- ASV advanced $22.5 million, up 6% organically

- Adjusted EPS rose 10% to $1.22

FactSet Research Systems Inc. (NYSE:FDS) (Nasdaq:FDS), a leading

provider of integrated global financial information and analytical

applications to the investment community, today announced its

results for the second quarter of fiscal 2014.

For the quarter ended February 28, 2014, revenues increased to

$226.9 million, up 7% over the prior year. Included in this total

was $2 million from the acquisition of Matrix. Operating income was

$75.1 million compared to $56.2 million in the year ago quarter.

Net income was $52.4 million versus $44.5 million a year ago.

Diluted earnings per share was $1.22 compared to $1.00 in the same

period of fiscal 2013.

Adjusted operating income for the quarter was up 4% over the

prior year. Adjusted operating income in the fiscal 2013 period

excludes the prior year non-cash pre-tax charge of $15.7 million

for vesting performance-based stock options. Adjusted net income

advanced 6%. Adjusted net income in the year ago quarter excludes

both the after-tax charge of $11.0 million related to

performance-based stock options and $6.3 million in income tax

benefits from the U.S. Federal R&D credit. Adjusted diluted EPS

rose 10%. Prior year adjusted diluted EPS of $1.11 excludes the net

effect of a $0.25 decrease for the vesting of performance-based

options, partially offset by a $0.14 increase in diluted EPS from

the U.S. Federal R&D credit.

A reconciliation between GAAP and adjusted financial measures is

presented on page 9 of this press release.

|

Consolidated Statements of Income |

| (Condensed and Unaudited) |

|

| |

Three Months Ended February

28, |

| (In thousands, except per

share data) |

2014 |

2013 |

Change |

| Revenues |

$226,934 |

$213,083 |

7% |

| Adjusted operating income |

$75,054 |

$71,860 |

4% |

| Adjusted net income |

$52,426 |

$49,281 |

6% |

| Adjusted diluted earnings per share |

$1.22 |

$1.11 |

10% |

| Diluted weighted average shares |

43,107 |

44,455 |

|

| |

"Our second quarter results reflect an improving buy-side client

base, and include acquiring the remaining 40% interest in Matrix,"

said Philip Hadley, Chairman and CEO. "I'm pleased to see that our

net client growth in the past three months was the highest

quarterly total since 2006 and buy-side users grew at a level we've

not seen since 2004. This is validation that our sizable

reinvestment in our products and services is being recognized by

the market."

Annual Subscription Value ("ASV")

ASV totaled $920 million at February 28, 2014, up 6% organically

over the prior year. Including $7.3 million from the acquisition of

Matrix, ASV increased $29.8 million over the last three months.

Buy-side clients account for 82.7% of ASV and the remainder from

sell-side firms who perform M&A advisory work and equity

research. ASV at any given point in time represents the

forward-looking revenues for the next 12 months from all services

currently being supplied to clients.

Financial Highlights – Second Quarter of Fiscal

2014

- ASV from U.S. operations was $626 million and $294 million was

related to international operations.

- U.S. revenues were $154.3 million, up 6% from the year ago

quarter.

- Non-U.S. revenues rose to $72.7 million. Excluding incremental

revenue from the acquisition of Matrix and the impact of foreign

currency, the international growth rate was 6%.

- Operating margin was 33.1% compared to 26.4% a year ago. The

acquisition of Matrix reduced the operating margin by 40 basis

points.

- The effective tax rate was 30.5%. If the U.S. Federal R&D

tax credit had been re-enacted by February 28, 2014, the annual

effective tax rate would have been 29.0%.

- Quarterly free cash flow was $38 million.

Operational Highlights – Second Quarter of Fiscal

2014

- Client count rose by 96, including 32 new clients acquired from

Matrix and totaled 2,632 at February 28, 2014.

- Annual client retention was greater than 95% of ASV and 92%

when expressed as a percentage of clients.

- Users of the FactSet workstation increased by 849 over the past

three months and totaled 51,863 professionals at February 28, 2014.

The user count does not include Matrix users.

- Employee count was 6,486 at February 28, 2014, an increase of

87 employees during the quarter.

- Capital expenditures were $2.6 million.

- A regular quarterly dividend of $14.8 million or $0.35 per

share was paid on March 18, 2014, to common stockholders of record

as of February 28, 2014.

- The Company repurchased 800,000 shares for $86.1 million during

the second quarter. At February 28, 2014, $219 million remains

authorized for future repurchases.

