Evine Live Inc. (“Evine”) (NASDAQ:EVLV) today announced results for

the first quarter ended April 29, 2017. The Company posted

quarterly net sales of $156 million. The Company also posted

a net loss of $3.2 million, a 35% improvement year-over-year, EPS

of ($0.05), a 44% improvement year-over-year, and an Adjusted

EBITDA of $3.1 million.

“As expected, it was a tough retail environment so I’m pleased

that our teams were able to deliver on our revenue and EPS guidance

to our stakeholders,” said CEO Bob Rosenblatt. “This is the

fourth quarter in a row we have improved our bottom line

profitability. We are more passionate than ever that our

discipline around the interactive video commerce fundamentals is

positioning our company well for continued improvement in

profitability throughout the year.”

Fiscal Year 2017 First Quarter

Highlights

- Net sales were $156 million, a 6.3% decrease

year-over-year.

- Gross profit as a percentage of sales decreased 80 basis points

to 36.0% year-over-year.

- Net loss was $3.2 million, a 35% improvement

year-over-year.

- Adjusted EBITDA was $3.1 million, an 11% decrease

year-over-year.

- EPS was ($0.05), a 44% improvement year-over-year.

- Total cash, including restricted cash, was $26 million.

Rosenblatt continued, “Our 2017 growth strategy remains focused

on building proprietary and exclusive brands as well as using our

national multi-platform distribution to showcase lesser known

compelling brands that cannot replicate our kind of reach in

today’s retail landscape. Our team finds the brands and helps tell

their stories in a way only interactive video commerce can

do.”

“It is clear,” Rosenblatt added, “the traditional department

store retail strategy of offering everything to everyone has been

disrupted by technology, which allows for narrowcasting of personal

shopping capabilities to consumers. We believe our growth

strategy positions us to become the platform for the next

generation of personalized ecommerce.”

| SUMMARY RESULTS AND KEY OPERATING

METRICS |

|

| ($ Millions, except average selling price and

EPS) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Q1 20174/29/2017 |

|

Q1 20164/30/2016 |

|

Change |

|

| |

|

|

|

|

|

|

|

|

| Net

Sales |

|

$ |

156.3 |

|

|

$ |

166.9 |

|

|

(6.3 |

%) |

|

| Gross

Margin % |

|

|

36.0 |

% |

|

|

36.8 |

% |

|

(80 bps) |

|

| Adjusted

EBITDA |

|

$ |

3.1 |

|

|

$ |

3.4 |

|

|

(11 |

%) |

|

| Net

Loss |

|

$ |

(3.2 |

) |

|

$ |

(4.9 |

) |

|

(35 |

%) |

|

| EPS |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

(44 |

%) |

|

| |

|

|

|

|

|

|

|

|

| Net Shipped

Units (000s) |

|

|

2,580 |

|

|

|

2,417 |

|

|

7 |

% |

|

| Average

Selling Price (ASP) |

|

$ |

54 |

|

|

$ |

62 |

|

|

(13 |

%) |

|

| Return Rate

% |

|

|

18.8 |

% |

|

|

19.2 |

% |

|

(40 bps) |

|

| Digital Net

Sales % |

|

|

50.6 |

% |

|

|

48.8 |

% |

|

180 bps |

|

| Total Customers - 12

Month Rolling (000s) |

|

|

|

1,409 |

|

|

|

1,441 |

|

|

(2 |

%) |

|

| |

|

|

|

|

|

|

|

|

| % of Net

Merchandise Sales by Category |

|

|

|

|

|

|

|

| Jewelry & Watches |

|

|

41 |

% |

|

|

43 |

% |

|

|

|

| Home & Consumer Electronics |

|

|

22 |

% |

|

|

24 |

% |

|

|

|

| Beauty |

|

|

15 |

% |

|

|

15 |

% |

|

|

|

| Fashion & Accessories |

|

|

22 |

% |

|

|

18 |

% |

|

|

|

| Total |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

First Quarter 2017 Results

- Wearable categories, which include Jewelry & Watches,

Fashion & Accessories, and Beauty, decreased in sales by 5%

year-over-year, which was primarily driven by the Watches

category. The top performing category in the quarter was

Fashion, which grew 8% year-over-year. Consumer Electronics,

which continues to decline as a result of Management’s proactive

reduction of lower margin merchandise in this category, decreased

by 45% year-over-year.

- Return rate for the quarter was 18.8%; an improvement of 40

basis points year-over-year.

- Gross profit as a percentage of sales decreased 80 basis points

to 36.0% year-over-year, driven primarily by rate and mix pressures

from the Watches category. Gross profit dollars decreased 8%

to $56.3 million year-over-year.

