IPO OUTLOOK: Expect Slower IPO Issuance Ahead

June 01 2012 - 2:30PM

Dow Jones News

June and July are normally peak summer months for initial public

offerings in the U.S., but investors and bankers should prepare for

a slower flow of deals given the chilly market climate.

Bankers are scaling back their expectations for the number of

IPOs they will complete in the third quarter, companies are

uncertain they will be able to fetch the prices they want when

going public, and investors are jittery about buying new

stocks.

"Most people on the Street have been forced to re-evaluate the

timing of their IPO backlog. I don't think we will see things fall

out of the backlog, but we will most likely see things get

[delayed]," said Mary Ann Deignan, head of Americas equity-capital

markets at Bank of America Merrill Lynch. "That's concerning,

because June and July can normally be windows of opportunity, and

August tends to be so slow. And after Labor Day this year, we will

be in a pre-election environment, which tends to add uncertainty to

the market."

With no marketing road shows in recent weeks, the earliest

anyone can expect to see a deal price would be in the second half

of June--and that is only if some road shows launch this coming

week, said Scott Cutler, head of listings in the Americas for New

York Stock Exchange parent NYSE Euronext.

"The potential of market volatility affecting pricing is the

biggest problem and the most major concern," Cutler said.

"Decisions are being made right now as to timing of launches."

That is in sharp contrast to the optimism Wall Street and

investors displayed in April, when the broader market was still on

the rise, volatility wasn't climbing, and a software company called

Splunk Inc. (SPLK) delivered the strongest first-day performance in

a year, doubling on its debut.

A confluence of events that followed in May turned that

sentiment negative. Increased concern about Europe's debt crisis

and some worrisome U.S. economic data pulled the broader markets

down. Friday, disappointing monthly jobs data were released in the

U.S. for the third-straight month, while the unemployment rate had

its first increase in nearly a year; the Dow Jones Industrial

Average reacted by dropping into negative territory for the year.

Meanwhile, volatility as measured by the Chicago Board Options

Exchange's VIX--the so-called fear gauge--rose to its highest level

since late December.

Volatility and declines in the broader markets are always toxic

to new stocks, which are considered higher-risk investments. But

the Facebook Inc. (FB) factor has been heaped upon this backdrop.

The social-media company's much-anticipated deal turned out to be a

disaster for most investors, with the stock down nearly 27% from

its IPO price in recent trading.

When such a large deal doesn't work, it becomes harder to bring

out others. There hasn't been another new stock launched since the

company went public May 18, and there aren't any stocks on the

calendar for the coming week.

"Retail confidence is at a real low point, and the Facebook

debacle didn't do anything to help that," said Peter Kies, co-head

of equity capital markets at R.W. Baird & Co.

While Kies expects IPO issuance to slow a bit in the months

ahead, he expects some companies still will be able to debut.

"There is going to be continued interest in true-growth IPOs, in

companies that are growing fairly rapidly. But the plain-Jane,

nothing-special companies that just want to go public for liquidity

reasons or for their shareholders to exit are going to have a

harder time for the foreseeable future," he said.

-By Lynn Cowan, Dow Jones Newswires; 202-257-2740;

lynn.cowan@dowjones.com

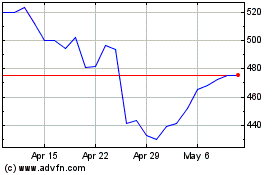

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

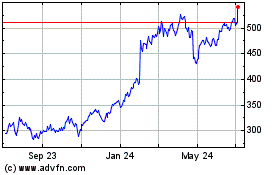

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024