- Common shares outstanding were 42.4 million at February 28,

2014.

- FactSet was named one of Fortune's "100 Best Companies to Work

For," marking the Company's sixth appearance on the list in the

last seven years.

- FactSet opened a new office in Singapore to meet the needs of

its growing international client base.

Matrix Acquisition

FactSet acquired Matrix Data Limited ("Matrix") for $32 million

during the second quarter of fiscal 2014. Headquartered in London,

England, Matrix's primary line of business is a provider of

intelligence to the UK financial services industry, covering market

share of mutual fund distribution. Matrix has developed customer,

channel and market benchmarking solutions that help clients

optimize product distribution and improve marketing effectiveness

to drive revenue growth. At the time of acquisition, Matrix

employed 85 individuals in England and had annual subscriptions of

$7.3 million. Matrix reduced FactSet's second quarter operating

margin by 40 basis points and diluted earnings per share by $0.01.

For the full year fiscal 2014, Matrix is not expected to have an

impact on diluted earnings per share.

Business Outlook

The following forward-looking statements reflect FactSet's

expectations as of today's date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially. The Company does not intend to update its

forward-looking statements until its next quarterly results

announcement, other than in publicly available statements.

Third Quarter Fiscal 2014 Expectations

- Revenues are expected to range between $229 million and $233

million.

- Operating margin is expected to range between 32.5% and 33.5%,

which includes a 70 basis point reduction from the recent

acquisitions of Revere and Matrix.

- The annual effective tax rate is expected to range between 30%

and 31% and assumes that the U.S. Federal R&D tax credit will

not be re-enacted by the end of the third quarter of fiscal

2014.

- Diluted EPS should range between $1.24 and $1.26. The lapse in

the U.S. Federal R&D tax credit on December 31, 2013 reduced

each end of the diluted EPS range by $0.03.

Conference Call

The Company will host a conference call today, March 18, 2014,

at 11:00 a.m. (Eastern Time) to review the second quarter fiscal

2014 earnings release. To listen, please visit the investor

relations section of the Company's website at www.factset.com.

Forward-looking Statements

This news release contains forward-looking statements based on

management's current expectations, estimates and projections. All

statements that address expectations or projections about the

future, including statements about the Company's strategy for

growth, product development, market position, subscriptions,

expected expenditures and financial results are forward-looking

statements. Forward-looking statements may be identified by words

like "expected," "anticipates," "plans," "intends," "projects,"

"should," "indicates," "continues," "subscriptions" and similar

expressions. These statements are not guarantees of future

performance and involve a number of risks, uncertainties and

assumptions. Many factors, including those discussed more fully

elsewhere in this release and in FactSet's filings with the

Securities and Exchange Commission, particularly its latest annual

report on Form 10-K and quarterly reports on Form 10-Q, as well as

others, could cause results to differ materially from those stated.

These factors include, but are not limited to, the current status

of the global economy; the ability to integrate newly acquired

companies and businesses; the stability of global securities

markets; the ability to hire qualified personnel; the maintenance

of the Company's leading technological position; the impact of

global market trends on the Company's revenue growth rate and

future results of operations; the negotiation of contract terms

with corporate vendors, data suppliers and potential landlords; the

retention of key clients; the successful resolution of ongoing

audits by tax authorities; the continued employment of key

personnel; the absence of U.S. or foreign governmental regulation

restricting international business; and the sustainability of

historical levels of profitability and growth rates in cash flow

generation.

About Adjusted Financial Measures

Financial measures in accordance with U.S. generally accepted

accounting principles ("GAAP") including operating income, net

income and diluted earnings per share have been adjusted. Fiscal

2013 adjusted financial measures exclude a non-cash pre-tax charge

of $15.7 million related to the vesting of performance-based stock

options and $6.3 million of income tax benefits related to the U.S.

Federal R&D credit. The second quarter fiscal 2013 pre-tax

stock-based compensation charge reduced GAAP operating income by

$15.7 million, GAAP diluted earnings per share by $0.25 and GAAP

operating margin by 730 basis points. Together, the stock-based

compensation charge and income tax benefits decreased GAAP net

income by $4.7 million and GAAP diluted EPS by $0.11 per share.