- Operating expense decreased $8.1 million year-over-year to

$56.9 million, a 12% decrease, driven by reduced selling and

distribution expenses, reduced management transition costs and

other reductions from our continued profit improvement

initiatives.

- Net loss was $3.2 million, a 35% improvement year-over-year and

Adjusted EBITDA decreased 11% to $3.1 million. EPS for the

fiscal 2017 first quarter improved $0.04 or 44% to ($0.05)

year-over-year.

Liquidity and Capital Resources

On January 31, 2017, as previously announced, the Company

purchased 4,400,000 shares of its common stock, representing

approximately 6.7% of shares then outstanding, for

approximately $4.9 million or $1.12 per share

in a private transaction with NBCUniversal Media, LLC, a

subsidiary of Comcast

Corporation (“Comcast”)(NASDAQ:CMCSA). The Company used

cash on hand to buy back the shares.

On March 21, 2017, also as previously announced, the Company

continued to strengthen its balance sheet and paid down $9.5

million, or approximately 60%, of its Great American Capital

Partners (GACP) high interest term loan. The Company used a

combination of cash on hand and $6.0 million from its lower

interest PNC Credit Facility to fund this pay down.

As of April 29, 2017, total cash, including restricted cash, was

$26 million, compared to $33 million at the end of fiscal

2016. The decrease is primarily related to the cash used in

the two transactions listed above. The Company also had an

additional $12 million of unused availability on its revolving

credit facility with PNC Bank, which gives the Company total

liquidity of approximately $38 million as of the end of the first

quarter.

Second Quarter and Full Year 2017

Outlook

The following details relate to our expected

performance for the second quarter and full-year of fiscal

2017:

For Q2: We expect revenues to decline 3% to 5%,

which reflects management’s continued rebalancing of the Company’s

merchandising mix to reduce low margin consumer electronics that

began back in Q2 of 2016. From a profitability perspective,

management expects the Company to post net income and EPS that is

in line with prior year’s Q2 results.

For Full Year: We continue to expect

slightly positive sales for fiscal 2017 and adjusted EBITDA to be

in the $18 to $22 million range, which would be growth of 11% to

36% year over year. These results include a 53rd week in

fiscal 2017.

Conference Call

A conference call and webcast to discuss the

Company's first quarter earnings will be held at 8:30 a.m. Eastern

Time on Tuesday, May 23, 2017:

WEBCAST LINK:

http://event.on24.com/wcc/r/1336366/E19C012FADA147573983E34DDF0EE365

TELEPHONE: 1-877-407-9039 (domestic) or 1-201-689-8470

(international)

PASSCODE: 13661446

Please visit www.evine.com/ir for more investor

information and to review an updated investor deck.

About Evine Live Inc.Evine Live Inc.

(NASDAQ:EVLV) operates Evine, a multiplatform video commerce

company that offers a mix of proprietary, exclusive and name brands

directly to consumers in an engaging and informative shopping

experience via television, online and mobile. Evine reaches more

than 87 million cable and satellite television homes with

entertaining content in a comprehensive digital shopping experience

24 hours a day.

Please visit www.evine.com/ir for more investor information.

| EVINE Live

Inc. |

|

| AND SUBSIDIARIES |

|

| CONSOLIDATED BALANCE SHEETS |

|

| (In thousands except share and per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 29, |

|

January 28, |

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

Current assets: |

|

|

|

|

| Cash |

$ |

25,938 |

|

|

$ |

32,647 |

|

|

| Restricted cash and investments |

|

450 |

|

|

|

450 |

|

|

| Accounts receivable, net |

|

85,538 |

|

|

|

99,062 |

|

|

| Inventories |

|

75,649 |

|

|

|

70,192 |

|

|

| Prepaid expenses and other |

|

5,784 |

|

|

|

5,510 |

|

|

| Total current assets |

|

193,359 |

|

|

|

207,861 |

|

|

|

Property and equipment, net |

|

53,672 |

|

|

|

52,715 |

|

|

| FCC

broadcasting license |

|

12,000 |

|

|

|

12,000 |

|

|

|

Other assets |

|

2,306 |

|

|

|

2,204 |

|

|

|

Total Assets |

$ |

261,337 |

|

|

$ |

274,780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

| Accounts payable |

$ |

58,211 |

|

|

$ |

65,796 |

|

|

| Accrued liabilities |

|

42,944 |

|

|

|

37,858 |

|

|

| Current portion of long term credit facilities |

|

3,440 |

|

|

|

3,242 |

|

|

| Deferred revenue |

|

85 |

|

|

|

85 |

|

|

| Total current liabilities |

|

104,680 |

|

|

|

106,981 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Other long term liabilities |

