

Earnings PR- http://finance.yahoo.com/news/amedica-corporation-release-third-quarter-201500678.html

Link to Amedica's Investor presentation at their website- http://investors.amedica.com/downloads.cfm

Link to Amedica's website providing information on the two analyst'

that cover their securities Needham and JMP Securities - http://investors.amedica.com/analysts.cfm

Needham and JMP's targets are $1 and $3/share.

If you would like to receive profiles in real time, text "Street"

to 25827

4 Brief Investor Updates

Peregrine Pharmaceuticals, Inc. (NASDAQ:

PPHM) is a biopharmaceutical company with a pipeline of novel

drug candidates in clinical trials focused on the treatment of

cancer. The company's lead immunotherapy candidate, bavituximab, is

in Phase III development for the treatment of second-line non-small

lung cancer (the "SUNRISE trial") along with several

investigator-sponsored trials evaluating other treatment

combinations and additional oncology indications.

The company just announced results from multiple new preclinical

studies demonstrating enhanced anti-tumor activity and immune

activation for combinations of a preclinical bavituximab (the PPHM

lead immunotherapy candidate) equivalent and checkpoint inhibitors

such as anti-PD-1 and anti-CTLA-4 in preclinical models of breast

cancer and melanoma. Results from these studies were presented at

the 2015 annual meeting of the Society for Immunotherapy of Cancer

on November 4 - 8, 2015.

Amarin Corp. Plc (NASDAQ:

AMRN) is a biopharmaceutical company focused on the

commercialization and development of therapeutics to improve

cardiovascular health. Amarin's product development program

leverages its extensive experience in lipid science and the

potential therapeutic benefits of polyunsaturated fatty acids.

Amarin's clinical program includes commitment to an ongoing

outcomes study. Amarin's first product, Vascepa® (icosapent ethyl)

capsules, is a highly pure EPA omega-3 prescription product.

Key Amarin achievements since June 30, 2015 include: REDUCE-IT,

study is progressing on schedule with enrollment now over 97%

complete; Recognized $21.3 million in net product revenue from

Vascepa® (icosapent ethyl) sales in Q3 2015 compared to $14.1

million in Q3 2014, an increase of 51%; Increased normalized

prescriptions, based on data from Symphony Health Solutions, by 51%

in Q3 2015 compared to Q3 2014.

RCS CAPITAL Corp. (NYSE:

RCAP) is a full-service investment firm focused on the

individual retail investor. RCS Capital's business is designed to

capitalize, support, grow and maximize value for the investment

programs it distributes and the independent advisors and clients it

serves.

On November 9, 2015 the company announced the following changes:

Completes $27 Million Issuance of New Senior Unsecured Promissory

Notes to Provide Incremental Liquidity; $12 Million Issued to

Affiliates of AR Capital, $15 Million Issued to Affiliates of Luxor

Capital Group; Company and its Lenders Agree to Certain

Modifications to Credit Facilities; Company Agrees to Sell Hatteras

Liquid Alternatives Platform to the Hatteras Funds Management

Group; Company Announces Changes to Board of Directors; Independent

Board Members of RCS Capital Given Proxy to Vote Majority Class B

Share and Series D-1 Preferred Shares; Company Given Right to

Purchase B Share for $1.

Northwest Biotherapeutics, Inc. (NASDAQ:

NWBO) is a biotechnology company developing immunotherapy

products to treat cancers, without toxicities of the kind

associated with chemotherapies. The Company has a broad

platform technology for DCVax dendritic cell-based vaccines.

The Company's lead program is a 348-patient Phase III trial in

newly diagnosed Glioblastoma multiforme (GBM), which is on a

partial clinical hold in regard to new screening of patients.

Last month the company raised $30 million with Woodford Investment

Management in the UK. Woodford will purchase $30 million of the

Company's common stock at $5.50 per share, for a total of 5,454,545

shares, raising Woodford's total holdings to 25,915,937 shares, or

about 28.1% of the Company. The purchase will take place in a

closing on or before October 22, 2015.

With the new funding from Woodford the company will move its

clinical programs for DCVax-L and DCVax-Direct ahead.

Forward-Looking Disclaimer

This report may contain certain forward-looking statements and

information, as defined within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, and is subject to the Safe Harbor created by those

sections. This material contains statements about expected future

events and/or financial results that are forward-looking in nature

and subject to risks and uncertainties. Such forward- looking

statements by definition involve risks, uncertainties and other

factors, which may cause the actual results, performance or

achievements of mentioned company to be materially different from

the statements made herein.

Compliance Procedure

Content is researched, written and reviewed on a best-effort basis

by a 3rd party research analyst. However, we are only human and may

make mistakes. This report was prepared for informational purposes

only. A full disclaimer can be found by viewing the full

analyst report. We do not engage in high frequency trading or hold

any positions of profiled company.

For more information and services provided beyond this release

please use contact information provided below. If you notice any

errors or omissions, please notify us below.

Source: Small Cap Street

Contact: editor@smallcapstreet.com

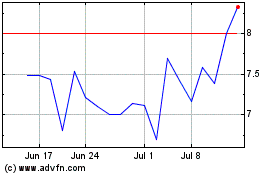

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

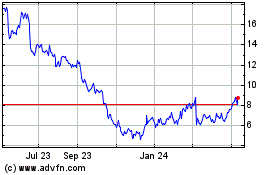

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Apr 2023 to Apr 2024