FactSet uses these adjusted financial measures, both in presenting

its results to stockholders and the investment community, and in

its internal evaluation and management of the business. The Company

believes that these adjusted financial measures and the information

they provide are useful to investors because it permits investors

to view the Company's performance using the same tools that

management uses to gauge progress in achieving its goals. Investors

may benefit from referring to these adjusted financial measures in

assessing the Company's performance and when planning, forecasting

and analyzing future periods and may also facilitate comparisons to

its historical performance. The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with GAAP.

About Non-GAAP Free Cash Flow

The GAAP financial measure, cash flows provided by operating

activities, has been adjusted to report non-GAAP free cash flow

that includes the cash cost for taxes and changes in working

capital, less capital expenditures. Included in the just completed

second quarter was $41 million of net cash provided by operations

and $3 million of capital expenditures. The presentation of free

cash flow is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with GAAP. FactSet uses this financial measure, both in

presenting its results to stockholders and the investment

community, and in the Company's internal evaluation and management

of the business. Management believes that this financial measure is

useful to investors because it permits investors to view the

Company's performance using the same metric that management uses to

gauge progress in achieving its goals and is an indication of cash

flow that may be available to fund further investments in future

growth initiatives.

About FactSet

FactSet, a leading provider of financial information and

analytics, helps the world's best investment professionals

outperform. More than 50,000 users stay ahead of global market

trends, access extensive company and industry intelligence, and

monitor performance with FactSet's desktop analytics, mobile

applications, and comprehensive data feeds. The Company has been

included in FORTUNE's Top 100 Best Companies to Work For, the

United Kingdom's Great Places to Work and France's Best Workplaces.

FactSet is listed on the New York Stock Exchange and NASDAQ

(NYSE:FDS) (Nasdaq:FDS). Learn more at www.factset.com, and follow

us on Twitter: www.twitter.com/factset.

| FactSet Research Systems Inc. |

|

|

|

|

| Consolidated Statements of Income –

Unaudited |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

Six Months Ended |

| |

February 28, |

February 28, |

| (In thousands, except per share data) |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Revenues |

$226,934 |

$213,083 |

$449,909 |

$424,167 |

| |

|

|

|

|

| Operating expenses |

|

|

|

|

| Cost of services |

87,254 |

75,842 |

170,504 |

149,427 |

| Selling, general and

administrative* |

64,626 |

81,077 |

129,610 |

147,492 |

| Total operating expenses |

151,880 |

156,919 |

300,114 |

296,919 |

| |

|

|

|

|

| Operating income |

75,054 |

56,164 |

149,795 |

127,248 |

| |

|

|

|

|

| Other income |

344 |

357 |

685 |

785 |

| Income before income taxes |

75,398 |

56,521 |

150,480 |

128,033 |

| |

|

|

|

|

| Provision for income taxes |

22,972 |

11,982 |

45,876 |

33,726 |

| Net income |

$52,426 |

$44,539 |

$104,604 |

$94,307 |

| |

|

|

|

|

| Diluted earnings per common share |

$1.22 |

$1.00 |

$2.41 |

$2.11 |

| |

|

|

|

|

| Diluted weighted average common shares |

43,107 |

44,455 |

43,432 |

44,788 |

| |

|

|

|

|

| * Of the total pre-tax

stock-based compensation charge of $15.7 million from the vesting

of performance-based stock options, $15.5 million is reflected

within the Selling, general and administrative expense line above

for the three and six months ended February 28, 2013,

respectively. |

| |

| FactSet Research Systems

Inc. |

| Consolidated Statements of Comprehensive

Income – Unaudited |

|

|

| |

Three Months Ended February

28, |

Six Months Ended February

28, |

| (In thousands) |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Net income |