|

407 |

|

|

|

428 |

|

|

|

Deferred tax liability |

|

3,719 |

|

|

|

3,522 |

|

|

|

Long term credit facilities |

|

78,454 |

|

|

|

82,146 |

|

|

| Total liabilities |

|

187,260 |

|

|

|

193,077 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

| Preferred stock, $.01 par value, 400,000 shares

authorized; |

|

|

|

|

| zero shares issued and outstanding |

|

- |

|

|

|

- |

|

|

| Common stock, $.01 par value, 99,600,000 shares

authorized; |

|

|

|

|

| 60,968,092 and 65,192,314 shares issued and outstanding |

|

610 |

|

|

|

652 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Additional paid-in capital |

|

432,574 |

|

|

|

436,962 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Accumulated deficit |

|

(359,107 |

) |

|

|

(355,911 |

) |

|

| Total shareholders' equity |

|

74,077 |

|

|

|

81,703 |

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

261,337 |

|

|

$ |

274,780 |

|

|

| |

|

|

|

|

|

|

|

|

|

| EVINE Live

Inc. |

|

| AND

SUBSIDIARIES |

|

| CONSOLIDATED STATEMENTS

OF OPERATIONS |

|

| (Unaudited) |

|

| (In thousands, except share and per share data) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

For the Three-Month

Periods Ended |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

April 29, |

|

April 30, |

|

|

| |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

| Net

sales |

$ |

156,343 |

|

|

$ |

166,920 |

|

|

|

|

Cost of sales |

|

100,057 |

|

|

|

105,472 |

|

|

|

| Gross profit |

|

56,286 |

|

|

|

61,448 |

|

|

|

| Margin % |

|

36.0 |

% |

|

|

36.8 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expense: |

|

|

|

|

|

| Distribution and selling |

|

48,730 |

|

|

|

53,425 |

|

|

|

| General and administrative |

|

5,995 |

|

|

|

5,769 |

|

|

|

| Depreciation and amortization |

|

1,636 |

|

|

|

2,107 |

|

|

|

| Executive and management transition costs |

|

506 |

|

|

|

3,601 |

|

|

|

| Distribution facility consolidation and technology upgrade

costs |

|

- |

|

|

|

80 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Total operating expense |

|

56,867 |

|

|

|

64,982 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

(581 |

) |

|

|

(3,534 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

Other income

(expense): |

|

|

|

|

|

| Interest income |

|

2 |

|

|

|

2 |

|

|

|

| Interest expense |

|

(1,495 |

) |

|

|

(1,205 |

) |

|

|

| Loss on debt extinguishment |

|

(913 |

) |

|

|

- |

|

|

|

| Total other expense |

|

(2,406 |

) |

|

|

(1,203 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

Loss before income

taxes |

|

(2,987 |

) |

|

|

(4,737 |

) |

|

|

| |

|

|

|

|

|

|

|

|

| Income tax

provision |

|

(209 |

) |

|

|

(205 |

) |

|

|

| |

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(3,196 |

) |

|

$ |

(4,942 |

) |

|

|

| |

|

|

|

|

|

|

|

|

| Net

loss per common share |

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

|

| |

|

|

|

|

|

|

|

|

| Net

loss per common share |

|

|

|

|

|

| ---assuming

dilution |

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

|

| |

|

|

|

|

|

|

|

|

| Weighted

average number of |

|

|

|

|

|

| common

shares outstanding: |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Basic |

|

60,918,508 |

|

|

|

57,181,155 |

|

|

|

| Diluted |

|

60,918,508 |

|

|

|

57,181,155 |

|

|

|

| |

|

|

|

|

|

|

|

|

| EVINE Live Inc. |

|

| AND SUBSIDIARIES |

|

| Reconciliation of Net Loss to Adjusted

EBITDA: |

|

| (Unaudited) |

|

| |

|

|

|

|

|

| |

|

For the Three-Month

Periods Ended |

|

|

| |

|

|

|

|

|

| |

|

April 29, |

April 30, |

|

|

| |

|

|

2017 |

|

|

2016 |

|

|

|

| |

|

(In Thousands) |

|

|

| |

|

|

|

|

|

| Net loss |

|

$ |

(3,196 |

) |

$ |

(4,942 |

) |

|

|

|

Adjustments: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,604 |

|

|

3,041 |

|

|

|

|

Interest income |

|

|

(2 |

) |

|

(2 |

) |

|

|

|

Interest expense |

|

|

1,495 |

|

|

1,205 |

|

|

|

|

Income taxes |

|

|

209 |

|

|

205 |

|

|

|

| EBITDA

(as defined) |

|

$ |

1,110 |

|

$ |

(493 |

) |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| A reconciliation of EBITDA to Adjusted EBIDTA is as

