By Ted Greenwald

The Federal Trade Commission's lawsuit against Qualcomm Inc.

this week is part of an escalating international regulatory battle

that has laid bare tensions between the dominant maker of

smartphone chips and some of its biggest customers.

The commission's complaint, filed Tuesday in federal court in

California, alleges Qualcomm used illegal tactics to maintain a

monopoly on a key type of chip used in cellphones, harming phone

makers including Apple Inc. and Samsung Electronics Co., whose

names appear repeatedly in the complaint.

Qualcomm has said it will fight the FTC's suit, which it said is

based on inaccurate information and was rushed out ahead of the

change in presidential administrations.

The U.S. regulatory action came after South Korea's antitrust

regulator last month announced a roughly $853 million fine on

Qualcomm for alleged anticompetitive patent licensing practices --

a decision Qualcomm also vowed to fight.

Devices sold by Apple and Samsung accounted for nearly half of

Qualcomm's revenue, which totaled $23.5 billion in the latest

fiscal year. Samsung's relationship with Qualcomm is complicated:

In addition to using Qualcomm chips in its smartphones, it also

manufactures chips for Qualcomm -- and Samsung makes its own chips,

making it a potential competitor.

Device makers including Samsung and Apple pay Qualcomm licensing

fees and royalties based on a percentage -- as high as 5% -- of the

price of a device. Qualcomm licenses its patents in a bundle even

if customers use only a portion of the technology. The company gets

most of its pretax profit from such licensing.

For handset makers facing competitive pressure to cram more

electronics into smartphones while keeping prices down, Qualcomm's

approach to licensing is a costly burden, said Rufus Pichler, a

partner at Morrison & Foerster LLP, a law firm specializing in

intellectual property issues. They pay for chips and then pay again

for the underlying intellectual property, much of which they may

have no use for.

"Device manufacturers are under a lot of pressure to reduce

their costs and royalty burden across the board, and Qualcomm is a

big chunk of that, " said Mr. Pichler.

Said Stacy Rasgon, analyst for Sanford C. Bernstein: "Nobody

likes to pay Qualcomm."

Qualcomm declined to comment on its relationships with

customers.

Apple declined to comment. Samsung did not respond to a request

for comment.

The FTC's suit alleges that Apple sought relief from Qualcomm's

intellectual-property charges, which the commission suggests

exceeded the limits of the "fair, reasonable, and

non-discriminatory" terms that Qualcomm must commit to as an owner

of patents essential to making smartphones. Qualcomm gave Apple a

break on patent licensing costs in return for the iPhone maker's

commitment to use Qualcomm chips exclusively, blocking competitors,

the suit alleges.

That deal has expired, and Apple used chips from both Qualcomm

and Intel Corp. in its iPhone 7, launched last year.

The FTC complaint also says Samsung, among other chip makers,

had sought to license Qualcomm patents deemed essential for making

smartphones, but Qualcomm refused.

After the Korean regulator's action, Qualcomm signaled suspicion

that Apple and Samsung were involved by asking a U.S. federal court

to compel them -- along with five rival chip makers -- to hand over

any documents they may have provided to Korean authorities.

Qualcomm said the seven companies supplied documents and testimony

to the Korea Fair Trade Commission that would be kept confidential

under South Korean procedures.

A Qualcomm spokeswoman at the time said the company sought the

documents to better defend itself, and that there was nothing

adversarial about its filings.

Qualcomm says its innovations have facilitated explosive growth

of mobile communications, benefiting others in the industry. It

argues that its bundled approach to licensing patents is

cost-efficient for handset makers and chip makers alike, and that

licensing per component would add an expensive layer of

administration. The company notes that it has been licensing

patents this way for many years.

Not every semiconductor company licenses patents this way. ARM

Holdings PLC, whose technology is widely used in smartphones, sells

its licenses to chip vendors -- including Qualcomm -- not device

makers, for pennies per chip, not dollars per device, Bernstein's

Mr. Rasgon said. "It's viewed as a partner," he said. "Qualcomm is

viewed as a tax."

The antitrust actions in the U.S. and South Korea are likely to

take years to resolve, experts say. And the future of the FTC case

isn't clear, given the impending change in the White House.

However, the cases reinforce the sense that Qualcomm's customers

want to pay less for its patents, which could erode the chip

maker's ability to squeeze high profits from its intellectual

property, according to Mr. Pichler.

The biggest risk, Mr. Rasgon said, is the regulators' challenge

to whole-device licensing. The average selling price of a

smartphone is 10 times that of the chips that drive it, he said,

and shifting how the intellectual property is licensed could

sharply reduce revenue in Qualcomm's technology licensing

business.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

January 19, 2017 10:22 ET (15:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

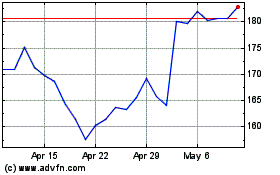

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024