$52,426 |

$44,539 |

$104,604 |

$94,307 |

| |

|

| Other comprehensive income (loss), net of

tax |

|

| Net unrealized gain on cash

flow hedges* |

387 |

84 |

3,284 |

1,371 |

| Foreign currency translation

adjustments |

3,506 |

(4,731) |

11,654 |

(1,657) |

| Other comprehensive income

(loss) |

3,893 |

(4,647) |

14,938 |

(286) |

| |

|

|

|

|

| Comprehensive income |

$56,319 |

$39,892 |

$119,542 |

$94,021 |

| |

| * For the three

and six months ended February 28, 2014, the unrealized gain on cash

flow hedges was net of tax expense of $231 and $1,961,

respectively. The unrealized gain on cash flow hedges disclosed

above for the three and six months ended February 28, 2013, was net

of tax expense of $50 and $822, respectively. |

| |

|

|

| FactSet Research Systems Inc. |

|

|

| Consolidated Balance Sheets - Unaudited |

|

|

| |

February 28, |

August 31, |

| (In thousands) |

2014 |

2013 |

| |

|

|

| ASSETS |

|

|

| Cash and cash equivalents |

$88,790 |

$196,627 |

| Investments |

14,185 |

12,725 |

| Accounts receivable, net of

reserves |

97,564 |

73,290 |

| Prepaid taxes |

14,487 |

16,937 |

| Deferred taxes |

3,474 |

2,803 |

| Prepaid expenses and other

current assets |

13,536 |

15,652 |

| Total current assets |

232,036 |

318,034 |

| |

|

|

| Property, equipment, and

leasehold improvements, net |

60,627 |

65,371 |

| Goodwill |

287,545 |

244,573 |

| Intangible assets, net |

47,390 |

36,223 |

| Deferred taxes |

21,871 |

22,023 |

| Other assets |

4,496 |

3,973 |

| TOTAL ASSETS |

$653,965 |

$690,197 |

| |

|

|

| LIABILITIES |

|

|

| Accounts payable and accrued

expenses |

$27,821 |

$29,864 |

| Accrued compensation |

24,649 |

40,137 |

| Deferred fees |

35,417 |

29,319 |

| Taxes payable |

6,576 |

3,769 |

| Dividends payable |

14,827 |

15,164 |

| Total current liabilities |

109,290 |

118,253 |

| |

|

|

| Deferred taxes |

2,723 |

2,396 |

| Taxes payable |

5,345 |

5,435 |

| Deferred rent and other

non-current liabilities |

18,953 |

22,334 |

| TOTAL LIABILITIES |

$136,311 |

$148,418 |

| |

|

|

| STOCKHOLDERS' EQUITY |

|

|

| Common stock |

$485 |

$481 |

| Additional paid-in capital |

359,253 |

326,869 |

| Treasury stock, at cost |

(601,101) |

(454,917) |

| Retained earnings |

775,251 |

700,519 |

| Accumulated other comprehensive

loss |

(16,234) |

(31,173) |

| TOTAL STOCKHOLDERS' EQUITY |

517,654 |

541,779 |

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$653,965 |

$690,197 |

| |

|

|

| FactSet Research Systems Inc. |

|

|

| Consolidated Statements of Cash Flows -

Unaudited |

|

|

| |

|

|

| |

Six Months Ended |

| (In thousands) |

February 28, |

| |

2014 |

2013 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

| Net income |

$104,604 |

$94,307 |

| Adjustments to reconcile net income to net

cash provided by operating activities |

|

|

| Depreciation and

amortization |

17,442 |

18,010 |

| Stock-based compensation

expense |

10,616 |

26,373 |

| Deferred income taxes |

(1,157) |

(2,394) |

| Gain on sale of assets |

(64) |

(2) |

| Tax benefits from share-based

payment arrangements |

(4,984) |

(9,870) |

| Changes in assets and

liabilities, net of effects of acquisitions |

|

|

| Accounts receivable, net of

reserves |

(20,466) |

(11,569) |

| Accounts payable and accrued

expenses |

(2,909) |

5,038 |

| Accrued compensation |

(15,949) |

(22,061) |

| Deferred fees |

2,460 |

1,937 |

| Taxes payable, net of prepaid

taxes |

9,754 |

(3,295) |

| Prepaid expenses and other

assets |

(331) |

772 |

| Deferred rent and other

non-current liabilities |

(389) |

(282) |

| Other working capital accounts,

net |

100 |

74 |

| Net cash provided by operating

activities |

98,727 |

97,038 |

| |

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

| Acquisition of businesses, net of cash

acquired |

(47,170) |

(705) |

| Purchases of investments |

(7,487) |

(8,098) |

| Proceeds from sales of investments |

6,871 |

7,500 |

| Purchases of property, equipment and

leasehold improvements, net of proceeds from dispositions |

(8,032) |

(9,084) |

| Net cash used in investing activities |

(55,818) |

(10,387) |

| |

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

| Dividend payments |

(30,011) |

(27,280) |

| Repurchase of common stock |

(146,184) |

(139,010) |