follows: |

|

|

|

|

| EBITDA

(as defined) |

|

$ |

1,110 |

|

$ |

(493 |

) |

|

|

|

Adjustments: |

|

|

|

|

|

| Executive and

management transition costs |

|

|

506 |

|

|

3,601 |

|

|

|

|

Loss on debt extinguishment |

|

|

913 |

|

|

- |

|

|

|

|

Distribution facility consolidation and technology upgrade

costs |

|

- |

|

|

80 |

|

|

|

| Non-cash

share-based compensation |

|

|

521 |

|

|

237 |

|

|

|

| Adjusted

EBITDA |

|

$ |

3,050 |

|

$ |

3,425 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

EBITDA represents net income (loss) for the

respective periods excluding depreciation and amortization expense,

interest income (expense) and income taxes. The Company defines

Adjusted EBITDA as EBITDA excluding non-operating gains (losses);

executive and management transition costs; loss on debt

extinguishment; distribution facility consolidation and technology

upgrade costs and non-cash share-based compensation expense. The

Company has included the term “Adjusted EBITDA” in our EBITDA

reconciliation in order to adequately assess the operating

performance of our television and online businesses and in order to

maintain comparability to our analyst's coverage and financial

guidance, when given. Management believes that the term Adjusted

EBITDA allows investors to make a meaningful comparison between our

business operating results over different periods of time with

those of other similar companies. In addition, management uses

Adjusted EBITDA as a metric to evaluate operating performance under

the Company’s management and executive incentive compensation

programs. Adjusted EBITDA should not be construed as an alternative

to operating income (loss), net income (loss) or to cash flows from

operating activities as determined in accordance with generally

accepted accounting principles (“GAAP”) and should not be construed

as a measure of liquidity. Adjusted EBITDA may not be comparable to

similarly entitled measures reported by other companies. The

Company has included a reconciliation of the comparable GAAP

measure, net income (loss) to Adjusted EBITDA in this

release.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

This document may contain certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such statements may be identified by words such as

anticipate, believe, estimate, expect, intend, predict, hope,

should, plan, will or similar expressions. Any statements contained

herein that are not statements of historical fact may be deemed

forward-looking statements. These statements are based on

management's current expectations and accordingly are subject to

uncertainty and changes in circumstances. Actual results may vary

materially from the expectations contained herein due to various

important factors, including (but not limited to): consumer

preferences, spending and debt levels; the general economic and

credit environment; interest rates; seasonal variations in consumer

purchasing activities; the ability to achieve the most effective

product category mixes to maximize sales and margin objectives;

competitive pressures on sales; pricing and gross sales margins;

the level of cable and satellite distribution for our programming

and the associated fees or estimated cost savings from contract

renegotiations; our ability to establish and maintain acceptable

commercial terms with third-party vendors and other third parties

with whom we have contractual relationships, and to successfully

manage key vendor relationships and develop key partnerships and

proprietary and exclusive brands; our ability to manage our

operating expenses successfully and our working capital levels; our

ability to remain compliant with our credit facilities covenants;

customer acceptance of our branding strategy and our repositioning

as a video commerce company; the market demand for television

station sales; changes to our management and information systems

infrastructure; challenges to our data and information security;

changes in governmental or regulatory requirements; including

without limitation, regulations of the Federal Communications

Commission and Federal Trade Commission, and adverse outcomes from

regulatory proceedings; litigation or governmental proceedings

affecting our operations; significant public events that are

difficult to predict, or other significant television-covering

events causing an interruption of television coverage or that

directly compete with the viewership of our programming; our

ability to obtain and retain key executives and employees; our

ability to attract new customers and retain existing customers;

changes in shipping costs; our ability to offer new or innovative

products and customer acceptance of the same; changes in customers

viewing habits of television programming; and the risks identified

under “Risk Factors” in our recently filed Form 10-K and any

additional risk factors identified in our periodic reports since

the date of such Form 10-K. More detailed information about those

factors is set forth in our filings with the Securities and

Exchange Commission, including our annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

You are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date of this announcement.

We are under no obligation (and expressly disclaim any such

obligation) to update or alter our forward-looking statements

whether as a result of new information, future events or

otherwise.

Contacts

Media:

Dawn Zaremba

press@evine.com

(952) 943-6043

Investors:

Michael Porter

mporter@evine.com

(952) 943-6517

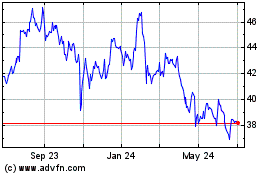

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

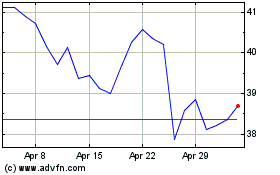

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024