| Proceeds from employee stock plans |

16,881 |

31,306 |

| Tax benefits from share-based payment

arrangements |

4,984 |

9,870 |

| Net cash used in financing activities |

(154,330) |

(125,114) |

| |

|

|

| Effect of exchange rate changes on cash and

cash equivalents |

3,584 |

733 |

| |

|

|

| Net decrease in cash and cash

equivalents |

(107,837) |

(37,730) |

| |

|

|

| Cash and cash equivalents at beginning of

period |

196,627 |

189,044 |

| Cash and cash equivalents at end of

period |

$88,790 |

$151,314 |

Reconciliation of Adjusted Financial

Measures

Financial measures in accordance with U.S. GAAP including

operating income, net income and diluted earnings per share have

been adjusted below. FactSet uses these adjusted financial

measures, both in presenting its results to stockholders and the

investment community, and in its internal evaluation and management

of the business. The Company believes that these adjusted financial

measures and the information they provide are useful to investors

because it permits investors to view the Company's performance

using the same tools that management uses to gauge progress in

achieving its goals. Adjusted measures may also facilitate

comparisons to FactSet's historical performance.

| |

| (Unaudited) |

Three Months

Ended |

| |

February 28, |

| (In thousands, except per share

data) |

2014 |

2013 |

Change |

| GAAP Operating income |

$75,054 |

$56,164 |

|

| Vesting Performance-based stock options

(a) |

-- |

15,696 |

|

| Adjusted Operating

income |

$75,054 |

$71,860 |

4% |

| |

|

|

|

| GAAP Net income |

$52,426 |

$44,539 |

|

| Vesting Performance-based stock options

(a) |

-- |

11,004 |

|

| Income tax benefits from the U.S. Federal

R&D credit (b) |

-- |

(6,262) |

|

| Adjusted Net income |

$52,426 |

$49,281 |

6% |

| |

|

|

|

| Adjusted Diluted earnings per common share

(a)(b) |

$1.22 |

$1.11 |

10% |

| Weighted average common

shares (Diluted) |

43,107 |

44,455 |

|

| |

| (a) GAAP operating income

was adjusted to exclude a non-cash pre-tax charge of $15.7 million

for stock-based compensation. The vesting of the performance-based

stock options increased stock-based compensation, net of tax by

$11.0 million and reduced diluted earnings per share by $0.25. For

the purposes of calculating adjusted net income and adjusted

diluted earnings per share, the pre-tax stock-based compensation

charge of $15.7 million was taxed at the prior year annual

effective tax rate of 29.9%. |

| |

| (b) The U.S. Federal R&D tax

credit was first enacted in 1981, but was never made a permanent

credit, resulting in 8 expirations and 15 extensions since 1981.

Only once in its 32-year history was the tax credit not

retroactively re-enacted, which was from July 1, 1995 through June

30, 1996. The timing of when FactSet is able to recognize the U.S.

Federal R&D tax credit has been volatile due to the numerous

lapses and retroactive re-enactments by legislation over the past

10 years. GAAP financial measures in the fiscal 2013 second quarter

were adjusted to exclude $6.3 million or $0.14 per diluted share in

income tax benefits from the U.S. Federal R&D credit. |

Reconciliation of Non-GAAP Financial

Measures

Financial measures in accordance with U.S. GAAP including

operating income, net income and diluted earnings per share have

been adjusted below.

| Three Months Ended February

28, 2014 |

| (Condensed and Unaudited) In

thousands |

GAAP |

Stock-Based Compensation |

Amortization of Intangible

Assets |

Non-GAAP |

| Operating Income |

$75,054 |

$5,500 |

$2,179 |

$82,733 |

| Net Income (a) |

$52,426 |

$3,823 |

$1,514 |

$57,763 |

| Diluted EPS (a) (b) |

$1.22 |

$0.09 |

$0.04 |

$1.34 |

| Weighted Average Shares |

43,107 |

|

|

43,107 |

| |

| (a) For the purposes of

calculating non-GAAP net income and non-GAAP diluted EPS,

stock-based compensation expense and the amortization of intangible

assets were taxed at the annual effective tax rate of 30.5%. |

| |

| (b) The sum of the non-GAAP

diluted earnings per share may not equal the totals above due to

rounding. |

CONTACT: Rachel Stern

FactSet Research Systems Inc.

203.810.1000

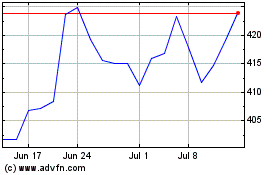

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

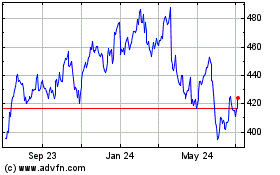

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Apr 2023 to Apr 2024